Table Of Contents

What Are Treasury Strips?

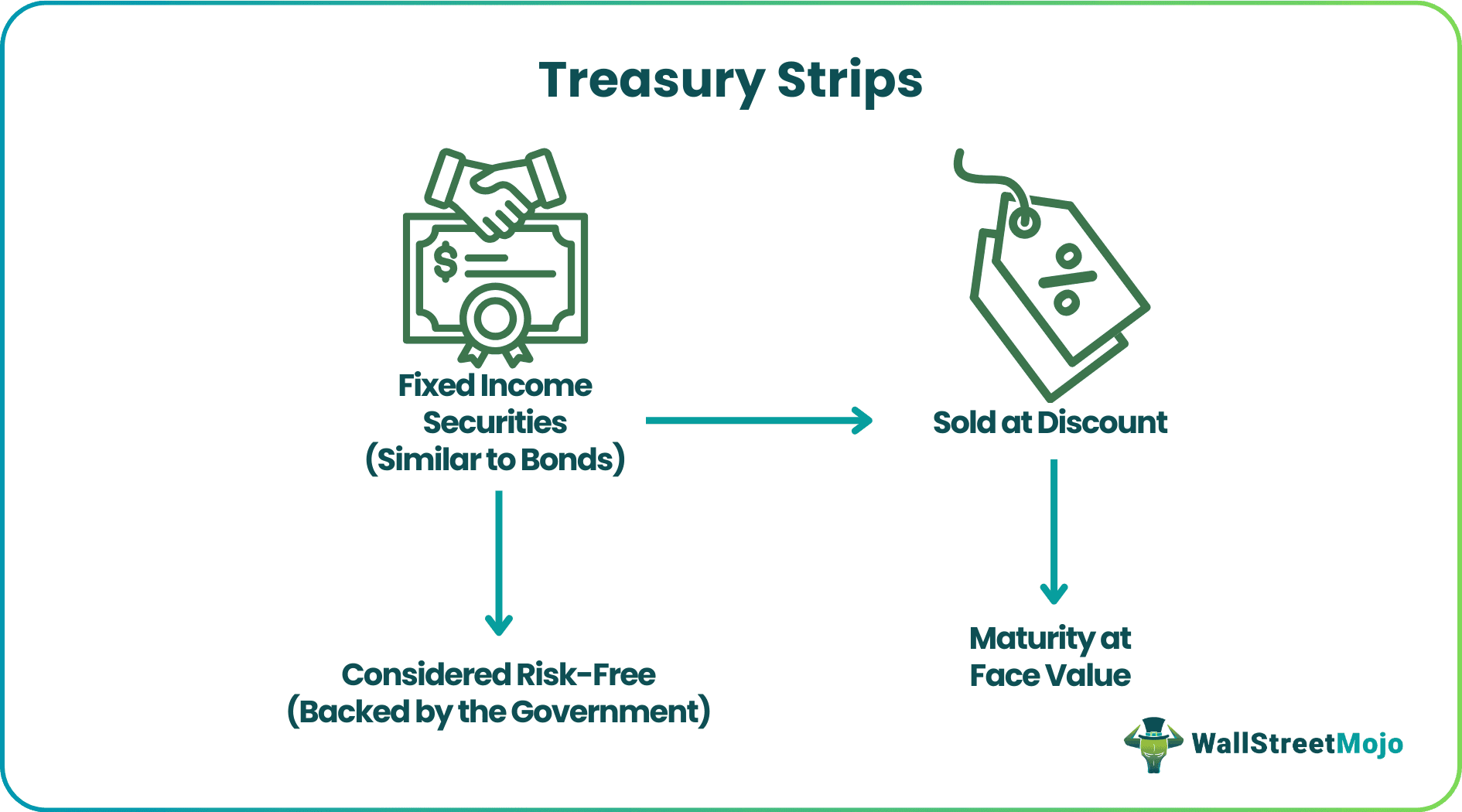

Treasury strips are fixed income products similar to bonds but sold at a discount and mature at face value, much like zero coupon bonds with the difference that they are backed by the government and hence are virtually free from credit risk.

These are high-quality debt instruments as they provide credit-free interest and have sovereign backing. They enable the investors to enjoy the earnings of treasury bills and bonds with a much lower investment. They are used by portfolio managers to hedge the risks and for asset allocation, thereby helping generate returns even in volatile markets.

Key Takeaways

- Treasury STRIPS are fixed-income securities that are sold at a discount and mature at their face value, resembling zero-coupon bonds. However, a key distinction lies in their government backing, rendering them virtually free of credit risk.

- These financial instruments originate from Treasury and Sovereign bonds, representing a method of separating the interest and principal components.

- Backed by the government, STRIPS provide investors the opportunity to reap the benefits of Treasury bills and bonds through a relatively lower investment.

Treasury Strips Explained

STRIPS is an acronym that stands for Separate Trading of Registered Interest and Principal of securities. These are specific financial products that are carved out of treasury/Sovereign bonds. In simple terms, this is nothing but stripping of the expected cash flow of a bond into multiple individual fixed-income products.

Treasury strips are used not only for investments but also by economists, investors, and regulators to measure the zero-coupon Treasury yield curve. Because of the fungibility these treasury strips data provide, these are unaffected by a single underlying security and give a smooth yield curve without any discontinuity. The finance community uses these financial products to extrapolate the curve behavior and forecast the interest rate curves, economic health, and the direction it moves. Two primary methods to calculate this curve are – Nelson-Siegel and Fisher – Nychka Zervos, named after the mathematicians who empirically calculated these.

The market for treasury strips data has grown into a huge one due to its stability and ease of investment. As per market figures in 1999, of all bonds, 37% of these were held in STRIPS and could be valued at $ 225 billion. Since these can be repackaged and demand-supply can be created, there are sizeable flows even in times of distress like the 2000 dot com bubble burst and the great depression of 2008.

Examples

Let us understand the concept with the help of an example.

Let us take an example of a fixed income product with a time to maturity of 10 years. The coupon payment is made annually at a coupon rate of 8%. Going by the contract terms of this bond, there will be 11 coupon payments in total. These payments can be repackaged into 11 zero-coupon bonds and could be called STRIPS in the financial community. Since the U.S. government distributes these, they are called treasury strips and have the comfort of being reliable and creditworthy.

Lest consider the cash flow of the simple vanilla bond

Now let’s consider the cash flow when this bond is stripped into multiple strips (treasury strips in the case of sovereign bonds). The new cash flow will be as follows: each coupon payment has become the treasury strips maturity date for the new zero-coupon bonds stripped from the original Vanilla bond.

| Bond Name | FV | Month |

|---|---|---|

| Bond 1 | $400 | 01-Jan-18 |

| Bond 2 | $400 | 01-Jan-19 |

| Bond 3 | $400 | 01-Jan-20 |

| Bond 4 | $400 | 01-Jan-21 |

| Bond 5 | $400 | 01-Jan-22 |

| Bond 6 | $400 | 01-Jan-23 |

| Bond 7 | $400 | 01-Jan-24 |

| Bond 8 | $400 | 01-Jan-25 |

| Bond 9 | $400 | 01-Jan-26 |

| Bond 10 | $400 | 01-Jan-27 |

| Bond 11 | $5,000 | 01-Jan-27 |

Calculations on the treasury strip's return on investment (ROI) are a bit compelled. There can be 2 cases.

1) If the treasury strip is liquidated before the maturity date, then

Return Calculated = Current Market Value - Purchased Price

2) The second scenario is when they are held until the treasury strips maturity date. Then

Return Calculated = Face Value of the Bond - Purchase Price

Advantages

Some of the advantages of this financial instrument is elaborated below:

- Have a huge range of maturities: As explained above, treasury strips are carved out of Vanilla bonds. Hence, they are customized by dealers as per the demand and can have a varying range of maturities.

- These are similar to zero-coupon bonds as they are issued at a fair discount and are matured at face value, as explained in the above example.

- The cash flow is quite simple and direct as there are no interest payments, and face value is received at maturity.

- This can be invested even in small chunks and hence is quite a favorite among retail investors too.

- One of the best advantages of this financial product is that they are backed by the government and hold the same credibility as Sovereign bonds.

- Owing to their customization, these strips are the best mechanism for hedging.

Risks

STRIPS have inherent risks because of their unique characteristics. Let’s consider these in detail.

- Credit Risk – Since the US government backs these, they are considered safe and have credibility similar to sovereign bonds. Hence, they are considered free from any default and have no credit risk.

- Interest Rate Risk - Since these financial instruments do not pay interests on a periodic basis, they are able to eliminate the reinvestment risks, which is the risk of reinvesting the coupons at a lower interest rate.

- Liquidity Risk - Compared to Treasury bonds, Treasury STRIPS are less liquid. This may lead investors to pay more in commissions to the brokers. Also, because of the less liquidity, there is a difference in bid and ask treasury strips prices, which may lead to 2 major problems- it will be challenging to get in and out at desired treasury strips prices and to affect the hedge for which these STRIPS were initially bought. Second, it may lead to a liquidity crisis because the high difference in bid-ask price liquidity may fluctuate further. Participants might find it challenging to get their orders through. However, STRIPS develop a unique mechanism due to their distinct characteristics. A broker can strip or repackage it flexibly to create new demand/supply through restriping at new equilibrium levels.

Treasury Strips Vs Zero-Coupon Bonds

The above are two different investment instruments that do not give interests to investors periodically like traditional bonds. However, let us point out some differences between them.

- The former is created by removing the interest component and principle form the US treasury bonds or notes but the latter is issued in the form of no coupon payments.

- The former represents individual cash flows from a particular treasury bond, where each strip is against a payment or maturity date. But the latter is a standalone bond with a single maturity date and no interest payment.

- The issuer or the former is the US Department of Treasury whereas the latter can be issued from the government, financial institution or municipality.

- The zero-coupon bonds are less commonly traded in the secondary market as compared to treasury strips.

- Both have different tax treatment. The treasury strips taxation is subject to annual tax treatment based in imputed interest, even though there is no actual interest payment. The latter may be subject to taxation on accretion of interest over time or on maturity unlike the treasury strips taxation.

Thus the above are some of the essential points of differences between them.