Table of Contents

Holder In Due Course Meaning

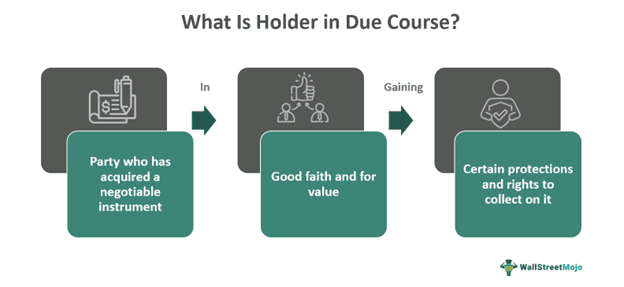

A holder in due course is an individual who acquires a negotiable instrument, such as a promissory note or check, in exchange for value, given in good faith without any notice that the instrument is overdue, faulty, altered, forged, or dishonored. This means they must act honestly in the transaction and be unaware of any problems with the instrument at the time of acquisition.

They are entitled to payment from the maker or drawer of the negotiable instrument and can enforce the instrument free from many defenses and claims that previous holders might raise. This status provides significant protection, ensuring the right to collect the instrument's total value. However, the status does not apply to individuals who found a lost instrument or obtained it through unethical means.

Key Takeaways

- Holder in due course is the person who is given a check or promissory note in good faith without any knowledge of it being forged, dishonored, or overdue.

- In such a case, the holder, in due course, has many rights and privileges, most notably the right to sue all the previous parties associated with the negotiable instrument.

- The entire transaction must be conducted in good faith, prior to the maturity date, and the holder must have a legitimate right to possess the instrument.

- It means that the holder must have obtained the instrument legally and not through any illegal or fraudulent means.

- Negotiable instruments received as gifts or found when someone finds a lost instrument do not account for the person becoming a holder in due course.

Holder In Due Course Explained

A holder in due course is a person who acquires a negotiable instrument, such as a promissory note or check, in good faith, for value, and without notice of any defects or claims against the instrument before it is due. To qualify, the individual must not be aware that the instrument has a defective title, is forged, or has been altered at the time of acquisition.

They have the right to enforce the instrument free from many defenses and claims that prior parties might raise. This status offers significant protection, ensuring that they can collect the instrument's total value even if there are issues with previous transactions involving the instrument. They can also sue all prior parties involved with the instrument for payment. However, the status does not apply if the instrument is acquired after its maturity or with knowledge of any defects.

Statutory protection for the holder in due course means the instrument is considered free of defects, and they are not required to prove their title. Laws and customer protection acts in various jurisdictions ensure that they receive full and satisfactory payment. Transactions made in good faith are vital for the smooth functioning of business and financial systems. Payors must act honestly and in compliance with the law, avoiding any attempt to pass defective instruments.

Requirements

The requirements of the holder in due course are -

- To become a holder in due course, the person must be a holder first. The person must have the right to possess the instrument.

- A holder in due course of a negotiable instrument must be for a valid consideration. Therefore, an exchange of value must exist. A check received as a gift cannot be claimed for the holder in due course.

- The negotiable instrument must be regular and complete. The holder, in due course, must examine the credibility of the instrument, checking on its date, form, contents, stamp duty, and so on.

- The whole transaction must have been initiated in good faith.

- The person must acquire the instrument before the date of maturity or payment.

Examples

Below are two simple examples of holders in due course –

Example #1

Suppose Jennifer owns an event management company that organizes parties, seminars, weddings, and other events. She recently organized a small wedding and received her payment via check after completing the event. Jennifer became a holder in due course when she received the check in good faith, before the date of maturity, and in exchange for the service of organizing the wedding.

When she went to deposit the check, it bounced, revealing that the negotiable instrument (check) was defective. Regardless of whether the payor issued the check with ill intent or by mistake, Jennifer, as a holder in due course, is entitled to payment. She has the right to sue the payor to recover the amount due on the check. Jennifer also benefits from other rights and protections afforded to holders in due course, which simplify the enforcement of her claim despite the check's defectiveness.

Example #2

According to the news from February 2024, a man from Gray, Maine, is warning others about a little-known law after he was sued in Small Claims Court. Len Sherwood said he was trying to help a neighbor by giving him a $150 check for gas so he could drive to a job in Virginia. When the check wasn't cashed after a few days, Sherwood, suspecting potential fraud, placed a stop payment order on it.

A month later, Sherwood received a letter from a local business called RepubliCash, stating that they had cashed the check, and now he owed them $150 plus a $35 return fee. He is now being sued in Small Claims Court for over $400 with added fees.

This situation involves the holder in due course rule, which is a significant part of commercial laws known as the Uniform Commercial Code (UCC), adopted by the State of Maine. According to a professor from the Maine School of Law, any person to whom a check is transferred is called a holder. If the check is endorsed and transferred in good faith, for value, and without any notice of defects, the holder becomes a holder in due course. This status allows the holder, in due course, to enforce the check against the original issuer, even if a stop payment order has been placed.

Rights And Privileges

The privileges and rights of the holder in due course are –

- A holder, in due course, receives a better title than the holder or transferor of the negotiable instrument.

- Such a person has the right to sue all the prior parties associated with the negotiable instrument, such as the maker, drawer, and other intervening endorsers of the instrument.

- Estoppel against denying the capacity of the payee to endorse.

- In the case of fictitious bills, the preference of the court will be given to the holder in due course.

- Estoppel against denying the instrument's original validity.

- The holder, in due course, also gets the privilege in case of inchoate stamped instruments. Referring to the fact that when the holder receives a check-in due course, he can claim the whole amount mentioned and the stamp charges as well.

- Another vital privilege is the preference given to the holder in due course when an instrument is delivered conditionally for a particular purpose only.

Difference Between Holder In Due Course And Holder

The main differences between holder in due course and holder are –

- Holder in due course is when a person acquires the instrument in good faith before the instrument becomes due for payment. In comparison, a holder is someone who legally obtained it with entitlement.

- A holder, in due course, has the right to sue every previous party. In contrast, a holder has no such right.

- In due course, the holder has more privileges than the holder and acquires a good title, but the holder never acquires a good title from any prior parties.