Table Of Contents

How Do Banks Make Money?

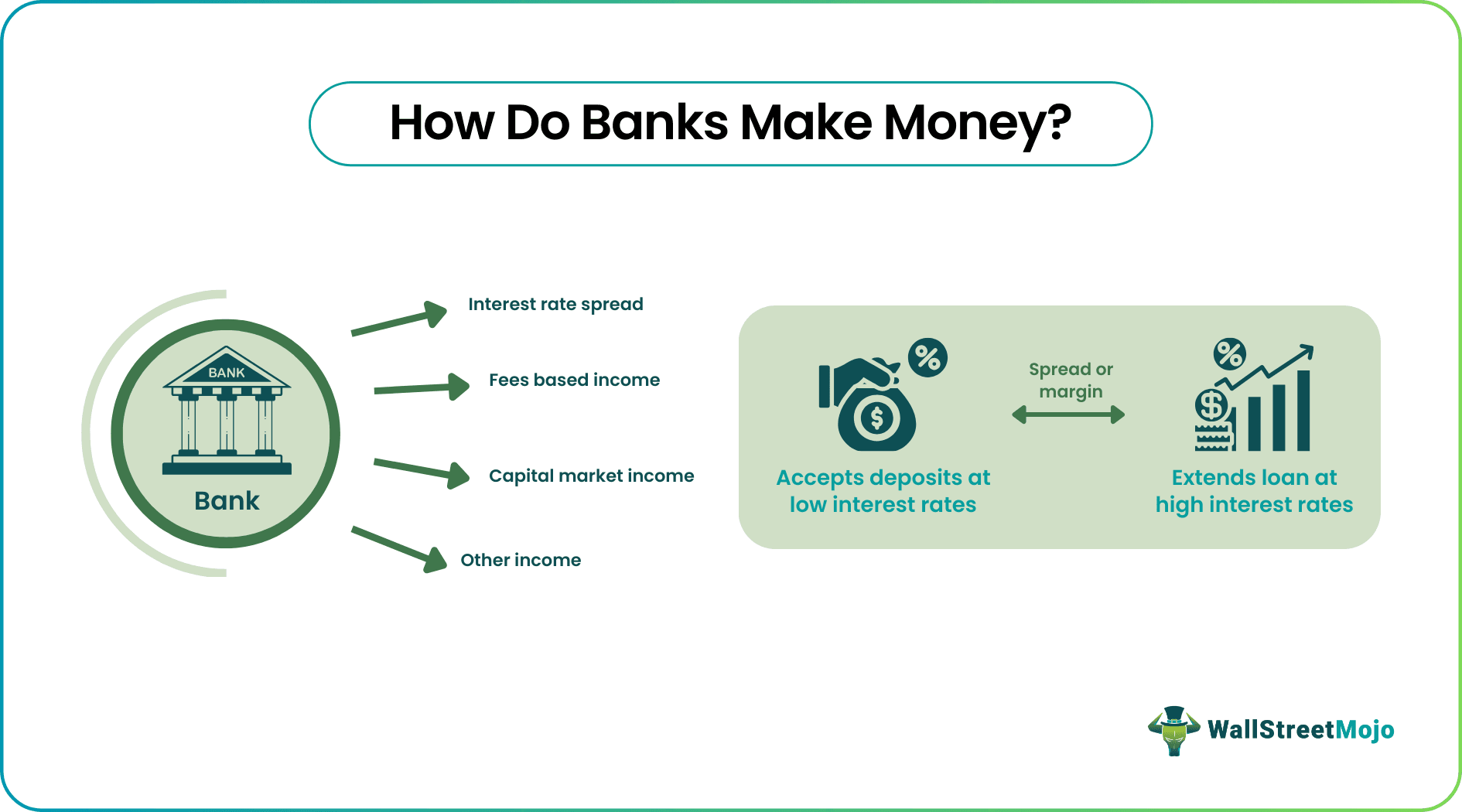

Banks make money through interest rate spreads earned by accepting deposits from customers (depositors or savers) at low interest rates and extending these funds as loans and credit to other customers (individual or corporate borrowers) at a higher interest rate after retaining a portion of these deposits as reserves.

Besides core operations, banks provide other services like investment advisory, asset management, mutual funds, brokerage services, insurance, retirement planning, money transfers, payment processing, and withdrawals. It charges specific fees for such additional services. They also earn through collaborations with e-commerce and other businesses by providing joint offers on debit and credit card purchases.

- Banks make money by levying a higher interest rate on loans borrowers take than the interest on the payout made to depositors. The difference between the higher interest rate (on loans) and the lower interest rate (on deposits) is called the interest rate spread or margin.

- Banks earmark a specific amount as deposits in reserve to ensure they have funds in hand for customer withdrawals at any given point in time.

- They offer many other chargeable services to individuals, corporate houses, and governments, such as ATM facilities, money transfers, withdrawals, investment advisory, mutual funds, brokerage, retirement planning, insurance, etc.

- Banks have three primary income sources—interest income, fees, and capital market earnings.

How Do Banks Work?

Banks are financial institutions that play a vital role in the economy by offering various services, such as accepting deposits, lending money, facilitating transactions, and providing multiple financial products.

In every economy, different types of banks operate, such as central banks, commercial banks, investment banks, payment banks, etc. Here, however, the focus would be on the functioning of commercial banks, thereby taking a closer and deeper look at - How do banks create money?

- Accepts Deposits: Banks receive deposits from individuals, businesses, and other entities through savings accounts, checking accounts, fixed deposits, and other types of accounts. When customers deposit money into their accounts, the bank becomes the custodian of such funds. Deposits are a low-cost source of funding that banks leverage to extend loans to customers.

- Maintains Reserves: These financial institutions must hold a portion of their total deposits as reserves in compliance with regulatory guidelines set by central banks. These reserves are a buffer to ensure banks can fulfill customer withdrawal requests. They act as a liquidity cushion and help maintain public confidence in the banking system.

- Lends Funds: Banks utilize the deposits they receive, along with their capital and borrowed funds, to extend loans and credit to individuals and businesses. Lending stimulates economic growth by financing investments like homes, startups, or other capital projects. It also leads to job creation.

- Processes Transactions: It serves as a platform for secure financial transactions, such as payments, transfers, and withdrawals, through robust systems and protocols. They offer services like debit cards, credit cards, online banking, and mobile banking to facilitate these transactions.

- Offers Investment and Wealth Management Services: Other banking services may include investment advisory, brokerage services, mutual funds, retirement planning, and insurance products. Banks may have specialized divisions or subsidiaries to manage and grow their clients' wealth. These services bring in significant non-interest revenue streams for banks through fees and commissions.

- Cross-selling: It involves selling allied or additional financial products and services to customers. Mutual funds and insurance are commonly sold in this manner. Cross-selling increases a bank’s revenue and strengthens customer relationships.

These financial institutions aim to generate profits through various activities, primarily by earning interest on loans and charging fees for services provided. The interest rates imposed by banks are determined by factors like prevailing market rates, the borrower's creditworthiness, underlying risk, and the type of loan.

Similarly, banks offer interest payments on certain types of deposits to attract and retain customers. Thus, they act as financial intermediaries between those with surplus funds (depositors) and those needing funds (borrowers). They mobilize the funds from savers to borrowers, facilitating investment and economic activities and enabling the optimal use of available resources.

Banks are subject to extensive regulations to ensure stability, transparency, and consumer protection. Regulatory bodies, such as central banks and financial authorities, establish rules and guidelines. These regulations cover capital adequacy, risk management, anti-money laundering, customer privacy, and fair lending practices. Compliance is mandatory as it helps maintain public confidence and trust in the banking system.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Different Ways Of Making Money

Banks generate revenue through several services and activities. Here are the primary methods through which they make money.

1. Interest Income

A significant portion of a bank's revenue comes from charging interest on loans and credit extended to individuals, businesses, and governments. Banks typically offer loans at higher interest rates than the interest paid on deposits, enabling them to earn a margin or spread. The various interest incomes generated by banks are:

- Interest on home loans, car loans, personal loans, education loans, business loans, etc.

- Interest on credit cards, specific debit card withdrawals, international ATM withdrawals, etc.

2. Fee-based Income

Banks impose various fees for their services, thereby building their revenue stream. These charges may include:

- Interchange fees imposed on debit or credit card transactions

- Account maintenance fees

- ATM fees charged on ATM withdrawals

- Transaction fees imposed on online payments

- Overdraft fees on amounts overdrawn despite insufficient account balance

- Wire transfer fees

- Annual charges on bank accounts, credit, and debit cards

- Late payment fees on credit cards

- Safe deposit box fees

- Stop payment fees

- Any other relevant charges

3. Capital Market Income

Banks engage in multiple capital market operations and investment activities, such as purchasing and selling securities, stocks, bonds, and other financial instruments. They earn income through capital gains, interest, and dividends from these investments.

4. Other Income

- Interbank Lending and Borrowing: Banks lend and borrow money from each other in the interbank market. They earn money by charging interest on these short-term loans.

- Foreign Exchange Services: Banks provide currency exchange services to individuals and businesses, earning revenue through exchange rate spreads and transaction fees.

- Asset Management: Many banks offer asset management services, including mutual funds, retirement accounts, and investment advisory services. They charge management fees based on the value of the assets under management.

- Insurance: Some banks have insurance divisions to offer services like life insurance, property insurance, and health insurance. They generate revenue through premiums paid by policyholders.

- Underwriting: Some banks support companies interested in raising capital by issuing new securities like stocks or bonds. By acting as intermediaries between the company and investors and accepting the risk of unsold securities, they earn considerable fees.

- Mergers & Acquisitions (M&As) Advisory: They may offer advisory services to companies signing M&A deals and help them negotiate the best possible terms. For this expertise, banks charge fees.

- Trading: Banks make money from trading via market making (offering liquidity by quoting buy and sell prices for certain securities), proprietary trading (using their own capital to trade in the markets), and client-driven trading (acting as an intermediary on behalf of a client).

Examples

Here are a few examples for a more in-depth look at how banks earn money.

Example #1

Suppose the Bank of Starfin is a commercial bank that accepts deposits from customers and lends to borrowers. Let us try to answer how do banks make profits.

- Bank of Starfin accepts fixed deposits from savers or depositors @7% pa.

- It extends personal loans to borrowers @11% pa.

- It maintains 10% of the deposit as a reserve.

If Abby, a depositor, opens an FD with the bank and deposits $10,000. A borrower, Donna, borrows $9,000 from the bank. Now, the interest income for the bank will be:

- Annual interest paid to Abby = $700 (7% of $10,000)

- Annual interest received from Donna = $990 (11% of $9,000)

- Interest spread or margin = $290 ($990 - $700)

Hence, the bank will earn $290 annually from these banking transactions initiated by customers.

Example #2

An October 2023 report about Citigroup’s third-quarter revenue increase underscored the significance of earning money from all services and activities for banks. Citigroup’s personal banking and wealth management division registered revenue worth $6.8 billion in this quarter, which was a 6% increase from the second quarter.

Another report stated that the bank’s deposits in the third quarter were recorded at $1.3 trillion, which was a 3% fall from the previous year. This happened because many customers preferred to redirect their deposits toward investments in high-yielding assets.

It was also reported that Citigroup’s competitors, Wells Fargo and JPMorgan Chase, also posted high quarterly profits. These revenue figures were primarily driven by interest payments, where banks earned significant amounts in the form of interest earnings.

This indicates that banks track various parameters, including deposits and corresponding interest payments, to arrive at revenue numbers and focus on improving performance across all their divisions and functions.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Listed below are the various ways in which banks make money with credit cards:

● They charge annual, balance transfer, cash advance, foreign transaction, and late payment fees.

● They earn via daily interest charges.

● They earn interchange fees from merchants accepting money via credit cards.

● Through co-branded credit cards, banks charge marketing tie-up fees to collaborating brands.

It is a fallacy that banks make money from nothing. They follow fractional reserve banking to create and induce cash in the system. Hence, commercial banks accept deposits and extend loans while retaining only a fraction of the deposited amount. Trading, investment banking, ATM charges, account maintenance fees, wire transfers, etc., also contribute to their revenues.

Banks generate revenue from Certificates of Deposit (CDs) through interest rate spread or margin. They lend the funds deposited as CDs to borrowers at higher interest rates than the interest rates charged on deposits.

Interest income is the primary method of earning from mortgages. Additionally, they charge various fees to borrowers, including origination fees (to initiate the process), mortgage servicing fees (associated with collecting payments), late fees, prepayment penalties, etc. Mortgages offer predictable, long-term interest earnings. Hence, it is a lucrative product that banks push to sell.

Recommended Articles

This has been a guide to How Do Banks Make Money. Here, we explain the different ways of making money along with its examples. You can learn more about financing from the following articles –