Table Of Contents

What Is Present Value Factor (PV)

The present value factor is the factor that is used to indicate the present value of cash to be received in the future and is based on the time value of money. This PV factor is a number that is always less than one and is calculated by one divided by one plus the rate of interest to the power, i.e., the number of periods over which payments are to be made.

Thus, it is used to calculate the present value of a series of future cash flows, which is the value of a given amount of money today. The discount rate used in the calculations is the opportunity cost of using the fund for some other purpose. The interest rate is fixed irrespective of the inflation rate.

Key Takeaways

- The present value factor computes the current value of future cash payments using the time value of money.

- It is always less than one and is calculated by dividing one by one plus the power's interest rate, i.e., the number of payment periods.

- It computes the future total's present equivalent quantity of time value for money. Then, it calculates how much profit may be made by reinvesting the current equivalent in a comparable, superior channel.

- It may assist in determining whether it is preferable to continue with an existing investment or whether a portion of it should be sold.

Present Value Factor (PV) Explained

The present value factor is the element that is used to obtain the current value of a sum of money that will be received at some future date. The concept of time value of money is the basis of this calculation. Thus, it shows us that the fund received now is worth higher than the fund that will be received in future because it is possible to invest it some current source of investment.

Usually, the factor for the cash flows that will be received in the near future is more than the ones that will be received at a later date. This implies that any sum of money will be worth more if it is received earlier. These factors or values are printed or presented in a tabular format. The present value factor table contains a combination of interest rates and different time periods.

These factors are also used in annuity analysis. In the case of the present value factor for annuity calculation, this factor helps estimate whether it is more profitable to accept a lump sum payment at the current date or an annuity payment during the later years. First, however, it is essential to know the final amount and its period.

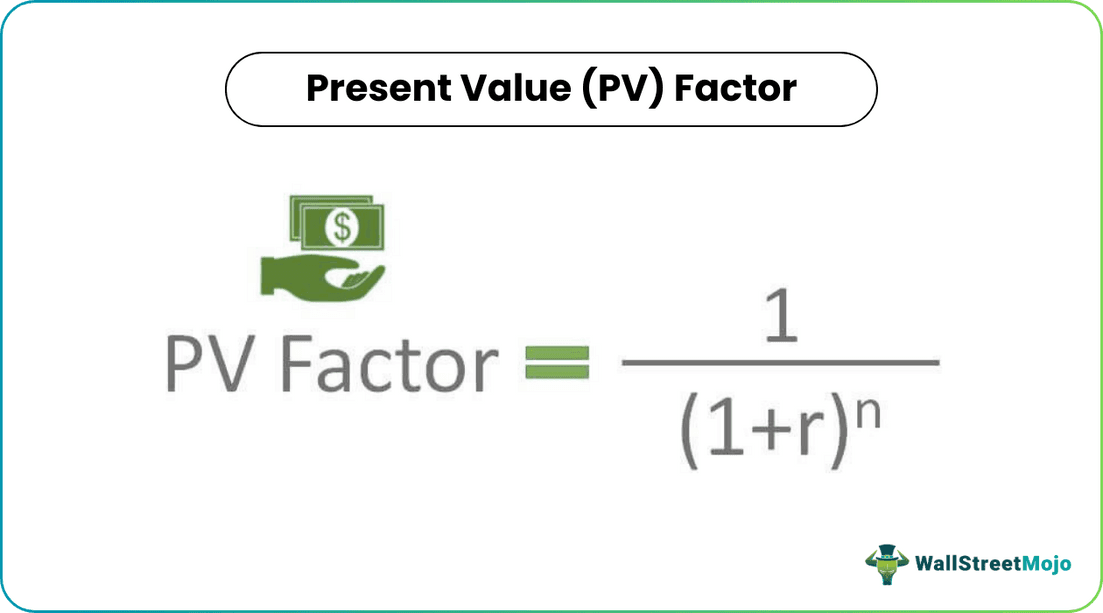

Formula

- r = rate of return

- n = number of periods

This formula is centered on assessing if an ongoing investment can be encashed and utilized better to enhance the outcome compared to an actual outcome that can be had with the current investment. Intending to estimate the present value of a certain sum to be received on a future date, we need two factors: the time interval after which the sum is to be received and the rate of return for the same. These two factors can then be used to calculate the present value factor for annuity for any given sum to be received on any future date. This PV factor would help calculate the current equivalent amount for the future sum in terms of time value for money. Then it calculates how better returns can be achieved by reinvesting this current equivalent in a relatively better avenue.

Examples

Suppose, if someone were to receive $1000 after 2 years, calculated with a rate of return of 5%. Now, the term or number of periods and the rate of return can be used to calculate the PV factor for this sum of money with the help of the formula described above.

PV factor = 1 / (1+r)n = 1/(1+0.05)2 = 0.907

Now, multiplying the sum of $1000 to be received in the future by this PV factor, we get:

$1000 x 0.907 = $907

This means that $907 is the current equivalent of the sum of $1000 to be received after two years with a rate of return of 5%, and it could be possible to reinvest this sum of $907 somewhere else to receive greater returns.

Present Value Factor in Excel (with excel template)

Let us now do the same example above in Excel. This is very simple. You need to provide the two inputs of Rate of Returns and Number of Periods.

We can easily calculate present value factor in the template provided.

Benefits

Let us try to understand the importance of this concept.

- This concept of the PV factor that is available in the present value factor table can be of great use in estimating if a current investment would be worth continuing with or if a portion of it can be received today and reinvested to receive greater returns.

- Since it takes into account the time value factor, it allows the investors to fairly compare and evaluate different investment options.

- The net present value factor is very useful in capital budgeting, investment analysis, and appraisal. Investors, analysts, and companies can evaluate the profitability and returns from their investments or projects.

- The risk factor of the future cash flows can be accounted for by taking a higher discount rate, and the uncertainty can be adjusted accordingly.

- It helps in investment decisions. For example, suppose one finds that the present value of the sum to be received in the future can yield higher returns in an alternative investment. In that case, it sheds further light on the value of the current investment and any viable alternatives. This would be of great help in making better-informed investment decisions.

Limitations

Let us now analyze some of the limitations of the net present value factor.

- The concept assumes a constant discount rate for the entire period of the cash flow. But they may fluctuate during the time period.

- The present value factor is very sensitive to the discount rate. A small change can affect it to a great extent. Therefore, it is necessary to select a relevant discount rate so that the calculation gives accurate result.

- It also assumes that the cash flows are consistent. In real world, they may be irregular, and the amount may also vary. Thus, the factor does not account for these problems.

- The calculation also ignores inflation which is an essential element. Inflation erodes the value of the cash flows, and there may also be other risk factors that influence the purchasing power of money. This makes the calculation inaccurate.

Thus, it is important to consider both benefits and limitations of the concept while applying it in real life scenario.