Definite guide to Alibaba IPO: Financial and Valuation Model

Table of Contents

#9 – Alibaba’s 5 Big Numbers to Know from F-1 Filing

- $5.8 billion – Alibaba processed $5.8 billion in transactions and 254 million orders on Singles Day 2013 (China’s equivalent of Cyber Monday).

- $248 billion – This is Alibaba’s total Gross Merchandise Value (GMV) on China’s retail marketplaces, more than Amazon and eBay combined.

- 5 Billion Packages – Alibaba’s logistics network delivered approximately five billion packages generated from Alibaba-owned marketplaces in 2013.

- 31 million orders per day! – Alibaba sees an average of 11.3 billion orders annually, with 231 million active buyers. This is approximately 31 million orders per day and 49 average annual orders per active customer.

- 136 million – Alibaba has 136 million monthly active users (December 2013), representing US$37 billion in Mobile Gross Merchandise Value.

Alibaba IPO

#1 – What is Alibaba?

Alibaba is the most profitable Chinese e-commerce company. Alibaba handled transactions worth more than $248 billion last year, more than Amazon and eBay combined. Alibaba has 231 million active buyers and 8 million active sellers.

- Alibaba, founded in 1998-99 by an English Teacher Jack Ma, is headquartered in Hangzhou, China.

- Alibaba mainly consists of two big shopping websites: 1) Taobao, a consumer-to-consumer marketplace launched to compete with eBay in China, and 2) Taobao Mall (or Tmall), an Amazon-like market that allows Chinese consumers to purchase directly from brands.

- Along with Juhuasuan, a Groupon-like group-buying marketplace, those sites make up more than 80 percent of Alibaba’s revenue.

- Another point to note is that China’s online shopping market size was $295 billion in 2013, and Alibaba controlled 80% of this pie (excellent!)

- With China’s online shopping market size estimated to multiply 2.5 times to $713 billion by 2017 (source: iResearch), Alibaba’s size can only grow from here.

#2 – What is Alibaba’s Business Model?

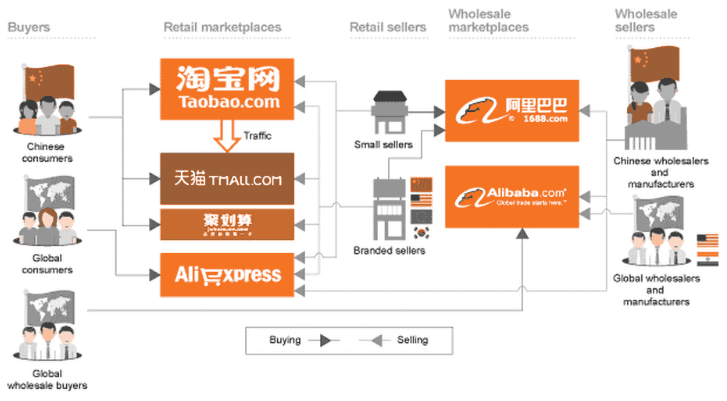

To understand Alibaba’s Business Model, we can look at the below chart that depicts the network of entities that Alibaba operates. Also, you will note how the buying and selling of goods are done through Alibaba’s system for Business to Business (B2B) or Business to Customers (B2C) models.

#1 - Alibaba’s Business Model

source – Alibaba IPO Prospectus

#2 - Buyers

- Chinese consumers buy on Taobao Marketplace, Tmall, and Juhuasuan

- While browsing or searching on Taobao Marketplace, consumers see product listings from both Taobao Marketplace and Tmall

- Global consumers buy on AliExpress

- Global wholesalers buy on Alibaba.com

#3 - Retail Sellers

- Small sellers in China sell on Taobao Marketplace and AliExpress

- Chinese brands sell on Taobao Marketplace, Tmall, Juhuasuan, and AliExpress and global brands sell on Tmall Global

- Sellers source products on 1688.com

#4 - Wholesale Sellers

- Chinese wholesalers and manufacturers supply retail merchants in China on 1688.com and global wholesale buyers on Alibaba.com

- Chinese wholesalers and manufacturers provide directly to global consumers on AliExpress

- Global wholesalers and manufacturers supply global wholesale buyers on Alibaba.com

# 3 – Why this name – Alibaba?

Jack Ma, a founder of Alibaba, wanted a name that would be easy for anyone, even non-Chinese, to say. According to an interview he gave in 2006 with CNN’s Talk Asia program, Ma was in a San Francisco coffee shop when he came up with the name. Below is the excerpt of his interview.

One day I was in San Francisco in a coffee shop, and I was thinking Alibaba is a good name. And then a waitress came, and I said do you know about Alibaba? And she said yes. I said what do you know about Alibaba, and she said, “Open Sesame.’ And I said yes, this is the name! Then I went onto the street and found 30 people and asked them, ‘Do you know Alibaba’? People from India, people from Germany, people from Tokyo and China… They all knew about Alibaba. Alibaba — open sesame. Alibaba — 40 thieves. Alibaba is not a thief. Alibaba is a kind, smart business person, and he helped the village. So…easy to spell, and global knowledge. Alibaba opens sesame for small- to medium-sized companies. We also registered the name AliMama, in case someone wants to marry us!

#4 – How does Alibaba compare to big-name Internet companies?

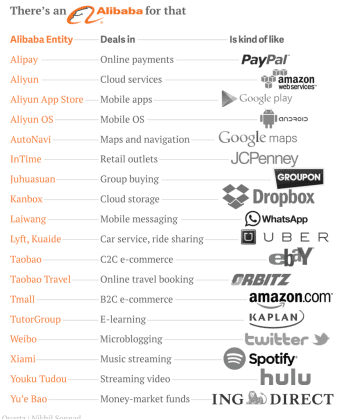

Finding a trustworthy business comparable to Alibaba is impossible! Alibaba is a mix of marketplace, search engine, bank, software company, mobile services company, eLearning, microblogging, video streaming, and much more.

Below is an interesting chart that compares Alibaba’s portfolio with its respective known comparable.

source: qz.com

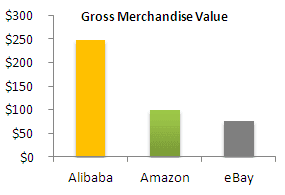

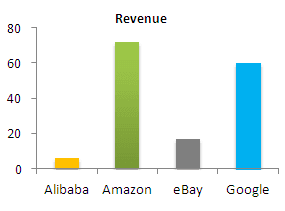

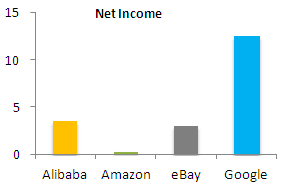

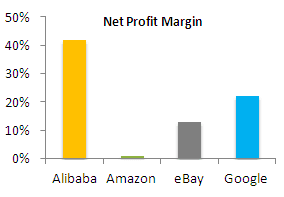

Let us now compare some of the key financials of Alibaba with the biggies like Amazon,eBay, and Google.

Alibaba’s Gross Merchandise Value of $248 billion is more than Amazon and eBay combined.

Alibaba Revenue is lower than that of Amazon and eBay. The primary reason is the business model; Alibaba makes money by charging merchants for advertisements on their website and transaction fees.

While Alibaba’s revenue is less than Amazon and eBay, however, Alibaba is a highly profitable company as compared to Amazon or eBay.

Alibaba’s net profit margin at 40% is way higher than eBay, Amazon, or Google.

#5 – Why Alibaba IPO is so important?

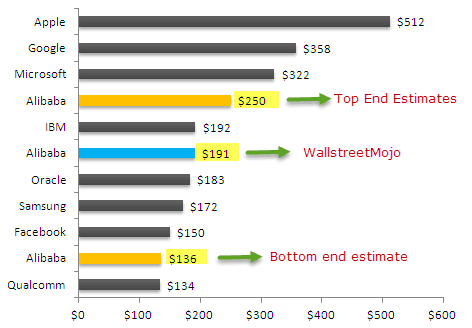

Alibaba IPO is a big deal, primarily because of the size of the IPO. As discussed later in the article, my valuation estimates for Alibaba is around $191 billion. Download the Alibaba IPO Valuation Model here

Also, Alibaba’s IPO signifies global changes. With its vast size and network, Alibaba IPO may look at international expansion beyond China and lead to price wars and intensive competition in the US. According to Reuters,

Alibaba has closely guarded its ambitions for the United States and executives have privately played down suggestions it would take Amazon head-on. But there’s little question that investments in the United States are a high priority, people familiar with the company say.

#6 – Will this become the biggest IPO in US history?

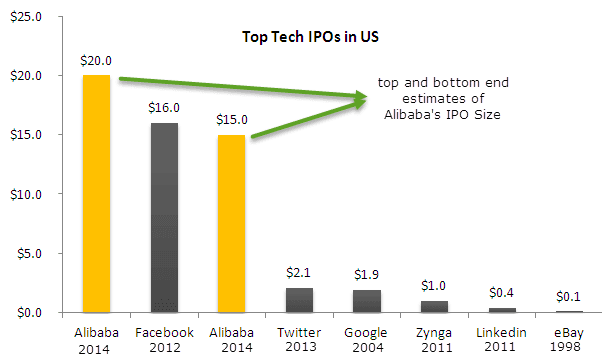

The exact size of the Alibaba IPO has been closely guarded. The company has used a $1 billion placeholder for its registration documentation with the SEC. Many expect that the size of the Alibaba IPO could be between $15 billion – $20 billion.

The below chart shows a quick comparison of Alibaba with the Tech IPOs in the US.

#7 – Why going public in the US, not in China or HK?

Alibaba initially approached the Hong Kong Exchange for listing. However, they had to abandon their plans of listing in HK due to its share structure.

- A fundamental governance principle of Hong Kong’s listing rules is restricting dual-class share structures or other schemes that allow controlling shareholders or managers to possess disproportionate voting power.

- Alibaba wanted to list in Hong Kong; however, Hong Kong Exchanges and Clearing or the Securities and Futures Commission (SFC) rejected Alibaba’s demand that its partners be able to nominate most of the company’s board.

- Alibaba argued for an exception for its structure, citing its unique business model. Hong Kong Exchange could have granted this exception as the rule book does have a provision; however, they decided against it.

- The main reason was that there are many Chinese state-owned enterprises listed in Hong Kong Exchange, and if it bends a rule for Alibaba, then it’s going to have to turn the law for all of these state-owned Chinese enterprises. This decision underscores the importance of regulatory consistency—an element that aliexpress dropshipping sellers also rely on when evaluating platform policies and marketplace governance.

- Alibaba then decided to list the company in the US as such dual structures are not prohibited in US exchanges.

#8 – Who are the Investors in Alibaba?

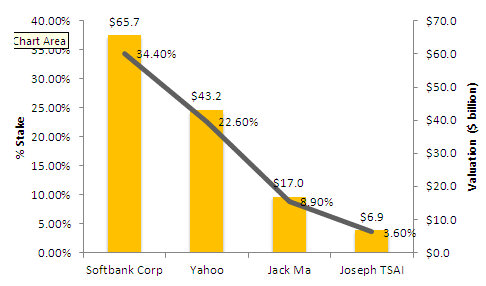

From Alibaba’s registration document, it is learned that SoftBank corp is the biggest investor in Alibaba, with its initial investment of $20 million in 2000. SoftBank is the biggest gainer from its investments in Alibaba.

The below chart shows the stake and its respective value. (assuming that my estimates of $191 billion valuations hold :-) )

#9 – Alibaba’s 5 Big Numbers to Know from F-1 Filing

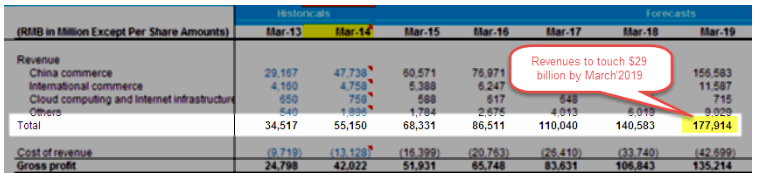

# 10 – Alibaba’s Financial Model

After struggling for more than three days to prepare Alibaba’s Financial model, I was able to get a basic model ready (with the limited information provided in the S-1 Filing). I wish there was more information about revenue segments and cost details, yet this model serves as a good heads up for understanding Alibaba Group and Alibaba IPO Valuation.

You may download Alibaba Financial Model here

Alibaba Financial Model Assumptions

- March’14 income statement figures include the estimated numbers of Jan’14-March’14 quarter

- I have only adjusted the Cash and Cash Equivalents and Shareholder’ equity to reflect the estimated numbers. Other BS items are kept as reported in the December quarter.

- Projected the next eight years of Alibaba’s Financial Statements Analysis (Financial Modeling – Income Statement, Balance Sheet and Cash Flows)

- The currency used in the model is RMB (China’s local currency). One can use the currency conversion to derive an appropriate valuation figure. F-1 filing has used 1 US$ = RMB 6.2164.

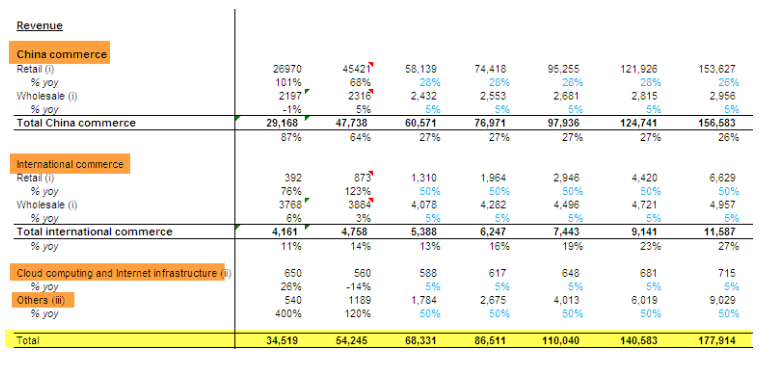

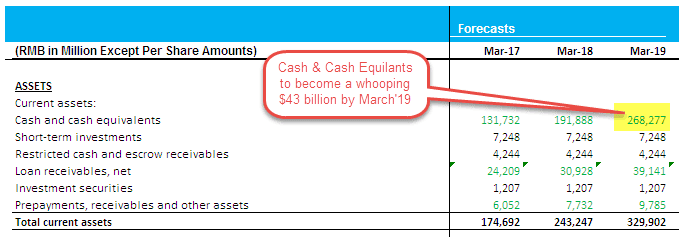

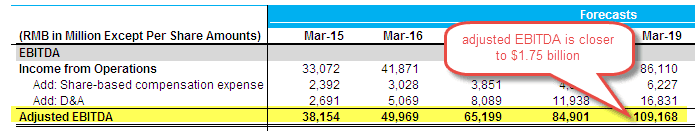

Below are the findings from the Excel-based Financial Model

1) Revenues to grow at a CAGR of approx 26% in the next five years and touch US$29 billion by March 2019.

2) China Commerce will remain the largest contributor to the Revenues.

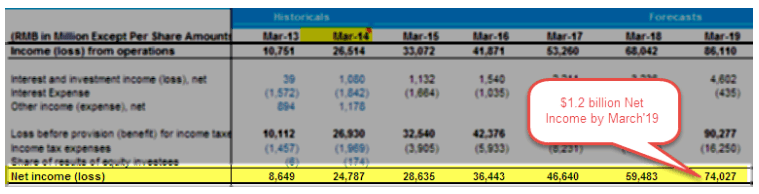

3) Net Income close to US$1.2 billion by the end of March 2019.

4) Cash and Cash Equivalents will balloon to $50 billion in the next five years. How they will deploy this much cash is an important thing to watch out for.

5) The company has remained EBITDA positive and will generate $1.75 billion EBITDA by March’19.

#11 – Alibaba IPO – To Buy or Not to Buy?

Bloomberg polled 12 analysts to understand Alibaba’s valuations and found that it is closer to $168 billion, while some expect the valuation to cross $250 billion once it starts trading. There is a considerable variation in valuation estimates, so I decided to develop my guidelines on Alibaba valuations. Download Alibaba Valuation Model here

So, how do we value the Alibaba IPO?

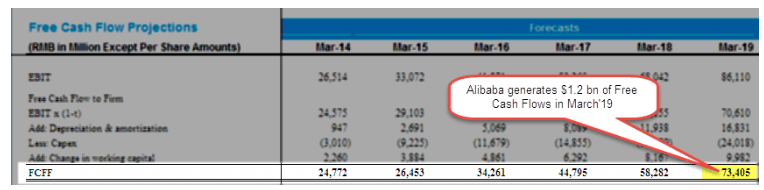

- Alibaba is cash flow positive and is a profitable company. The most suitable approach that can be used to value Alibaba is the Discounted Cash Flow valuation approach.

- I am explicitly avoiding the comparable valuations (relative valuations of Alibaba) because it is nearly impossible to pin down a set of companies that are truly comparable to Alibaba.

- The Discounted Cash Flow (DCF) approach requires forecasting and modeling future financials.

#1 - Forecasting Alibaba’s Free Cash Flow (FCFF)

Alibaba will generate $1.2 billion of free cash flows in March’19. As we note below, Alibaba will generate predictable positive Free Cash Flows.

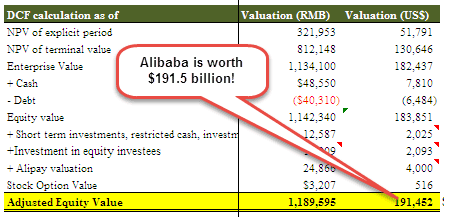

Below is the table that summarizes Alibaba’s DCF Valuation output.

We note the following from the table above –

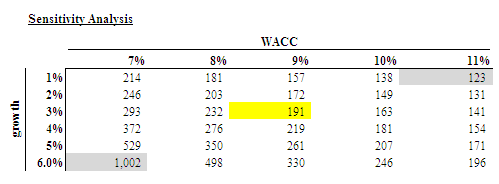

- Alibaba valuation is $191.5 billion (WACC of 9% and perpetuity growth of 3% )

- Short Term Investments, restricted cash and Investment securities taken at Cost (Balance Sheet Amount)

- Investments in Equity Investees are also valued at Cost (balance sheet amount). Though the two companies Weibo and AutoNavi, are publicly traded, I have taken them at Cost and NOT at their trading prices.

- I have also assumed an average Alipay’s valuation payout of $4 billion (floor of $2 billion and $6 billion). Below is the excerpt from the Alibaba’s F-1 Filing

Upon the occurrence of certain liquidity events with respect to Alipay (which includes, subject to certain conditions, an initial public offering of Alipay, a transfer of 37.5% or more of the equity interests of Alipay or a sale of all or substantially all of the assets of Alipay), Small and Micro Financial Services Company will pay to us an amount equal to 37.5% of the equity value of Alipay achieved in such liquidity event, with a minimum payment of US$2.0 billion and a maximum payment of US$6.0 billion, subject to certain increases and additional payments if no liquidity event has occurred by the sixth anniversary of the date of the original agreement, or the liquidity event payment.

#2 - Alibaba DCF Valuation Sensitivity Analysis

As noted above, the minimum valuation of Alibaba is $123 billion (WACC of 11% and a growth of 6%)

If you are using different assumptions, you may use the above table for your set of valuation guidance.

Learn more on how to perform Sensitivity Analysis in Excel.

What Next?

Anything I missed? What are your views on valuations? Are you investing in Alibaba? Let me know what you think, your feedback by Leaving a Comment.

p.s. – I do not represent any brokerage firm. The above views are my assessment of the Alibaba IPO. I have tried my best to ensure the factual accuracy of the analysis; however, please feel free to provide me with corrective measures if you spot any errors.