Table Of Contents

Diversifiable Risk Definition

Diversifiable risk is also known as unsystematic risk. It is defined as firm-specific risk and impacts the price of that individual stock rather than affecting the whole industry or sector in which the firm operates. A simple diversifiable risk example would be a labor strike or a regulatory penalty on a firm. So, even if the industry is showing good growth, this firm will face challenges, and shareholders might see lower prices even though the industry might be doing well.

Key Takeaways

- Diversifiable risk, also known as unsystematic risk, refers to firm-specific risks that affect individual stock prices rather than the entire industry or sector.

- The key components of diversifiable risk are business, financial, and management risks. Diversifiable risk is crucial for investors seeking better returns and protecting their initial investment.

- An uncertain risk can arise from various factors such as scams, labor strikes, regulatory penalties, management changes, internal issues, or news specific to the firm.

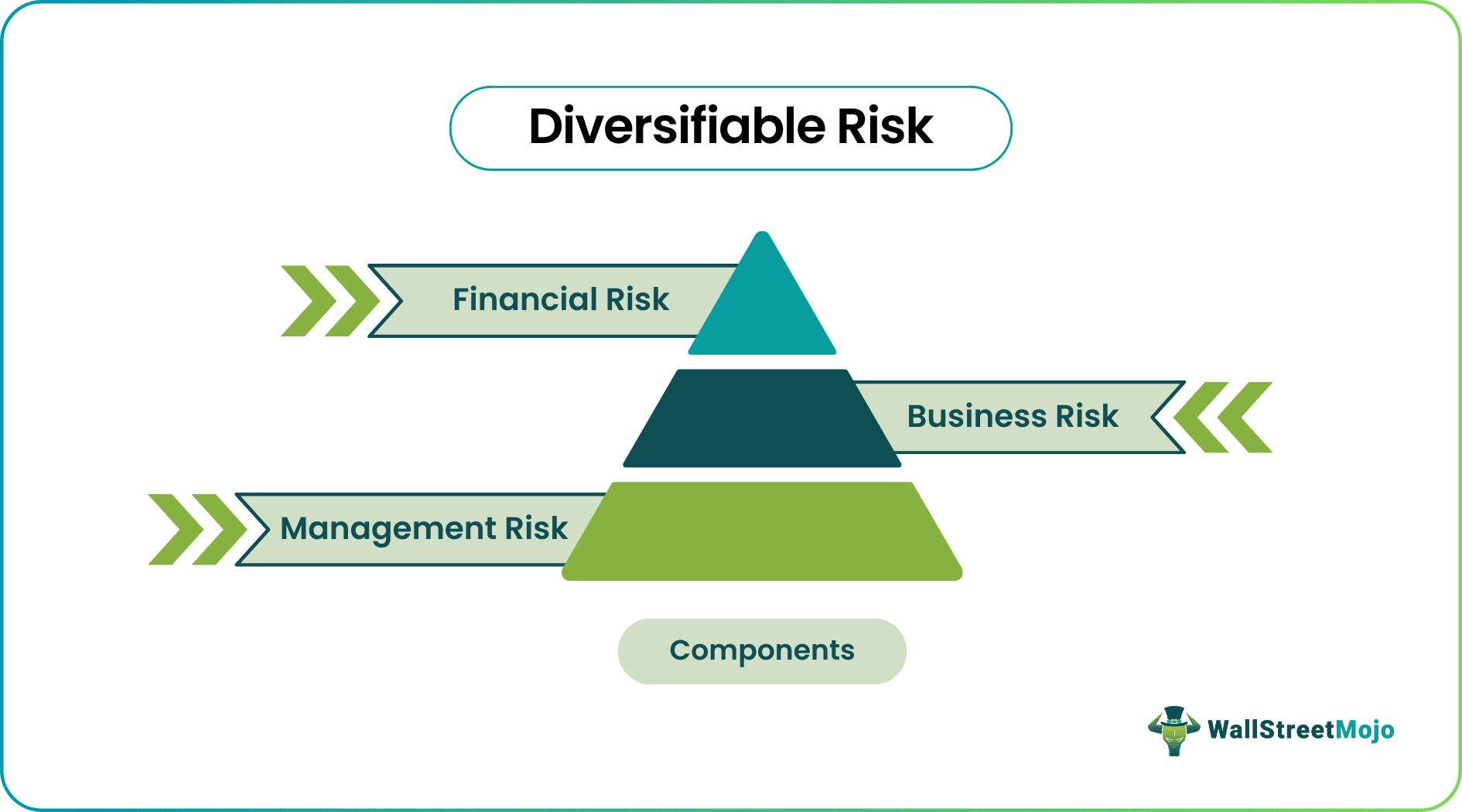

Components of Diversifiable Risk

The three major components of diversifiable risk are as follows:

#1 - Business Risk

Business risk arises because of the challenges a firm faces while doing business. They can be internal and external but are only specific to the firm. For example, a major pharma firm spends a considerable amount of funds on research and development but cannot find a patent for it; this will affect the cash flow and profitability of the firm. That will include an internal example of diversifiable risk. On the other hand, if the firm can release the new product in the market, it is banned after two weeks as it failed some checks. That will be an external business risk.

#2 - Financial Risk

Financial risk is purely an internal risk related to how the firm's capital and cash flow are structured. For a firm to be solvent and pass-through times of turmoil, the capital structure must be robust, and the firm must have an optimal level of debt and equity.

#3 - Management Risk

It is the riskiest and most difficult to manage segment for the firm. Change in leadership has a huge impact as there is always a threat of close associates of the outgoing leader also resigning. That impacts the future strategic growth and the current strategic transformations the firm is undergoing. And least of all to say, there can be said that no strategy in the world can counter corporate governance issues.

Examples of Diversifiable Risk

The simplest way to mitigate diversifiable risk is to diversify. Let us try to understand it with a simple example. Consider a mutual fund that invests on behalf of its investors and is bullish on IT sectors. The fund wants to invest $120,000.

There can be two scenarios:

# Scenario 1

Since the mutual fund is bullish on the IT sector, it invests in the firm with not only the most robust model but is also the market leader in its segment – Google (Alphabet). The firm is hopeful of double-digit growth and invests with a time frame of 5 years for $1,200. As expected, the stock gives a consistent return of 15% for the first three years. However, in the 4th year, the European Union enacted regulations to curb long-standing privacy issues. That affects Google’s business model and affects its profitability. It leads to stock crashing by 40%. However, Google resolved these issues soon. In the 5th year, the stock is back on track and gives a 20% return. Overall, the total return across 5 years is 14% because of 1 very bad year.

Investment without Diversification

Amount post 5 Years of Google

- =1368.79*100.00

- Amount post 5 Years of Google =136878.75

Return

- =(136878.75-120000.00)/120000.00

- Return = 14%

# Scenario 2

Instead of putting all its money in Google, it invests across four major IT firms – Google, Facebook, Apple, and Accenture. Keeping the initial investment equal to $120,000. Let us assume that Facebook, Apple, and Accenture give much lower returns than Google, but they are not affected by any regulatory decision. Hence, even though they do not provide high returns, they did not crash like Google in year 4.

Investment with Diversification

Amount post 5 Years of Google

=1368.79*50.00

- Amount post 5 Years of Facebook = 68439.38

Return

- =(68439.38-60000.00)/60000.00

- Return = 14%

Amount post 5 Years of Facebook

=322.10*100.00

- Amount post 5 Years of Facebook = 32210.20

Return

- =(32210.20-20000.00)/20000.00

- Return = 61%

Similarly, we calculate the amount post 5 years and the return of apple and Accenture.

Apple

Accenture

Total return for scenario 2, considering cashflows of apple and Accenture similar to Facebook.

Therefore, the total amount of post 5 years will be as follows,

- =68439.38+32210.2+26764.51+25525.63

- Total Amount Post 5 Years =152939.72

The return will be -

= (152939.72 - 60000 - 60000)/(60000 + 60000)

Return = 27%

For detailed calculations, please refer to the attached excel sheet above.

The distinction in returns of the two scenarios clearly depicts how diversification protects your returns and initial investments.

Important Points to Note About Diversifiable Risk

- Diversifiable or unsystematic risk is a firm-specific risk compared to systematic risk, which is an industry the specific risk or, more specifically, the risk impacting the whole market or sector. It is an unpredictable risk and can occur any time may be due to – a scam, labor strike, regulatory penalty, management reshuffle, internal factors, or any such news specific to the firm.

- Diversifiable risk as to the term denotes means the risk that can be reduced without negatively impacting returns, and the best part is that it can be mitigated by following simple diversification strategies in your investments. For example, to diversify risk in IT stocks, one can diversify its investments in Google, Accenture, and Facebook.