Table Of Contents

What is Index Investing?

Index investing is a hands-off investment approach used by investors with long-term goals. Index investing encompasses investing in a portfolio of assets that mimic a particular index or financial market. It allows investors to own portions of stocks in many companies, all through one fund. Index funds have proven to be superior in generating earnings over longer periods.

They are also less expensive than their actively managed counterparts. It also offers scope for wider diversification. Index investing does not require the active management of stocks and is, therefore, passive investing is more viable through this form of investing as investors do not have to spend their time and efforts on a regular basis to track the performances.

Table of contents

- Index investing is a hands-off way to create long-term gains. It allows investors to diversify their investments by choosing funds that mimic specific financial indexes. It is a type of “set it and forget it” investing.

- Index funds follow specific financial indexes.

- Index funds have low trading fees and are quite easy to get started.

- One can invest in indexes through mutual funds or ETFs.

Index Investing Explained

Index investing strategy is the trading technique of using index funds to build a portfolio. It’s a passive investment strategy that helps investors build wealth with less expense. Index funds can be mutual funds or (ETFs). They are built by financial firms to mimic a specific financial index. The fund one buys will hold the shares of stocks from companies in that particular index.

While there are financial indexes all over the world, here are a few popular that anyone can easily find index funds for:

- S&P 500

- Dow Jones Industrial Average

- Nasdaq Composite

- The Wilshire 5000

- S&P Mid-Cap 400

Most index funds hold shares of all of the stocks in the index they’re mimicking. However, some funds have only a sampling of the securities in their index.

This type of investing is often used in retirement savings strategies. Over many years, index investing has been proven to match general stock market performance. This makes index investing a buy-and-hold strategy.

Methods

Investing in index funds is incredibly easy. Moreover, an investor can choose to invest in either active or passive index investing depending on their convenience, knowledge, and time allocation.An investor can invest in index funds in two ways: through index mutual funds or ETFs.

The primary differences are:

Mutual funds - A company pools together investors’ money to purchase assets with a mutual fund. Mutual funds are bought directly from the fund and not publicly traded on the stock market. Every investor has part ownership of the fund in the share.

Mutual funds require active fund management, which means the fund’s creators are looking to beat the market. Actively managed funds have higher fees than their passive counterparts. Mutual funds offer immense diversification, liquidity and cost-effectiveness.

Exchange-traded funds- An exchange-traded fund is a bundle of assets that one can publicly trade in the stock market. ETFs are generally lower cost and more straightforward to access than mutual funds. They require passive management only and offer better liquidity than mutual funds. They are also comparatively cheaper.

A person can create both ETFs and Mutual Funds to copy a financial index. Once a person decides to invest, they can research indexes to choose the one most appealing to them.

To invest in an index fund, one can open up a brokerage account. Or, for mutual funds, one may be able to create an account directly through the company with the fund they are interested in.

Checklist

Before investing in any instrument or security, it is important to understand the applications. Below is a checklist that would help the investor choose the right ETF or mutual fund to commence their index investing strategy.

- Account minimum - Some brokerage companies will expect an investor to have a minimum amount of money invested with them. If a person already has a brokerage account, they don’t need to worry about this.

- Investment minimum - Some mutual funds may require to invest thousands, while some ETFs may require less than $100. The amount of money one has to invest can play a massive role in generating returns.

- Expense ratios - The expense ratio is the amount of money that one pays to the fund managers. This fee is typically around 0.2%. Be wary of fees with high expense ratios.

- Trading costs - Some brokerages charge a brokerage fee every time a person buys or sells an asset. If this fee is high, especially compared to the amount one is investing – one needs to find a different brokerage. It is possible to find fee-free options.

- Retirement accounts - If someone is looking to purchase index funds for their retirement savings strategy, it is best to contact their employer’s HR department to see if such investments are available through 401k.

Examples

Let us understand the concept of passive index investing in depth with the help of a couple of examples.

Example #1

Rachel works at a successful IT company as a team head. Her schedule is naturally jam-packed. Therefore, to ensure her hard-earned salary is put to better use, she decided to invest in S&P 500 passive index investing.

In the long-run her money multiples as the economy grows. Moreover, she did not have to spend extra time on choosing the right stocks or even checking the overall balance in her portfolio. The index’s growth helped her multiply her money in exchange for a minimal fee.

Example #2

The S&P 500 is a stock market index that holds the top 500 companies in the U.S. It calculates the companies market capitalization in its index and gives a snapshot of the United States’ financial health.

The S&P 500 is a list of companies, not a company that you directly invest in. However, one can invest in an index fund that holds all of the companies’ shares in this index. These funds are meant to match the S&P 500’s gains.

According to SPIVA, the S&P 500 has outperformed over 77% of other large-cap funds over the past five years. Since it began, the S&P 500 has returned an average of about 10% annually.

There are multiple S&P 500 index funds. A person can choose one based on past performance, fees, and minimum investment amounts required.

Benefits

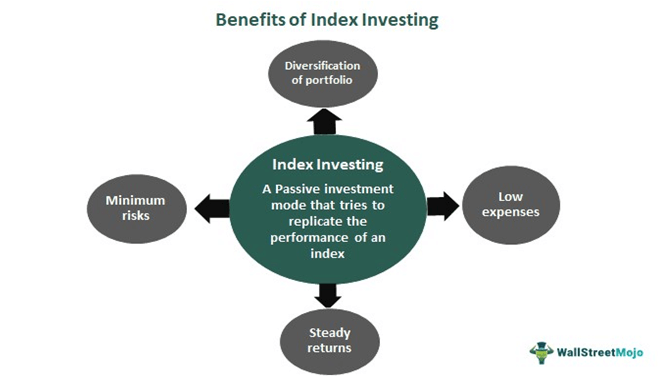

Let us understand the benefits of passive index investing through the explanation below.

- Index investing is less time-consuming and allows investors to concentrate on their primary sources of income without disturbances.

- The costs involved in such investments are significantly lesser in comparison to other investments.

- The risk involved is significantly lesser as the investor is betting on the growth of the economy for the long run which is pretty much inevitable.

- The returns are steady and can help the investor to invest in a tension-free manner.

Limitations

While the advantages to index investing strategy are multiple, there are a handful of factors that prove to be a disadvantage for investors. Let us discuss them through the points below.

- This type of investing, gains won’t be large or quick; they’ll be slow and steady, trending upward over time.

- There will be a lack of flexibility and lack of control over holdings as one cannot add or remove any holdings. Higher price stocks have a greater influence on market movements. There is also no cushion for downward movements or losses.

- Index investing is excellent for retirement savings and long-term buy-and-hold strategies. However, if one wants to be reactive while trading assets that won’t hold much value, index investing is not the way to go.

Frequently Ask Questions(FAQs)

Direct index investing is an investment strategy that involves constructing and managing an investment portfolio by directly owning individual stocks or securities replicating a specific index rather than investing in a mutual fund or exchange-traded fund (ETF) that tracks the index.

In direct index investing, investors typically work with a financial advisor or an online brokerage platform that offers the option to build a customized portfolio using individual stocks.

Passive index investing is the method of gaining higher returns with minimized trading. It is a long-term wealth-building strategy in which investors buy and sell index funds whose holdings mirror a particular benchmark.

There are many advantages to choosing index investing. It enables better diversification, more liquidity, and great affordability. They can bring steady and solid returns over time with minimal risks. It is considered one of the smartest investment strategies for beginners in trading.

Recommended Articles

This has been a guide to what is Index Investing. We explain its examples, benefits, limitations, methods, and provided a checklist to consider for investing. You may also have a look at the following articles to learn more –