Table Of Contents

What Are Financial Modeling Benefits?

The financial modeling benefits are on the continuous rise due to the ever-changing financial landscape across sectors and the overall economy of any country. There is a threat of various types of risks, and also the urge to make considerable returns from investments, where these models play a huge role.

Several organizations depend on financial models for effective decision-making. One can use historical data and current market scenarios to forecast future economic performances. These calculations help in designing strategies to mitigate risk and achieve financial objectives. The use of financial modeling tools and techniques is increasing, considering its overall benefits.

Key Takeaways

- A key objective of preparing a financial model is to forecast a business’s future financial performance. These forecasts help plan the growth of an organization and improve decision-making.

- Individuals can utilize spreadsheets to build such a model. The process involves entering financial data to compute projected losses, profits, expenses, and revenue.

- Financial modeling offers an extensive range of benefits. For example, it offers clarity regarding estimated cash outflows and inflows and helps determine the worth of a company.

Financial Modeling Benefits Explained

In the current economic environment, the financial modelling benefits play a very important role. The process involves the creation of a summary of data in a very organized format, which can be interpreted easily by its users. Such data is partly collected from past historical transactions and performances and partly calculated using various formulas.

They are used for forecasting future financial performances, based on which the stakeholders can make important decisions regarding investment and the growth potential of a business. The models are typically made in the form of spreadsheets, where financial data is entered to calculate projected revenue, expenses, profits, losses and so on.

Image Source: Financial Modeling and Valuation Course Bundle

The models help in understanding the impact of different financial transactions on different areas of the business. This, in turn, helps to analyze whether the strategies implemented in the business to carry out operational processes in departments have given positive results over a time period, or some changes are required to achieve the required objective.

If you want to learn how to build a financial model from scratch, this Financial Modeling 2-Day Bootcamp can be your ideal choice. The instructor of the program is a highly experienced industry expert who uses a step-by-step approach that involves case studies as well as real-world examples to help you build a practical understanding of the process.

These models act as a guide to analyze the stock performance that affects executive decisions in the long run. It is possible to estimate the value of a business and compare it with its peer companies to identify areas of high performance and areas that require immediate attention.

Overall, in this article, we will study the innumerable benefits of the process in detail so that we are able to use it in the best way possible for making financial decisions both as stakeholders and as management.

Benefits

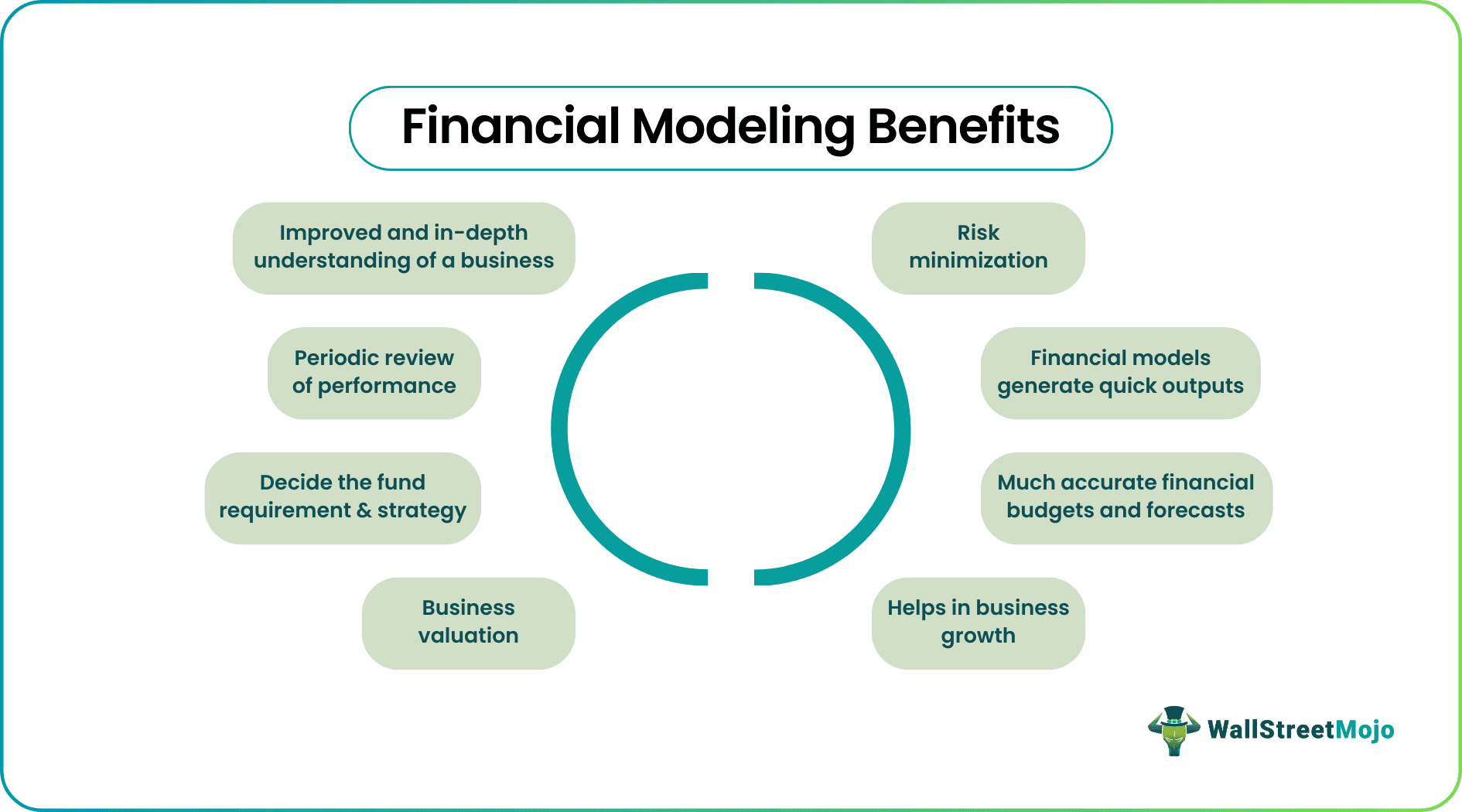

In this article, we discuss the top 8 benefits of using financial modeling.

#1 - Improved and In-Depth Understanding of a Business

A financial model is developed after having a deep insight into the business. The analysts understand how a business operates and what the different factors are that could impact such a business. The businesses are also required to understand what changes are expected to take place in a scenario when there are changes in the internal as well as external environment of the business. Thus, companies that develop financial models can understand their business as well as the factors affecting them better than their competitors and are therefore better prepared for any uncertain situation.

#2 - Periodic Review of Performance

To understand how a business is performing, it is important to do a variance analysis. Financial models help in carrying out the variance analysis by comparing the actual results of the business against the budgets. The performance review can be done periodically to get feedback on the business operations. Some advanced financial models help businesses to carry out adjustments in their operations based on the variance analysis so that overall profits can be improved.

#3 - Decide the Fund Requirement & Strategy

Financial models provide clarity on the expected cash inflows and outflows. A business can get to know the net cash flows that it would require to arrange to run its affairs. The next step is to decide the source of funding, i.e., debt vs equity. For this, the financial models help in understanding what the cash flow position would be after meeting the interest expense and repayment of loans. This helps to decide whether and to what extent the business can take debt and what the level of equity financing is.

#4 - Business Valuation

Companies that wish to know their worth can use financial models. A financial model helps in determining free cash flows that are expected to accrue to a business at different points of time, which further helps in reaching the fair value of a business. This becomes useful for businesses when making any restructuring, such as when selling the stake to outsider parties and investors.

#5 - Risk Minimization

Since a financial model helps in carrying out due diligence by suggesting the financial impact of a particular activity, thus, it helps businesses minimize the overall risk in a business. For example, suppose a business wants to enter a new market; a financial model would guide the business regarding the cost of such entrance, the effect of marketing, price changes, and so on.

#6 - Financial Models Generate Quick Outputs

Businesses may take months to get answers to certain financial questions and to determine the impact of a certain decision. However, financial models are quick in giving results, which helps in quick decision-making. In such a way, financial models become very useful for businesses.

#7 - Much Accurate Financial Budgets and Forecasts

Financial models build financial budgets and forecasts based on business data and thus, tend to be accurate. Businesses can use these budgets and forecasts for their business activities so that their activities remain structured and within the defined structure. Not following any budget or business strategy can be harmful to businesses.

#8 - Helps in Business Growth

How the financial models help a business to grow is by suggesting the areas that are capable of generating higher profits. The models also help in carrying out a cost-benefit analysis of new projects. Businesses can use financial models to understand where investments should be made and in which areas and projects for better profitability and growth.

Example

Let us take an example to understand the concept.

We assume ABC Ltd is a pharmaceutical company that operates within a country and plans to open offices outside the country too, in order to expand. The business has been in the market for the past 5 years and has performed reasonably well despite strict competition due to its quality of products, innumerable branches and online presence, which facilitates customers to order and get delivery instantly.

However, it is necessary for the management to decide whether it is feasible to invest in expansion at this stage, and if so, then how much funding is required to make it happen. They decide to use their past data to project future performances regarding sales, revenue, cost and profitability and then decide on the same after a detailed assessment of their asset and liability positions.

In such a case, financial modelling is a very useful tool, as it will suggest the way forward through calculation to evaluate the estimated cost of the process and projected profits that the business may expect. They ca also use the model to anticipate the effect of various external events on its existing strategies and frame budgets in advance. This will help in a planned financial approach during the expansion phase.

The above example explains the benefits and importance of these financial models in a company.