Table Of Contents

What is Treasury Bond?

A Treasury Bond (or T-bond) is a government debt security with a fixed rate of return and relatively low risk as the US government issues it. One can buy treasury bonds directly from the US Treasury or through a bank, broker, or mutual fund company. These are long-term bonds investors use to fulfill their financial goals through safe investments.

Since T-bonds are one of the safest investment vehicles, they are purchased by investors to finance their education, supplement their retirement income, and ensure a steady return, even in times of financial turbulence. Treasury bond rates majorly rely on the expected interest rates and are long-term. As in, their maturity period could be 20 or 30 years.

Key Takeaways

- Treasury bonds are debt instruments issued by the US government, making them a great investment for those prioritizing safety and a fixed interest rate.

- These bonds usually have long maturity periods, ranging between 20 to 30 years.

- T-bond holders receive semi-annual interest payments until maturity, when the T-bonds' initial investment amount (face value) is repaid to the investor.

- T-bonds can be purchased directly from the US Treasury. They can also be bought from banks and brokers or as a collection of securities in a mutual fund/ETF. They’re often used to diversify portfolios and offset the risk of equity investments.

How Do Treasury Bonds Work?

Treasury bonds are debt obligations issued by the U.S. government and backed by the treasury department that have maturity periods as long as 20 to 30 years. These bonds are usually, can go up to $10 million in bonds of non-competitive nature.

The US government issues various treasury securities to fund development projects, military undertakings, and day-to-day administrative activities. These government debt issuances can be divided into three categories: treasury bills, notes, and bonds. In this article, we will be talking about treasury bonds, one of the three types of treasury securities.

- The US Treasury organizes auctions to facilitate the sale of treasury bonds. At these auctions, the prices and interest rates of individual bonds are determined. The price set at the auction can be lower, higher, or equal to the bond’s face value.

- The two factors influencing the price of fixed-rate securities like T-bonds are the interest rate and the yield to maturity (YTM). The YTM of a T-bond is simply the total return that the owner can expect to get if the bond is held until maturity.

- As mentioned above, investors can purchase treasury bonds through brokers, banks, ETFs, and mutual funds. They can also buy these bonds directly from the website of the US Treasury, which we will discuss in greater detail later in the article.

- T-bonds are now issued only in electronic form. The last paper-format T-bonds reached maturity in 2016.

- T-bonds usually have a maturity period of 20 to 30 years and are issued with a minimum denomination of USD 100. The highest possible bid amount is $5 million for non-competitive bids.

- Bonds pay a fixed rate of interest to the holder every six months.

- In addition to the interest, after maturity, the holder of the T-bond will also get back the face value of the bond, which is the amount of money that was originally invested.

- As T-bonds are a virtually risk-free form of investment, they are preferred when the stock market is volatile and investors are looking for a safe place to park their savings.

- However, the safety of the T-bonds also means that they offer lower interest rates than shares, stocks, or even other fixed-income securities.

- T-bonds are preferred by those living in states with higher tax rates. Those who own T-bonds do not have to pay local or state income taxes. The federal government will tax the interest earned from T-bonds.

- Usually, the longer the maturity period of a treasury bond, the higher the returns will be. However, T-bonds can be sold in the secondary market before maturity.

Examples

Let us take the help of a couple of examplesthat have taken place in the world of T-bonds. They will help us understand the concept of using a treasury bond calculator better.

Example #1

Diana is a mother of two and wants to secure her retirement and sort funds for her children’s education. She purchases a 15-year bond for $100,000 which would mature just in time for her elder son’s college and her younger son’s high school

Since funds for retirement and children’s education are non-negotiables, she did not want to risk her investment in equity or other asset classes as they could be reduced to nothing in a few years.

Therefore, for an important purpose such as education, she chose to invest them in T-bonds that are issued by the government to support her children and secure her retirement life as well.

Example #2

In March 2021, many factors caused Treasury securities yields to rise dramatically from record lows in 2020. It allowed bondholders to earn higher-than-usual interest rates amidst the financial uncertainty brought on by the pandemic. The massive monetary stimulus packages approved by the US government and the news of Covid-19 vaccines stimulated investors’ hope, pushing the yields up.

In May 2021, the government auctioned a revamped 20-year Treasury bond, auctioning it for the first time since 1986. A day after the auction, the yield on the bond closed at 1.165%, which was less than the auction day yield of 1.22%. This was because the bond saw a price rise, which led to a fall in its yield. Whenever a bond price rises, its yield falls.

Yields

Treasury bond yields are essentially the return on investment one can expect when buying T-bonds. It is the interest paid by the government to borrow money for a particular period. There are some treasury bond calculators available online that can help in calculating the returns.

Source - scottgrannis.blogspot.com

Since T-bonds are almost risk-free, they offer a lower interest rate than many similar, fixed-income investments. This report showcases their changing rates over the years, with the average rate since 2012 hovering between 2.5-3%. For instance, the 30-year bonds yield around 2.30% as of April 2021, a massive improvement from the Covid-19 hit's fallen rates of around 1.65%. Although, it is nowhere close to 1981's 15.21%.

Many experts say the chance of a massive rate revival is a distant dream. Also, investors earn higher returns when they commit their money for longer periods. Consequently, 30-year bonds are more lucrative than 20-year ones. However, locking your money for such long periods with low-interest rates may not be profitable to many.

Moreover, when market volatility causes the demand for T-bonds to rise, then the yield usually goes down. Conversely, the yield on T-bonds increases when their demand is relatively low. Also, treasury bond rates undergo inflation adjustment, causing them to fall further. As such, it works best for people willing to sacrifice high earnings in return for a safer, low-risked, and guaranteed investment.

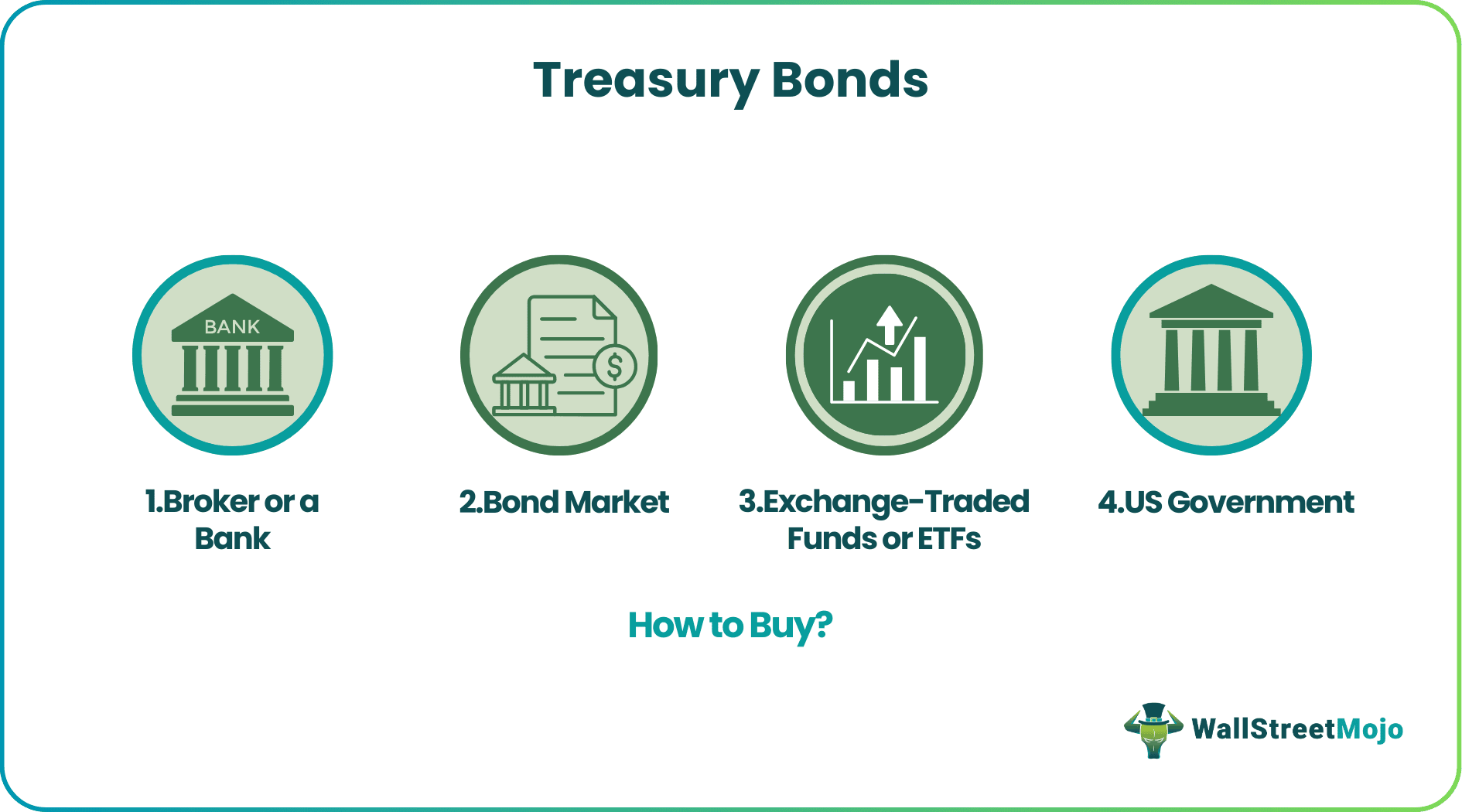

How to Buy?

Investors can buy Treasury bonds from a broker or a bank. Most mutual fund companies also offer treasury bond funds as a diversified portfolio. Investors often buy T-bonds to diversify their portfolios and offset the risk of stocks and shares through treasury bond rates.

If you already have a brokerage account, you can buy T-bonds in the secondary market – known as the bond market. Another way to buy these bonds indirectly is through exchange-traded funds or ETFs. This option offers greater liquidity than if you were to buy the T-bonds directly from the government.

If you want to buy T-bonds directly from the US government, you can do so through a website known as TreasuryDirect. Make sure that the browser's URL field says treasurydirect.gov so as not to spend money on sham websites.

Source - treasurydirect.gov

First, you must open an account with TreasuryDirect, which involves a three-step setup process. You can apply to TreasuryDirect as an individual investor, a corporation, a limited liability company (LLC), or a partnership. You will then need to complete an online form with all the relevant information, including your social security number and taxpayer identification number.

Once you’ve set up your account, you can click on the Buy Direct tab at the top of the website to start purchasing T-bonds directly from the US Treasury.

Treasury Bond Vs Treasury Bill

Although both these are issued by the government, there are fundamental differences in cases such as the treasury bond rates and T-Bill rates. Let us understand their differences through the comparison below.

T-Bond

- They are long-term instruments issued by the government, usually ranging from 20-30 years

- They pay interest every six months

- Typically, they have a higher yield in comparison to T-Bills and treasury noted. However, during an inverted curve this might not be the case

- The interest rates for these bonds are fixed throughout the tenure

- However, investors can gain more if they purchase the bond at a discount

- The investor is paid the face value on maturity. However, they can choose to sell it before the maturity date but there is no guarantee that they can sell it for face value in the secondary market

T-Bills

- T-bills or treasury bills are short-term bonds issued by the federal government

- The interest on these investments is paid upon maturity. These bonds can have a tenure of a year or lesser.

- Due to the low-risk nature of these investments and since it is a short-term investment, the interest paid for them is low in comparison to stocks or corporate bonds.

- An investor typically buys these bonds at a discount and recovers them at face value along with interest upon maturity.

- Therefore, if the investor chooses to sell these bonds before maturity, they might not be able to recover the face value.

- The interest earned from selling it in the secondary market might be subject to federal taxes but not state or local income taxes.

- Since they are short-term and extremely low in terms of risk, their returns are lower than T-bonds and other similar instruments. However, the steady demand for these bills is for investors who want to beat the interest rates derived from a regular savings account with their bank.