Table Of Contents

What Is Levered Beta?

Levered beta is a measure of the systematic risk of a stock that includes risk due to macroeconomic events like war, political events, recession, etc. Systematic risk is inherent to the entire market and is also known as the undiversifiable risk. It cannot be reduced through diversification. The levered beta formula is used in the CAPM.

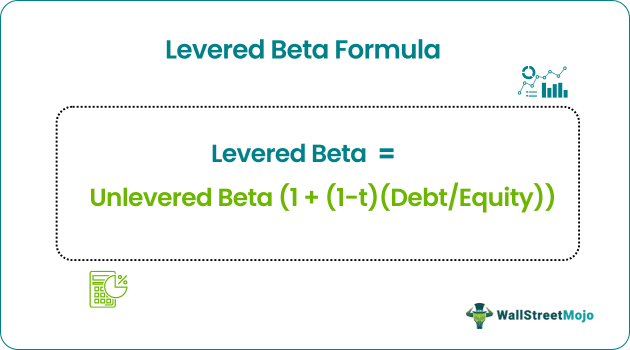

The levered beta formula is represented as follows,

Levered Beta = Unlevered Beta (1 + (1-t)(Debt/Equity))

Where t is the tax rate

Alternatively, the formula is:

Unlevered Beta = Levered Beta (1 + (1-t)(Debt/Equity))

Where t is the tax rate

Explanation of Levered Beta Formula

To calculate the levered beta, use the following steps:

Step 1: Find out the Unlevered Beta

Step 2: Find out the tax rate for the stock. The tax rate is represented by t.

Step 3: Find out the total debt and equity value.

The formula for calculating total debt is:

Debt = Short term debt + Long term debt

Step 4: Calculation using the formula:

Levered Beta = Unlevered Beta (1 + (1-t)(Debt/Equity))

To calculate the unlevered beta, we adjust the above formula. The steps for calculation of the unlevered beta are as under:

Step 1: Calculate the levered beta.

Step 2: Find out the tax rate for the organization. The tax rate is represented by t.

Step 3: Find out the total debt and equity value.

Step 4: Calculation of the unlevered beta using the formula:

Unlevered Beta =Levered Beta (1 + (1-t)(Debt/Equity))

Examples of Levered Beta Formula

Let’s see some simple to advanced practical examples to understand it better.

Example #1

Calculate the levered beta for Company A using the following information:

- Unlevred Beta: 0.8

- Tax Rate: 25 %

- Debt Equity Ratio: 0.30

Solution

Calculation

=0.8*(1+(1-25%)*0.30

- = 0.98

Example #2

The CFO of Fabrix Inc. got some information from the company's financial statements and a popular financial database. The information is as under:

- Short Term Debt: 5000

- Long Term Debt: 4000

- Equity: 18000

- Tax Rate: 0.35

- Beta: 1.3

Calculate the Unlevered beta from the above information.

Solution

Calculation of Debt

- = 5000 + 4000

- = 9000

Calculation of Debt Equity Ratio

- =9000/18000

- = 0.5

Calculation of Unlevered Beta

= 1.3/1+(1-0.35)*0.5

- = 0.98

Example #3

Plumber Inc. is a manufacturing concern listed on the stock exchanges. The Chief Financial Officer (CFO) of Prumber Inc. wanted to calculate the riskiness of a stock. For this purpose, he wants to calculate the levered beta. He gives you the following information, which he has obtained from the company's financial statements and a popular financial database that gives relevant financial information related to the company. Let us calculate the levered beta from the information given below.

- Unlevered Beta: 0.85

- Tax Rate: 30%

- Equity: $80,000

- Non-Current Term Debt: $50,000

- Current Term Debt: $30,000

Calculate the levered beta from the above information.

Solution

Calculation of Total Debt

- = $50,000 + $30,000

- = 80,000

Calculation of Debt Equity Ratio

- =80,000/80,000

- = 1

= 0.85* (1+ (1-0.30)*1)

- = 1.445

Relevance And Uses

The risk of a firm in its capital structure to the volatility in the market is measured by levered beta. It measures the risk of a company that cannot be reduced by diversification. Levered beta considers both equity and debt while calculating the risk of a company. A beta of 1 indicates that the stock's riskiness is similar to that of the market.

A beta of greater than 1 indicates that the stock is riskier than the market. A beta of less than 1 indicates that the stock is less risky than the market. For instance, a beta in finance indicates that the stock has double the volatility compared to the market. A negative beta implies that the stock has an inverse correlation with the market.

Different types of firms have different betas based on their characteristics. Certain cyclical sectors such as stock brokerage firms, automobiles, and banking are known to have higher betas than non-cyclical sectors. Similarly, sectors like fast-moving consumer goods (FMCG), pharma, etc. have lesser betas than cyclical sectors. Firms with higher operating leverage tend to have higher betas as their profits are more volatile than their peers. Similarly, firms with higher financial leverage have higher betas than those with lesser financial leverage. In other words, firms with higher levels of debt have higher betas. It is because fixed interest expenses have to be paid on this debt irrespective of the levels of profitability.

On the other hand, the unlevered beta measures the market risk of a company without the impact of debt. Thus, the contribution of a company's equity to its risk is measured by unlevered beta.

One of the criticisms of beta is that a single number dependent on past price fluctuations cannot represent the risk entailed by security. Similarly, the past performance of a security may not predict the future risk of security. Similarly, beta does not consider fundamental factors related to the company. The underlying assumption in beta is that the downside risk and upside potential are equal, which sounds intuitively incorrect.

Levered Beta Formula in Excel (with Template)

The following information related to George Inc, which is listed on the bourses, is as below:

- Levered Beta: 0.9

- Debt: $50,000

- Equity: $100,000

- Tax Rate: 40%

Calculate the Unlevered Beta from the above information.

Solution

Step 1: We first need to calculate the debt-equity ratio. To calculate the debt-equity ratio, insert the formula = B4/B5 in cell B7.

Step 2: Press Enter to get the Result

Step 3: Insert the formula =1+(1-B6)*B7 in cell B8 to calculate the denominator of the Unlevered Beta Formula.

Step 4: Press Enter to get the Result

Step 5: Insert the formula =B3/B8 in cell B9 to calculate the Unlevered Beta.

Step 6: Press Enter to get the Result

- =0.6923

The Unlevered Beta is 0.6923.