Table Of Contents

The Formula for Money Multiplier Calculation

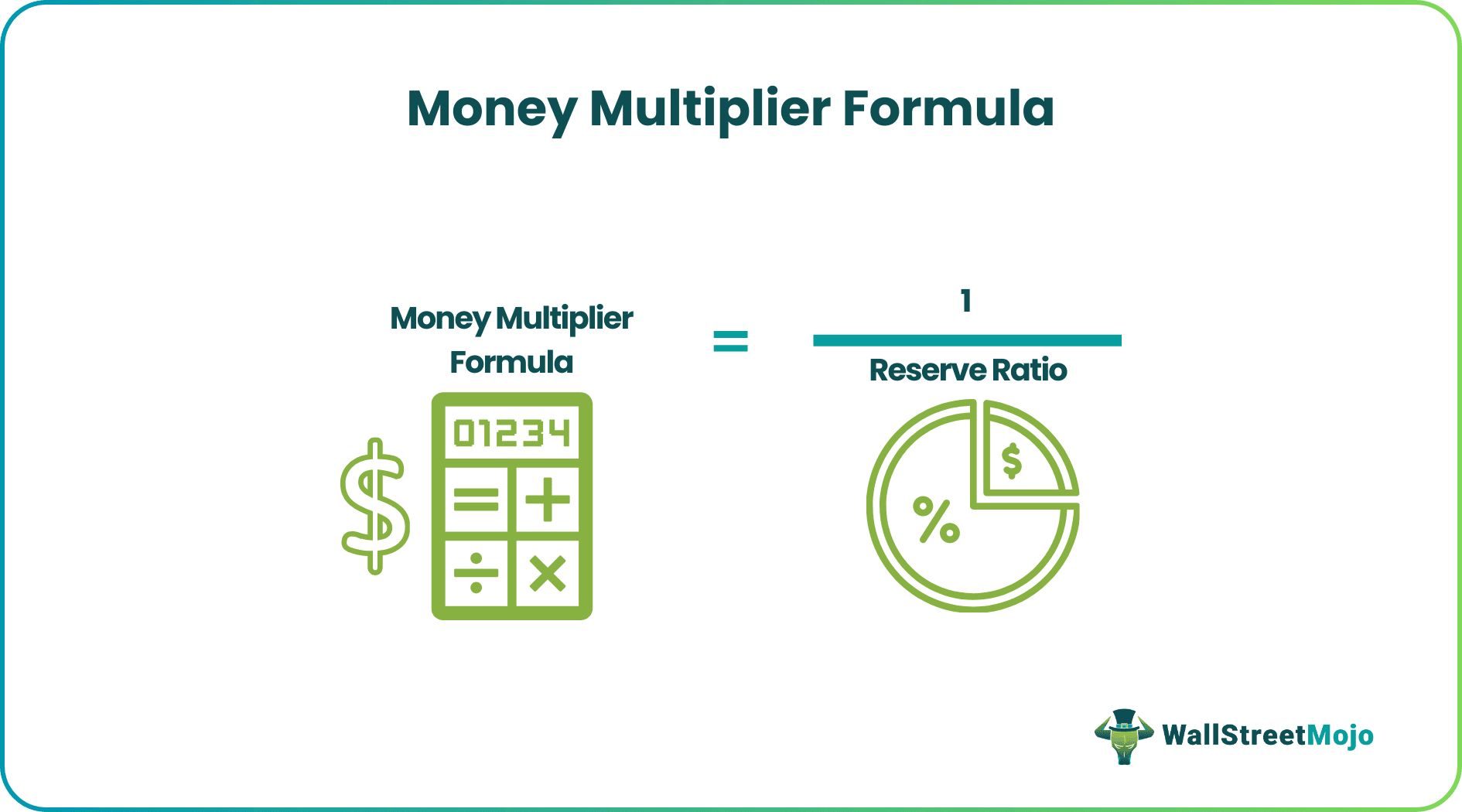

The money multiplier can be defined as the kind of effect referred to as the disproportionate rise in the amount of money in a banking system that results from an injection of each reserve dollar. The formula to calculate the money multiplier is represented as follows: -

Money Multiplier = 1 / Reserve Ratio

The amount of money that the economy or the banking system will generate with each dollar reserve. That will depend on the reserve ratio.

The bank's more money to hold them in reserve, the less they would lend the loans. Thus, the multiplier maintains an inverse relationship with the reserve ratio.

Key Takeaways

- The money multiplier refers to the increase in money supply in the banking system resulting from each dollar of reserves injected.

- Commercial banks are required to hold a percentage of deposits as reserves, known as the reserve ratio.

- The money generated by the banking system with each dollar of reserves injected depends on the reserve ratio.

- The higher the reserve ratio, the lower the potential for lending and the lower the money multiplier. Conversely, a lower reserve ratio leads to a higher money multiplier.

Examples

Example #1

Calculate the money multiplier if the reserve ratio is 5.5% prevailing as per current conditions.

Solution:

Given,

Reserve Ratio = 5.5%

Therefore, the calculation of the money multiplier will be as follows: -

Money Multiplier will be -

=1/0.055

= 18.18

Hence, the money multiplier would be 18.18.

Example #2

World WWF was one of the most prosperous countries globally in handling the country's financial and economic conditions due to Mr. Right, who led the Central Bank. Mr. Right retired a few years ago; then, he was succeeded by Mr. Medium, who is looking after the current affairs of the Central Bank. It observed that the country faces high inflation compared to a few years ago. The Central Bank is now interested in reducing inflation, and one way they have thought of it is by injecting liquidity into the market.

Due to the peak of currency depreciation, the Central Bank is hesitant to print new currency. It is also not interested in lowering the bank rates as that might result in the outflow of FII funds. In the meeting held, where the former Governor of the Central Bank, Mr. Right, was also invited, he suggested reducing the reserve ratio from 6% to 5%. The current money supply in the market is U.S. $35 trillion, and Mr. Right also suggested injecting the U.S. $1 trillion, which they already hold in reserves. After this action, the banks' target money supply in the market is U.S. $54 trillion.

You must calculate the money multiplier and whether a Central Bank took action with suggestions from Mr. Right to be impactful. What will happen if the reserve ratio is not changed?

Solution:

Given,

Reserve Ratio = 5.5%

Therefore, the calculation of the money multiplier will be as follows: -

Money Multiplier will be:

= 1 / 0.05

=20 times

Hence, this would mean that if 1 unit of money is deposited in the economy, it shall multiply that money in the economy by 20 units.

Therefore, if the Central Bank aims to inject U.S. $1 trillion into the market, that would lead to a money supply of U.S. $1 trillion x 20 times, which equals U.S. $20 trillion. There is already a money supply of US$35 trillion; this U.S. $20 trillion would reach the U.S. $55 trillion economy in virtual terms. The action plan was the U.S. $54 trillion; per this ratio, there is a surplus of U.S. $1 trillion.

If the Central Bank kept a reserve ratio of 6%, the money multiplier would be 1/0.06, which is 16.67. If preserved, it would not reach the Central Bank's target.

Example #3

Two students were arguing with each other on the topic of a money multiplier. The first student says if the reserve ratio is kept low, the more money supplies, the lower the inflation in the economy. At the same time, the second student stated that the higher the ratio, the less the money supply, which would reduce inflation. You must validate which statement is correct, taking 7% versus 8% as the reserve ratio.

Solution:

We are given an example of the reserve ratio, and from this, we can calculate the money multiplier from the below formula: -

Case I

Reserve Ratio - 7%

Therefore, the calculation of the money multiplier will be as follows: -

Money Multiplier will be:

= 1 / 0.07

= 14.29

Case II

- Reserve Ratio = 8%

Therefore, the calculation of the money multiplier will be as follows: -

Money Multiplier will be:

= 1 / 0.08

= 12.50

The above can infer that keeping a reserve ratio at 7% will infuse more money as it will be more circulated, whereas keeping it at 8% will infuse less.

Hence, if more money comes into the market, inflation will increase, and vice versa will be the case. Therefore, the statement made by student 2 is correct that a higher reserve ratio will reduce inflation, and the information produced by student 1 is incorrect.

Relevance and Uses

As with almost all countries for the banking system, commercial banks are only required to hold for all deposits as a certain percentage as reserves, which is termed the reserve ratio. The remaining deposits can be utilized to lend out the loans, increasing the money supply. However, one must note that the creation of money will not pause here. It will further deposit the newly created money in a different bank, lending a fraction to other customers. That will continue and can also repeat this process forever in theory.