Let's now look at the head to head differences Discount Rate vs. Interest Rate:

Table Of Contents

Discount Rate vs Interest Rate Differences

Discount rate vs. Interest rate may sometimes move in different paths and sometimes in the same ways. It becomes more important to know the difference between the discount rate and the interest rate if you are in the field of finance.

The difference between Discount Rate vs. Interest Rates is discussed below.

What is Discount Rate?

The rate charged by the Federal Reserve Bank from the commercial banks and the depository institutions for the overnight loans given to them. The Federal Reserve Bank fixes the discount rate and not by the rate of interest in the market.

Also, the discount rate is considered as a rate of interest, which is used in the calculation of the present value of the future cash inflows or outflows. The concept of the time value of money uses the discount rate to determine the value of certain future cash flows today. Therefore, it is considered important from the investor's point of view to have a discount rate for comparing the value of cash inflows in the future from the cash outflows done to take the given investment.

For example, what is more, beneficial to earn $500 at the starting of the year or at the end of the year? Obviously, the best choice will be to earn it at the starting of the year because if the money is earned at the starting of the year, we can invest it and fetch a good amount of return. So that at the end of the year, the money value will be $500 plus the return earned till the end of the year. But if we directly earn $500 at the end of the year, then the value of money will be $500 only.

Moreover, the discount rate is also used by the insurance companies and the pension plan companies to discount their liabilities.

What is Interest Rate?

If a person called as the lender lends money or some other asset to another person called the borrower, then the former charges some percentage as interest on the amount given to them later. That percentage is called the interest rate. In financial terms, the rate charged on the principal amount by the bank, financial institutions, or other lenders for lending their money to the borrowers is known as the interest rate. It is basically the borrowing cost of using other's funds or, conversely, the amount earned from the lending of funds.

There are two types of interest rate:-

- #1 - Simple Interest -In Simple Interest, the interest for every year is charged on the original loan amount only.

- #2 - Compound Interest - In Compound Interest, the interest rate remains the same, but the sum on which the interest is charged keeps on changing as the interest amount each year is added to the principal amount or the previous year amount for the calculation of interest for the coming year.

Interest Rate - Example #1

We can take the example of Mr. Tom having a requirement of $200 lakhs. Now Mr. Tom will approach a bank or other financial institution to avail of the loan. Now the bank agrees to pay him the loan but requires him to repay $230 at the end of the year. Now the borrowing cost (interest) of Mr. Tom is $30 ($230-$200), and the interest rate is $30/$200 = 15%

Interest Rate - Example #2

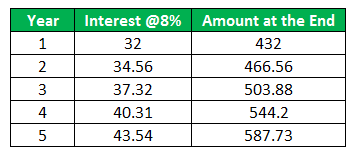

Now another example can be of a person depositing $400 in the bank in its fixed deposit account, giving interest @8% p.a. simple interest. It is the investment done by the person on which he will earn interest. So at the end of 5 years, he will get $560 , and if the interest is given @8% compounded annually, then the amount an investor will receive at the end of 5 years will be $587.73. The calculation is as follows.

Discount Rate vs. Interest Rate Infographics

Here we provide you with the top 7 difference between Discount Rate vs. Interest Rate.

Discount Rate vs. Interest Rate Key Differences

The followings are the key differences between Discount Rate vs. Interest Rate:

- The use of discount rate is complex compared to the interest rate as the discount rate is used in discounted cash flow analysis for calculating the present value of future cash flows over a period of time, whereas the interest rate is generally charged by the investors by two simple ways. The first is simple interest, and the second is compound interest.

- The discount rates are charged on the commercial banks or depository institutions for taking overnight loans from the Federal Reserve Banks, whereas the interest rate is charged on the loan which the lender gives to the borrower by the lender. The lender can be banks, financial institutions, or individuals.

- The discount rate is fixed by the Federal Reserve banks after taking into account the average rate at which one bank would give an overnight loan to other banks, whereas the Interest rate is dependent upon the market scenario, creditworthiness of the borrower, lending risk, etc.

Discount Rate vs. Interest Rate Head to Head Differences

| Basis - Discount Rate vs. Interest Rate | Discount Rate | Interest Rate |

|---|---|---|

| 1. Charged on | It is a rate charged by the Federal Reserve Banks from the commercial banks or depository institutions on the overnight loans given to them.

| It is a rate charged on the sum of the number of assets given for use to the borrower by the lender. The asset or the amount belongs to the lender, and it is given to the borrower for a certain time period. Borrowers/ Individuals |

| 2. Usage | It is used in calculating the present value of future cash inflows or outflows.

| It cannot be used in the calculation of the present value of future cash flows. |

| 3. Rates are Decided by | Central banks

| Commercial Banks

|

| 4. Dependency | It is dependent on the federal reserve banks, not on the market interest rate. | It is dependent on many factors like market interest rate, the creditworthiness of the borrower, lending risk, etc. |

| 5. Economies | It is not affected by the demand and supply in the market.

| It is affected by the demand and supply in the market.

|

| 6. Perspective | It focuses on the Investor's perspective.

| It focuses on the lender's perspective and is based on market demand and supply.

|

Conclusion

As per the analysis, we can conclude that the discount rate vs. Interest rate are the two different concepts where the discount rate is the broader financial concept having multiple definitions and usage, whereas the interest rate is a narrow financial concept. However, many things are to be considered for calculating the interest rate. Discount rate calculations show that the interest rate is one of the components for estimating the discount rate. The interest rate is useful to capture the part of the project's risk, but the calculation of the discount rate incorporates the risk of equity also.