There are many aspects in which these differ from each other, as shown in the table:

Table of Contents

What Is Warrant Bond?

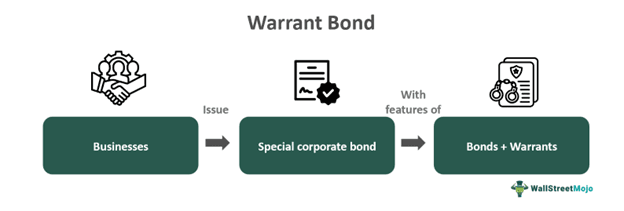

A warrant bond refers to a particular category of corporate bond that is sold together with an entitlement to the holder or warrant to purchase shares of the bond-issuing corporation at a pre-decided price. It incentivizes investors to purchase bonds of corporations delivering below-average returns.

The bond and warrant may be exercised or traded separately. It pays interest on the bond principal at a predetermined rate as coupon payments or gives investors an avenue to earn gains on the price discrepancy between the face value and purchase price. Bondholders have contractual power to exercise their warrant to buy shares at their discretion.

Key Takeaways

- A warrant bond is a type of corporate bond that is offered together with the right or warrant to acquire shares of the bond-issuing firm at a predetermined price.

- It encourages investors to buy bonds from firms that provide below-average returns.

- It has many types, including traditional, detachable, non-detachable, naked, callable, and puttable.

- It can be traded separately as securities and used for cash, whereas a convertible bond can be transformed into a fixed number of shares of common stocks of the bond issuer.

Warrant Bond Explained

A warrant bond definition is stated as a particular type of security issued by businesses to raise capital, having the feature of both bonds and warrants. Basically, they act as a call option onto the issuer's common shares that can be exercised for stock or cash. They help investors with the option of gaining profits when the stock price of the bond issuer increases. It also offers a unique right to the holder to purchase a particular number of common stocks at a fixed or exercised price valid for a particular duration.

Investors obtain a fixed-income facility from the bond, and the warrant gives them a chance to leverage capital gains when the stock price rises. It has two parts – bond and warrant using which it works. A bond works like a debt security paying a set interest rate, whereas a warrant acts as an option, giving the holder the encash of the predetermined number of common shares at a prefixed price. Moreover, the bond offers a steady income source, while the warrant element provides the ability to benefit from capital gains during rising stock prices.

Bond issuers, it becomes convenient to raise capital from the market without diluting the shareholders. This is because new shares issued come at an exercise price instead of the current market price. Investors, both institutional and individual, use it widely because of the amalgamation of potential capital gain and source of income. Additionally, it can be freely traded on stock exchanges, converting it into a liquid investment option.

Types

For diversification of their portfolio, investors must understand the types of warrant bonds as shown below:

Traditional or detachable warrants have the trait where warrants could be separated underlying bonds to trade separately. Hence, traders can trade warrants autonomously and significantly obtain extra returns when the stock price increases.

Nondetachable warrants have no option to separate the warrant from the bond, offering more stability and security to investments. It is preferred by non-risk-taking investors, who prefer certainty in investment strategy as it provides a fixed source of income.

Naked warrants have their warrants un-detachable from their derived bonds that are issued as part of bond issuance without being tradable separately.

Callable warrants have the feature of bond redemption before reaching the maturity date. On meeting certain conditions, these bonds can be called back by the issuer with a specific set price.

Puttable warrant gives the power to the buyer to sell their bonds back to the issuer before their maturity. It acts as a strategic exit point for investors if certain adverse conditions are fulfilled or occur. As a result of this put option exercise, investors get an additional layer of cash and down-flip safety.

Examples

Let us use a few examples to understand the topic.

Example #1

Let us assume Old York Corporation issued a warrant bond with:

Face value= $500 each.

Coupon rate = 10% payable annually.

Maturity tenure = 5 yrs.

Detachable warrants 2, which allows the holders to buy one stock of Old York Corporation conventional shares at $100 per share during the next four years.

Now, an investor, Noah, buys ten warrant bonds of the old York corporation, then they would get an annual coupon payment

= $500*10%*10= $500

Moreover, Noah would also get to commit 20 warrants to buy 20 extra shares of the corporation at $100 per share.

Consequently, if the share price of the corporation goes beyond $100, then the investor could buy these at a predetermined price of $100, only leveraging on the price increase of the share of the old York corporation.

Example #2

An article published on April 28, 2023, discussed the repayment of euros 750 million to the economic stabilization fund of the German state by Tui. The repayment comprised the settlement of silent participation and a warrant bond as per the contract made with the German government. Tui has also paid a sum of approximately euros 381 million towards conversion rights compensation, coupons, and interest. Currently, Tui AG had its trading price lowest on October 25, 2023, at 401.0 GBX, to an all-time high at 812.5 GBX on May 21, 2018, per the below TradingViewchart:

CEO of the company also showcased the significance of the said repayment by Tui in its strengthening and concentrating on its profitable growth. Moreover, the successful capital increase allowed Tui to repay its financial obligations. Further, the event has become a milestone in its journey to financial autonomy.

Warrant Bond Vs. Convertible Bond

| Meaning | Warrant Bond | Convertible Bond |

|---|---|---|

| 1. Structure | Consists of a bond and a warrant; the warrant provides the right to purchase the issuer's shares at a predetermined price. | A single security that can be converted into a predetermined number of the issuer's shares. |

| 2. Components | Two distinct components (bond and warrant) which can often be separated and traded independently. | A hybrid security that combines debt and equity features, but is inseparable. |

| 3. Exercise/Conversion | The warrant can be exercised at the holder's discretion within a specified period to purchase shares. | The bond can be converted into shares at the holder's discretion, usually at a specified conversion rate and within a set period. |

| 4. Income | Provides fixed interest payments (coupon payments) from the bond. | Provides fixed interest payments (coupon payments) until conversion. |

| 5. Capital Gain Potential | Investors can benefit from potential stock price increases by exercising the warrant. | Investors can benefit from potential stock price increases by converting the bond into shares. |

| 6. Dilution | No immediate dilution for existing shareholders; new shares are only issued if the warrant is exercised. | Conversion results in the issuance of new shares, potentially diluting existing shareholders. |

| 7. Risk | Investors retain the bond even if the warrant is not exercised, maintaining some level of income. | If the stock price does not rise above the conversion price, the bond may not be converted, and the investor retains the bond. |