Table Of Contents

Formula

For calculating this, the estimates and judgment of the investors are used. The The equity risk premium calculation is as follows:

Firstly we need to estimate the expected rate of return on the stock in the market, then the estimation of the risk-free rate is required, and then we need to deduct the risk-free rate from the expected rate of return.

Equity Risk Premium Formula:

Equity Risk Premium = Market Expected rate of return(Rm) - Risk Free Rate (Rf)

The stock indexes like Dow Jones industrial average or the S&P 500 may be taken as the barometer to justify arriving at the expected return on stock on the most feasible value because it gives a fair estimate of the historical returns on the stock.

As we can see from the formula above that the market risk premium is the excess return that the investor pays for taking the risk over the risk-free rate. The level of the risk and the equity risk premium is correlated directly.

Let's take the example to calculate long term equity risk premium where we use of a government bond giving a return of 4% to the investor; Now, in the market, the investor will choose a bond that will give a greater than 4% return. Suppose an investor choose a company stock giving a market return of 10%. Here the equity risk premium will be 10%- 4% = 6%.

Interpretation

The interpretation of short or long term equity risk premium are as follows:

- We know the risk associated with debt investment, as the investment in bonds, is usually lower than that of equity investment. Like that of preferred stock, there is no surety of receiving the fixed dividend from the investment in equity shares as the dividends are received if the company earns a profit and the dividend rate keeps on changing.

- People invest in equity shares, hoping that the value of the share will increase shortly and they will receive higher returns in the long term. Yet there is always a possibility that the value of a share may decrease. This is what we call the risk that an investor takes.

- Moreover, if the probability of getting a higher return is high, the risk is always high. If the probability of getting a smaller return is high, then the risk is always lower, and this fact is generally known as a risk-return trade-off.

- The return that an investor on a hypothetical investment can receive without any risk of having financial loss over a given period is known as the risk-free rate. This rate compensates the investors against the issues arising over a certain period like inflation. The rate of the risk-free bond or government bonds having long-term maturity is chosen as the risk-free rate as the chance of default by the government is considered to be negligible.

- The riskier the investment, the more is the return required by the investor. It depends upon the investor's requirement: risk-free rate and equity risk premium help determine the final rate of return on the stock.

Use In the Capital Asset Pricing Model (CAPM)

The CAPM model explained in the Valuation Course is used to establish the relationship between the expected return and the systematic risk of the securities of the company. CAPM model is used to price risky securities and calculate the expected return on investment using the risk-free rate, expected rate of return in the market, and the beta of the security.

The equation for CAPM:

Expected Return on security = Risk-free rate + beta of security (Expected market return – risk-free rate)

= Rf +(Rm-Rf) β

Where Rf is the risk-free rate, (Rm-Rf) is the equity risk premium, and β is the volatility or systematic risk measurement of the stock.

In CAPM, to justify the pricing of shares in a diversified portfolio, It plays an important role in as much as for the business wanting to attract the capital it may use a variety of tools to manage and justify the expectations of the market to link with issues such as stock splits and dividend yields, etc.

Example

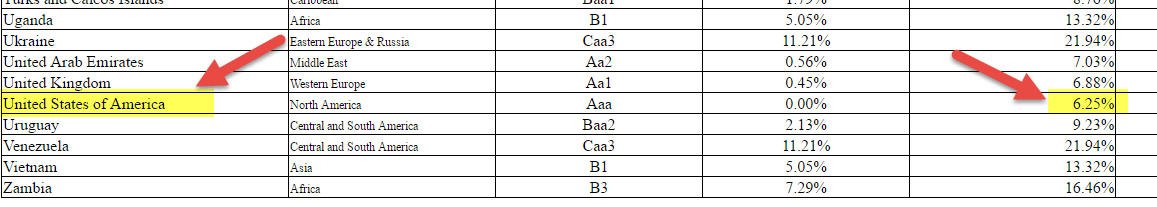

Suppose the rate of return of the TIPS (30 years) is 2.50% and the average annual return (historical) of the S&P 500 index by 15%, then using the formula equity risk premium of the market would be 12.50% (i.e., 15% – 2.50%) = 12.50%. So here, the rate of return that the investor requires for investing in the market and not in the risk-free bonds of the government will be 12.50%.

Apart from the investors, the company managers will also be interested as the equity risk premium will provide them with the benchmark return, which they should achieve for attracting more investors. For instance, one is interested in XYZ Company's equity risk premium, whose beta coefficient is 1.25 when the prevailing equity risk premium of the market is 12.5%. Therefore, he will calculate the company's equity risk premium using the details given, which comes to 15.63% (12.5% x 1.25). This shows that the rate of return that XYZ should generate should be at least 15.63% for attracting investors to the company rather than risk-free bonds.

Advantages And Drawbacks

Just as every financial concept has its own advantage and disadvantage, so does this concept. Let us look at them in details.

Advantages

- Using this premium, one can set the portfolio return expectation and determine the policy related to asset allocation. For example, the higher premium shows that one would invest a greater portfolio share into the stocks.

- Also, CAPM relates the stock's expected return to equity premium, which means that a stock with more risk than the market (measured by beta) should provide an excess return over and above equity premium.

- Thus in a way it provides a measure to assess the risk and return trade-off while designing the portfolio for investment.

- The historical equity risk premium helps in prediction of return expectations from a stock in future, which leads to adjustment of investment strategies.

- It helps in comparing different investment options and choose the one with maximum return with minimum risk and cost. Comparison is done with asset classes and investors can take informed decisions regarding investments.

Drawbacks

- On the other hand, the drawback of average equity risk premium calculation includes the assumption that the stock market under consideration will perform in the same line as its past performance. No guarantee is there that the prediction made will be real.

- Different financial models offer different theories on the measurement of the premium which leads to ambiguity. This lack of consensus proves to be challenging.

- It may be influenced by investor sentiments. They may be irrational and be biased regarding various factors that influence the premium. This distorts the accuracy level, risk factor and return expectations, affecting the premium value.

- The market dynamics are never static. They change with time and as per investor preference. It requires continuous tracking and monitoring to understand and make adjustment as per the current market conditions.