Table Of Contents

What is Accommodative Monetary Policy?

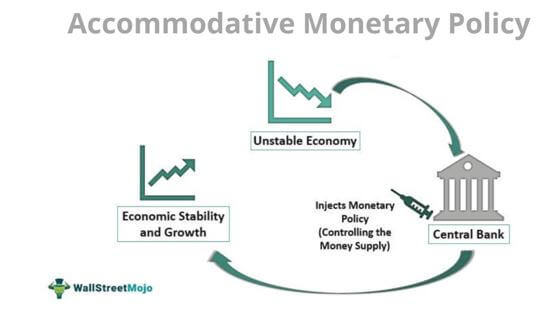

Accommodative monetary policy refers to the corrective measures adopted by a nation's central bank during an economic slowdown. It is an attempt to boost the money supply and meets the nation's money demand.

The Federal Reserve implements the following accommodative monetary tools—decreasing the reserve requirement, offering discounts on short-term loans, and buying government-backed securities. The policies increase the money supply in the economy. Money supply, in turn, encourages people to save less and spend more.

Table of contents

- The accommodative monetary policy is a corrective action taken by central banks. During a recession, these policies enhance the nation's economic condition by escalating the money supply.

- It is an attempt to match the national income—in order to fulfill the economy's demand for money.

- When purchasing power rises, consumers and companies consume more. As a result, goods demand rises. Goods demand triggers increased production, ultimately generating more employment.

- Accommodative policies are meant to be applied in the short term. Long-term implementation causes negative side effects. Once the recession is controlled, excess money circulation and surplus demand cause inflation.

Accommodative Monetary Policy Explained

The accommodative monetary policy is an expansionary tool. It is a policy that tries to accommodate adverse market conditions. Central banks use it as a response to economic slowdowns—to improve market conditions.

During a recession, consumers have little disposable income—purchasing power is limited. Therefore, goods demand is low during a recession. Consequently, manufacturers curtail production without really wanting to do so. In extreme scenarios, employee layoffs and business shutdowns are witnessed.

The Federal Reserve tries to boost the economy by inducing more money into the system. It also curtails Fed fund rates and short-term interest rates to encourage borrowing. But, if interest rates are low, to begin with, central banks cannot reduce discount rates. In such scenarios, the central bank purchases government securities —this corrective action is known as quantitative easing. Quantitative Easing stimulates the economy by reducing the number of government securities in circulation. It directs disposable income towards consumers and companies.

Thus, all recovery measures try to increase market demand—they boost the production of goods and services—reducing unemployment. Economic growth and acceleration are the objectives of accommodative monetary policies. But it is important to note that long-term implementations of these policies can result in adverse consequences— high inflation or stagflation.

Accommodative Monetary Policy Examples

Let us look at real-world applications of accommodative policies:

Example #1

In May 2022, China reduced borrowing rates for five-year loans—bringing them down to 4.45%—a discount of 15 basic points.

The People's Bank of China adopted this measure to boost the housing sector. It was an attempt to control the post-Covid economic slump. However, some investors expressed concerns—rate cuts alone, might not be enough to revive the real estate market.

Example #2

In March 2020, the Federal Reserve took various emergency accommodative monetary measures to mitigate the Covid-19 economic slump. The Fed reduced Fed fund rates by 1.5 points to make it close to zero.

It was an attempt to bring down the cost of borrowing—for companies and households. In addition, The Fed bought many debt securities—treasury and mortgage-backed securities.

Example #3

During the Great Recession, United States housing prices reduced, and the economy slowed down significantly. The Federal Reserve cut discount rates—it fell from 5.25% in June 2007 to 0% in 2008.

But the economy was still weak. In response, the Fed started purchasing government securities in January 2009—for a total value of $3.7 trillion.

Advantages

Accommodative monetary measures are implemented to accommodate economic crises. Central banks initiate various corrective actions.

Accommodative policies benefit the economy, country, and citizens in the following ways:

- Controls Recession: The central bank applies accommodative monetary actions to check the economic slowdown—it is an attempt to bring the nation out of the economic crisis.

- Expands Purchasing Power: Accommodative policies induce money supply into the markets to increase consumers’ purchasing power. Consequently, the demand for goods and services rises.

- Increases Production: When goods demand rises, businesses once again ramp up production to increase the supply of goods and services. Ultimately, economic activities get accelerated.

- Reduces Unemployment: When goods production rises, manufacturers require more labor—ample employment opportunities are created.

- Economic Growth: The slowed- economy gets a kick start. The increase in consumer spending results in a positive or inflationary movement.

- Encourages Investors to Take Risk: When savings account interest rates are curtailed, investors find new opportunities to make a profit. The governmental measure pushes investors toward taking more risk—to generate a better return on their investments.

Disadvantages

Accommodative policies have a direct impact in the short run. However, they are unsuitable for long-term implementations. The drawbacks of accommodative monetary measures are as follows:

- Inflation or Hyperinflation Risk: Once the recession is controlled, the excess money floating in the market can become a problem. Excess money circulation means high goods demand for goods, but supply is limited; surplus demand causes inflation. Customers have to deal with inflated prices for goods and services.

- Discourages Savings: The accommodative monetary actions focus too much on consumer spending—often, savings account interests are brought down. The action attempts to increase borrowing, but it does not benefit risk-averse individuals and businesses.

- Depreciates Currency Value: Long-term implementation of expansionary measures can adversely affect the value of a nation's currency. Again, this is caused by surplus cash circulation in the market.

Frequently Asked Questions (FAQs)

Monetary policies are primarily categorized into three stances:

1. Accommodative Stance

2. Neutral Stance

3. Hawkish Stance

The central bank uses major accommodative policies to curb economic downturns. The central bank induces increased cash circulation in the market through various expansionary measures to enhance consumers’ purchasing power. The market responds with an increased goods demand triggering an increase in production. Ultimately, more employment is generated.

When the economy experiences a downfall, the Federal Reserve curtails Fed fund rates and interests on short-term loans. In addition, the Fed expands open market operations—purchase of government securities. Curtailed loans trigger an increase in borrowings. Ultimately money circulation increases—consumers end up possessing more disposable income. Purchasing power dictates goods demand—which in turn impacts goods supply and production.

Recommended Articles

This has been a Guide to What is Accommodative Monetary Policy. We discuss accommodative monetary policy stances, examples, & advantages. You can learn more about it from the following articles –