Table Of Contents

Top 3 Examples of Adjusting Entries

Below are the examples of Adjusting Journal Entries.

Adjusting Entries Example #1 - Accrued but Unpaid Expenses

Mr. Jeff, an owner of a small furniture manufacturing company named Azon, offers A-Z varieties of furniture. Azon ends its accounting year on June 30. The company took a loan of $100,000 for one year from its bank on May 1, 2018, @ 10% PA, for which interest payments have to be made at the end of every quarter.

The company's accountant needs to take care of this adjusting transaction before closing the accounting records for 2018.

Given:

- Loan Amount: $100,000

- Interest amount @10 PA: $10,000

- Monthly Interest Payable: $833.33

- 2 months interest payable: 1667

- First interest payment due date: 31-Jul-18

- Accounting year end date: 31-Jun-18

As per accrual principal company needs to record all the incurred expenses, whether paid or not. The incurred expense will adjust the income statement and the balance sheet. The company incurred interest expenses from 1/5/2018 to 30/6/2018, i.e., for two months, and the remaining un-incurred and unpaid interest expenses will adjust in the next accounting period.

The accrued interest payable account will increase the company's liability because interest expense was incurred but remain unpaid, and an equal amount will increase the expenses of the income statement.

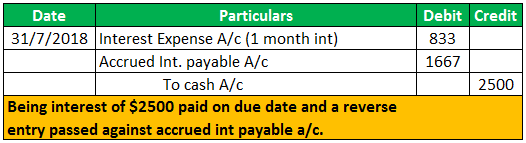

Note: After the payment made on 31/7/2018, i.e., at the due date, a reverse entry passed to write off the liability account as follows:-

Adjusting Entries Example #2 - Prepaid Expenses

Mr. Jeff, an owner of Azon, wants to ensure the company's inventory (or stock). On June 1, 2018, he purchased an insurance policy for a premium of $ 3000 for six months.

The accountant records the transaction of $3000 on 1/6/2018. The accounts need to be closed on 30/6/2018.

The entry for insurance reflects six months' expenses, which have been paid, but coverage of only one month could have been used by June end.

As per the accrual principle, only 1-month expenses can be adjusted against the income statement, and the remaining paid balance will increase the balance sheet's assets as prepaid insurance. The journal entry will be:-

Adjusting Entries Example #3

Jack owns a fast-growing retail store chain in China named Baba, headquartered in Hong Kong. Being in the business for more than two decades, it has started making its presence nationwide and has made a good reputation amongst its major customer base.

Baba follows the same pattern as many commonwealth nations and closes its accounting year on 31st March.

The accountant of Baba records journal entry daily and post them to ledger accounts Baba's accountant records journal entries daily and periodically posts them to ledger accounts. He prepares the unadjusted trial balance for the year ending 31/3/20** as follows:-

The accountant of the company needs to take care of the following adjusting entries before closing its accounting records:-

Adjusting Entries are:-

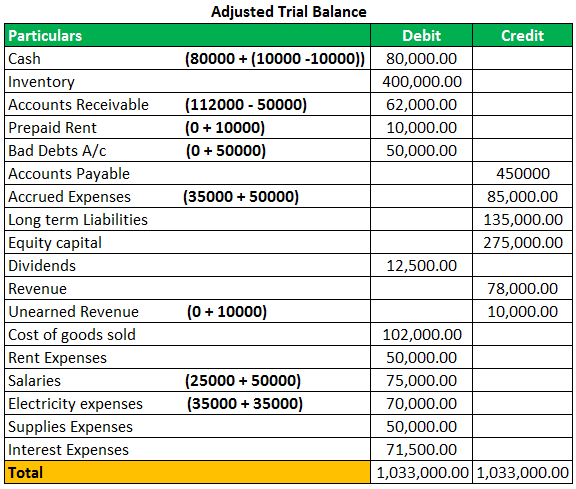

The adjusted trial balance for the year ending 31/3/20** is as follows:-

Conclusion

A business needs to record the true and fair values of its expenses, revenues, assets, and liabilities. Adjusting entries follows the accrual principle of accounting and makes necessary adjustments that are not recorded during the previous accounting year. The adjusting journal entry generally takes place on the last day of the accounting year and majorly adjusts revenues and expenses.

Adjusting Entries are made after trial balances but before preparing annual financial statements. Thus these entries are very important for the representation of the accurate financial health of the company.

Recommended Articles

This article has been a guide to Adjusting Entries Examples. Here we discuss the definition and top 3 examples of Adjusting Journal Entries. You can learn more about accounting from the following articles –