Table Of Contents

What Is A Breakup Fee?

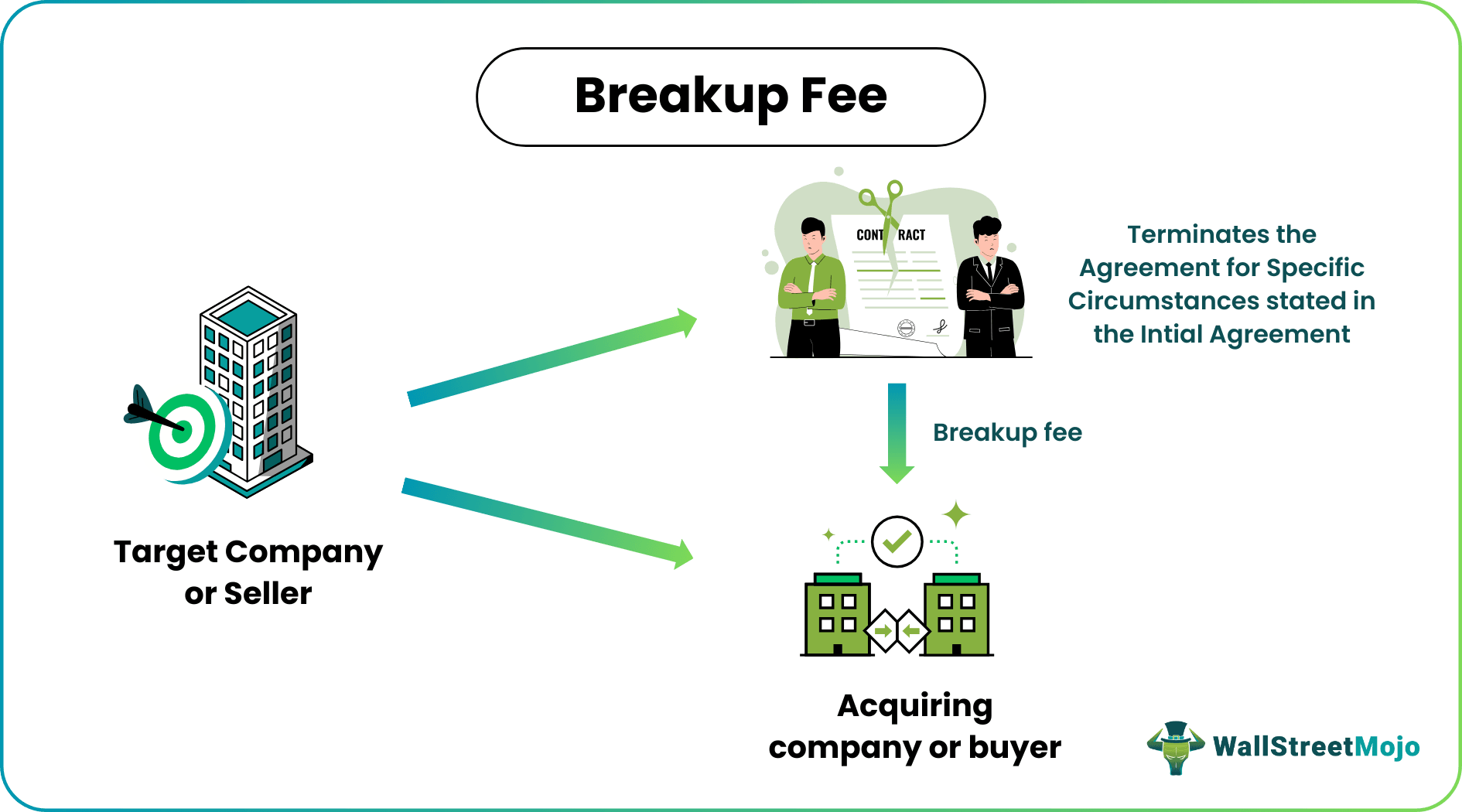

A breakup fee refers to a clause in the merger and acquisition agreements that makes a seller liable to pay a certain percentage of the deal value to the buyer as compensation if the former terminates the deal. It is, thus, disbursed against the time and resources contributed by the buyer for the transaction.

The breakup fee protects the buyer from any loss if the seller finds another purchaser with a more favorable offer. Such a clause ensures the genuine intent of the seller. Therefore, it is a part of various initial agreements in public takeovers, mergers, or acquisitions. Since such prospective dealings are made public, the competitors can influence the seller with a competitive bid.

Table of Contents

- What is a Breakup Fee?

- A breakup fee refers to a clause negotiated and incorporated into merger and acquisition agreements to safeguard the buyer's interests.

- The clause makes the seller liable to pay the decided compensation if the latter leaves the deal.

- A target company may cancel a deal due to various factors. Like a more competitive bid, a change in the Board of Directors' decision, negative shareholders' voting, or regulatory reasons.

- A breakup fee in M&A transactions differs from a reverse breakup fee that holds the buyer accountable for withdrawing from the deal.

Breakup Fee Explained

A breakup fee or termination fee is a crucial provision facilitating the negotiation process in many merger and acquisition (M&A) agreements. Essentially, the seller agrees to pay the buyer a predetermined sum of money. If the former cancels the deal under certain predefined circumstances specified in the agreement. If the seller breaks the contract, the buyer often uses it as a shield. The seller may cancel the contract after receiving a better offer with a more attractive bid price from a third party.

In the present scenario, a termination fee supports major private contracts and dealings, including construction or industrial projects. However, the terms and conditions of breakup fees can vary widely and are subject to negotiation between the parties involved in the deal. It is generally calculated as a percentage of the total deal value ranging between 1% to 3%. Should the deal fail to close due to the specified circumstances outlined in the agreement as defaulted by the seller, the seller is responsible for paying the breakup fee to the buyer. Moreover, it doesn't account for the mutual termination of the agreement by both parties.

Reasons

The reasons triggering the breakup fee include:

- Regulatory Approvals: In situations where the execution of the deal depends on obtaining regulatory approvals, a termination fee can compensate the buyer if they fail to secure these approvals.

- Competitive Bidding: A breakup fee can discourage competitive bidding or incentivize exclusivity if they are outbid or the deal falls through.

- Open Offer to Public: If the target company publicly invites companies to place negotiable offers after signing the preliminary agreement with the acquirer, the latter will receive the termination fee.

- Failure to Close: If the seller fails to abide by its obligations as in the contract, leading to the deal's failure to close, a termination fee shall be payable to the buyer.

- Shareholder Approval: In cases where mergers or acquisitions require approval from the target company's shareholders, a breakup fee can compensate the acquiring party if shareholders reject the deal.

- Board of Directors' Actions: If the board of directors (BOD) of the target company alters its recommendation or withdraws its support for the deal, the buyer exercises a breakup fee provision.

- Breach of Trust: If the target company hides significant facts or figures related to the business, the purchases may exercise the M&A breakup fee provision while canceling the deal.

- Time Delays: In instances where the deal takes significantly longer to close than initially anticipated, on the seller's part, such a fee can compensate the acquirer for the extended resources and expenses allocated to the transaction.

- Specific Event Triggers: Contracts can specify unique conditions that trigger a breakup fee, such as breach of confidentiality, exclusivity, or other predefined events.

Sample Clauses

Here are some sample clauses that illustrate the use of breakup fees in contracts:

#1 - No Shop Clause

During the term of this agreement, the seller agrees not to seek alternative offers actively. If the seller breaches this provision, and as a result, the agreement is terminated, the seller shall pay the buyer a breakup fee equal to % of the deal value.

This clause combines a no-shop clause with a breakup fee provision, prohibiting the seller from soliciting other offers. If the seller violates this provision, a breakup fee trigger occurs.

#2 - Reverse Breakup Fee Clause

Suppose the buyer fails to secure the financing required to complete this transaction or cannot obtain shareholder approval. In that case, the buyer shall pay the seller a reverse breakup fee equal to % of the total deal value.

This clause introduces a reverse breakup fee. The buyer is liable to pay the seller if the buyer cannot fulfill specific obligations.

#3 - Material Adverse Change (MAC) Clause

Should a Material Adverse Change (MAC) occur, as defined in Section , leading to the termination of this agreement, the buyer shall be entitled to a breakup fee equal to % of the deal value.”

This clause ties the payment of a breakup fee to the occurrence of a significant adverse event. This is a Material Adverse Change, leading to the deal’s termination.

Examples

A termination fee is a shield for the acquirer in an M&A transaction. Let us see how the buyer can use this provision in case of deal cancellation:

Example #1

In the AB Ltd. and XY Corp agreement for an M&A deal, AB Ltd. was not allowed to make a public offer after signing the letter of intent. If this condition were violated, AB Ltd. would owe XY Corp a breakup fee of 2% of the deal's value, which equals $50,000. However, AB Ltd. pursued a public bidding process in search of a better deal. The agreement's termination entitles XY Corp. to receive $50,000.

Example #2

Elon Musk's $44 billion deal to buy Twitter included a $1 billion breakup fee, as disclosed in a securities filing. The world's richest man planned to take Twitter private and enhance the platform's product while promoting free speech. If the deal, set to close in three to six months, had fallen through, either party would have had to pay the other $1 billion under certain circumstances.

Such circumstances include Twitter entering into a superior deal or Musk's financing for the acquisition failing. Musk's financing for the deal had raised intrigue, as he had secured bank loans and pledged substantial sums of his money. The fee structure was considered standard for such agreements. Furthermore, both parties could have walked away if the deal didn't close by a specified date.

Breakup Fee vs Reverse Breakup Fee

The breakup fees and reverse breakup fees have various purposes. Such provisions allocate risks and provide financial incentives, ensuring both parties act in good faith during the negotiation and execution of the agreement. Hence, they offer security for both parties as they invest resources into the transaction.

The primary use of such a clause was in the public takeover agreements since the finalization of such dealings is based upon the target company's shareholders' voting, where they may or may not agree to surrender their stocks to the buyer company. Here are the differences:

| Basis | Breakup Fee | Reverse Breakup Fee |

|---|---|---|

| Definition | A percentage of the deal value is payable as compensation by the target company to the acquirer for canceling a takeover transaction due to the predetermined events or circumstances in the initial agreement. | The seller charges a certain percentage from the buyer as a penalty for terminating an M&A transaction due to the specific circumstances stated in the preliminary agreement. |

| Payer and Receiver | It is payable by the seller to the buyer. | It is payable by the buyer to the seller. |

| Protects | Buyer | Seller |

| Objective | Its purpose is to compensate the buyer for potential costs and risks associated with the seller's inability to meet their obligations, such as obtaining regulatory approvals or securing financing. | It compensates the seller for their investment of time, effort, and resources in negotiating the deal and aims to encourage the buyer to continue the agreement with valid reasons. |

| Reasons | Seller's default - consideration of other offers, regulatory non-compliance, shareholders' negative voting, Board of Directors's disagreement, breach of trust, breach of confidentiality, breach of exclusivity, inviting public offers | Buyer's default - financial incompetency, regulatory non-compliance, inability to convince target company's stockholders, refusal from Board of Directors |

Frequently Asked Questions (FAQs)

When properly documented, a breakup fee is generally a legal and enforceable contractual provision. It also complies with applicable laws and regulations. However, the enforceability can vary depending on jurisdiction and the specific terms outlined in the agreement.

The breakup fee has several key advantages. It helps maintain good faith between the parties involved and safeguards the interests of the acquiring company. It also compensates them for the time and resources invested in the M&A transaction, especially if the target firm fails to finalize the deal.

The disadvantages of a breakup fee include the potential for abuse by either party, as it can discourage honest negotiations and may incentivize one party to terminate the deal to collect the fee rather than work towards a successful transaction. Additionally, the fee amount can be a significant financial burden on the party responsible for paying it.

Recommended Articles

This has been a guide to what is Breakup Fee. Here, we explain its examples, sample clauses, reasons, and comparison with reverse breakup fee. You can learn more about it from the following articles –