Table Of Contents

What Is Aging Accounts Receivables?

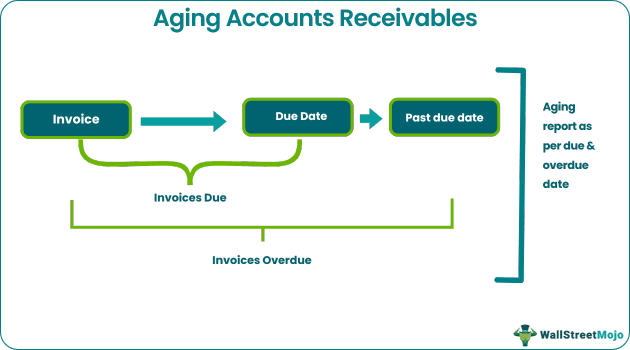

Aging accounts receivable is a periodic report that categorizes a company’s accounts receivable based on the time an invoice has been overdue for payment. This report normally comprises columns with 30-day date ranges and provides the total receivables that are due now and those that are due in the future.

This report helps the stakeholders assess the financial health of the company. It is also a very important and useful tool for the collections department, and the management uses it to understand the effectiveness of the company’s credit policy and customers’ creditworthiness. Decisions regarding provisions and write offs are taken based on this report.

Aging Accounts Receivables Explained

The aging accounts receivable method helps in preparing a report that gives a detailed list of all invoices due and overdue for payment. It is a tool used in the collections department and for management decision-making to assess the credit policy and client creditworthiness.

The method to prepare an accounts receivable aging schedule is simple. It is a table of rows and columns that specify the receivables for each customer. Columns are as under:

- Total Amount Due: Total Receivables from the customer;

- Not yet due: Out of the total, receivables booked on the day we prepare the report.

- 1 to 30 days: Out of the total, receivables are due for 30 days from the due date of payment.

- 31 to 60 days: Out of the total, receivables which due for 60 days from the due date of payment.

- 61 to 90 days: Out of the total, receivables which due for 90 days from the due date of payment.

- More than 90 days: Out of the total, receivables which due for more than 90 days from the due date of payment.

Explanation of Accounts Receivables in Video

Example

Let us understand the accounts receivable aging schedule with an example.

On April 5, 2019, firm XYZ supplied products worth $360,000 to Indigo Whales Inc with a 30-day credit period. Payment must be received by May 4, 2019. Assume that the payment from the Indigo whales was not received when the accounts receivable aging report was prepared on May 31, 2019.

As a result, this sum is due within 30 days of the due date as of May 31, 2019. (i.e., within 30 days from May 04, 2019). Therefore, it will appear in the column numbered 0 to 30 days.

Assume that payment will not be received until June 2019.On June 30, 2019, another aging report for Accounts Receivables was prepared. The sum is now overdue for a period of more than 30 days but less than 60 days from the due date. As a result, it will be classified as 30 to 60 days.

Note: Crux of Accounts Receivables Aging Report - How many days due from Due Date?

Report

Let’s take an example of an aging accounts receivable in excel.

We can download this aging accounts receivable in excel Template here – Aging Accounts Receivables Excel Template.

A company prepared the following report on September 30, 2019.

Based on the above report, the management can decide to provide $114,87,873. The above allowance is based on corporate policy to provide for 1% as a normal allowance, 2.5% for debts outstanding within 30 days, 2.5% for debts outstanding within 60 days but beyond 30 days, 4.5% for debts outstanding within 90 days but beyond 60 days, 5.0% for debts outstanding beyond 90 days. In the future, it can revise the percentage estimates. Thus the above details clearly states the aging accounts receivable excel template.

Importance

- The recovery process is streamlined & thus, cash flow is manageable in advance by using the aging accounts receivable method.

- The report may be used to estimate the allowance for bad debts.

- The report is further used by top management to decide on whether to continue business with the customer or not.

- It helps initiate legal recovery actions for amounts outstanding for more than two years (i.e., more than 730 days). Some organizations prefer initiating legal actions post 365 days.

- Interest may be chargeable for amounts overdue for more than 60 or 90 days. Interest calculations are made easy with the help of an aging report.

Limitations

- The aging accounts receivable excel template may give a misleading decision that the customer's financial status is not good. The amount might be outstanding due to any dispute between the parties.

- The report does not provide reasons for the delay. The collection officer has to call the individual customers to trace the reasons.

- The report does not provide for interest to be recovered for unacceptable delays.

- The report does not automatically decide for provisions to be made for doubtful debts.