Table of Contents

What Is PEP Screening?

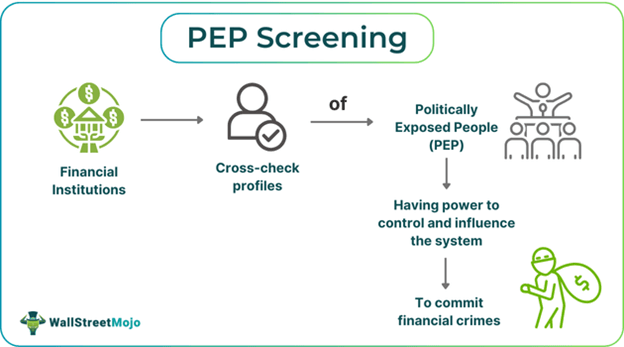

PEP screening, which stands for politically exposed persons screening, is a type of Know-Your-Business (KYB) check whereby financial institutions cross-check the profiles of politically exposed persons before engaging in any financial affair with them. The financial institutions conduct this check to ensure they do not become involved in any illegal financial activity.

PEPs are influential figures in the financial, corporate, military, legal, or political arena who have the potential to be involved in or commit a financial crime, such as money laundering or corruption. Because of their influential positions, they are supposed to evade authorities and have control over law and security, international affairs, or other national interests, including finances. Hence, proper screening in the national interest becomes a must.

Key Takeaways

- PEP screening, or politically exposed person screening, is a process of cross-checking profiles with significant power, resources, or positions, which are likely to misuse the same, committing financial crimes.

- resources, or positions, which are likely to misuse the same, committing financial crimes.

- PEPs are predominantly of two types - domestic and foreign.

- Organizations identify customers based on the collected data, assess risks associated with each profile, approve profiles, and continuously monitor them.

PEP Screening In Business Explained

PEP screening is the profile filtration process carried out to identify and further monitor high-risk individuals holding significant positions. PEPs are likely to have access to resources and influential people or have the power to manipulate the financial system for personal advantage or illegal gain. In short, PEPs are those who hold positions of power at present. In the United States, the Financial Crimes Enforcement Network (FinCEN) is responsible for the process. However, the PEP screening requirements may differ from one country to another.

People can become PEPs at any point in time, and hence, due diligence of customers at all times helps financial institutions remain in a safe zone. When their customers are found committing financial crimes or involved in money laundering or corruption cases, their names and reputations are also negatively affected. Hence, financial firms have to follow the screening process not only to comply with the rules but also to prevent reputational damage.

Moreover, if a person occupies a spot on the PEP list, they will remain under screening even after they leave their positions. This is given the possibilities of their continued contact with influential figures, which might enable them to exercise the same control over the nation's legal, political, and economic system. The term is also often used for foreign individuals entrusted with a prominent public function. PEP can also include immediate family members and close aids.

If this screening is not conducted seriously or properly and financial institutions are found to have individuals involved in financial crimes as their customers, they might have to face criminal charges for their ignorance.

Process Steps

The screening of PEP profiles has to be conducted properly to ensure disapproval of the ones that indicate illegal involvement. Let us check the series of steps that businesses or entities follow for tight screening of customer profiles:

- Identification of new customers - Businesses collect adequate data such as the customer's name, date of birth, address, and other personal details. These data are verified and validated to check if the profiles are fit for onboarding.

- Assessing risks involved - After identification, businesses conduct due diligence and assign risk levels, taking various factors into consideration. Foreign PEPs are generally considered riskier.

- Giving approvals - Top management approves PEP customers after a proper risk assessment. The approval stage includes documentation.

- Continuous monitoring of profiles - Businesses or financial institutions need to monitor essential changes in a customer's PEP status. This involves regular checks and list updates using various PEP screening tools and techniques.

Types

When PEP screening in banking or other financial institutions is conducted, financial institutions come across two broad categories of such profiles, which include:

#1 - Foreign PEPs

They are individuals who hold prominent positions in a foreign country. They include diplomats, high-ranking government officials, or people holding significant positions in international organizations. Their connections in the foreign land could expose them to getting involved in financial crimes.

#2 - Domestic PEPs

They are individuals with influential public positions within the country they reside in. They include government officials, judiciary members, and executives of enterprises owned by the state. They yield significant influence in the home country and are possible targets of money laundering channels.

Examples

Let us look at some of the instances to understand the PEP screening meaning better:

Example #1

Suppose bank ABC begins to operate recently in the United States and hence it needs more new customers. Though the US government issues guidelines that banks are required to follow to prevent money laundering, it still accepts a lot of account opening applications without conducting any documentation and verification process. The authorities, however, come to know about the bank's acceptance of the details provided by the account holders without verifying their details or financial transactions. As a result, they ask them to pay hefty penalties as a punishment besides the huge reputational damage they already face because of their ignorant act.

Example #2

In August 2024, the Financial Action Task Force (FATF) urged India to scrutinize the bank accounts that belong to politicians and government officials, including their families. This was recommended as part of India's anti-money laundering (AML) PEP screening system that was initiated in 2023. The recommendation came following the PEP's high-risk nature toward a commitment to financial crimes. FATF, according to the report, suggested that India facilitate vigorous monitoring of sources of funds that domestic PEPs possess. In addition, the authority also insisted on the involvement of only senior managers in the approval of new accounts of those PEPs or their family members as a more cautious approach toward the prevention of financial crimes.

Importance

Below are some of the points that highlight the importance of screening PEPs:

- Risk assessment and mitigation - PEPs, when compared to normal people, are at a greater risk of committing crimes. Financial institutions, hence, have to be careful when choosing to be involved in a professional relationship with them, as any negative investigations could also tarnish their reputation. Corruption is one of the threats to an economy, and mitigating the risk of people's involvement prevents financial instability. The growth and developmental activities stay afloat when economies carry out the basic prevention processes.

- Customer interest - It ensures fair treatment of all consumers. If a financial institution's reputation gets stained, it automatically affects the existing customers, including other PEPs and normal people who have nothing to do with the ongoing illegal financial affairs. Hence, when financial institutions undertake this screening, they assure other customers that they will try their best to keep themselves free from any reputational damage in the future.

- Compliance with regulations - Different countries and economies have different regulations for handling anti-money laundering activities. Every unit worldwide that shoulders the responsibility of keeping away from such PEP profiles cooperates and works together with a common goal of combating financial crimes. Abidin, by these rules, helps financial institutions avoid penalties, legal charges, and reputational damage.

- Financial crime prevention - Businesses screening for PEPs identify potential threats and prevent people from carrying out such activities. This helps prevent social collapse.

- Protects reputation - Regular screening helps financial institutions maintain their reputation. A positive reputation helps businesses build a loyal customer base and increase their profits. Screening issues not only induce trust issues and reduced profits but also expose them to criminal charges.