Table Of Contents

What Is Caisse Populaire?

Caisse Populaire is a French Word for 'Credit Union,' and it simply refers to financial institutions owned and controlled by its members. These institutions perform similar activities as banks but only provide services to their members. At times, based on member needs, the institutions may perform additional services, such as investment advisory.

Caisse Populaires are mostly found in Canada, with the majority of them being focused in the province of Quebec. Different forms of credit unions exist all over the world. Caisse Populaire is one of Canada's most popular and effective financial institutions. Though the system has limitations, with the increasing regulations and technology, these may be easily overcome.

Key Takeaways

- Caisse Populaire is a French term that means "Credit Union," referring to financial institutions owned and operated by their members.

- These institutions provide banking services to their members, such as loans, savings accounts, and credit cards, and may also offer additional services, like investment advice, based on their members' needs.

- While credit unions exist globally in various forms, Caisse Populaires are primarily found in Canada, with the majority located in Quebec. Some typical services offered by Caisse Populaire include checking accounts, online banking, savings accounts, certificates of deposit, credit cards, and loans.

How Does Caisse Populaire Work?

Caisse Populaire is a type of financial institution that works like a cooperative organization, run and owned by its members. Their working is very similar to banks, providing all banking facilities along with lending money to borrowers, investment facilities and insurance services. They are quite famous the Canada, in the Quebec area,

These institutions are almost same as the credit unions existing in United States, the only difference is in the fact that in case of these institutions, the people are typically proficient in French. The first of these came into existence in the 1900 in Quebec, founded by a civil servant named Alphonse Desjardins, who was also a journalist by profession.

A group of people may form Caisse Populaire with a common interest – usually, these are formed by people living in the same community. The members of Caisse Populaire pool their money together (deposits) and use it to provide loans and other financial services to its members. The board of directors is elected democratically, with each member getting one vote regardless of the size of their deposits or investments.

As these institutions work towards the welfare of their members and are not profit-oriented, the fees charged are considerably lower. Unlike major banks, these caisse populaire alliance institutions would be more likely to charge lower interest rates on loans while offering higher interest rates on their deposits. Any profit earned by these institutions would be shared by its members.

The Caisse Populaire is mostly concentrated in Quebec and they also tend to limit their functions within their own community, common ethnic groups or people who stay in the same region. This leads to more customised or personalised service levels.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Types Of Services

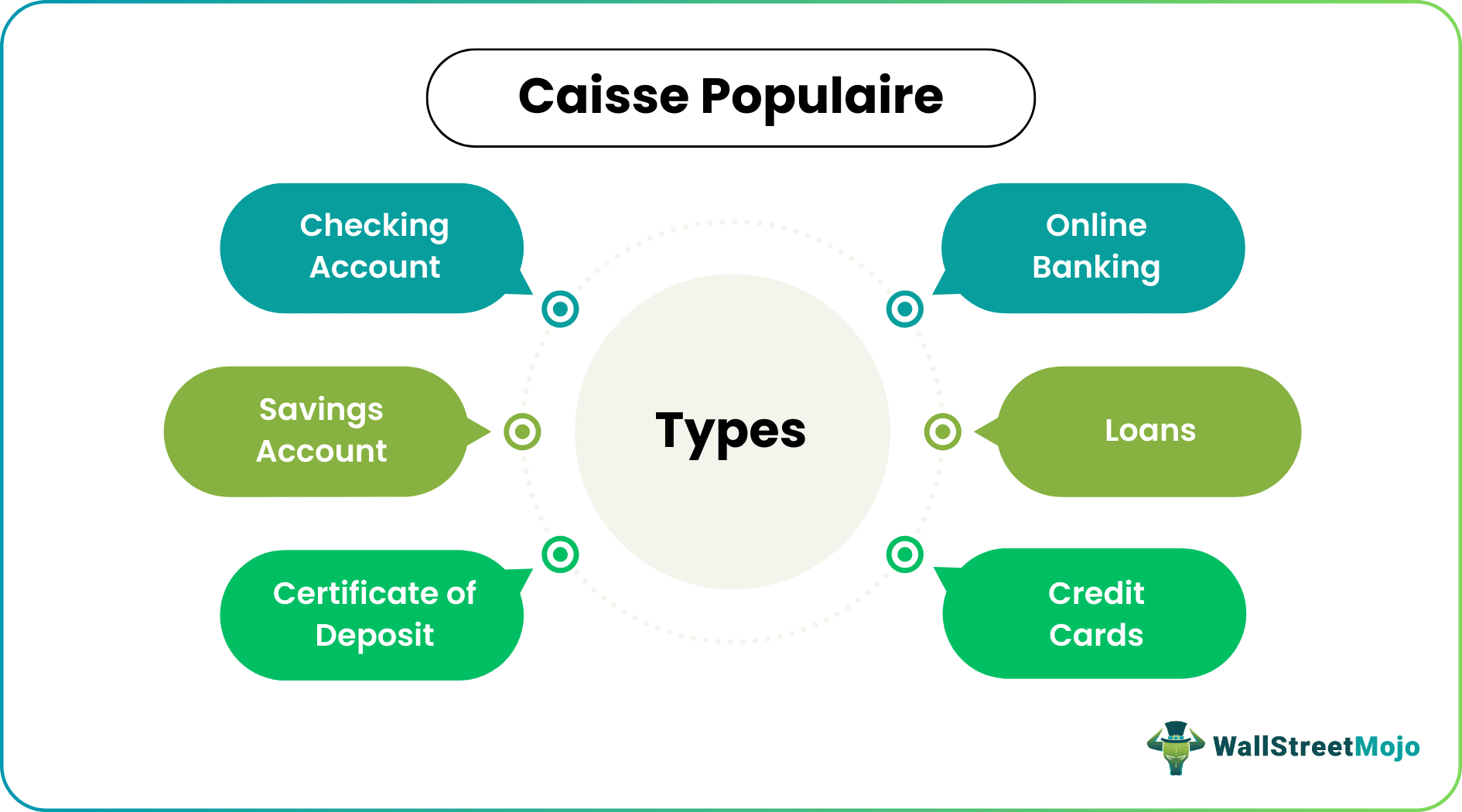

Similar to a regular bank, the following services are offered at Caisse Populaire –

- Checkings Account

- Savings Account

- Certificate of Deposit

- Online Banking

- Loans

- Credit Cards

These services are offered only to the members and not to the general public. However, there are some specific criterias that should be met in order to become a member of caisse populaire alliance. They are as given below:

- The person should be of age of majority in that province. In case they are not, then account can be opened using signature of any guardian or parent.

- They should stay in the area where these institutions operate.

- Each of them should possess a Social Insurance Number.

- They are also required to pay membership fee which is one-time payment.

If the above conditions are clearly met then the person can open an account with a deposit. But this is only the application process. To become a member, they have to purchase a qualifying share, in which case, the caisse will deduct the amount from the deposit to buy it. Thus, now the individual is a permanent member and has the eligibility to vote at annual general meetings of the organization, ad receive dividends too, in case there is surplus profit earned during that fiscal year.

Example

Here are some popular examples of a caisse populaire bank.

Caisse Populaires are both provincially as well as federally regulated in Canada. Each province (except a few) has its legislation relating to the incorporation and operations of credit unions. The bank act of 2012 provided for the setting up of Caisse Populaire on a national scale. As such, the uni financial corporation became Canada's first federal credit union in 2016.

Quebec's credit unions, Canada, are formally federated into the Desjardins group. The Desjardins group was established in 1900 by Alphonse Desjardin, headquartered in Quebec. It is currently the largest federation of credit unions in North America. Other than the traditional banking services, the group also offers additional services such as insurance, real estate, brokerage through its subsidiaries.

Advantages

- Customers are Members: In a credit union, the members and customers are the same. Therefore, the policies and services would be highly customer friendly.

- Welfare Oriented Model: Since the Caisse Populaires do not work on a profit-oriented model, there is no constant drive to increase profits on all possible fronts. Rather, these institutions offer a lower rate for loans to benefit the members of society.

- Charges are Lower: A Caisse Populaire does not charge any fees since all the services are provided only to the members.

- Strict regulation: The regulation process of caisse populaire bank is quite strict and ensures the interest of the members are thoroughly protected.

- Protection of deposits: Members have the facility to protect their deposits using the insurance facility provided to them through the Deposit Insurance Reserve Fund of Financial Services Regulatory Authority (FSRA).

- Simple account opening: The account opening procedure is quite simple and easy to follow.

- Active member participation: The facility of purchasing shares and also vote during the meetings ensures that the member become an active participants in the entire process. This also ensures that they feel their participation will add value to the working of the organization.

- Incentive to grow: Becoming a shareholder means the members take interest in the development of the institution, because good earning will bring dividends and help the institution to expand and grow.

- Low rates – It is important to note that the caisse populaire mortgage rates are lower as compared to any other bank of financial institution. This is a big facility for the members who can borrow money at much lower rates to fulfil their needs. The caisse populaire mortgage rates offer better affordability to the members when it comes to borrowing money.

Disadvantages

Some noteworthy disadvantages are mentioned below. Let us understand them.

- Poorer Technology: They have lower assets and deposits. They do not possess sufficient funds to compete technologically with major financial institutions or banks. Therefore, they tend to be quite an old school in their practices and offerings about technology.

- Location-Oriented: Caisse Populaires was introduced to cater to the needs of members of a particular community. These communities were generally geographically concentrated. Therefore, the services of such credit unions are more likely to be concentrated within a particular geographical area. They are less likely to have worldwide branches and provide banking services from anywhere across the world.

- Lesser ATMs: Automated Teller machines have greatly reduced manual banking services strain. However, Caisse Populaires are less likely to offer wider ATM facilities than a regular bank.

- Restricted Membership: They offer services only to their members. Gaining membership into these credit unions is highly restrictive and is not open to the general public. Therefore, non-members cannot enjoy the benefit of the services of credit unions.

Thus, the above are some advantages and disadvantages of the concept.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Caisse Populaire operates on the principle of cooperative ownership, where each member has an equal say in how the institution is run, regardless of their account size. Members elect a board of directors to oversee the institution's operations and make decisions on behalf of the membership.

Caisse Populaire has a long history in Quebec, dating back to the early 1900s when the first institution was established in Levis. The movement grew rapidly; by the 1960s, over 700 caisses populaires were operating across the province. Today, over 300 caisses populaires in Quebec serve millions of members.

Caisse Populaire is a cooperative institution owned and controlled by its members, whereas a traditional bank is a for-profit corporation that shareholders own. Furthermore, Caisse Populaire offers similar banking services to a traditional bank but typically with lower fees and better interest rates.