Table Of Contents

Key Takeaways

- Insurance expense is also known as the insurance premium. It is the amount paid to insurance companies to cover the uncertain risks from unexpected life events.

- Insurance companies calculate insurance expense as a set percentage of the sum insured and is paid at a regular pre-specified period.

- Insurance expense provides long-term financial safety and creates a pool of funds that can be used at an appropriate place and generate income.

- Insurance expense does not guarantee that one may receive a refund equivalent to the incurred loss from the insurance company.

What Is Insurance Expense?

Insurance expense, also known as insurance premium, is the cost one pays to insurance companies to cover their risk from any unexpected catastrophe. It is calculated as a set percentage of the sum insured and is paid at a regular pre-specified period.

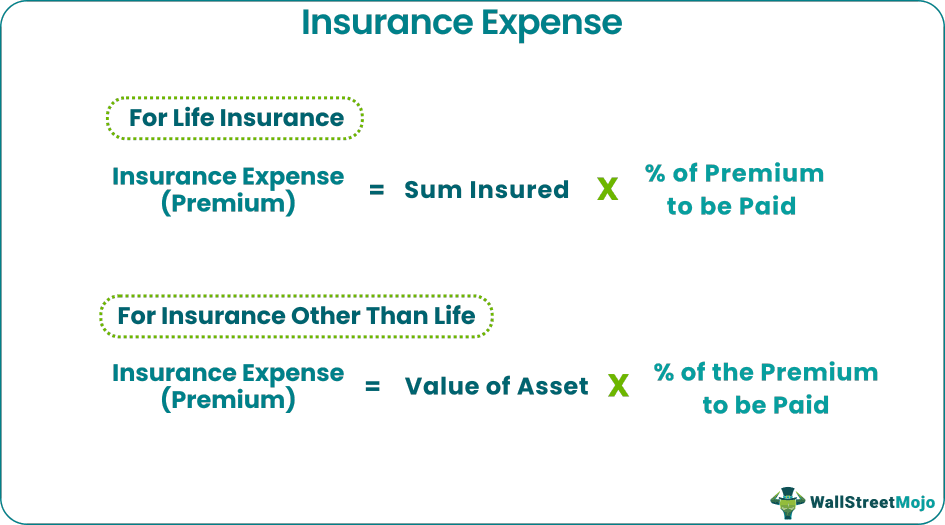

Insurance Expense Formula

1 - For Life Insurance

Insurance Expense (Premium) = sum insured * % of the premium to be paid

2- For insurance other than Life Insurance

Insurance Expense (Premium) = Value of asset * % of the premium to be paid

Exploring insurance options can help you find coverage that fits your unique needs. For those interested in comparing a range of insurance products, resources like SuperMoney make it easier to review and select policies from top providers.

Examples of Insurance Expense

Example #1

Generally, a manufacturing concern must pay an insurance cost of 2.89% of the asset value. From the below value of the assets, calculate the insurance expense to be paid by XYZ Ltd.:

- Machinery: $9,000,000

- Industrial shed: $1,23,100

- Spares: $45,000

- Forklift: $32,000

- Safety equipment: $18,500

- Total: $9,218,600

Solution:

Calculation showing insurance cost to be paid for machinery-

- =9,000,000*2.89%

- =260,100.00

Similarly, we can calculate insurance expenses for other assets, which are shown below:

Total will be -

Thus, XYZ Ltd. would have to pay $2,66,417.54 as an insurance premium for the given year.

Example #2

Anthony has a habit of smoking. He is presently pursuing a master's from Boston University. His father is interested in taking the insurance for Anthony's health due to his bad habit of smoking. Therefore, he consulted the PQR insurance company for medical insurance. When getting quotes - especially for profession-specific coverage like malpractice - some platforms can speed up the process by pulling basic details from your NPI number (Docshield is one example). They provided the following details related to the medical plan:

| Age | 0-15 | 16-24 | 25-50 | 51-70 | 70 and above |

|---|---|---|---|---|---|

| Base Premium Rate for Mediclaim | 1.30% | 2.01% | 2.19% | 2.70% | 3.50% |

| Additional premium to cover a specific illness | 1% | 1.20% | 1.50% | 1.70% | 2% |

| Additional premium if smoking | 0.50% | 0.65% | 0.80% | 1% | 1.20% |

Calculate the insurance expense for the medical plan, including coverage of a specific illness of $500,000, which https://www.wallstreetmojo.com/insurance-premium/needed to be paid by Anthony’s father.

Solution:

Anthony is 23-years old. Hence, all the premium rates will apply to the slab of 16-24 years.

Calculation showing insurance expense to be paid

Similarly, we can calculate insurance expense which is shown below:

Total Premium to be Paid will be -

- =10,050+6,000+3,250

- =$19,300.

Thus, the total insurance expense to be paid is $19,300 for the sum insured of $500,000.

Advantages

- Ensures security – It protects the insured from future wrongdoings in their lives or businesses. It will ensure security and give mental calmness in their life.

- Long-term financial safety – It will provide long-term financial safety to the insured person and safeguard the personal interest of individuals. One can obtain these benefits through life insurance.

- Source of collecting funds – It allows for creating a pool of funds that can be parked at a proper place and create a steady flow of income, which can help cover the catastrophe of the insured person.

- Creates a habit of saving – It nurtures a practice of insurance among individuals that will ensure good cash flow over a long time.

Disadvantages

- Reimbursement is not equal to loss – Insurance expense does not guarantee that one will get a refund from an insurance company equivalent to the loss incurred. Reimbursement of claims is always dependent on various factors. As a result, the loss amount is often not fully recovered from insurance companies.

- Complexity in schemes and clauses – Scheme documents of insurance are highly complex. Moreover, they will put various provisions that laypeople are unaware of. As a result, an insured person will not be fully aware of all the terms and conditions of the insurance contract.

- Lack of trust – Insurance companies have often behaved recklessly in the past. As a result, they always have a somewhat low level of trust.

- Limit in the claim – All the insurance policies will have a fixed sum insured. This sum insured often gets wrongly estimated and, as a result, has to bear the risk. As a result, if the coverage is $1 million, and even if an individual incurs the loss of $2 million, the insured person will only get reimbursement of $1 million.

Conclusion

Thus, insurance contracts are almost inevitable for a smooth life and business. Anyone who misses taking the insurance is prone to a considerable risk. As a result, they will face severe mental and financial loss. Therefore, it is always advisable to incur the insurance expense considering the danger one faces and the requirements against the same.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.