The Best USA CRM Software For Financial Advisors in 2025

Table of Contents

Introduction

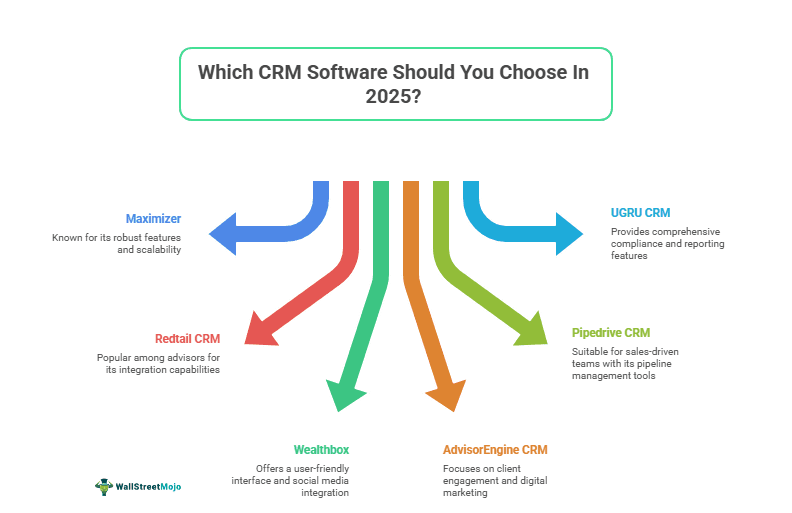

One of the most significant technology choices an advisory firm will face is selecting the correct CRM - it influences client acquisition, the level of compliance, the processes of collaboration, and the way you grow. In 2025, U.S. financial advisors are likely to use six CRM and advisor-tech platforms: we review them below:

1. Maximizer

Maximizer is a 25-year-old CRM vendor business that sells industry-tailored versions including financial services. The product targets contact and pipeline management which is configurable and has secure document storage and characteristics aimed at ensuring that advisory firms are audit ready.

Pros

- Purpose-built modules and templates for financial services firms.

- Solid built-in workflow automation and task management.

- On-prem and cloud deployment options (useful for firms with strict data requirements).

- Advanced analytics and reporting for sales performance, client interactions, and business trends

- Secure, encrypted document storage with built-in compliance features

- Customizable dashboards and workflows to match firm-specific processes

Cons

- Interface and user experience can feel dated compared with newer, modern CRMs.

- Pricing and storage tiers (per-user storage limits) may become a constraint for data-heavy teams.

Unique Features

Provides an extremely flexible platform that can be customized to the needs of financial advisors, including customizable dashboards, business workflows, and fields that fit particular advisory workflows. Its powerful compliance solutions, such as storage of documents in a safe place and audit capabilities, make sure that the firms are able to comply with the regulations effectively.

Verdict

Ideal for mid-sized companies seeking a stable, specialist CRM that has an adjustable compliance feature and may be configured with alternative deployment models. Should you be overly concerned with the current UX and extensive integrations with the current advisor stacks, you may want to consider a newer cloud-first CRM.

2. Redtail CRM

Redtail is widely recognized as a purpose-built CRM for financial professionals (RIAs, broker-dealers, insurance agencies). It emphasizes contact management, workflows, calendar integration, and compliance tracking — and it has long been a default choice for advisors wanting a financial-industry focused CRM.

Pros

- Built specifically for financial services — many advisors find onboarding straightforward.

- Strong ecosystem of integrations (custodians, planning tools, document imaging).

- Good balance of features vs. price for small-to-mid advisory teams.

Cons

- UI and modern collaboration features lag behind some “newer” CRMs that emphasize social/modern UX.

- Some firms report needing add-ons or third-party tools for advanced automation or client portals.

Unique Features

Provides a cloud-based CRM designed specifically for financial professionals, offering tools for contact management, workflow automation, and calendar integration. Its seamless integration with over 100 financial tools and platforms enhances its utility for advisory teams seeking a comprehensive solution.

Verdict

If you want a reliable, industry-standard CRM with a mature integration ecosystem and a proven track record, Redtail remains one of the safest, most practical choices in 2025 — especially for small to mid-sized advisory practices.

3. VCITA

vcita provides an all-in-one solution to manage clients that integrates customer relationship management, scheduling, online payments, and communication among other features, now also featuring AI capabilities aimed at minimizing administrative work and ensuring that teams progress from an engagement to an action without delays.

Pros

- All-in-one workflow: CRM + scheduling + client communications + payments/invoicing.

- AI assistance in completing mundane activities such as writing responses and performing administrative tasks.

- Client-facing experience (portal, confirmations, and reminders) that improves responsiveness and reduces back-and-forth.

- Automation for repetitive business activities (follow-ups, reminders, task nudges, and administrative activities).

- Mobile friendly to easily manage the activity of your clients while on the move.

Cons

- Practices that involve a lot of compliance work may need third-party archiving/supervision software

- Big organizations with intricate management structures may require enterprise CRM systems that have comprehensive role/permission structures.

Unique Features

AI-assisted front-office solution that integrates CRM, scheduling, payments, and communication, with the added benefit of AI assistance in helping advisors convert routine conversations with clients into quick follow-ups. This is particularly helpful for advisors who would like to provide their clients a seamless experience, right from scheduling a meeting to having a follow-up, without having to perform mundane admin tasks.

Verdict

Best used by solo advisors or small to mid-sized advisory firms where the primary goal is operational efficiency and strong connection with clients. In a situation where relationship management, being nimble and light on admin work with the assistance of AI in speeding along mundane processes is the aim, vcita is a viable alternative to a full-fledged CRM designed exclusively for advisors.

4. Wealthbox

Wealthbox positions itself as a progressive, straightforward, collaborative CRM created with financial advisors in mind. It puts emphasis on an intuitive user interface, activity streams, two-way emails sync and lightweight automation to minimize training friction. Wealthbox often sells itself as being easy to use and well-designed.

Pros

- Modern, clean user interface that many teams adopt quickly.

- Useful collaboration features (activity streams, task flows) and strong two-way email sync.

- Fast implementation and low training overhead.

Cons

- May lack some enterprise-level depth (advanced compliance or very large-team permissioning) compared with full advisory platforms.

- Firms that need highly customized workflows or deep portfolio integrations might need complementary tools.

Unique Features

Provides a contemporary and convenient CRM experience with such functionality as streams of activities, bi-directional email synchronization and automated process. Its group working tools and easy to use interface make it useful to teams in need of simplifying the client management process and improving internal communication.

Verdict

Best suited to small to mid sized advisory firms and teams that are fast moving and value ease of use and quick adoption. Wealthbox is a good choice when UX is important, and you desire a CRM, which would be used by the team on a daily basis.

5. AdvisorEngine CRM

AdvisorEngine CRM is a complex system that targets financial advisors. It provides a set of products to support customer relationships, promote workflow, and business expansion. The platform combines client management, financial planning, and reporting into one platform.

Pros

- Financial advisors-specific, with industry-specific characteristics.

- Well-developed workflow automation to facilitate daily work.

- Powerful data-driven decision-making reporting and analytics.

- Direct connection with other financial applications and platforms.

Cons

- Pricing can be expensive relative to other rivals and this may be a factor to the smaller companies.

- New users will be faced with a learning curve, since the feature set is comprehensive.

Unique Features

CRM features an integrated client portal and financial planning applications, which provide workflow automation and advanced analytics to allow advisors to handle client management and wealth management activities in one platform.

Verdict

AdvisorEngine CRM is a good option when companies require a one-stop solution which will allow their firms to be exposed to both CRM and financial planning and compliance features. Its powerful feature set and industry-specific tools make it a powerful candidate in case of financial advisors who would like to make operations more efficient and improve relationships with clients.

6. Pipedrive CRM

Pipedrive is a CRM that is sales specific and has an easy to use interface and pipeline management. Although it is not specifically made to suit financial advisors, it can be customized to suit the financial services industry.

Pros

- Drag and drop user-friendly interface.

- Good pipeline management and tracking of deals.

- Massive integration features of more than 500 apps, including the ability to connect with Pipedrive via tools like Surfe for enhanced LinkedIn prospecting.

- Lower-cost pricing ranges of small and medium companies.

Cons

- The financial planning tools that Lacks developed industry-specific.

- To satisfy the requirements of financial advisors completely, May has to do more integrations.

- Poor conformity and control capabilities to industry specific CRM.

Unique Features

Focused on visual sales pipeline management, where advisors can monitor deals, automate repetitive work, and utilize vast amounts of applications to streamline the workflow efficiency.

Verdict

Pipedrive can be recommended to the financial advisor who pays more attention to the management of sales pipes and automation. Although it might not provide industry specific tools directly, its customization capabilities and integrations enable it to be taken to fit those of financial services companies.

7. UGRU CRM

UGRU is a CRM solution that is all-in-one and specific to financial advisors. It integrates customer management, finance planning, accounting and marketing automation in one platform.

Pros

- Extensive feature base that is inclusive of CRM, financial planning, accounting and marketing.

- Free trial and affordable prices.

- Specifically designed to serve the financial advisory business.

- Easy to operate interface with small to medium-sized companies.

Cons

- May does not have certain advanced functions as bigger and more established platforms.

- Less users can lead to less community resources and integrations.

- Very large firms cannot be scaled.

Unique Features

All-in-one solution through the combination of CRM, financial planning, accounting, and marketing automation, which allows small to medium advisory firms to control customer relationships, operations, and business expansion using one platform.

Verdict

UGRU would be a good option to financial advisors who need an all-in-one CRM at a low cost. The multitude of features and industry-specific tools provide it with a powerful competitor within the markets of small to medium-sized companies that have to optimize their operations and improve customer relationships.

8. HubSpot CRM

HubSpot CRM is a small business-friendly solution that stands out through its flexibility and ease of use. The platform unifies customer data from sales, marketing, and service departments to help companies develop a customer-centric approach. Financial advisors can use the platform to generate and nurture leads, as well as store and manage client data.

Pros

- A massive integration library (with accounting apps) for extra flexibility.

- Free forever and affordable entry-level paid packages included.

- Advanced sales and marketing automation tools.

- Little to no learning curve.

Cons

- Large pricing differences between higher-tier plans can hinder scalability.

- Not an industry-specific solution.

Unique Features

HubSpot’s prospecting tools are particularly advanced. The platform automatically collects lead information from publicly available resources from across the web (company news, funding rounds, etc.) and uses these details to craft personalized outreach emails at scale.

Verdict

HubSpot CRM is a good option for small financial advisory companies. The platform’s free forever is perfect for small-scale sales and marketing activities. Plus, its integration library does help expand the CRM’s functionality to your particular needs.

Quick Recommendations

- Maximizer: Best overall for firms that want a CRM built for financial advisors, with compliance, flexibility, and scalability.

- AdvisorEngine: Ideal for firms seeking an integrated wealth management platform with CRM capabilities.

- Redtail: Reliable and trusted; great for small-mid firms with standard advisor workflows.

- Wealthbox: Modern, easy, and intuitive; ideal for teams that prioritize UX.

- Pipedrive: Suitable for firms seeking a visual, sales-focused CRM with strong pipeline management.

- UGRU: Best for firms desiring an all-in-one CRM with integrated financial planning and accounting.

Overall Recommendation

While all six platforms provide valuable functionality, Maximizer stands out as the most balanced choice for advisory firms in 2025. Its financial-industry focus, compliance-ready features, flexible deployment, and scalability make it the best CRM software for growing practices.

Ultimately, your choice should align with your firm’s size, workflow, and priorities — but for most advisory practices, Maximizer offers the best combination of compliance, flexibility, and scalability.