Table of Contents

What is Cash Flow Coverage Ratio (CFCR)?

The cash flow coverage ratio determines the credit risk of a company or business by comparing its OCF (Operating Cash Flow) and total outstanding debt. It signifies the business’s ability to meet debt obligations using its operating cash flow. Therefore, the higher the CFCR, the lesser the credit risk and vice versa.

Investors and other internal and external stakeholders use the cash flow coverage ratio calculator to gauge the company's financial strength. Moreover, even lenders look at this ratio to assess a loan application and decide if the company can repay the loan. While the exact CFCR may differ based on industry, a general benchmark is 1.5.

Key Takeaways

- The cash flow coverage ratio is a metric that represents a company's ability to meet its debt obligations entirely through its operating cash flow.

- Lenders keep a close eye on the CFCR as it shows if the company can repay a loan efficiently or not.

- Moreover, even investors look at the figure to ensure the business or company is financially stable and can sustain itself in the long run.

- A higher CFCR indicates financial stability and shows that the company is efficiently utilizing its resources. A low CFCR indicates a need to improve cash flows or reduce outstanding debt.

Cash Flow Coverage Ratio Explained

The cash flow coverage ratio is a metric that signifies a company's liquidity by comparing the operating cash flow and its overall debt obligation. Simply put, it reflects how a business or company uses cash flow from its operating activities to cover its outstanding debt obligation.

It is a critical metric as investors and other stakeholders gauge the company's financial health based on the efficiency shown by this metric. Moreover, even lenders look at the number to understand if they can approve the loan and if the company has the resources to repay them without facing any hurdles.

Cash flow coverage ratio measures are also an efficient way for internal decisions. For instance, a company decides to expand its operations and has to spend on installing a new plant or purchasing land. Meeting these financial obligations will be easier if they have a high ratio.

While different benchmarks across industries determine a “good” CFCR, a score of 1.5 or higher generally indicates that the business has a significantly efficient financial system to tackle its debt obligations.

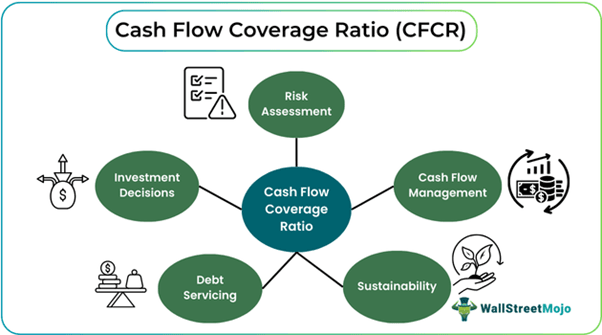

Since cash flow is the lifeblood of any organization, CFCR can be viewed as a means to streamline financial operations, optimize cash flow management, and mitigate risks internal and external to the organization.

Formula

The formula that makes cash flow coverage ratio interpretation and calculation possible is:

Cash Flow Coverage Ratio (CFCR) = Operating Cash Flow / Total Debt

Examples

Now that the theoretical aspects of the concept are well-established, it is time to explore the practical applicability through the examples below.

Example #1

XYZ & Sons has a duct tape manufacturing business and wanted to expand their product line to produce glues. Therefore, the stakeholders and management figured securing a loan would be the best way to expand.

The bank requested XYZ’s management to submit a CFCR figure. The management reviewed the financial statements and found an operating cash flow of $500,000. However, they also owe $75,000 as bills receivables and $25,000 as part of a long-term loan. Therefore, their CFCR figure is:

CFCR = Operating Cash Flow / Total Debt

- = 175,000 / 100,000

- = 1.75

The bank approved the loan since the CFCR score exceeded satisfactory limits, and XYZ entered the new segment.

Example #2

Westlake Chemical Partners LP declared their 2024 results for the third quarter and declared a dividend of $0.471 per unit. For the third quarter of 2024, the company’s cash flow from operating activities added to $126.1 million compared to the $100.9 million in the previous quarter.

For the same period, the company's total liabilities were $456,881. Since the company’s total liabilities, including debt, were well below the cash flow they were able to generate through operating activities, it is natural that its financial utilization was top-notch, and it was able to declare dividends.

Importance

The importance of cash flow coverage ratio measures is beyond just internal reference. It has significance for entities external to the company. Below are a few points that reiterate its importance.

- It is invaluable in assessing a company's financial health by representing how the existing debt is handled through core business activities.

- A good CFCR helps companies secure loans more easily as lenders look at the ratio to gauge if the company can repay the loan through the cash flow generated through its core activities.

- Investors also look at this metric to check if the investment is safe, as businesses with high CFCR indicate a relatively low-risk investment.

- The financial risk and the risk of damaging reputation are extremely low as they are most likely to fulfill all their financial obligations easily.

- Apart from assisting with identifying current financial standing, the ratio also aids with devising strategy and a plan for a longer time frame.

Cash Flow Coverage Ratio Vs. Debt Service Coverage Ratio

The distinctions between cash flow coverage ratio interpretation and debt service coverage ratio are discussed below.

Cash Flow Coverage Ratio

- It measures a company’s capability to acknowledge its debt and other financial obligations through the operating cash flows, excluding financing activities.

- The evaluation of liquidity is done through gauging if the company can churn out enough cash flow from its operations to meet its debt obligations.

- A higher CFCR indicates robust liquidity and reduced financial risk for investors.

- Lenders also look at the ratio before a loan is sanctioned to check if the company can repay the loan.

Debt Servicing Coverage Ratio

- It indicates how efficiently a company can service its debts, including principal and interest, through its operating income.

- It is an assessment of the company’s creditworthiness by placing impetus on the company’s debt repayment obligation.

- Ideally, DSCR must be above one. It indicates that the company’s income is higher than its debt commitments.

- A higher DSCR indicates strong financial health and stability.