Table Of Contents

Formula to Calculate FV

Future Value (FV) Formula is a financial terminology used to calculate the value of cash flow at a futuristic date as compared to the original receipt. The objective of this FV equation is to determine the future value of a prospective investment and whether the returns yield sufficient returns to factor in the time value of money.

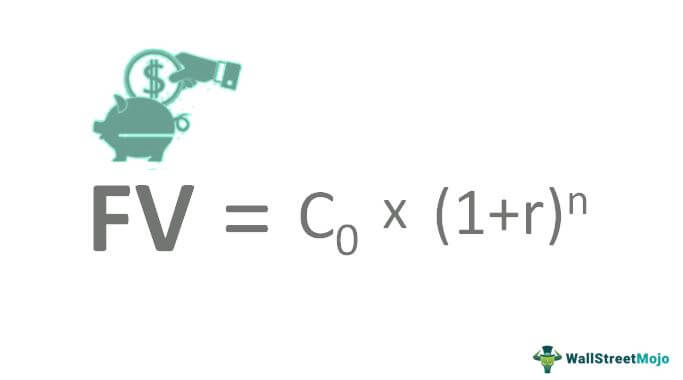

The formula for Future Value (FV) is:

FV=C0 * (1+r)n

Whereby,

- C0 = Cash flow at the initial point (Present value)

- r = Rate of return

- n = number of periods

Key Takeaways

- The future value formula is a financial calculation used to determine the value of an investment or asset at a future date based on the initial investment amount, the interest rate, and the period.

- It considers the compounding effect of interest, which allows the investment to grow exponentially over time.

- By using the future value formula, individuals and businesses can estimate the potential growth of their investments and make informed decisions about saving, investing, and financial planning.

- Time has a significant impact on investment future value. Longer periods offer greater potential for growth due to compounding.

Video Explanation of Future Value Formula

Example

If Mrs. Smith has $9,000 in her bank account and she earns an annual interest of 4.5%. With the help of the future formula, her account after 15 years will be:

- FV = 9,000 * (1 + 0.045) ^ 15

- FV = 9,000 * (1.045) ^ 15

- FV = 9,000 * 1.935

- FV = $17,417.54

We can consider another example for better understanding:

Mrs. Smith has another account that has $20,000 paying an annual rate of 11% compounded on a quarterly basis. Since January 1, 2017, the terms of the agreement have been renewed, and the compounded interest is attributed twice a month. Does Mrs. Smith want to calculate the total value of the account on December 31, 2017?

We firstly need to arrive at the opening balance as on January 1, 2017:

- PV (Jan’16 – Dec’16) = $20,000

- Compounding period (n) = 4

- Annual interest rate (r) = 11% which converts to quarterly interest of 2.75 %

- FV = 20,000 * (1 + 0.0275) ^ 4

- FV = 20,000 * (1.0275) ^ 4

- FV = $22,292.43 (This is the opening balance as of January 1, 2017)

Thus, now for calculating Future value as of 31st December, 2017, the Present value if $22,292.43.

Compounding period (n) now is 2*12 = 24 since the compound interest is now twice a month.

Annual interest (r) = 11% which converts monthly interest rate = 11%/12 = 0.0092

- Thus, FV = PV (1 + r) ^ n

- FV = 22,292.43 * (1 + 0.0046) ^ 24

- FV = 22,292.43 * (1.00046) ^ 24

- FV = 22,292.43 * 1.116

- FV = $24,888

Use and Relevance

- The primary benefit of FV is to determine whether an investment opportunity will garner sufficient yield in the future.

- The concept is applicable to Personal and Corporate decisions.

- The objective is to have an understanding of how economic factors can have an impact on the earnings such as Inflation, Standard of living, operating expenses/recurring expenses (separate analysis is required to be done).

- It shows the stream of payments that are expected to receive over a period of time, e.g., a 10-year investment can show how much returns can be earned every year.

- In certain circumstances, the formula is also used as an input to other formulas. For e.g., annuity in the form of recurring deposits in an interesting account will be the FV of every deposit.