Table Of Contents

What Is Top-Down Approach?

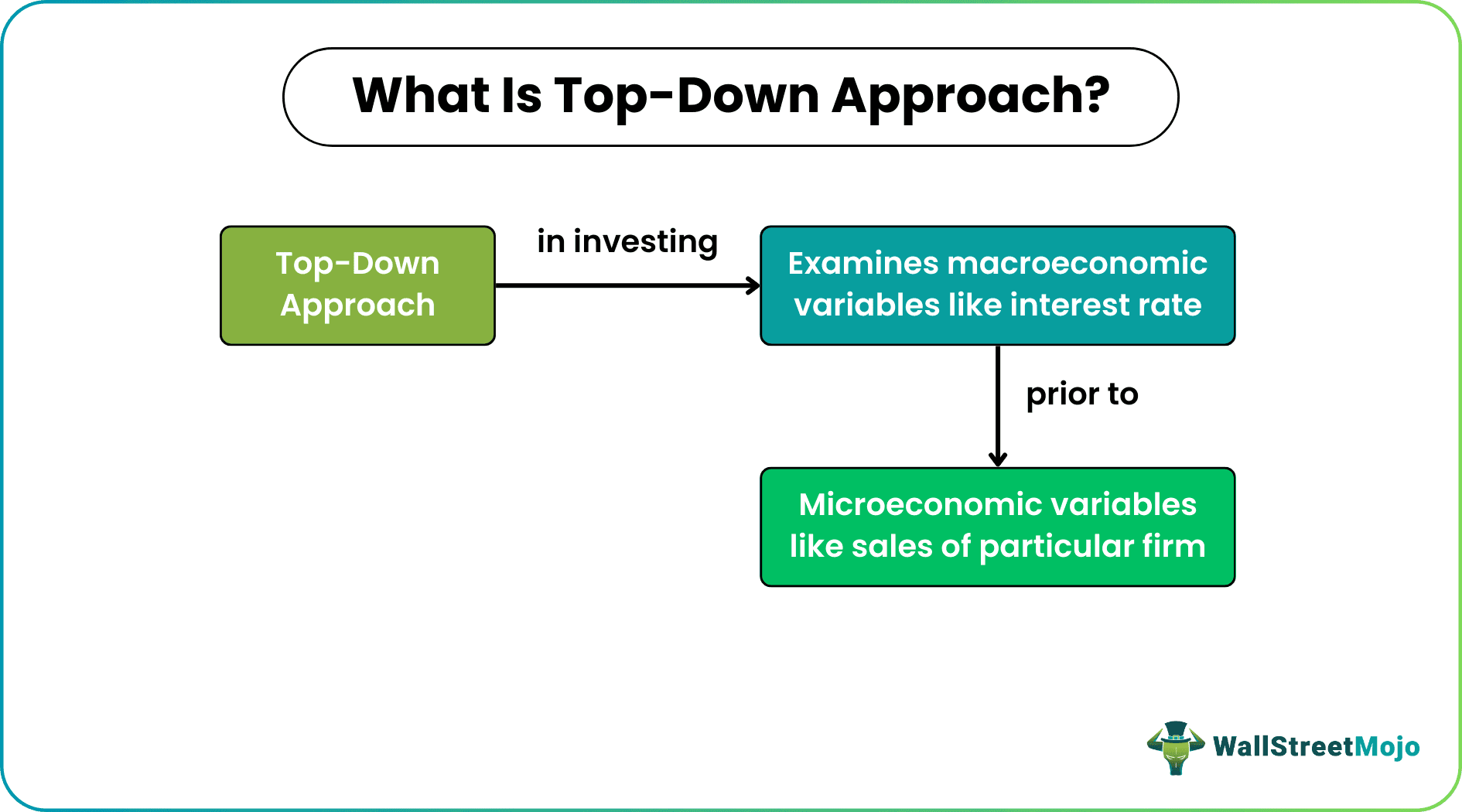

In top-down approach, when it comes to investing, it refers to emphasizing on forecasting the economy rather than selecting specific stocks. This approach originates from the discipline of management although it is widely used in finance sector by traders and professionals in the industry.

The top-down approach begins with examining macroeconomic factors, followed by an in-depth examination of specific industries. The fundamental analysis of a corporation is not conducted until much later. In contrast, the bottom-up analysis focuses on assessing fundamentals or essential performance measures before anything else.

Table of contents

- What Is Top-Down Approach?

- A top-down investment approach requires analyzing a nation's economy, many industries and sectors, and assets.

- When it comes to investment, a top-down approach looks at the larger aspects of the economy, such as GDP, before investigating the smaller aspects, such as individual industries or firms.

- The top-down approach to investing may be compared with the bottom-up approach, which places a higher priority on the profitability and basics of individual firms before moving on to macro variables.

- Top-down investing can help traders save money by reducing the time and attention they must devote to their assets. But on the other hand, investors risk missing out on potentially lucrative individual investment opportunities.

Top-Down Approach To Investing Explained

Top-down investing is a method of financial research that examines macroeconomic variables of the economy, such as the gross domestic product (GDP), employment rate, taxation rate, interest rate, etc., before focusing on microeconomic factors, such as particular industries or enterprises.

It is a strategy that begins with a high-level overview of the market, then gradually focuses on more specific aspects as it moves downward. This continues until a decision can be reached on how to invest one's money.

The top-down analysis begins with examining macroeconomic variables, followed by an investigation of individual industries in more depth. After then, it doesn't go into the basic study of a company until much later. Bottom-up analysis, on the other hand, concentrates on looking at basics or key performance indicators before anything else.

When doing business in developing countries, you need to consider various risk factors, such as the possibility of geopolitical unrest, fluctuations in local currency and exchange rates, and the valuation of assets. Various technical and basic methods may be used to determine the worth of certain assets; nevertheless, you might find applying more than one of these approaches helpful.

Examples

Let us look at the examples to understand the concept better.

Example #1

Top-down investors can also invest in a single nation or area if that nation or region's economy is performing well. For example, if the price of a commodity such as crude oil increases, the top-down analysis may emphasize investing in oil corporations such as Castrol shares.

Example #2

A top-down trader can view increasing interest rates and bond yields as a chance to invest in banking equities if they look at the situation from that perspective. When long-term yields go up and the economy is doing well, banks typically can charge more interest rates on their loans, which results in increased income for the banks. However, this is not always the case. On the other hand, a positive link between interest rates and bank equities is not always the case. The economy as a whole must be doing well at the same time as yields are climbing.

Diagram

Let us look at a diagram to understand the concept better. The diagram discusses the relationship between gold and US CPI. It depicts the movement of gold prices highlighted in dark blue color. The sky blue or light blue line represents the movement of the US CPI.

This graph helps compare the movement of both variables and understand if they are connected. The graph depicts the movement over 50 years, starting from 1970 till the year 2020. It can be seen that, at most points, both variables have a similar movement. Thus an investor who uses a top-down approach would choose a macro variable like CPI and then invest in gold with the belief that both follow similar trends.

Advantages And Disadvantages

Let us look at the pros and cons of the top-down approach:

Pros

- Traders become more knowledgeable about economic policies and indicators, which enables them to make more informed investment decisions.

- The procedure enables a trader to recognize chances in fields of work and geographic areas that you would not have thought to investigate otherwise.

- Top-down investments promote diversity. In addition to diversifying one's assets in the top industries, this strategy compels one to explore the top international markets.

Cons

- When using this strategy, an investor risks missing out on crucial distinctions between firms and investments. For instance, the success of some industries does not automatically translate to the expansion of all businesses.

- The behavior of markets is not always easy to forecast. Sometimes, the indicators point to an outcome, but this is not always the case.

- A significant amount of research is required in this area. This is because there are a lot of different macro elements, each of which is complicated and always shifting.

Top-Down Approach vs Bottom-Up Approach

- The top-down methodology starts with the big picture and works down to the nitty-gritty details. The bottom-up methodology starts with the and goes up to the general.

- Top-down investment is typically simpler for beginning investors who have less expertise in reviewing a company's financial statements than bottom-up investing does. However, the bottom-up technique is frequently simpler for experienced investors proficient at interpreting charts and financial statements.

- Investing methods that start at the top and work their way down often center on capitalizing on prospects that follow market cycles. Bottom-up investment strategies such as fundamental analysis are one example.

Frequently Asked Questions (FAQs)

A top-down study aims to comprehensively understand the markets or industries in which potential investors are interested. Following the selection of companies and markets, the next stage is to analyze the detailed information and financial statements to conclude whether or not to proceed with the investment.

Investors who are less experienced or do not have the time to evaluate a company's financials may find it simpler to use the top-down strategy. However, investing from the bottom up can assist investors in selecting high-quality stocks that beat the market even during a market collapse.

Traders increase their understanding of economic policies and indicators, which helps them to make more informed investment decisions. In addition, investing from the top down encourages variety.

Recommended Articles

This article has been a guide to what is Top-Down Approach & its meaning. We explain its examples, diagram, advantages & disadvantages & differences with the bottom-up approach. You may also find some useful articles here -