Table Of Contents

What is Capital Adequacy Ratio?

The capital adequacy ratio is a measure to determine the proportion of a bank's capital concerning the bank's total risk-weighted assets. The credit risk attached to the assets depends on the bank's entity lending loans. For example, the risk attached to a loan it is lending to the government is 0%, but the amount of loan lent to individuals is very high in percentage.

A very high ratio can indicate that the bank is not utilizing its capital optimally by lending to its customers. Regulators worldwide have introduced Basel 3, which requires them to maintain higher capital concerning the risk in the company's books to protect the financial systems from another major crisis.

Table of contents

- The capital adequacy ratio determines financial institutions' economic capability or ability to meet obligations utilizing the assets and capital.

- One can calculate the ratio by dividing the bank's capital by risk-weighted assets.

- The ratio represents a percentage. Usually, a higher ratio indicates safety. Conversely, a low ratio means the bank does not have sufficient capital for risk concerning assets. Subsequently, it can give rise to an adverse crisis in the recession.

- It plays a critical role in determining banks' globally post-subprime dilemma.

Capital Adequacy Ratio Explained

The capital adequacy ratio helps measure financial institutions' financial strength or ability to meet their obligations using their assets and capital. One can calculate it by dividing the bank’s capital by its risk-weighted assets.

The ratio represents the form of a percentage. Generally, a higher ratio implies safety. Conversely, a low ratio indicates that the bank does not have enough capital for the risk associated with its assets. As a result, it can bust any adverse crisis during the recession.

A high capital adequacy ratio percentage indicates good financial health of a bank. As in, in the event of an unexpected loss or a huge default in payment from a borrower, the bank would still be able to deal with those losses in a more efficient manner than a bank with a low percentage of the same.

Regulators often set minimum capital requirements for banks to ensure policyholders’ or depositors’ money is safeguarded. In fact, banks constantly make efforts towards increasing the ratio to absorb or deal with losses if at all they arrive. The minimum ratio that has to be maintained by banks in The United States of America is 8%.

Formula

Let us understand the capital adequacy ratio analysis by understanding its formula. The discussion below gives a detailed insight into the components of the formula.

- The total capital, the numerator in the capital adequacy ratio, is the summation of the bank's tier 1 and tier 2 capital.

- The tier 1 capital, also known as the standard equity tier 1 capital, includes share capital, retained earnings, other comprehensive income, intangible assets, and other minor adjustments.

- The tier 2 capital includes revaluation reserves, subordinated debt, and related stock surpluses.

- The denominator is risk-weighted assets. Risk-weighted assets include credit risk-weighted, market risk-weighted, and operational risk-weighted assets. The ratio represents in the form of a percentage. Generally, a higher percentage implies safety for the bank.

The mathematical representation of this formula is as follows: -

Capital Adequacy Ratio Formula = (Tier 1 Capital + Tier 2 Capital) / Risk-Weighted Assets

Examples

Let us conduct the capital adequacy ratio analysis with the help of a few examples. Also, an excel template is provided below for a better understanding.

Example #1

Let us try to understand the capital adequacy ratio of an arbitrary bank to understand how to calculate the ratio for banks. We need to assume the bank's tier 1 and tier 2 capital for calculating the capital adequacy ratio. We also need to consider the risk associated with its assets; those risk-weighted assets are credit risk-weighted, market risk-weighted, and operational risk-weighted assets.

The snapshot below represents all the variables required to calculate the capital adequacy ratio.

For the calculation of the capital adequacy ratio formula, we will first calculate the total risk-weighted assets as follows: -

Total Risk-Weighted Assets = 1200+350+170 =1720

The calculation of the capital adequacy ratio formula will be as follows: -

Capital Adequacy Ratio Formula = (148+57) /1720

Therefore:

Capital Adequacy Ratio = 11.9%.

The ratio represents the capital adequacy ratio for the bank is 11.9%, which is pretty high and is optimal to cover the risk it carries in its books for its assets.

Example #2

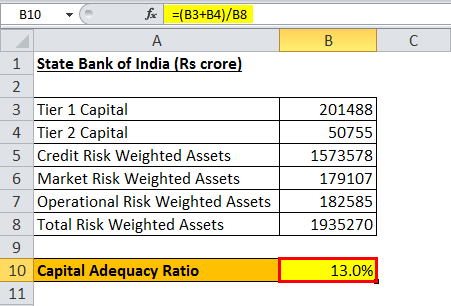

Let us understand the capital adequacy ratio for the State Bank of India. To calculate Capital Adequacy Ratio (CAR), we need the numerator, the bank's tier 1 and tier 2 capital. We also need the denominator, the risk associated with its assets; those risk-weighted assets are credit risk-weighted assets, market risk-weighted assets, and operational risk-weighted assets.

The snapshot below represents all the variables required to calculate the capital adequacy ratio formula.

For the calculation, we will first calculate the total risk-weighted assets as follows: -

The calculation of the capital adequacy ratio will be as follows: -

Capital Adequacy Ratio Formula = (201488+50755) / 1935270

Therefore:

Example #3

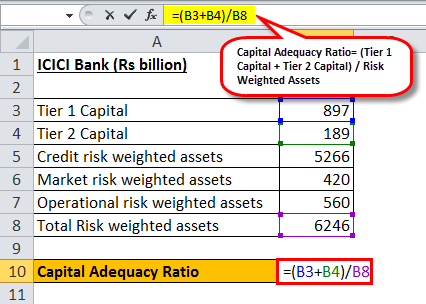

Let us try to understand the capital adequacy ratio for ICICI. First, we need the bank's tier 1 and tier 2 capital numerators to calculate the capital adequacy ratio. We also need the denominator, which is the risk-weighted assets.

The snapshot below represents all the variables required to calculate the capital adequacy ratio.

For the calculation of the capital adequacy ratio, we will first calculate the total risk-weighted assets as follows: -

Total risk-weighted assets =5266+420+560 = 6246

The calculation of the capital adequacy ratio will be as follows: -

Capital Adequacy Ratio Formula = (897+189) / 6246

Therefore:

Capital Adequacy Ratio =17.39%

The capital adequacy ratio for the bank is 17.4%, which is pretty high and is optimal to cover the risk it is carrying in its books for the assets it holds. Also, find below the snapshot for the company-reported numbers.

Relevance and Uses

The capital adequacy ratio percentage is the capital set aside by the bank that acts as a cushion for the risk associated with the bank's assets. A low ratio indicates that the bank does not have enough capital for the risk associated with its assets. Higher ratios will signal safety for the bank. It plays a very important role in analyzing banks globally post-subprime crisis.

Many banks were exposed, and their valuation plummeted as they were not maintaining the optimal amount of capital for the amount of risk they had in terms of credit, market, and operational risks in their books. Moreover, with the introduction of the Basel 3 measure, the regulators have made the requirements more stringent than earlier Basel 2 to avoid one more crisis in the future. As a result, many public sector banks have fallen short of CET 1 capital in India, and the government has been infusing these requirements over the last few years.

You can download this Excel Template from here - Capital Adequacy Ratio Formula Excel Template

Frequently Asked Questions (FAQs)

Basel III standards guarantee an 8% capital-to-risk-weighted assets ratio. As a result, Indian scheduled commercial banks are required by RBI regulations to maintain a CAR of 9%. Indian public sector banks prioritize keeping their CAR around 12%.

Banks can boost the CAR by raising the regulatory capital levels and the capital ratio numerator. In addition, they also retain the CAR by reducing the risk concerning weighted assets. Therefore, it is considered the capital ratio denominator.

A high capital adequacy ratio is good because it shows that the bank can manage unexpected losses due to adequate capital availability.

Banks are required to maintain a minimum capital adequacy ratio (CAR) as a regulatory measure to ensure their financial stability and ability to absorb potential losses. Here are the key reasons why banks are required to maintain the CAR:

a Risk mitigation

b Protecting depositors and creditors

c Enhancing confidence and stability

d Regulatory compliance

e International Standards and Basel Accords

Recommended Articles

This article is a guide to what is Capital Adequacy Ratio. We explain its formula, examples, relevance in the business world, and its uses. and an Excel sheet. You can learn more about accounting from the following articles: -