The differences between both the concepts are given as follows:

Table of Contents

What Is Warehouse Financing?

Warehouse financing is a credit facility used by manufacturers to secure funds by collateralizing their inventory (raw materials and goods). The collateral is typically non-perishable goods and is held in trust in public warehouses or in-field facilities managed by a third party.

It can provide liquidity to firms by leveraging their inventories. It assists companies in closing the distance between production and sales cycles, providing a steady cash flow. Businesses can satisfy their immediate financial responsibilities, such as compensating suppliers, supporting operating expenses, and investing in development possibilities by borrowing money based on the value of their inventory.

Key Takeaways

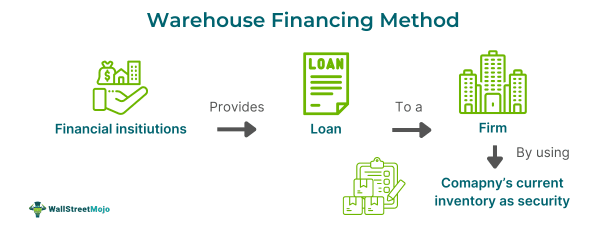

- Warehouse financing is a loan issued by a financial institution to a firm or wholesaler, using the company's existing inventory as collateral.

- It often finds applications in industries such as agriculture, retail, and manufacturing, which necessitate the maintenance of substantial inventory volumes.

- For lenders, it represents a relatively low-risk financing option as the inventory serves as collateral.

- Simultaneously, borrowers benefit from its flexibility, enabling them to access funds based on their inventory's value, aligning financing with their specific needs.

Warehouse Financing Explained

Warehouse financing is a loan made by a financial institution to a firm, wholesaler, or processor that uses the company's current inventory as security. This sort of inventory finance allows importers to retain operational efficiency by offering funding as working capital, depending on the value of the provided collateral. They are a great option, especially for importers. Importers can benefit from longer payback periods and lower interest rates than other funding alternatives, such as unsecured loans or credit lines. Importers can also use warehouse finance to keep their products secure until they are needed.

The warehouse financing facility, within commodity production or trading, involves banks offering short-term loans to agricultural commodity producers or traders. The loans are given using warehouse receipts as collateral. In securitization, securitized financing entails providing secured financing to originators of receivables through the securitization special purpose vehicle (SPV). This allows them to acquire receivables before a securitization, with repayment upon the securitization's closure, using the receivables as security.

The process involves borrowers opting to store their inventory within a warehouse, leveraging its value to secure financing from the lender. The lender, in turn, determines the financing amount based on the assessed worth of the inventory stored in the warehouse. The lender conducts periodic inspections to verify the inventory's condition and adjust the financing provided in response to any fluctuations in its value.

Process Steps

Individuals seeking warehouse financing facility should follow these steps:

- Research: Familiarize themselves with the requirements, warehouse financing structure, eligibility criteria, and terms associated with it.

- Prepare Documents: Gather necessary paperwork such as business registration documents, financial statements, and proof of warehouse ownership or lease.

- Complete Application: Fill out the Business Loan application form provided by the financial institution, ensuring all required information is accurately provided.

- Submit Application: Send the completed form along with the required documents to the financial institution.

- Review and Approval: The financial institution will assess the application, creditworthiness, and feasibility of the loan according to its warehouse financing structure.

- Loan Offer and Acceptance: If approved, review the loan offer provided by the financial institution and accept the terms if satisfactory.

- Loan Disbursement: The financial institution will transfer the funds to the applicant's account promptly upon acceptance of the loan offer.

The general process involved entails several steps:

- The borrower, who is required to maintain a substantial inventory of goods, stores them in a warehouse.

- Subsequently, a lender, typically a finance company like trade finance or a bank, evaluates the inventory's value and extends a loan offer to the borrower.

- The borrower continues to store their items in the warehouse and utilizes the loan to finance their inventory.

- The lender periodically evaluates the condition of the inventory to adjust the financing based on any changes in its value.

- Throughout the duration, the borrower is responsible for paying the loan's interest until they distribute the imported stock.

Examples

Let's look at a few examples to understand the concept better:

Example #1

Let's consider a hypothetical example involving XYZ, a clothing company. With the upcoming holiday season approaching, XYZ needs additional funds to manage its inventory effectively. With this financing solution, XYZ obtains the necessary funds from a lender based on the assessed value of its seasonal merchandise.

Warehouse financing securitization here is the merchandise. Subsequently, XYZ utilizes these funds to purchase inventory, stock its warehouse, and fulfill customer orders during the bustling holiday period. As XYZ successfully sells its merchandise, it systematically repays the loan, ensuring a seamless flow of inventory and meeting customer demand throughout the festive season.

Example #2

A working paper on the use of warehouse receipt finance in the field of agriculture in transition countries was presented at the World Grain Forum 2009.

This study explores the potential of warehouse receipt finance in Eastern Europe and Central Asia (ECA) for agricultural sectors. Warehouse financing securitization enables stakeholders to secure loans using stored goods as collateral. It mainly benefits rural small and medium enterprises needing more conventional loan collateral. While offering opportunities for increased finance and better returns, there are associated transaction costs. The study lists Bulgaria as a very successful attempt at financing. Bulgaria's warehouse receipt system highlights the effectiveness of incorporating all essential components for a thriving program.

Benefits

Given below are some of the benefits attained by both borrowers and lenders

Benefits to Lenders:

- Collateralized Security: Lenders derive a significant advantage from warehouse financing, which involves the borrower pledging collateral in the form of goods or inventories. This collateral assures the lender, reducing their risk exposure. In the event that the borrower is unable to repay, the lender has the right to seize and liquidate the inventory to recover the outstanding debt.

- Efficient Debt Recovery: In the unfortunate event of borrower default, lenders can swiftly take possession of the inventory and sell it to recoup the debt. This streamlined process eliminates the need for prolonged legal battles associated with unsecured loans. Consequently, lenders can recover their funds promptly and with minimal hassle.

- Cost-Effectiveness: Warehouse financing is often a more economical option for lenders. With the presence of collateral, lenders face reduced risk levels, which can translate into lower interest rates and fees compared to unsecured loans or other lending avenues. This cost-effectiveness enhances the profitability of lenders' loan portfolios.

Benefits to Borrowers:

- Favorable Loan Terms: Warehouse financing offers borrowers more favorable loan terms compared to unsecured loans or short-term working capital options. The provision of collateral instills confidence in lenders, leading to lower interest rates, extended repayment periods, and flexible terms. This enables borrowers to access funds at a lower cost and structure repayment plans that align with their inventory utilization.

- Aligned Repayment: Borrowers can synchronize their repayment schedule with the utilization of their inventory or materials. As they sell their goods or deplete inventory in production, they generate cash flow that can be utilized for loan repayment. This flexibility enables borrowers to optimize their cash flow and effectively manage their working capital requirements.

- Cost Savings: Warehouse financing presents a cost-saving opportunity for borrowers. The interest rates and the associated fees with secured lending are generally lower compared to unsecured loans or alternative financing options. By accessing funds at a reduced cost, borrowers can minimize their overall borrowing expenses, thereby improving their financial well-being and profitability.

- Credit Enhancement and Future Borrowing Potential: Successful repayment of a secured loan like warehouse financing can improve a borrower's credit score. Responsible repayment behavior enhances the borrower's creditworthiness, enabling them to secure larger loans, negotiate better terms, and access more favorable financing options in the future.

Warehouse Financing vs Warehouse Lending

| Parameters | Warehouse Financing | Warehouse Lending |

|---|---|---|

| 1. Concept | Warehouse finance is a type of financing in which a lender lends money to a borrower in exchange for the borrower's inventory. | Warehouse lending is a financing strategy commonly employed by banks or other financial institutions to offer capital to mortgage lenders. Here, The lender utilizes the warehouse line of credit to finance mortgage loans they've originated but haven't yet sold to investors. Upon selling the loans, the lender repays the warehouse line of credit using the proceeds from the sale. |

| 2. Financing Option | Short-term financing | Long-term financing |

| 3. Borrower | Businesses with an inventory of goods are the borrowers. | Mortgage lenders or financial institutions are the borrowers. |

| 4. Collateral | Inventory of goods stored in a warehouse is used as collateral. | Mortgage loans originated but have yet to be sold. |

| 5. Repayment | Repayment when inventory is sold. | Repayment when mortgage loans are sold to investors. |