Table Of Contents

What is Cost of Refinancing?

Cost of Refinancing means the various costs incurred in replacing an existing debt obligation with another debt under a new set of terms. This can be an effort to reduce EMI, lower interest rates, take cash out of homes for large purchases or change mortgage companies for some other reason.

Refinancing occurs when an individual or an organization revises its terms of finance, including repayment schedule, rate of interest, credit, etc.; which will usually be opted for when the refinanced loan is available at a lower rate of interest or higher maturity period with similar net cash outflows and this involves various costs known as average cost of refinancing which ranges between 2% – 4% of the total loan amount.

Key Takeaways

- The term "cost of refinancing" refers to the numerous expenses of exchanging one debt obligation for another with new conditions.

- It could be an attempt to cut the EMI, lower interest rates, withdraw cash from the house for expensive purchases, or switch mortgage firms for several reasons.

- Refinancing is of four types: Through cash-out, Through home equity loan, rate and term refinance, and streamlining.

- Before refinancing, borrowers must keep their first and original mortgage for at least 12 months because most banks and lenders initially look to see if the requirements are met.

Cost of Refinancing Explained

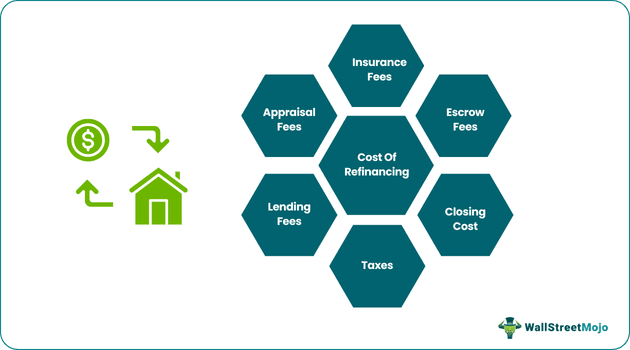

The cost of refinancing is the expense incurred in replacing an existing debt with a new debt with a fresh set of rules. This step can be taken to reduce EMIs, interest rates, or even to change mortgage companies for other reasons. The cost of refinancing mortgage can include taxes, escrow fees, closing fees, lending fees, appraisal fees, and insurance fees.

The terms and conditions of refinancing may vary widely by country, or state, based on several economic factors.

It is always important to shop around for low or free refinancing. It’s worth considering saving thousands of dollars against wrong refinancing while getting a new line of credit.

Types

Let us understand the types of cost of refinancing mortgage to fully understand this concept. Depending on the situation of the borrower and the reason for the shift, the types would differ. Let us discuss in detail through the explanation below.

#1 - Refinance Through Cash-Out

The borrower can use the equity built up to get cash in cash-out refinance. It is a new loan for the amount of the mortgage. It also includes cash received that would be up to 80% of the loan-to-value ratio.

#2 - Refinance Through Home Equity Loan

A home equity loan is also known as a second mortgage. It is a separate mortgage. With home equity loans, the borrower can take up to 80% of the loan-to-value ratio.

#3 - Rate and Term Refinance

It's a typical mortgage refinance. The main purpose is to take benefits of the revised low-interest rates and new loan terms based on new criteria.

#4 - Refinance Through Streamline

Government-backed home loans are available to streamline refinance. The processes of such refinance are usually very quick and easy.

Formula

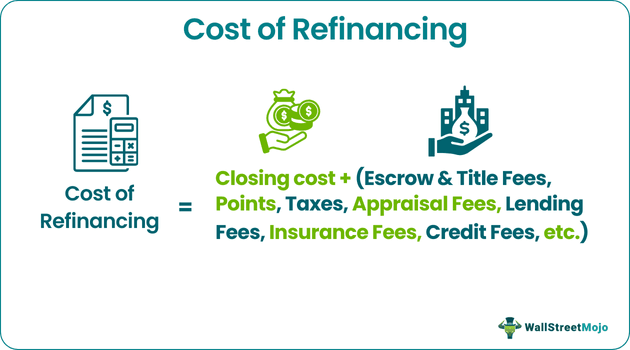

The average cost of refinancing can be different for different borrowers based on the mortgage company, the quantum of debt, and the type of debt. However, it is important to understand the formula to calculate the ultimate refinancing costs.

Scenario 1: Closing costs and various fees are involved.

Cost of Refinancing Formula = Closing cost + (Escrow & Title Fees, Points, Taxes, Appraisal Fees, Lending Fees, Insurance Fees, Credit Fees, etc.)

Scenario 2: Closing costs are borne by the lender and various fees are involved.

Cost of Refinancing Formula = Escrow & Title Fees + Points + Taxes + Appraisal Fees + Lending Fees + Insurance Fees + Credit Fees etc.

Examples

Let us take the help of a couple of examples to understand the concept of cost of refinancing mortgage in depth.

Example #1

Mr. Bill has taken a mortgage loan and is thinking of refinancing it. We have the below information:

Points calculation:

In the above example, the total cost of refinancing = Points + Closing cost

=$(2,295.72+1200) = $3,495.72.

Example #2

In 2020, amidst the peak of the pandemic, many homeowners took the advantage of interest rates ranging at around 2% and refinanced their home loans to pay it off faster and more importantly to benefit from a lower rate of interest.

However, in December 2022, the interest rates soared up to 6-7% and it was still a good time for some homeowners to refinance their loans. Despite the high-interest rates, homeowners benefitted from cutting the tenure of the loan and completing the loan faster than expected. Moreover, for individuals with a cash crunch, even half or one percentage of lesser interest would make a huge difference in the long run for them.

Components

The average cost of refinancing can vary depending on the loan's interest rate, the borrower's credit score, the relationship with the lender, and the amount of the loan. There are various components of the cost of refinancing.

- Closing Cost - It is usually some percent of the outstanding amount of mortgage.

- Title Fees and Escrow Fees - Includes both owner and lender policy for the clause of title insurance and the escrow fee. They also include courier fees, miscellaneous drawing, a recording fee, the office's fee, mortgage document notarization fees, and the notary's fee.

- Appraisal Fees - Appraiser charges these fees for the critical property inspection be it an investment property or owner-occupied.

- Lending Fees - The lender charges these fees to process a mortgage. It is also referred to as garbage fees. These fees include underwriting, document preparation, processing, funding fees, administrative fees, wire, flood certification charges, and tax service fees.

- Points – Point is a combination of discount fees and origination fees. Discount fees are prepaid interest paid by the homeowner and are beneficial for reducing interest rates. Origination fees also reduce the interest rate, but they are mainly used to compensate an originator during the complete transaction. One point usually equals 1% of the total amount of mortgage.

- Taxes - Property taxes as agreed upon on a yearly or half-yearly basis. Other outstanding property taxes must be paid and cleared off at the time of the first mortgage closing.

- Credit Fees - It is the fees to review the borrower’s credit report to assess the overall credibility in the particular timeframe.

- Insurance Fees - The borrower’s home insurance policy should be up-to-date at the time of the deal. It usually should not be less than four months. The standard coverage required by the lender is equivalent to replacement cost coverage.

Importance

Timely financial decisions can quite literally be the difference between an individual with cash crunch and someone with a well-charted financial roadmap. Let us understand the importance of performing the due diligence and incurring an average cost of refinancing.

- Borrowers must maintain their first and original mortgage for at least 12 months before refinancing, as most banks and lenders mainly check for the criteria to be fulfilled before proceeding. Also, the borrower must check the lender to know all possible restrictions.

- Borrowers looking for refinancing may get numerous offers by different lenders but sometimes the may get the best interest rate staying with the original lender.

- Interest rate environments are cyclical and impact new credit and credit refinancing. National monetary policy, economic cycle, and market competition can fluctuate interest rates for consumers and businesses.

Advantages & Disadvantages

Let us understand the advantages and disadvantages of incurring the cost of refinancing mortgage through the discussion below.

Advantages

- Reduction in the interest rate of the mortgage. With an increased credit score, people can procure loans at lower rates. It impacts monthly payments as well.

- Many people refinance to obtain money. It can be used for purchasing a car, reducing credit card debt, etc. This can be done by taking equity out of the home.

Disadvantages

- For borrowers with a perfect credit history, refinancing can be a good way to convert a loan to obtain a lower interest rate. Refinancing can be risky for borrowers with bad credit history, or with too much debt.

- There could be penalties incurred in the cost of refinancing which could be thousands of dollars.

- Refinancing costs may include paying an attorney and bank fees which can ultimately not be a worthy affair.