Table Of Contents

Rehypothecation Definition

Rehypothecation refers to a practice where financial institutions like brokers and banks reuse the assets posted as collateral by their clients to secure their borrowings. Therefore, they provide a rebate or lesser cost of borrowing to the client who permits rehypothecation of their collateral.

When an individual decides to give away his asset as collateral to get a loan sanction from a bank or financial institution, it is known as hypothecation. However, when the bank now decides to use the collateral posted by the client for purposes or transactions of its own with that of another financial institution by providing the same asset of the client as collateral, the first bank is said to have engaged in rehypothecation. As a result, the client will now be rewarded with a lower cost of borrowing on his funds or maybe even a certain rebate amount.

Key Takeaways

- Rehypothecation is a practice where financial institutions reuse the collateral provided by their clients to secure their borrowings, offering cost savings or lower borrowing costs to clients who allow it.

- The benefits of rehypothecation include reduced borrowing costs, increased access to capital for financial institutions, and the ability to leverage assets.

- Drawbacks of rehypothecation include a lack of transparency for consumers, the risk of default, and the potential misuse of pledged collateral.

- Banks and financial institutions commonly use rehypothecation to facilitate additional transactions and access additional capital by utilizing client assets as collateral.

Examples of Rehypothecation

Example #1

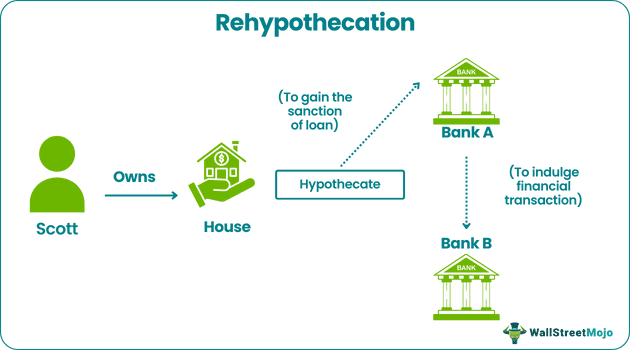

Let us consider the example of Scott, who requires capital for his business. He owns a house and thus decides to hypothecate the bank to sanction the amount for his business. Therefore, Scott has made hypothecation to bank A.

Now, the bank wishes to indulge in another financial transaction by borrowing money from bank B using the asset posted by Scott as collateral. So, Scott is now rewarded with a lower financing cost and some rebate.

Example #2

Another example would be Mr. Tony, who owns shares of Good Co. to the extent worth $100. He wants to purchase shares of Better Co. but lacks the financial resources. He can now make use of his margin account by hypothecating $100 to the borrower and borrowing against shares of Good Co.

The balance sheet would now tend to look like this.

| Particulars | Amount | Particulars | Amount |

|---|---|---|---|

| Equity (Used to Purchase Good Co) | $100 | Shares in Good Co (Pledged) | $100 |

| Debt (With Margin Offered by Broker) | $100 | Shares in Better Co | $100 |

| $200 | $200 |

How Can I Plan for Rehypothecation?

- If an individual is planning for rehypothecation, he needs to be ready to let go of his asset that gets pledged as collateral and enter into an agreement with financial institutions like banks and brokerages, stating that they are ready to allow the financial institution to use his asset as collateral against which the bank can now rely on to engage in transactions for purposes of its own.

- The individual needs to assess the requirement and extent of the loan required and then proceed with the exercise of hypothecation. Normally, only 70%-80% of the collateral value is sanctioned as a loan, and the individual needs to gauge their requirement and then make the assessment in this regard.

- The banker or lender will now have access to the individual's collateral, which can then make use of and pledge with other banks and financial institutions to gain further funding or borrowing for purposes of its own. The lender has the right to seize the collateral if payments are not being made, and the individual who pledges his asset needs to be careful in this regard.

Advantages of Rehypothecation

- Lower Cost of Borrowing: When a borrower undertakes to let go of his asset as collateral for rehypothecation, he tends to be awarded a certain amount of rebate or lower cost of borrowing for the loan he has requested. Thus, the individual or entity tends to save a lot of amounts due to lower interests and borrowing costs.

- Helps Financial Institutions to Access Capital: There will be times when banks, brokers, and financial institutions are in a crunch and need help accessing capital. At times like this, methods like rehypothecation emerge as saviors for the occasion. By pledging the original collateral of the customer or entity, the bank is now free to engage in additional transactions for purposes of its own with other banks and financial institutions, thereby providing the necessary finance and capital to carry out its operations without hindering them or coming to a significant halt.

- Promotes Leverage: By engaging in trading without using own money by pledging and rehypothecation securities, leverage is being generated in accessing capital markets. Thus, necessary trading encourages price discovery and helps increase efficiency in the capital markets.

Disadvantages

- Consumers in Dark: There may be times when an individual is unaware that they have signed on to the rehypothecation clause and the asset is being used for further rehypothecation by the entity for its speculative purposes. The customer would not want that, and the bank would tend to act against the consumer's interest by misusing the asset for its speculative purposes. Securities are often misused in this fashion.

- Risk of Default: Owing to leverage and borrowing if the underlying entity defaults, it causes enormous stress on the whole financial system. That happens to have a cumulative effect causing repercussions on the entire economy. One default would magnify the impact owing to the significant leverage involved, and rehypothecation tends to cause massive losses in this regard.

- Misuse: There may be times when banks may often misuse the underlying pledged collateral to their advantage and even for speculative activities.

Conclusion

Rehypothecation being a method commonly adopted by banks and financial institutions to undertake further transactions for purposes of its own, allows banks to gain access to further such capital by using the borrower's assets as collateral. As a result, the borrower is also gaining due to the lower cost of funds and rebate income. However, it becomes of utmost importance for companies to use such collateral carefully and not misuse the borrower's assets for their speculation and advantage.