Table Of Contents

What Is Middle Office?

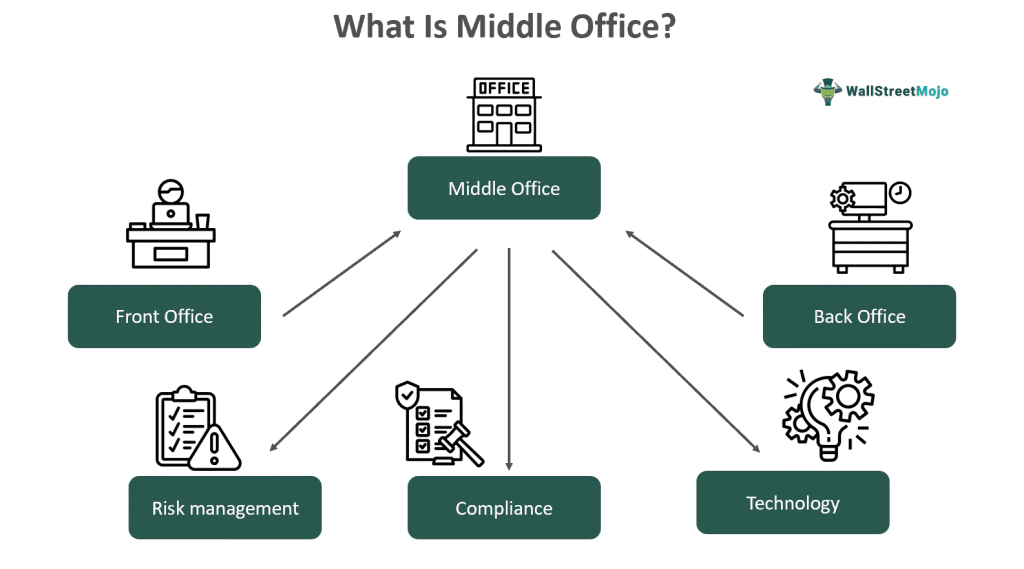

Middle Office refers to the operational and support divisions of a financial services firm that is in charge of duties, including risk management, compliance, and technology. The primary purpose of this office is to support and oversee front-office operations and ensure the company complies with legal and regulatory obligations.

It aids in identifying, evaluating, and managing financial risks, ensuring that the business functions within its risk tolerances. In addition, it provides the technical framework and assistance essential for front-office operations to run smoothly. It is also responsible for overseeing its capital investments and other financial issues; it also handles the organization's losses and gains.

Key Takeaways

- The middle office refers to a financial services firm's operational and support divisions that are in charge of duties such as risk management, compliance, and technology.

- It assists in identifying, evaluating, and managing financial risks, ensuring that the company operates within its risk tolerances.

- Furthermore, it provides the technical framework and support required for front-office operations to run smoothly.

- The back office handles administrative and support tasks like settlements, record-keeping, and compliance, whereas the middle office handles support and value-added services for the front and back offices.

Middle Office Explained

The middle office serves as a link between the front office and the back office of a financial services organization. It ensures that the firm adheres to regulatory standards and appropriately manages risk while providing assistance and control for front-office activities like sales and trading. An institution is divided into three offices, namely, the front office, the middle office, and the back office.

The front office deals with clients directly and makes money by selling them financial products and services. The back office handles operational duties such as processing transactions, concluding deals, and keeping track of client accounts. Meanwhile, the middle office is responsible for customer onboarding, supply chain management, product and service fulfillment, deal confirmation, etc.

With changes in time and technology, the banking sector is also changing. Thus, automation makes tasks like trading and risk management more effortless. This results in higher output, lower costs, and the requirement for banks and staff to adjust. This is the main reason why the middle office is depleting.

However, to save money and obtain specialized knowledge, businesses that keep the middle office division are outsourcing a portion of their operations to private organizations. Some businesses are outsourcing parts of their middle office operations to nations with highly educated and competent labor but at significantly lower pay scales.

Roles & Responsibilities

The middle office functions as an essential function of an organization. The following are the roles and responsibilities:

- Monitoring and managing risk: Risk management includes identifying and evaluating financial risks, establishing risk exposure limits, keeping track of those risks, and creating risk management plans.

- Executing compliance: Compliance includes designing and putting compliance policies and processes into practice and conducting audits and reviews to ensure the business abides by all applicable laws and regulations.

- Measuring performance: It includes providing the infrastructure required for front-office operations, such as trading, risk, and customer relationship management systems.

- Technology support: This division encourages usage of modern technologies to simplify workflows and cut expenses by automating manual tasks, enhancing data management, and utilizing technology.

- Communication: Planning for business continuity involves creating and putting into action strategies to ensure the company can keep running in the case of unanticipated disruptions like power outages, natural catastrophes, or cyberattacks.

Examples

Let us look at some examples to understand the concept better:

Example #1

Suppose a financial services firm has a front office responsible for sales and trading. The front office interacts directly with clients, offering various financial products and services.

To support these front-office activities, the middle office performs several critical functions. For example, it may use risk management tools to monitor the risks associated with the financial products and services offered. Suppose the level of the risk exceeds the firm's risk tolerance. In that case, it may take actions to mitigate the risk, such as by reducing exposure or implementing new risk management strategies.

Finally, the middle office works closely with the back office, which performs administrative tasks such as processing transactions, settling trades, and maintaining customer accounts. It helps to ensure that the back office processes are streamlined, efficient, and in compliance with regulatory requirements.

Example #2

Consider a financial technology (fintech) company that offers financial institution risk management software. The middle office assists its clients in making informed risk management decisions. This business gathers and analyzes data from both the front office (client-facing operations like sales and trading) and the back office (administrative tasks like settlements and record-keeping). The fintech company links the front and back offices by offering helpful information and instruments for efficient risk management.

Example #3

To gain a competitive edge in an expanding market, J.P. Morgan introduced its Middle Office Investment services that focus on an extensive, scalable operating model. As Asset managers attempt to rebuild their middle office operations for investments. According to 73% of asset managers, the need to find scalable and efficient solutions is primarily driven by rising operational costs, with global assets under management expected to reach $145 trillion by 2025. Though it is not without difficulties, middle office transformation is seen as a critical differentiator against industry-wide operating margin compression, declining fees, growing costs, and resource limitations.

The transformation of middle offices presents asset managers with five common challenges: a heightened regulatory environment, multiple aging systems, complex asset classes, and staff demands. Due to these challenges, a costly and ineffective model causes investment data to be fragmented and inconsistent. Thus, to address these issues, J.P. Morgan offers asset managers to implement the best platform option with a logical service model and improved front-office technology.

Middle Office vs Back Office

The differences between the middle and the back office are as follows:

| Middle Office | Back Office |

|---|---|

| It refers to the support and value-added services provided to the front and back offices. | It refers to administrative and support tasks, such as settlements, record-keeping, and compliance. |

| It links the front and back offices, ensuring all activities are coordinated and risks appropriately controlled. | Back office functions are crucial to run the organization but are not directly involved with client-facing activities. |

| Functions of this office include risk management, compliance, treasury, and product control. | It is responsible for administrative functions, IT, and operational settlements. |