Table Of Contents

What Is Financial Modeling for Startups?

Financial modeling for startups is the process of projecting and forecasting revenue, costs, and profitability for future periods on the basis of current data, estimates, and assumptions. The main objective of carrying out this process is to prepare an effective budget, plan for growth, and enhance financial decision-making.

Typically, startups create a financial model to project revenue and costs for periods ranging from 1 to 5 years. Such a model offers a roadmap for sustainable business growth and allows organizations to establish realistic financial goals. Moreover, the projections also allow entrepreneurs to spot areas requiring improvement and make the necessary adjustments to the existing strategy.

Key Takeaways

- Financial modeling for startups refers to a process that involves estimating the income and expenses for a startup, which represent its future financial performance.

- A key objective of building a financial model is to plan for growth and assess risk.

- Two popular approaches adopted by analysts to conduct financial modeling for startups are top-down and bottom-up.

- There are various benefits of building a financial model for startups. For example, it helps make more informed decisions and aids in addressing financial challenges.

- The process of creating the model is based on specific assumptions related to taxes, running costs, growth rate, etc.

Two Approaches to Startup Financial Modeling

#1 - Top-Down Approach

In the top-down approach, the entrepreneur starts with macro factors and then works through the micro factors. Starting points are the industry standards, which narrow down to targets the companies can fit in. This approach helps define the forecast based on the market share you want to acquire.

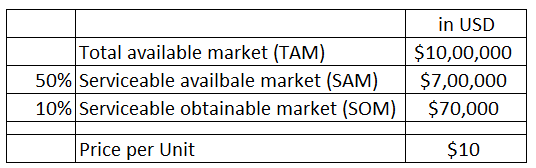

TAM (Total Available Market), SAM (Serviceable Available Market), and SOM (Serviceable Obtainable Market) models help in this kind of approach. In this model, at first, TAM for the product is estimated. Then we have to decide the part of the market we want to acquire, known as SAM. From that SAM, the existing service base of the company is known as SOM based on the existing competition. So in this model, we start with industry size to the market share we can capture.

#2 - Bottom Down Approach

The main problem with a top-down approach is that it can be too optimistic. Usually, we take SOM as a percentage of the total market, which is very hard to achieve. In the bottom-down approach, the entrepreneur takes a tiny portion of the market for his sales and then assesses the sales from his company's inside point of view to estimate the forecasts and modeling procedures.

Steps To Create A Startup Financial Model

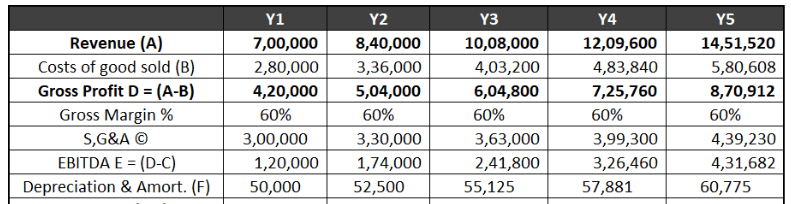

Here we use the top-down approach to create the financial model in excel

- Revenue: The first thing is to determine and forecast the revenue for the product you are launching. It can be a bit tricky because you are a new entrant into the market. For determining the sales, you can use the Total Available Market (TAM), Serviceable Available Market (SAM), and Serviceable Available Market (SOM) model. First, the total available market is to be determined and from that company’s estimated revenue needs to be found.

- Costs: This can be easier since the firm controls its resource and overhead costs. Costs will include direct costs, overhead costs etc.

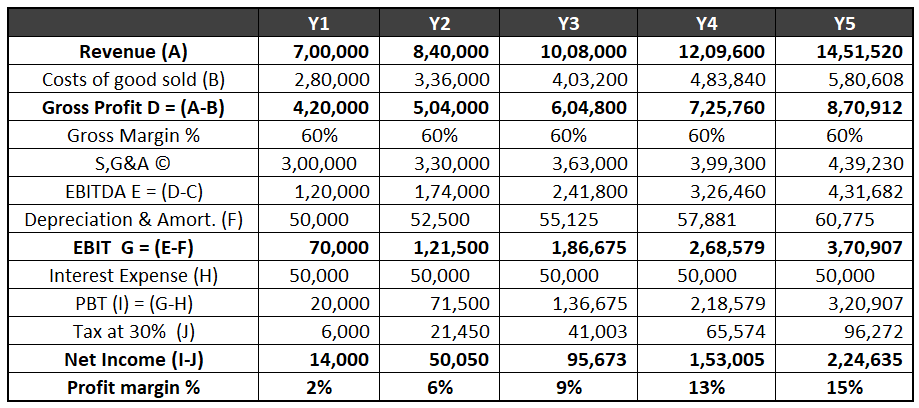

- Income: To achieve and calculate Operating Income and Net Income, we use the above two parameters. You can calculate Operating income by subtracting operating costs from revenue.

- Growth Rate: The future growth rate for revenue and costs also needs to be determined, which can be quite tricky, given the uncertainties over the future. For projecting future revenue, the industry outlook, the company's available cash, and future investment need to be seen. Cost projection can be a function of revenue.

Below is the excel format for the Startup financial model:

If you want to build practical knowledge of the financial modeling process, enrolling in this Financial Modeling 2-Day Bootcamp can be a wise move. The instructor adopts a step-by-step approach with real-world examples and case studies to help you understand how to build a financial model for any company from scratch.

Assumptions Used in A Financial Model

The following assumptions lay the foundation of a financial model for startups:

- Growth Rate: This is one of the main assumptions driving the financial model. While taking the revenue and cost growth rate, the entrepreneur needs to understand the macroeconomic factors such as industry or country health, and then look through their startup's cash position.

- Future investment: For growth, startups need continuous investment from external sources, and they will also have to make that assumption while creating the financial model.

- Running Costs: When estimating the cost structure of any startup, assumptions related to the operating expenses, including rent, utilities, and wages, are vital. When evaluating such costs, startups might factor in expected industry benchmarks, investments, or past data.

- Cost Presumptions: The pricing assumptions determine the price level at which the company will offer its products and services. Note that the cost-plus pricing, competitive analysis, value-based pricing, and other pertinent variables provide the foundation in this regard. Pricing hypothesis must consider the startup’s profitability, goals, positioning, and target market.

- Financial Premises: Tracking expected capital inflows as well as outflows becomes easier because of financing assumptions. Such assumptions cover premises concerning different funding sources, including equity and debt financing. Startups have to project the time, quantity, and terms of the funding operations to assess the impact of financing decisions.

- Tax Presumptions: Tax assumptions make it easier to project the relevant tax breaks and incentives for which the startup may fulfill the eligibility criteria.

Why Should An Entrepreneur Focus On Financial Model?

While creating the financial model, the entrepreneur can understand some aspects of the business that he otherwise won't be able to understand. Though there are many templates for financial modeling present online, entrepreneurs should always create the model, keeping in mind the nature and assumptions of their business.

Also, by working through each row and column of the financial model, the entrepreneur can understand what the missing aspects of the business are; or what elements are unnecessary and remove those from the financial model. It also boosts their confidence while presenting to the investors.

Why Build Financial Model for Startups?

- It helps in understanding the revenue and cash flow forecast for the business.

- It helps in understanding the company's assumptions while creating the business.

- Investors carefully look through the financial model before investing in the business

- It helps in understanding the viability and profitability of the business.

- It helps in presenting the real picture of the business to the external investor and debating the investment terms.

- It helps in quantifying the assumptions for the startups.

- Building a financial model can help in identifying and planning for financial challenges and risks.

- A financial model offers a framework that facilitates the effective allocation of resources concerning daily operations.

- Such a model assists in setting clear targets and gauging future performance against the benchmarks.

- A financial model can play a vital role in determining the actual worth of a given startup during negotiations or stake sales.

- Preparing a financial model at regular intervals can provide business owners and other key stakeholders with key insights that can help improve financial decision-making.

- Lastly, by building a financial model, startups can make sure that their short-term actions are in line with their long-term goals.