Table Of Contents

What Are Investment Banking Case Studies?

Investment banking case studies are a part of the hiring process of the investment banking sector. This is the round of interview where organizations try to assess the ability of an individual to work efficiently on a particular real-life scenario. Interviewers provide candidates a theoretical situation and seek answers to questions that follow.

It is the most crucial part of the interview process and the toughest to crack. Hence, proper preparation is expected from the ones applying for the investment banking jobs. Not clearing this round might lead to the rejection of the candidate no matter how well they perform in the other stages of the investment banking interview.

Table of contents

- Investment banking case studies are a practice followed by nearly every bulge bracket Investment Bank (IB) hiring process.

- Typically, investment banking case studies have the features such as hypothetical situations. However, it resembles an existing corporation condition, recreates strategic decisions and advisors, and financial details that may or may not be provided depending on the analysis's relevance.

- The investment banking job requirements differ from those of general finance jobs. Therefore, bankers must use non-traditional candidates to recognize investment banking capabilities.

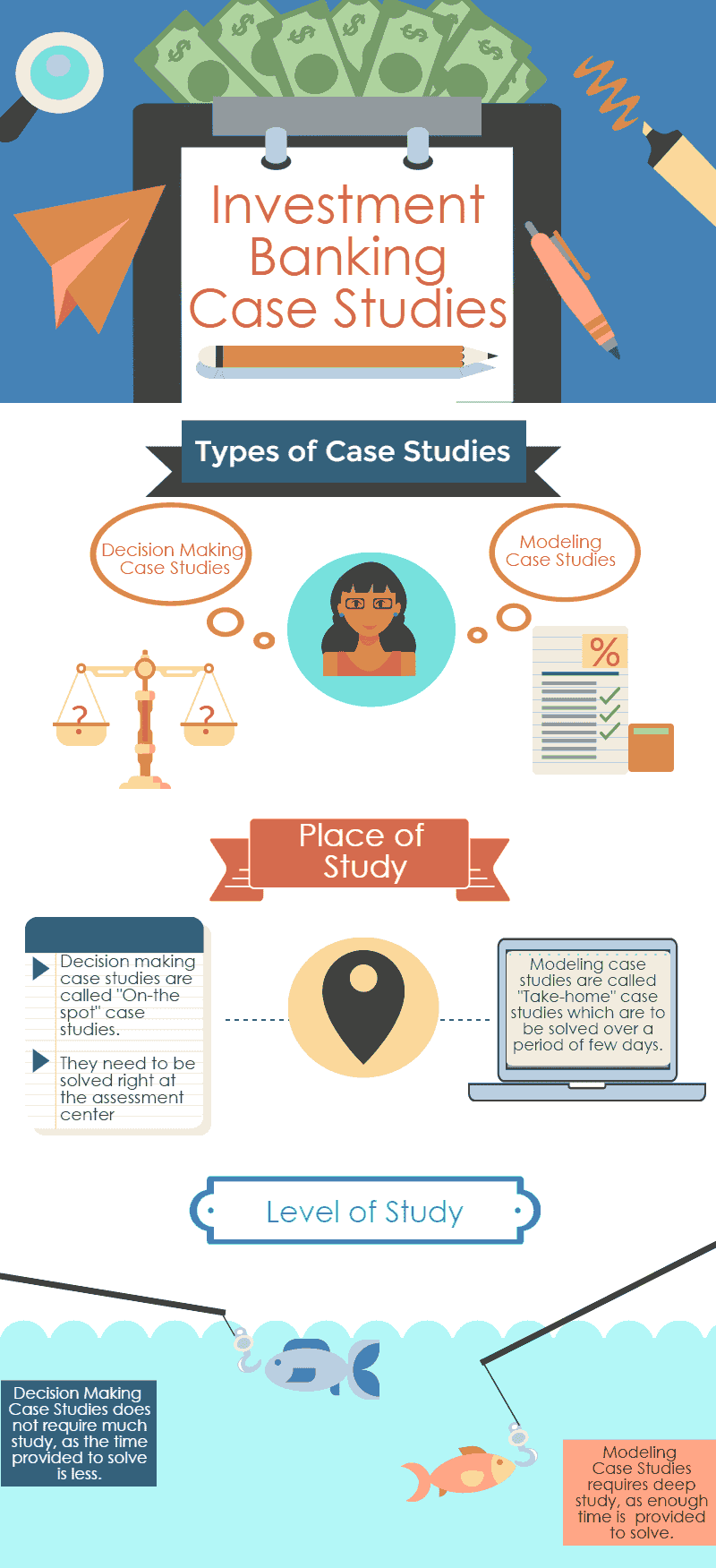

- Decision-making case studies and modeling investment banking case studies are the two case studies.

Investment Banking Case Studies Explained

Investment banking case studies play a great role in assessing the abilities of a candidate and figure out their presence of mind and effective utilization of their skills and qualifications. Though it is an important part of the assessment, case studies are not for all. It is meant for the ones applying for a higher position in the investment banking sector.

Investment banking case studies are incorporated in the interviews of senior professionals, including senior analysts and associates. For someone who has attended business school, solving case studies are common. However, as part of the hiring process, the case studies given here are business-based and candidates are expected to provide detailed recommendations based on the given scenario.

Candidates receive all the required information and enough time to study general case studies. It is typically a business problem that asks for their opinion. Hence, they need to:

- Make necessary assumptions

- Analyze the given situation, which could usually be a client’s business

- Advise solution on the present problem with supportive reasons

While the case study round would happen most of the time on the day of your interview, some recruiters also provide the material beforehand for the candidates to prepare well at home. Candidates are then expected to discuss the case study during the interview.

A typical case study would have the following features: –

- It would be a hypothetical situation, although it could resemble an existing condition of a corporation.

- It attempts to recreate its strategic decisions and its advisors.

- Financial information may or may not be provided depending on the relevance of the analysis that needs to be done.

- The suggestions must be original work of the candidates or their team.

Video Explanation of Careers in Investment Banking

Why Investment Banking Case Studies?

Investment banking case studies are the best ways of analyzing the practical skills and abilities of a candidate and this is what make it an important part of the interview process in any investment banking unit. Through this process, the bankers try to judge a candidate in real-world situations. They want to test the three most important skills required in a banker, analytical, communication, and people skills. Due to these reasons, the case study weighs much more than the other ways of judging candidates in the investment banking recruitment process.

The investment banking job requirements differ from those of general finance jobs. Hence, the bankers want to use non-traditional candidates to identify the IB potential. Case studies give banking recruiters an indicator of how one would perform on the job. Hence, considered a better measure to judge candidates.

- One does not have to worry if an answer is correct or not. Instead, the interviewers are eyeing the candidate’s thought process and analytical skills to find a solution to the given problem creatively.

- Investment banking case studies are designed in such a manner that it enables the candidates to think on their own and brainstorm.

- One of the primary skills required in candidates for such jobs is solving problems. Therefore, recruiters want a basic insight into tackling challenging situations and apply their intelligence, education, and work experience to handle them successfully.

- Case studies appraise how one processes information and react to new and surprising situations.

- Many times, the case studies are to be solved with a group. Hence, the interviewer here tests how they work within a team.

Types

Broadly, candidates can expect two types of case studies at the IB assessment center: the decision-making case studies and financial modeling case studies.

Decision-Making Case Studies

They are more commonly asked as compared to the modeling-type case study. In this case study, candidates must make decisions for clients and advise them in certain situations.

The client case studies could be based on finding sources through which one should raise capital, whether they should undertake the proposed merger, and why.

One should expect these questions to be made available on the spot., They must solve and present the case within the given time frame. For this entire process, they would be given around 45-60 minutes for preparation and a 10 minutes presentation followed by a round of questions and answers. On-the-spot case studies would not involve a deep analysis of the case as the time required to do the same is not sufficient and would be more about presentation and teamwork skills put to the test.

Example

Let’s say one of the clients is a global corporation that manufactures and distributes a wide range of perfumes. They are contemplating ways to expand their business. There are two ways to either introduce a new range of fragrances with the current distribution channels or start a completely new company with different stores.

The candidates are supposed to find out which would be a better solution for the business. To solve this, they must compare the returns of the investments and decide on the solution with supportive reasons.

Modeling Case Studies

These are the take-home case studies where the candidates are expected to do financial modeling and simple valuation. So, it is more like a modeling test than a case study.

The case study would perform FCFF valuation on a company or prepare a simple merger or leveraged buyout model.

One would be expected to analyze the corporations’ valuation multiples and decide whether they are undervalued or overvalued. Here, they are given a few days to complete the analysis. Then, the candidates need to showcase their recommendations to the bankers on the interview day over a 30–45-minutes presentation. Compared to the client case studies, the analysis would be much more profound as the candidates get enough time to work on them.

Example

A pharmaceutical company has decided to make an acquisition. It has identified the company and has approached candidates to advise how much they should pay. In addition, they are provided with the necessary financial information, metrics and multiples, and the buyer and seller company overview.

To solve this, first, one needs to find out if the acquisition is possible. Then, how would the deal structure and synergies be if the buyer has sources to finance the deal? After this, they must use multiple valuation metrics to decide the price range of the agreement.

How To Prepare?

The preparation of the investment banking case studies involves an organized approach. Let us have a look at the most common ways of preparing for this part of the hiring process:

- Make sure to read business news often and focus on discussing how and what business transactions are concerned.

- Learn about various valuation techniques, their calculation, and how they are interpreted.

- Especially for modeling and valuation-based case studies, one must be prepared to format it consistently using PowerPoint and Excel.

- Yes, that is all one needs to do. Read and solve as many case studies as possible so that they get the knack for understanding business scenarios and solving them.

- The candidates may not find real case study questions that banks use for interviews. But since they have to practice, try asking a friend or colleague they know who has been through such case study rounds for the kind of questions they received.

- If even that is possible, create a case study. Yes, candidates are allowed to do that by taking up a company, building up a hypothetical situation, and asking themselves questions like whether they should merge with ABC Co.? What kind of capital structure should the company have?

Tips for Performing Well

Preparing for this round of interview for an investment banking job opportunity is tough. Hence. Here are a few tips that one may utilize to ensure their preparation remains on track and they efficiently crack this round:

While working on the Investment Banking Case Studies

- Make a concrete decision and base recommendations on logical reasons.

- Use a structured approach to tackle the problem.

- Focus on the most important issues prevalent in the case.

- Understand the case and questions carefully before interpreting and think twice before finalizing the problem’s decision.

- Do not panic if the solution to the case is not obvious.

- For modeling case studies, format the Excel and PowerPoint professionally.

- Prepare the type of questions that may be asked during the presentation.

- Assess all the relevant factors and possible problems, but keep in mind the resources.

- The solutions provided should be realistic and be aware of the implications of the organizations under study.

- Have strong logical reasons behind every statement made and cater to the case’s critical issues at the beginning.

- Having specific knowledge regarding the industry under study is unnecessary, but it would be an added advantage.

- When preparing, focus on reading deal news and practice as many scenarios as possible.

While presenting the Investment Banking Case study

- Practice public speaking.

- Speak slowly and clearly.

- The presentation needs to be structured logically.

- While working in groups, interact with everyone. The interviewer usually eyes leadership skills and teamwork.

- Do not just try to show the ability to talk finance and business knowledge in an applied sense.

- Remember not to exceed the time limit allotted to present the slides.

- Rehearse well before so that it goes through smoothly.

- If it is a group presentation, ensure everyone gets the chance to speak and express their views. The assessors would also mark the behavior while working in a team.

While Answering the Questions

- Do not hurry to provide the answer. Instead, always organize thoughts and then answer.

- Be attentive throughout the process.

- Expect the interviewer to ask additional questions to test how to deal with the unexpected.

- Be creative and think out of the box to get the banker’s attention.

- The next important step is collecting thoughts and bringing them across the main points. Do not beat around the bush, as the time given is limited. Hence, be precise while speaking.

- There is nothing right and wrong, but arguments (which surely happen if there are group discussions) strongly mention why one did not opt for those possibilities.

Samples

Let us understand investment banking case studies through an example discussed below: –

Investment Banking Case Study - Situation:

Simons Ltd., a software company, wants to maximize its shareholder value. It has three options to look forward to selling the company, i.e., making small acquisitions or growing organically. Argus Ltd. requests advice from the bank on the right course of action.

What to do:

- They would provide an overview of the business, its competitors, probable acquisition candidates, financial statements, and future projections to review the company.

- Read through the provided information and understand the industry.

- Try to gauge the worth of the company compared to its peers.

- Conduct a valuation analysis using DCF and relative valuation techniques.

- Compare the three options with the valuation and the impact of acquisitions.

- Prepare a presentation giving our recommendation on the best method to maximize the shareholder value in this situation.

The solution to the Investment Banking Case Study

The answer to this case study is somewhat subjective. They could take a stand and support it with reasons. However, here, we assume to sell the company for understanding purposes. Let us now see how one could sell as the suggested option.

Reasons:

We recommend selling because of the following reasons: -

- The industry is growing slowly (less than 5% a year).

- The companies are overvalued.

- The acquisitions would not increase the revenue or profit significantly.

Presentation of Investment Banking Case Study

- Please keep it straightforward with the reasons for recommendation to sell.

- A brief overview of the industry, its growth characteristic, and its position.

- How would the company grow organically in the next 5-10 years?

- Briefly explain the acquisition candidates and opportunities with them.

- Justify why both the organ growth options and the acquisitions do not work out.

- Explain the DCF analysis performed and show how selling is the best feasible option.

Frequently Asked Questions (FAQs)

Yes, there are various resources available to practice investment banking case studies. For example, investment banking textbooks, online financial modeling courses, and case study interview preparation guides can provide valuable insights and practice materials. Additionally, some investment banking firms and university career service departments may offer sample case studies or practice resources.

Case studies are commonly used in these interviews to assess a candidate's ability to apply financial and analytical skills to real-world situations. In addition, they test the candidate's critical thinking, problem-solving, and presentation abilities, essential skills for investment banking analysts and associates.

The banking case study examples are the Light Bank, Shine Bank, ITTI Digital Back-Office, Banking Super app, CashMetrics, MasterCard, FinTarget Trading, VR / AR Banking, Bank of Jordan, and Islamic Bank in Qatar.