Table of Contents

What Is Long-Short Equity?

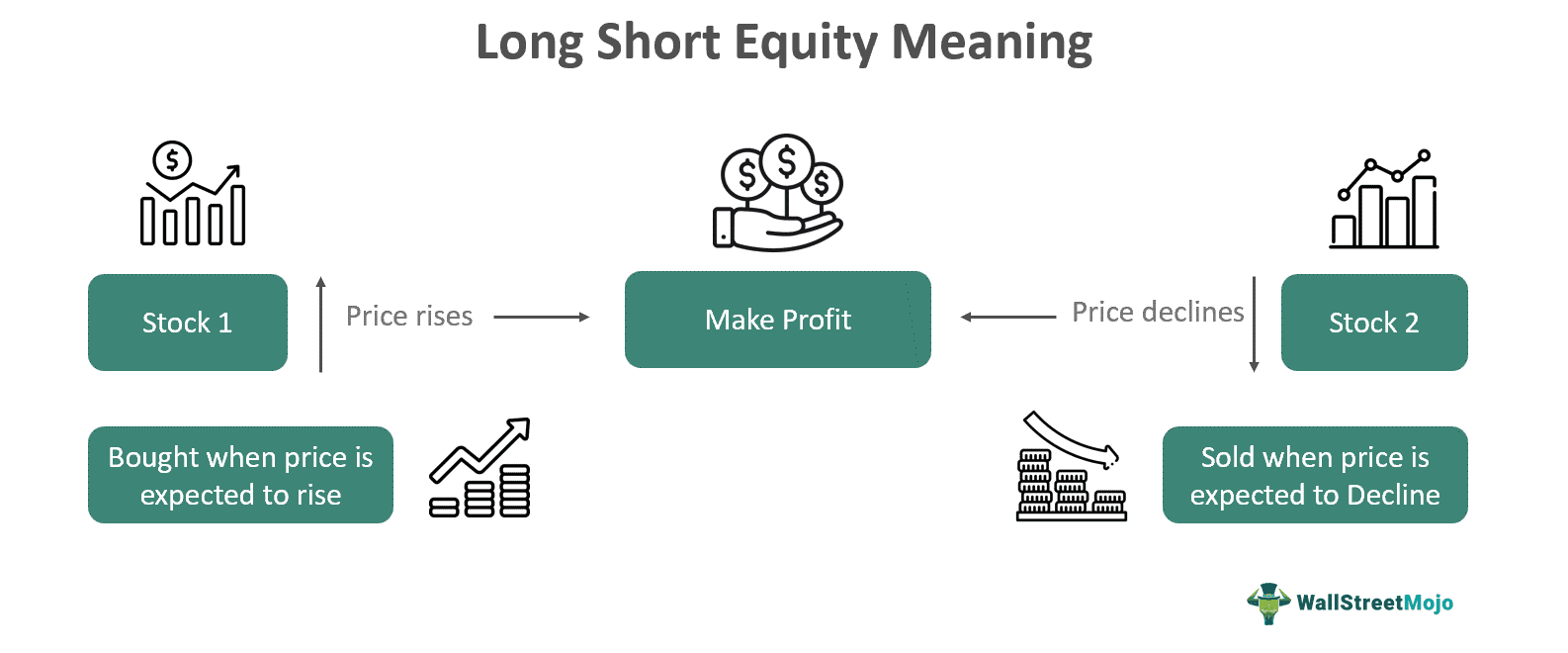

Long-short (L/S) equity is an investment technique that uses both long and short positioning to make a profit in the equity market. It encompasses the act of taking a long position when there is expected appreciation and likewise taking a short position when there is a foreseeable decline in equity prices.

Long position refers to buying shares when a price rise is anticipated. In a short position, borrowed securities from brokerage firms are sold to profit from repurchasing securities at a lower price. In a nutshell, the whole strategy can be summed up as buying when profit is expected and selling when loss is expected. It is more common with hedge funds.

Key Takeaways

- Long short equity is the technique of buying when price rises of securities are expected and selling when the decline is anticipated.

- Long positions denote the purchase of securities when profit is foreseeable, and short positions mean the selling of borrowed securities from brokers when the decline is expected.

- Similar to this are the equity market neutral strategies; both are commonly used in hedge funds but do have a few differences.

- A (L/S) equity strategy is complex and risky and can also fail miserably. Moreover, it depends on various market factors, the calculated assessment of stocks and companies, and risk management.

Long-Short Equity Explained

Long-short equity is the amalgamation of both long and short techniques to develop a strategy to maximize returns and reduce market exposure and risk. An investor takes a long position in stocks they expect to perform well, primarily having an increase in market price, coupled with a short position in stocks that they believe will underperform or decrease in price. In this way, there are only two primary components of the strategy: the extended position and the short position.

The exciting part of the strategy is that a long position means buying stocks with a foreseeable increase in value. Still, a short position refers to borrowing stocks from the broker and then selling them with the anticipation that their value will decline so that they can be repurchased at a lower price and register a profit.

Investors must select the stocks to form a combination of long and short positions. It is mainly done through fundamental, quantitative, and technical analysis. Fundamental analysis involves the assessment of a company's financial statements and management trends to derive intrinsic value. Technical analysis means studying market data and identifying patterns and trends using charts and other tools. Quantitative analysis refers to employing mathematical models and statistical tools to seek investment opportunities.

It is highly advised that to make a(L/S) equity strategy successful, investors can seek help and financial aid from wealth management firms and fund managers. By choosing the right brokerage firm, investors can optimize their portfolios and reduce risk exposure. It also helps in hedging against market volatility.

How To Build A Long-Short Equity Strategy?

The steps to build a (L/S) equity strategy are:

- Define The Sector - Ideally, l(L/S) equity is employed between stocks belonging to the same sector or industry, such as banking, IT, healthcare, energy, and so on. It is believed that stocks within a joint sector typically move up or down in unison. However, an investor may choose securities from multiple sectors as well.

- Stock Bucketing - Once the sectors are selected, investors can move forward to measure the stocks based on their sector to choose for their long-short equity strategy.

- Establishing Parameters For Long Or Short Securities - In this step, the stocks are gauged and ranked based on multiple factors, such as past performance, metrics, and other market ratios.

- Capital Allocation - It is a step of execution and taking a position on stocks, filtered in the last step. Ideally, equal amounts of capital are allocated to both positions. It is a popular allocation strategy. But again, it depends on the investor to distribute the capital as per their goals and investment style.

- Monitoring - In the final step, the investor has the responsibility to monitor the strategy, make amendments when necessary, and re-adjust the positions in a timely manner. It is one of the essential parts of building a long-short strategy in the market.

Examples

Below are two examples of the concept. The first is a hypothetical example, whereas the second example comes from world news:

Example #1

Suppose Jake is an investor; for a long time, he has been eyeing the IT sector. Two prominent companies trade on the New York Stock Exchange. Let them be IT1 and IT2. Jake may take a long position in IT1 and a short position in IT2. For instance, if IT1 is trading at $36 per share and IT2 is currently trading at $27.

Now, a short-leg scenario would mean that Jake buys 900 hundred shares of IT1 and 1350 shares of IT2 so that the dollar amounts of the long and short positions remain the same. In an ideal scenario, the IT1 should appreciate, and the IT2 prices will decline. Hypothetically, if IT1 prices increase to $39 per share and IT2 declines to $22, Jake's overall profit from this strategy would be $9450. To take this a little further, suppose that IT2 does not decline but appreciates and goes up to $29, and the strategy is still beneficial for Jake, with a profit of $6750.

Again, it is a simple example of long-short equity investing. In the real world of finance, it is a complex technique that requires proper research, analysis, and interpretation of market signals and indicators.

Example #2

As per an article, the long-short equity hedge funds experienced their first net inflow in the last two years in February 2024. It is welcome news for investors in this category—the net inflow of $1.52 billion in investor capital in AUM. Performance has always been a concern and has lagged down the entire industry.

According to the investments hedge fund industry asset flow report of NASDAQ, In the past 23 months, approximately $70 billion has been removed from these products—a decline of $38.02 billion in 2022 and $34.49 billion in 2023. For February, there have been other winners as well, such as multi-strat and directional credit.

Pros And Cons

The pros of long-short (L/S) equity are:

- It employs both long and short positions to make a profit.

- The strategy reduces market exposure and seeks profitable entry and exit points.

- It may only sometimes be applicable, but the technique is net-based and profitable.

- Maximizes the upside of markets and likewise limits the downside risk.

- Increases portfolio diversification through both positions.

- Since returns are possible from both scenarios, it helps in providing excess returns.

The cons of long-short (L/S) equity are:

- It is complex, complicated, and equally risky.

- Short selling and use of leverage can expand losses, eventually leading investors to huge losses.

- The whole strategy demands research, analysis, constant monitoring, and advanced skills to interpret market signals and the right stocks.

Long-Short Equity vs Equity Market Neutral

Although hedge funds employ both techniques, the critical differences between long-short (L/S) equity and equity market neutral are:

| Long-Short Equity | Equity Market Neutral |

|---|---|

| In this technique, the total value of long-short positions is not the same. | In this method, the long-short positions ensure that it remains close or equal |

| It is more focused on hedging the portfolio and remains lenient and balanced. | In this technique concentrates on generating positive returns independently of the market, even by missing out on more significant speculative investments. |

| When a market prediction is profitable, the (L/S) equity technique will not be re-adjusted. | The equity market neutral strategy will proceed to re-adjust the portfolio. |