Table of Contents

What Is A Revolving Line Of Credit?

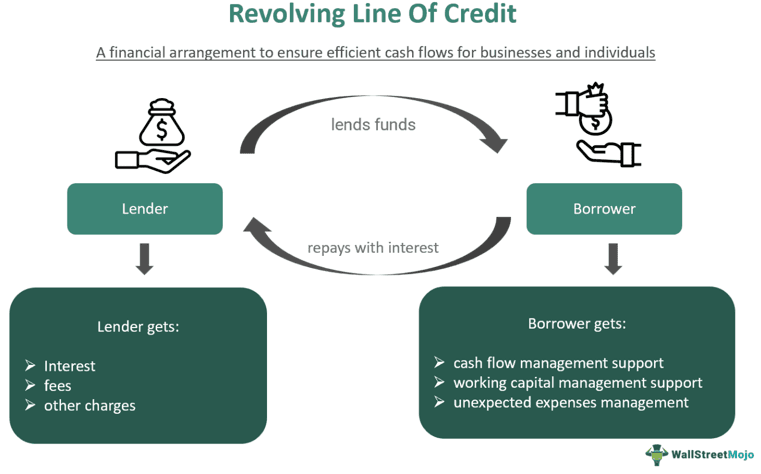

A Revolving Line of Credit is an agreement between a borrower and a lender that enables a borrower to raise funds when needed, repay it over a period, and borrow again based on the availability of funds. An entity can borrow up to a defined ceiling, called the credit limit.

When the amount is repaid before the end of the draw period, funds become available for borrowing again after lenders deduct their fees. As this cycle continues, credit in this form is referred to as “revolving”. Such credit facilities come with varying interest rates, where creditworthiness and market conditions play key roles in determining it alongside other terms.

Key Takeaways

- A revolving line of credit allows entities to borrow money when required and repay the borrowed sum over a specified period.

- When this borrowed money is repaid before the end of the draw period, it can be borrowed again, and the cycle of borrowing and repaying continues.

- These credit facilities offer short-term debt that acts as a buffer for businesses, enabling them to manage income and expenditure shocks.

- Revolving credit is governed by a credit limit, which means borrowers can only borrow up to a specific limit. These accounts are open-ended contracts that define the maximum amount a borrower can borrow and spend against their account.

- It differs from lines of credit and term loans in varied ways, including the core purpose of such a facility, manner of borrowing, tenure, and interest rate dynamics.

How Does A Revolving Line Of Credit Work?

A revolving line of credit is a type of credit facility that allows borrowers to take out new loans continually while paying off the outstanding debt periodically. The credit limit is the upper limit a bank or financial institution sets for a borrower based on their financial standing. Hence, it varies depending on an individual's credit history, income, and other liabilities.

Borrowers who choose this line of credit have access to a predetermined amount of money. It can be repaid and then borrowed again. Borrowers usually have two options: revolve or repeat their debt and carry a balance month-to-month with interest charges, or pay off their debt in full at the end of each billing cycle. They are a practical choice for entities wanting to pay off any ongoing expenditure or manage short-term cash crunches and handle cash flow fluctuations.

Revolving credit accounts are open-ended contracts that permit borrowers to take out loans up to a predetermined amount. These limits are the maximum amount of money a borrower can spend on their account. They can pay it back over time and make additional charges and payments as long as the account is active, in good standing, and open.

An individual's balance accumulates as they spend more on the revolving credit account, helping them gain credit. The credit limits depend on an individual's income capacity, credit score, and other debts or liabilities. After one gains it, they become eligible for another round of credit if they fully pay off their revolving credit statement balances without defaulting within the billing cycle.

If the minimum payment is not made, interest on the balance (which is carried over every month) will be charged. As stated in the agreement, the minimum payment is either a fixed amount or a percentage of the individual's total statement balance. This will, in turn, reduce the balance available in the upcoming statement cycle.

It enables an entity to maintain a balance on their card or account and requires minimum payment, either as flat amounts or a percentage of the balance. A revolving line of credit for business allows owners to manage budgets, handle unforeseen expenditures, and manage their cash flows. These lines of credit can be secured or unsecured, and their interest rates may vary.

Secured lines of credit are often extended when a borrower offers collateral. Unsecured credit facilities do not require collateral, but lenders typically charge a higher interest rate than secured credit to cover their increased risks in case of a default. The terms agreed upon between a lender and borrower govern how such a credit facility will pan out for them.

Examples

The following examples will shed light on how these credit facilities benefit individuals and companies under specific circumstances.

Example #1

Suppose Dana applied for a revolving line of credit facility with FastAdvantage Bank. She had a credit limit of $10,000, which was required to source raw materials for her apparel business. The charges for February 2024 were $2,000. According to the terms of the agreement, until she repays the borrowed amount, the credit available to her will be $8,000. However, once the payment is processed, Dana can have a credit limit of $10,000 again.

In March 2024, Dana received a huge order from a reputable fashion label, where she was asked to create apparel for a soon-to-be-held fashion exhibition. Now, Dana was in no position to repay the previous bill, but she needed funds to source additional raw materials for the new order. Let us see the options she has in this situation.

- Dana could speak with her relationship manager at FastAdvantage Bank and secure an extension on her payment, thereby effectively negotiating the terms and securing additional credit. She hoped this would work as Dana had a good credit history.

- She could request her suppliers/vendors to accept late payments or partial payments until her order is fulfilled and the invoice is cleared.

- Dana could also explore other financing options where her immediate funding needs could be met.

Luckily, FastAdvantage Bank adjusted Dana’s terms of payment and allowed her an extension. What effect did this negotiation have on Dana's revolving line of credit arrangement with the bank then? Along with an extension on the payment deadline, Dana also received a temporary increase in her credit limit. Due to this, she was able to fulfill the order and pay all her bills within the next couple of months.

Example #2

According to a December 2023 press release published on the website of the oil industry giant Eni, the company secured revolving credit of €3 billion (across 5 years) to further its sustainability projects and initiatives. This new credit line boosts the company’s existing credit facility of €6 billion acquired in 2022.

Around 26 global financial institutions jointly extended this credit to Eni with the condition that the agreed-upon sustainability targets must be met (titled Net Carbon Footprint Upstream - Scope 1 and 2). It also involves generating electricity from renewable sources to support various sustainability projects and achieve carbon footprint reduction.

This is a classic example of revolving credit since it focuses on financial flexibility through the 5-year borrowing window with the facility to withdraw as and when required. The credit limit or margin is linked to sustainability targets, which is a key feature of sustainability-linked revolving lines of credit.

Pros And Cons

It is important to study both the advantages and disadvantages of any facility, product, or service that involves one’s finances and may lead to varied negative financial implications if not understood well. In this section, let us see the pros and cons of a revolving line of credit.

Pros:

- Convenience: Revolving lines of credit are a convenient way to source funds. It enables businesses and individuals to borrow money when they need it. Cash flow gaps or fluctuations can be handled through this facility.

- Ease of application: The application process is easy. Also, the consistent interaction between lenders and borrowers speeds up the approval and disbursement process.

- Favorable interest rates: The interest rates were typically lower than other ways of borrowing money, such as cash advances and payday loans. It is possible to secure interest-free loans if the borrowed amount is paid in full on the due date.

- Low collateral hassles: These loans can be secured or unsecured, meaning that collateral is only necessary if the application is for a secured line of credit. Hence, unsecured lines of credit issued keeping creditworthiness in view do not demand collateral.

- Quick availability: It allows individuals or businesses to avail themselves of loans repeatedly without much effort if they repay on a timely basis. This helps businesses meet urgent financial obligations and exploit business opportunities.

Cons:

- High credit score requirement: Borrowers need good to excellent credit scores (typically 690 or above) to avail themselves of such credit facilities.

- Fees and other charges: There may be an annual maintenance fee, a late fee, or a returned payment fee that the borrower may be required to pay. This can increase the cost of borrowing.

- Lack of tax benefits: The interest accrued on such credit facilities is not tax-deductible, which affects a borrower’s overall tax benefits.

- High interest on unsecured loans: Interest rates on revolving lines of credit are typically higher than those on installment loans. This is especially true if the credit account is unsecured.

- Adverse impact on credit scores: When loans are left unpaid, they have a negative impact on credit scores. Late payments can affect credit scores, too. This makes future borrowing difficult.

Revolving Line Of Credit Vs. Line Of Credit Vs. Term Loan

Before sending in applications for credit, it is important to understand the differences between the different kinds of credit facilities available in the market. The table below shows the key differences between revolving credit lines, lines of credit, and term loans.

| Key Points | Revolving Line Of Credit | Line Of Credit | Term Loan |

|---|---|---|---|

| Concept | Borrowers can withdraw money up to a predetermined limit, pay it back, and then redraw it as needed with revolving credit lines. A borrower with a revolving line of credit can also pay down their loan balance and keep drawing on it as long as the line of credit is valid. | A line of credit is a loan that gives borrowers access to funds when needed. They can draw on the credit when they want. After drawing from a line of credit, the borrower pays the interest that accrues on the amount drawn regularly by making the minimum payments required. | In term loans, borrowers typically make a single draw of funds and agree to make regular payments of a set amount in the form of installments. |

| Loan tenure | Revolving loans have short-term revolving tenures. These loans have longer loan periods than term loans. | A line of credit has a shorter tenure than term loans. | Term loans have fixed tenures. |

| Interest rate | It can be fixed or variable. | The interest rate can be fixed or variable. | Term loans have lower interest rates than revolving loans. However, it can be fixed or variable. |

| Examples | Bank overdrafts, personal revolving lines of credit, and credit cards are examples of revolving credit. | Home Equity Line of Credit (HELOC), business line of credit, and personal line of credit are some examples of this credit facility. | Housing loans, car loans, and education loans are typical examples of such a credit facility. |