Table Of Contents

What Are Forecasting Methods?

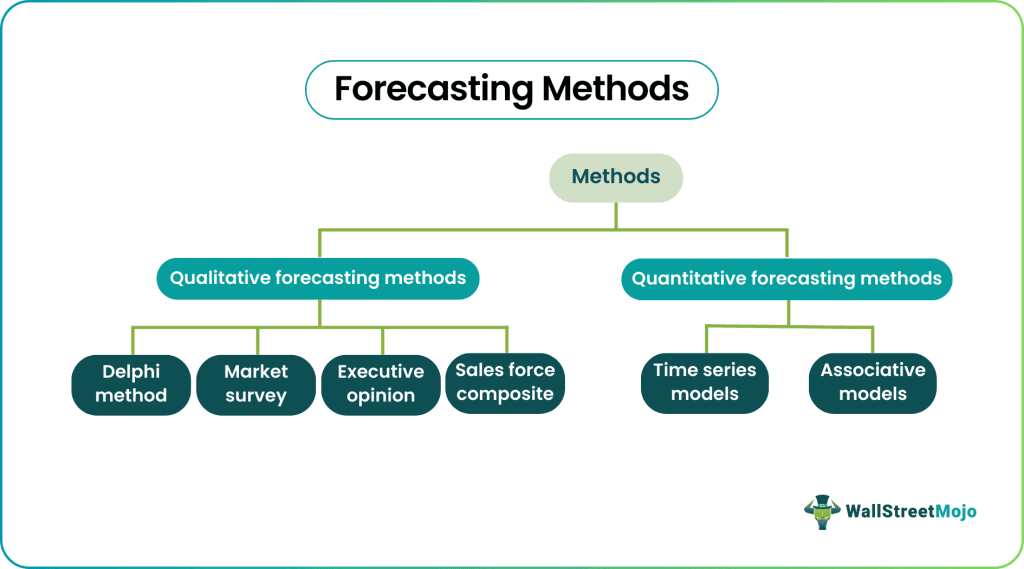

Forecasting is estimating the magnitude of uncertain future events and providing different results with different assumptions. Top forecasting methods include Qualitative Forecasting (Delphi Method, Market Survey, Executive Opinion, Sales Force Composite) and Quantitative Forecasting (Time Series and Associative Models).

Not all methods would necessarily serve the purpose of forecasting, the decision-makers should understand what type is best suited for the business. For this purpose, the nature and type of business, time horizon, future prospects, threats and limitations, etc, should be considered. The data available for the purpose should be accurate and provide best results.

Key Takeaways

- A projected income statement refers to a financial statement that shows the prediction regarding a business’s performance for a specific period in the future. Preparing this income statement is vital to ensure better future planning.

- This financial statement offers various benefits to the company. For example, it improves stakeholders’ decision-making with regard to the company. Moreover, such an income statement allows businesses to prepare budgets more effectively.

- A key difference between cash budgets and projected income statements is that the latter does not depict cash movement.

Forecasting Methods Explained

The forecasting methods are the techniques of processes followed for the purpose of making future decisions related to sales, financing, pricing, investment, project feasibility etc. The methods depend on various types of inputs, which may be historical data, current market scenarios, past experiences regarding similar situations, or the ability to identify current trends.

There are possible estimates that are made by using sales forecasting methods or any other related ones that can be used to predict what may happen in the future and based on that, different decisions related to production planning, prices, sale targets, etc, are made.

Traders, investors, and analysts frequently use a wide variety of models that can help in such predictions and have already proved to do the same efficiently. However, these models and methods are not only restricted to manufacturing and production. They are also used for predictions and forecasting in fields like economic outlook, business trends, weather conditions, technological usage and so on.

It is always essential that the management and stakeholders understand the business and current situations well in order to make a forecast because the choice of sales forecasting methods or any other similar ones is crucial. If this is not done correctly, then it will lead to a collection of incorrect types of data, and analysis will not give fruitful results.

This topic not only highlights key concepts but also provides a broader understanding of the field. If you’re curious to explore these ideas more thoroughly, this Financial Planning & Analysis Course offers a structured way to dive deeper.

However, if your focus is to be confined to understanding the financial models and methods in depth to grab a fulfilling career in this field, this Financial Modeling Course is the program recommended for you.

Types

There are different types of sales or financial forecasting methods can be broadly classified into:

- Qualitative Methods - These methods are based on emotions, intuitions, judgments, personal experiences, and opinions. This means that there is no math involved in qualitative forecasting methods. Delphi Method, Market Survey, Executive Opinion, SalesForce Composite are part of this type of forecasting.

- Quantitative Methods - These methods depend wholly on mathematical or quantitative models. The outcome of this method relies entirely on mathematical calculations. Time Series and Associative Models are a part of this type of forecasting.

Top 6 Methods Of Forecasting

The top 6 methods of forecasting are given below. Let us study the same in details.

#1 - Delphi Method

The agreement of a group of experts in consensus is required to conclude in the Delphi method. This method involves a discussion between experts on a given problem or situation. An argument or brainstorming is done to complete that everyone involved in the debate agrees to.

#2 - Market Survey

In a market survey, interviews and surveys of customers are made to understand the task of the customer and tap the trend well in advance to deliver the right product or service according to the changing needs of the customer.

#3 - Executive Opinion

As the name suggests, the executives or managers are involved in such forecasting. This method is very similar to the Delphi method; however, the only difference here is that the executives may or may not be experts of the matter in question, albeit they have the experience to understand the problem or situation and formulate a forecasting method that would bring out the best possible result.

#4 - Sales Force Composite

The information and intuition of the salesperson determine the needs of the customer and estimate the sales in the particular region or area assigned to the salesperson. This information is vital in forecasting the needs of the customer, which can be used to make necessary changes in the business to meet the needs of the customer and identify the sales volumes beforehand.

#5 - Time Series Models

Time series models look at historical data and identify patterns in the past data to arrive at a point in the future based on these historical values. Since the historical data has a pattern, it becomes evident that the data in the future should also have a pattern, and this method looks at cracking the pattern in the future so that there is very little deviance from the actual calculations and the outcomes in the real world. Below is the example of a time series model.

One of the simplest methods in forecasting is the Straight Line Method; This uses historical data and trends to predict future revenue.

#6 - Associative Models

Associative models look at the variable that is being forecasted as being related to other variables in the system, which means each variable is associated with the other variable in the system. The forecast projections are made based on these associations.

Thus, the above are the top 6 sales or financial forecasting methods commonly followed for the process. They outline the basic approach to the situation, the type of data obtained, in what way that type of data is helpful in order to achieve the target, and what kind of result we can expect by using this method.

Examples

Example #1

ABC Ltd. looks to achieve a YoY growth of 6% for the next three years. In a straight-line method, the first step is to find the growth rate of sales used in our calculation. For 2019, the growth rate is 6%, as per historical data.

Example #2

Moving averages are averages in statistical forecasting methods that move with the underlying data, thereby providing accurate information relevant to the current scenario. In the below example, the Sales generated for the year 2019 for ABC Ltd are represented. The moving averages for Bi-Monthly, Quarterly, and Half-yearly are calculated below. The Excel shows the formulae used to arrive at the moving averages.

Objectives

There are various important objectives behind this entire process of different forecasting methods and estimation. Let us dive deeper into the details.

- The main objective is to track whether the policies and procedures implemented by the management in terms of production planning, prices, marketing, customer retention, etc are really giving the desired results of not. The evaluation of current data for the purpose of future estimation will find loopholes, if any.

- These different forecasting methods help in setting a benchmark for the business and compare their own current performance and future expectations with that of their peer companies. This acts as a guide to identify any cons in the process and take necessary action depending on the urgency of the situation.

- This concept also gives an idea about what are the possible impact, be it positive or negative, that the company might have in future related to any changes that are being implemented in various levels of the organization.

- The statistical forecasting methods are beneficial for management, shareholders, lenders, and other stakeholders who want to have substantial knowledge about the business going forward. This is because they plan to put their hard-earned money into the company with the hope of a reasonable return. Thus, these methods help them to make crucial decisions.

Forecasting enables a business to take the necessary steps to achieve a particular goal by providing vital information regarding future events and its occurrence and magnitude. Forecasting can be either Qualitative or Quantitative, depending on the information gathered and its nature, usually subjective or objective, and as a result, is based on mathematical calculations or no mathematical calculations at all. The management decides on the best forecasting method to be used according to the business. It is based on internal and external factors and whether the external factors are controllable or uncontrollable. Uncontrollable factors can be government policies, competitors’ strategies, natural calamities, and so on. Quantitative forecasting uses mathematical models to arrive at the forecasting results, and it also relies on historical data to back the findings. Qualitative forecasting uses emotions, intuition, past experiences, and values. It is an essential procedure in business that enhances business operations and ensures the functions can be performed smoothly in the ever-changing business environment.