Table Of Contents

Financial Structure Meaning

The financial structure refers to sources of capital and the proportion of financing coming from short-term liabilities, short-term debt, long-term debt, and equity to fund the company's long-term and short-term working capital requirements.

- Debt includes a loan or other borrowed money that has an interest component associated with it which is periodically paid till the borrowed amount is fully repaid.

- Equity refers to diluting the owner's stake in the company and selling it to investors. Equity investor does not need to be paid interest like debt. Rather, the profit earned by a company is attributed to them as they own a share in the company and are part owners. Profit is distributed through dividends paid by the company to its investors.

Key Takeaways

- The financial structure refers to the sources of capital, including short-term liabilities, short-term debt, long-term debt, and equity, that a company uses to fund its long-term and short-term working capital requirements.

- The cost of capital, control, leverage, flexibility, credibility, and company size can affect a company's financial structure.

- The financial structure provides insight into a company's leverage and cost of capital.

- The economic system is a broader concept than the financial structure. It encompasses a range of factors that influence the production, consumption, and distribution of goods and services in an economy.

Optimal Financial Structure

While every company or firm, private or public, is free to use any structure, any random mix of debt and equity is neither preferable nor good for a going concern company. Furthermore, the kind of structure a company employs affects its WACC (Weighted Average Cost of Capital), which directly affects the valuation of a company. Therefore, an optimal design is necessary to maximize the value of a company. WACC is the weighted average of the marginal cost of financing for each type of financing used.

The formula for WACC:-

WACC = Ke*We + Kd(1-tax rate)*Wd

- Ke = Cost of equity

- We = Weight/Proportion of equity in the financial structure

- Kd = Cost of debt

- Wd = Weight/Proportion of debt in the financial structure

E.g., A company named ABC Ltd. has a total capital of $1 million structure with $500,000 each of equity and debt. Both equity and debt come with a cost. The cost of debt is interest paid, while the cost of equity is the minimum return that an investor would expect. Assume the cost of equity is 12%, the cost of debt at 8%, and the tax rate at 30%, so the WACC of ABC Ltd. is: -

- WACC = .12*(500,000/1,000,000) +.08*(1-0.3) *(500,000/1,000,000)

- =.088 or 8.8%

Some may argue against debt as to why to use it and pay interest on it? There are many reasons for it, like a firm may not have equity to finance its business activity and will finance it with debt. Another reason is the lower effective cost of debt than equity, which reduces WACC, increases valuation, and amplifies certain profitability ratios like return on equity. How the cost of debt is less than the cost of equity can be explained with the following example: -

Suppose a company needs capital of $100,000 for its business operations, so it either issues debt of $100,000 at a 10% interest rate or can dilute its equity by 10%. As mentioned and calculated below, the company going with the debt financing route pays 10% interest on $100,000 of $10,000 and earns $273,000. However, whereas the company going through the equity financing route will generate a profit of $280,000 due to nil interest cost, the net profit attributable to the owner would be only $252000 ($280,000-10%*280,000) as the owner owns only 90% of the company and 10% is owned by someone else due to the sale of 10% equity.

So, the profit from debt financing is greater than equity financing due to less cost associated with debt and its tax-deductible feature.

Again, one should consider the inherent financial risk debt brings; no free lunches exist. Therefore, the risk with debt is also higher. The optimal leverage level is when the value-enhancing effect of additional debt is offset by its value reducing the impact.

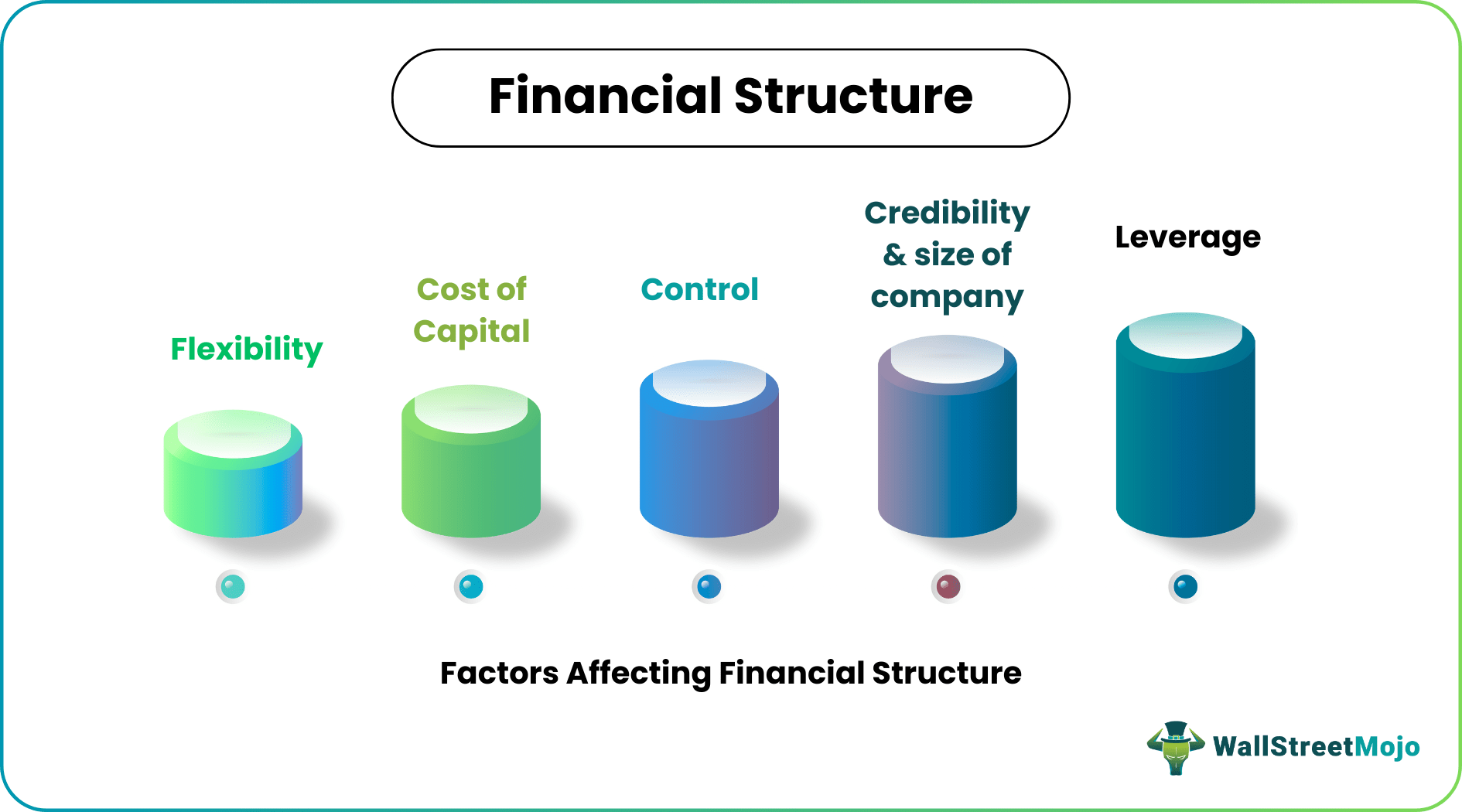

Factors Affecting Financial Structure

Various factors affect financial structure decisions. Some of them are explained below: -

- Cost of Capital - As discussed above, debt and preference shares are a cheaper source of capital than equity, and a company focuses on reducing its cost of capital.

- Control - Equity as a source of capital has its limitations. The excessive dilution or selling of stake may lead to loss of power in decision making and controlling stake in a company.

- Leverage - Debt can be both positive and negative. On the positive side, it helps keep the low cost of capital as it is a cheaper source than equity and a small increase in profit magnifies certain return ratios. On the other hand, however, it may negatively create solvency issues and increase its financial risk.

- Flexibility - The financial structure should be arranged to change the environment. Too much rigidity may make it difficult for a company to survive.

- Credibility and Size of a Company - Small-sized companies, new companies, or companies with a bad credit history may not have unrestricted access to the debt due to insignificant cash flows, lack of assets, and a missing guarantor for the security of a loan. Therefore, it may be forced to dilute its equity to raise capital.

Financial Structure v/s Capital Structure

Some people confuse financial structure with capital structure. Although there are many similarities, there is a slight difference between them. The economic system is a broader term than capital structure.

The financial structure includes long-term and short-term sources of funds and contains the whole of liabilities and equities on the balance sheet. But on the other hand, the capital structure includes only long-term fund sources like equity, bonds, debentures, and other long-term borrowings, not accounts payable and short-term borrowings. So basically, capital structure is a section of financial structure.

Advantages of Debt Financing

Although excess debt increases the financial risk to the firm, reasonable debt has its advantages: -

- Debt financing allows the promoter and owners to retain ownership and control over the company.

- The owner is free to decide on the allocation of capital or retention of profits, dividend distribution, etc., without any interference from lenders as long as timely payment is made to them.

- In the long term, debt financing is less costly than equity which lowers the cost of capital.

- Debt obligations exist until the loan is repaid, after which the lender can have no claim to the business.

Disadvantages of Debt Financing

- It must be paid regularly, inviting heavy penalties and a lower credit rating.

- Debt is limited to established companies, and young companies that face a shortage of cash flows in initial periods have difficulty accessing debt.

- Debt financing also increases the financial risk to the company.

Advantages of Equity Financing

- A company following the equity financing route has no obligation to repay the money, as in the case of debt. Their risk and rewards are aligned with a company's performance. If the company grows and earns a profit, equity owners have their share in those profits, and if the company goes bankrupt, then the equity owner loses all of its value equal to their shareholding.

- Young, newly formed, or unproven companies can acquire equity financing much more ease than debt financing due to lack of assets, credit history, etc.

- Equity financing brings new investors to the table, providing management guidance and advice for existing owners.

Disadvantages of Equity Financing

- Capital raised by diluting equity stake leads to less control and decision-making power over the company.

- Too many stakeholders with different ideas can delay decision-making and solve day-to-day business operations.

- Equity financing, compared to debt financing, is a complex and sometimes expensive process like an IPO (Initial Public Offering)

- Equity financing, as explained earlier, is more costly than debt financing, increasing capital costs.

Conclusion

Financial structure gives an insight into a company's leverage and cost of capital. For example, an asset to equity, debt-to-equity, etc., are some ratios that give an idea about financial structure. In the initial years, many companies may deviate from their target or optimal capital structure due to the need for funds and, therefore, may not think about the sources of funds.

But in the long term, every company moves towards its target or optimal capital structure whereby the cost of capital is minimized, and the firm's value is maximized.