Table Of Contents

What Is Senior Debt?

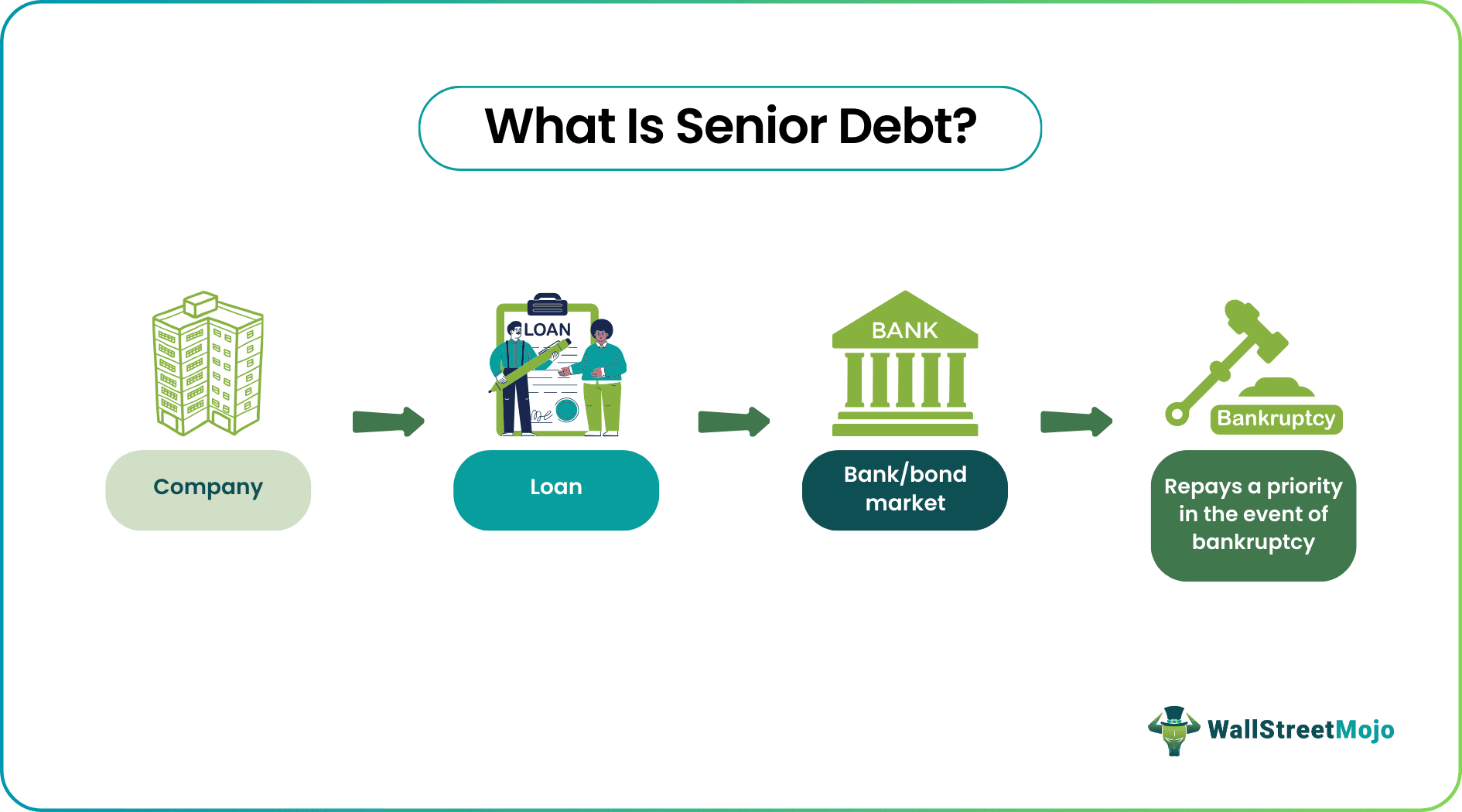

Senior debt refers to the loan that the company must repay first if it shuts down or goes bankrupt. Such debts have the lowest interest rates and risks due to their highest priority and are often secured by collateral. Banks and the bond market are two options for businesses to raise these debts.

Also known as a senior note or senior loan, senior debt gives the lender or creditor the first lien claim over the company assets and cash flows in the event of nonpayment. The issuers of such debts, mostly banks and bondholders, are paid first, followed by subordinated debt, hybrid debt, and preferred stockholders.

Key Takeaways

- Senior debt is the loan that the company obtains from banks or the bond market and must repay first if it goes bankrupt.

- Due to their highest repayment priority, such debts have the lowest interest rates and risks and are often secured by collateral. If the debt is not paid, the company risks losing its collateral.

- A senior loan enhances the company's financial structure, allowing it to operate more efficiently.

- Senior loan differs from subordinated debt in that the latter is unsecured, has a lower payback priority, and has higher interest rates and risks.

How Senior Debt Works?

Senior debt offers senior creditors leverage over other creditors when it comes to getting their money back if the company goes bankrupt. A business can obtain this debt from banks or the bond market at a fixed and lower interest rate and for a specified length of time. In addition, it can be secured (i.e., supported by collateral and given priority during liquidation) or unsecured (i.e., not backed by collateral and given last priority during liquidation). The creditor can sell the company assets in the former type if it defaults on the loan.

A company filing for bankruptcy tries to obtain senior debt relief by liquidating its assets and bank accounts. Banks offer secured senior loans because it is easy for them to give low-interest loans with the high priority of recovering their funds. At the same time, banks use collateral to secure these loans.

Since firms make regular principal and interest payments to creditors, these debts become less risky. As a result, lenders (banks and bondholders) get paid before shareholders in the event of bankruptcy or liquidation but receive smaller returns.

Features Of Senior Debt

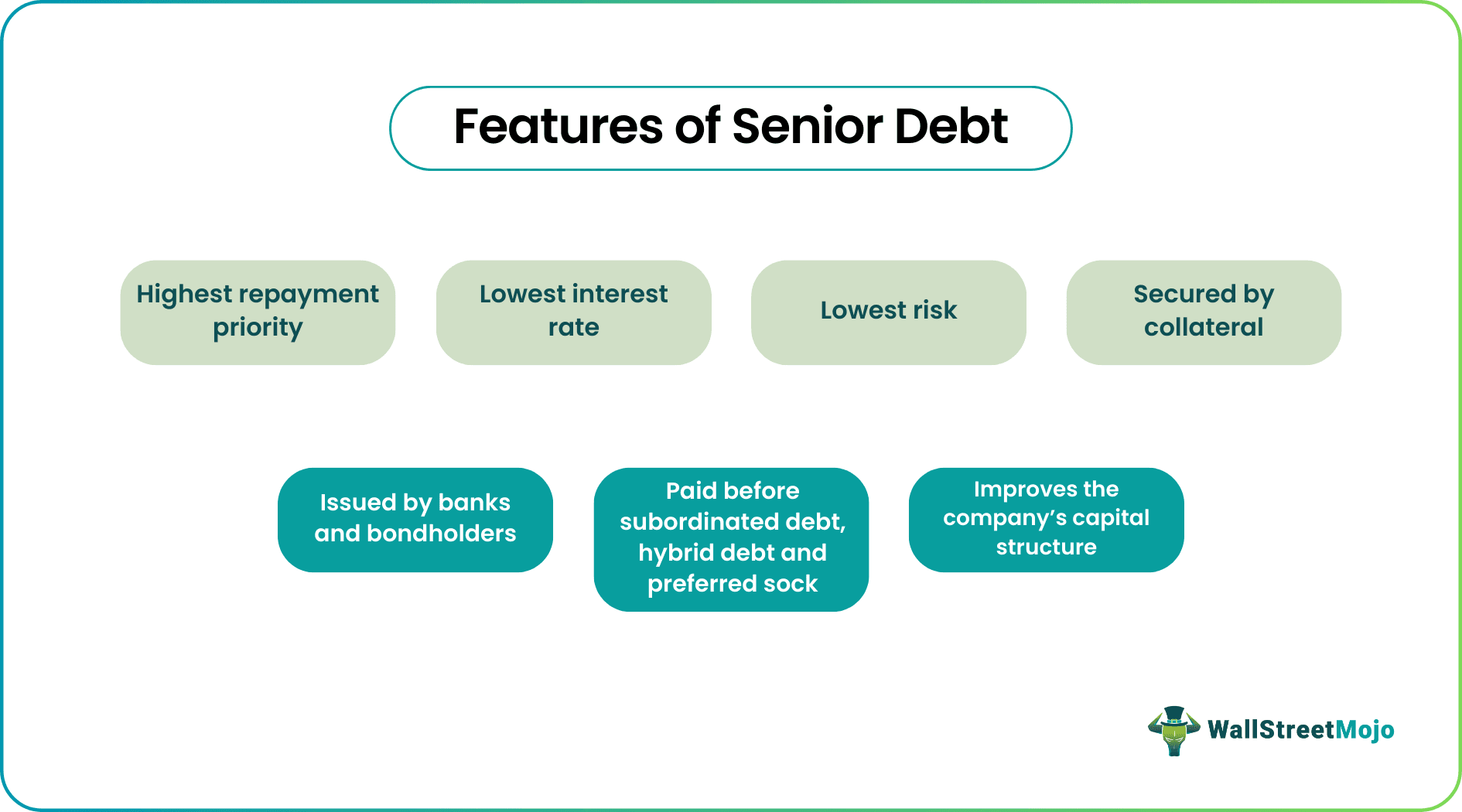

- Banks and bondholders provide companies with senior debt financing secured by collateral and have the lowest interest rate and highest repayment priority.

- A company understands a senior loan and its consequences and hence duly notes the repayment schedule and interest rate and ensures attaining senior debt relief.

- The senior loan is often granted in tranches and helps resolve inflation risk, and is paid before subordinated debt and preferred stock or common stock.

- Companies opting for senior loans must maintain specific financial ratios and limits, such as dividends, capital expenditures, etc.

- Senior loan improves a company's capital structure that helps in its smooth operation.

- A company that takes out a senior loan must function efficiently; otherwise, it risks losing an asset for not repaying the debt.

Examples Of Senior Debt

Let us understand the senior debt meaning with the following examples -

Example #1

Natasha dreams of opening a hardware store, but she needs money. So she applies for a business loan and puts her house up as collateral. Natasha opens her hardware store once the bank authorizes her loan. However, she needed to borrow money from her friend Thomas for inventory and operations.

After six months, the store suffers a considerable loss due to the COVID-19 pandemic, so Natasha decides to close it down. Her top priority is to repay the bank's senior debt financing she received. If she does not repay the loan, she will be evicted from her home. The interest rates were low in this case, but the payback schedule was strict. Natasha explains the issue to Thomas and pledges to pay him back later.

Example #2

If a firm fails to repay the senior loan, it might face legal consequences. For example, in February 2012, Reliance Communications' chairman Anil Ambani took out more than $700 million personal guarantee loan from three Chinese banks - Industrial and Commercial Bank of China Ltd., Exim Bank of China, and China Development Bank.

The company, which is now bankrupt, has failed to repay the loan. On May 22, 2020, a UK court ordered Ambani to disclose his worldwide assets and repay the loan right away. On the other hand, the Chinese banks plan to take legal action against him and seize his worldwide assets to recover their debts.

Senior vs Subordinated Debt

Subordinated debt, also known as junior debt, has a lower payback priority than the senior loan. When it comes to senior debt vs subordinated debt, a business will always repay the former. Let us look at the following key distinctions between the two types of debt:

| Senior Debt | Subordinated Debt |

|---|---|

| Has the highest payback priority during bankruptcy or liquidation of the company | Has the lowest payback priority during bankruptcy or liquidation of the company |

| Has lower interest rates | Has higher interest rates |

| Paid back before the subordinated debt | Paid back after the senior loan |

| Often secured with collateral | Not secured with collateral |

| Lowest or no risk for creditors to lose funds when it comes to debt repayment | The highest risk for creditors to lose funds when it comes to debt repayment |

| Examples include a senior note | Examples include mezzanine debt |