Table Of Contents

Risk-Free Asset Meaning

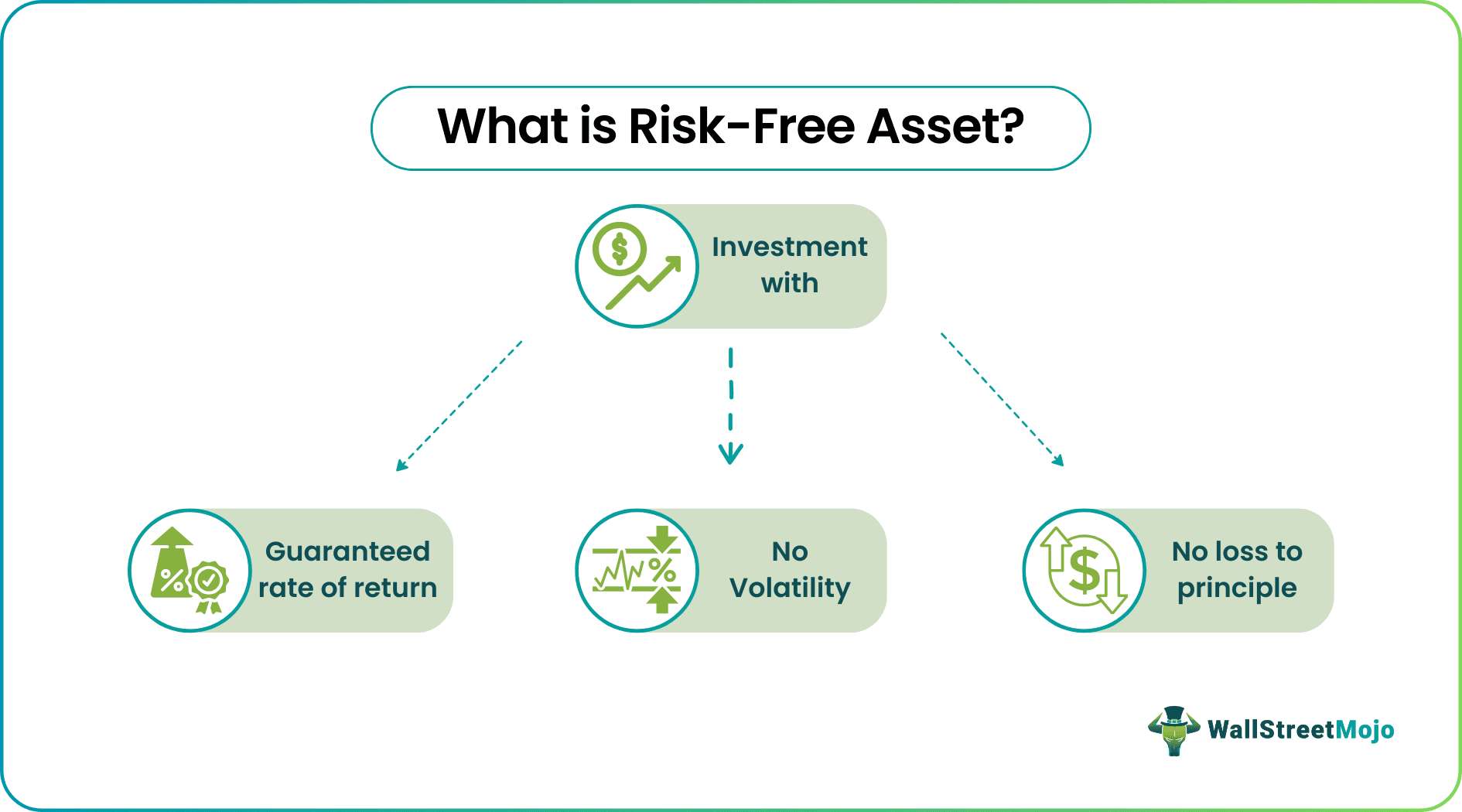

A Risk-Free Asset refers to an investment in an asset having a guaranteed rate of return where the value of the principal does not decline and has no volatility. It serves as a benchmark for other investments and is an essential element of financial models like the Capital Asset Pricing Model (CAPM).

Such an asset helps an investor determine the lowest return they can expect from their investment without any risk. It plays a critical role in helping investors balance return and risk in their portfolio investments. US Treasury bills are backed by the full faith and credit of the US state and are an example of this asset.

Key Takeaways

- A risk-free asset means an investment in an asset with a guaranteed rate of return and no volatility or fall in the value of the principal.

- Many investors use it as a benchmark for additional investments, and it forms a crucial component of financial models like CAPM.

- They have advantages like safe investment options, guaranteed returns, no default on principal and interest payments, stabilized mixed portfolios, low risk, and providing a safety net in times of inflation and recession.

- They possess disadvantages like lower interest rates, limited diversification, resulting in losses during rate fluctuations, and being unsuitable for wealth accumulation and retirement planning.

Risk-Free Asset Explained

A risk-free asset can be defined as a safe investment asset that gives guaranteed future returns without almost any virtual value loss to investors regarding returns as predicted. These assets belong to the capital markets, fixed income securities category, or liquid monetary markets, offering assured returns irrespective of any associated risk, like treasury bills. Treasury bills are evidently risk-free assets because the US state can print as much money as it wants, so it poses no risk to investors lending it money. This is because the US government will always pay interest and principal payments on the due date.

Besides, US government-issued debt obligations like bonds and notes are also included in the list. All such instruments have government backing or high-creditworthiness corporations. Hence, they tend to give fixed interest rates and principals as promised on the due date. Owing to their lowest risk, they attract a large number of investors who want to retain their capital to access funds immediately.

Investors use these instruments to compare guaranteed returns on a risk-free asset with returns on riskier assets to evaluate risk-return tradeoffs. Moreover, in times of economic recession, these assets offer a safe avenue for protecting their capital. Most of the time, governments, individuals, and institutional investors use it for emergency savings, liquidity buffers, and short-term investments. In the financial world, they set prices for securities and serve as interest rate references. These assets help in the proper allocation of capital to help stabilize financial markets. Hence, such instruments contribute to the stability of the financial system.

Examples

Let us use a few examples to understand the topic.

Example #1

A recent article published on March 29, 2023, demonstrates that the US Treasury is also vulnerable to market risks and volatility. It is because the Silicon Valley Bank (SVB) collapse has led its customers and clients to panic, as they had more than $250,000 in federal deposit insurance. Hence, they started selling all their Treasury holdings plus mortgage bonds supported by state agencies at huge losses. Consequently, the Federal Reserve raised interest rates at a high pace to tame inflation by raising its key policy rate to 5% from 4.75%.

As a result, the prices of Treasury bills fell due to the opposite bond price movement. SVB had to sell all its holdings at huge losses while facing such a duration risk, which it failed to acknowledge. Hence, the SVB collapse has highlighted concern regarding the broader vulnerability of the banking system to government-backed, risk-free assets or securities held by US banks, which amount to $4 trillion.

Moreover, all emergency measures by the US government still need to restore confidence in the stability and risk-free asset nature of the $24 trillion treasury markets. As a result, the role of the Federal Reserve and ambiguity regarding the Treasury's future exhibit the characteristics of past US financial crises.

Example #2

Let us assume Emily invested in series I bonds issued by the US Treasury, which are backed by the faith and credit of the US government. They offer guaranteed returns and safeguard cash value from inflation. Their interest rates are aligned with changing market prices, providing attractive avenues of investment for investors. These investors invest in I-series bonds because of their stability and protection against inflation.

Therefore, investors get risk-free assets while making a low-risk investment choice as compared to high-interest savings accounts and certificates of deposit. Moreover, these bonds are free from any state or local taxes, making them even more appealing for investment by investors in highly taxed cities or states.

Advantages

One should invest in these assets, which offer returns at zero risk, as they provide the following advantages:

- It provides a safe investment option, protecting investments from potential losses and market fluctuations.

- Government-backed securities give guaranteed returns since they have the full faith and credit of the government or the issuing entity.

- These assets assure capital safety by avoiding default on interest and principal payments.

- A risk-free asset in the portfolio adds to risk mitigation and stabilizes the foundation within a mixed investment strategy. It is based on the efficient frontier and the risk-free asset concept of portfolio theory.

- Investors with low risk and a stable return appetite find these to be the best options for investment.

- These assets are an integral part of CAPM, assisting in estimating the actual value of an asset while also explaining the relationship between expected return and risk.

- It also acts as a financial cushion in times of financial meltdown and high inflation.

- The US Treasury, a risk-free benchmark, draws international investors and is globally acclaimed.

Disadvantages

One should know the disadvantages before investing in these assets regarding offering return at zero risk as below:

- It gives a relatively lower rate of interest to investors.

- During rate of interest fluctuations, it might become challenging to time the investments in these assets strategically.

- It may lead to the loss of better opportunities with higher returns at slightly higher risk.

- CAPM models may not always hold as they are based on weak assumptions of stable, risk-free rates.

- It may limit the diversification potential of an investment portfolio.

- During interest rate changes, existing risk-free assets might lead to potential losses.

- It might not be suitable for long-term retirement and wealth accumulation planning for investors due to its conservative nature.

- Many times, the government and central bank's monetary policies may impact these assets' guaranteed return and principal payment as per the due date.