Table Of Contents

Differences between Current Ratio vs. Quick Ratio

The current ratio measures the organization's liquidity to find that the firm resources are enough to meet short-term liabilities and compares the current liabilities to the firm's current assets. In contrast, the Quick Ratio is a liquidity ratio that compares the cash and cash equivalent or quick assets to current liabilities.

Table of contents

- Differences between Current Ratio vs. Quick Ratio

- Current Ratio vs. Quick Ratio - Formula

- Current Ratio vs. Quick Ratio - Interpretation

- Current Ratio vs. Quick Ratio - Basic Example

- Colgate - Calculate Current Ratio and Quick Ratio

- Apple's Current Ratio and Quick Ratio

- Microsoft's Current Ratio and Quick Ratio

- Software Application Sector - Current Ratio vs. Quick Ratio Examples

- Steel Sector - Current Ratio vs. Quick Ratio Examples

- Tobacco Sector - Current Ratio vs. Quick Ratio Examples

- Current Ratio vs. Quick Ratio - Limitations

- In the final analysis

Explained

As an investor, if you want a quick review of how a company is doing financially, you must look at the company's current ratio. The current ratio means a company's ability to pay off short-term liabilities with its short-term assets. Usually, when the creditors are looking at a company, they look for a higher current ratio; because a higher current ratio will ensure that they will get repaid easily, and the certainty of payment would increase.

So what current ratio is all about? First, we will look at the balance sheet of the company and then select the current assets and divide the current assets by the current liabilities of the company during the same period.

If we get all we need to know as investors from the current ratio, why should we look at a quick ratio? Here's the catch.

The quick ratio helps investors get to the bottom of things and discover whether the company can pay off its current obligations. There is only one thing that's different in the quick ratio than the current ratio. While calculating the quick ratio, we consider all the current assets except inventories. Many financial analysts feel that inventory takes time to turn itself into cash to pay off debt. We also exclude prepaid expenses to get to the quick ratio in some cases. Thus, the quick ratio is a better starting point to understand whether the company can pay off its short-term obligations. The quick ratio is also called the acid test ratio.

As we saw earlier that Toll Brothers had a current ratio of 4.6x. This makes us believe that they are in the best position to meet their current liabilities. However, when we calculate the Quick ratio, we note that it's only 0.36x. This is due to high inventory levels in the balance sheet, as seen below.

source: Toll Brothers SEC Filings

Current Ratio vs. Quick Ratio Explained in Video

Current Ratio vs. Quick Ratio - Formula

Current Ratio Formula

Let's look at the formula of the current ratio first.

Current Ratio = Current Assets / Current Liabilities

As you can see, the current ratio is simple. Go over to the company's balance sheet, select "current assets," and divide the sum by "current liabilities," and you get to know the ratio.

But what do we include in the current assets?

Current Assets: Under current assets, the company would include cash, including foreign currency, short term investments, accounts receivables, inventories, prepaid expenses, etc.

Current liabilities: Current Liabilities are liabilities that are due in the next 12 months or less. Under current liabilities, the firms would include accounts payable, sales taxes payable, income taxes payable, interest payable, bank overdrafts, payroll taxes payable, customer deposits in advance, accrued expenses, short-term loans, current maturities of long term debt, etc.

Now, let's look at the quick ratio. We look at the quick ratio in two ways.

Quick Ratio Formula # 1

Quick Ratio = (Cash & Cash Equivalents + Short Term Investments + Accounts Receivables) / Current Liabilities

Here, if you notice, everything is taken under current assets except inventories.

Let's look at what we include in cash & cash equivalents, short term investments, and account receivables.

Cash & Cash Equivalents: Under Cash, the firms include coins & paper money, un-deposited receipts, checking accounts, and money order. And under cash equivalent, the organizations take into account money market mutual funds, treasury securities preferred stocks which have the maturity of 90 days or less, bank certificates of deposits, and commercial paper.

Short Term Investments: These investments are the short term that can be liquidated easily within a short period, usually within 90 days or less.

Accounts Receivables: The sum of money that is yet to be received from the company's debtors is called accounts receivable; including accounts receivable is criticized by some analysts because there is less certainty in the liquidation of accounts receivable!

Quick Ratio Formula # 2

Let's look at the second way of computing the quick ratio (acid test ratio) –

Quick Ratio = (Total current assets – Inventory – Prepaid Expenses) / Current Liabilities

In this case, you can take the whole current assets from the balance sheet of the company and then simply deduct the inventories and prepaid expenses. Then divide the figure by current liabilities to get to the quick or acid test ratio.

Current Ratio vs. Quick Ratio - Interpretation

First, we will interpret the current ratio and then the quick ratio.

e will interpret the current ratio and then the quick ratio.

- When creditors look at the current ratio, it's usually because they want to ensure the certainty of repayment.

- If a company has less than one as its current ratio, then the creditors can understand that the company will not be able to pay off its short-term obligations easily.

- And if the current ratio of the company is more than 1, then they are in a better position to liquidate their current assets to pay off the short-term liabilities.

- But what if the current ratio of a company is too higher? For example, let's say that Company A has a current ratio of 5 in a given year, what would be the possible interpretation? There are two ways of looking at it. First, they are doing exceptionally well to liquidate their current assets very well and pay off debts faster. Second, the company cannot utilize its assets well, and thus, the current assets are much more than the current liabilities of the company.

Now, let's have a look at a quick ratio.

- Many financial analysts believe that a quick ratio is a better way to understand a company's financial affairs than the current ratio.

- Their argument is inventoried shouldn't be included in the expectation of paying off current liabilities because no-one knows how long it would take to liquidate inventories.

- It is similar to prepaid expenses. A prepaid expense is an amount paid in advance for goods and services to be received in the future. As it is something that is already paid, it can't be used to pay off the further obligation. So we also deduct the prepaid expense from the current assets while computing the quick ratio. In

- In the case of the quick ratio, if the ratio is more than 1, creditors believe the company is doing well and vice versa.

Current Ratio vs. Quick Ratio - Basic Example

We will discuss two examples to try to understand the current ratio and quick ratio.

Let's have a look.

Current Ratio vs. Quick Ratio Example # 1

| X (in US $) | Y (in US $) | |

| Cash | 10000 | 3000 |

| Cash Equivalent | 1000 | 500 |

| Accounts Receivable | 1000 | 5000 |

| Inventories | 500 | 6000 |

| Accounts Payable | 4000 | 3000 |

| Current Taxes Payable | 5000 | 6000 |

| Current Long-term Liabilities | 11000 | 9000 |

Compute "Current Ratio" and "Quick Ratio."

First, let's start with the current ratio.

Here's what we will include in current assets –

| X (in US $) | Y (in US $) | |

| Cash | 10000 | 3000 |

| Cash Equivalent | 1000 | 500 |

| Accounts Receivable | 1000 | 5000 |

| Inventories | 500 | 6000 |

| Total Current Assets | 12500 | 14500 |

We will look at current liabilities now –

| X (in US $) | Y (in US $) | |

| Accounts Payable | 4000 | 3000 |

| Current Taxes Payable | 5000 | 6000 |

| Current Long-term Liabilities | 11000 | 9000 |

| Total Current Liabilities | 20000 | 18000 |

Now we can easily calculate the current ratio.

The current ratio of X & Y would be –

| X (in US $) | Y (in US $) | |

| Total Current Assets (A) | 12500 | 14500 |

| Total Current Liabilities (B) | 20000 | 18000 |

| Current Ratio (A / B) | 0.63 | 0.81 |

From the above, it can be easily said that both X & Y need to improve their current ratio to be able to pay off their short term obligations.

Let's look at the quick ratio now.

To calculate the quick ratio, we need to exclude "inventories" as no "prepaid expenses" are given.

| X (in US $) | Y (in US $) | |

| Cash | 10000 | 3000 |

| Cash Equivalent | 1000 | 500 |

| Accounts Receivable | 1000 | 5000 |

| Total Current Assets

(Except "Inventories") | 12000 | 8500 |

Now the quick ratio would be –

| X (in US $) | Y (in US $) | |

| Total Current Assets (M) | 12000 | 8500 |

| Total Current Liabilities (N) | 20000 | 18000 |

| Current Ratio (M / N) | 0.60 | 0.47 |

One thing noticeable here. There is not much difference in the quick ratio for X because of excluding inventories. But in the case of Y, there is a vast difference. That means inventories can inflate the ratio and give creditors more hope in getting paid.

Current Ratio vs. Quick Ratio Example # 2

Paul started a clothing store a few years back. Paul wants to expand his business and needs to take a loan from the bank to do so. Bank asks for a balance sheet to understand the quick ratio of Paul's clothing store. Here are the details below –

Cash: US $15,000

Accounts Receivable: US $3,000

Inventory: US $4,000

Stock Investments: US $4,000

Prepaid taxes: US $1500

Current Liabilities: US $20,000

Compute "Quick Ratio" on behalf of the bank.

As we know that "inventory" and "prepaid taxes" wouldn't be included in the quick ratio, we will get the current assets as follows.

(Cash + Accounts Receivable + Stock Investments) = US $(15,000 + 3,000 + 4,000) = US $22,000.

And the current liabilities are mentioned, i.e., US $20,000.

Then, the quick ratio would be = 22,000 / 20,000 = 1.1.

A quick ratio of more than 1 is good enough for the bank to start. The bank will now look at more ratios to think over whether to lend a loan to Paul to expand his business.

Colgate - Calculate Current Ratio and Quick Ratio

In this example, let us look at how to calculate the Current Ratio and Quick Ratio of Colgate. If you wish to get access to the calculation excel sheet, then you can download the same here - Ratio Analysis in Excel

Colgate's Current Ratio

Below is the snapshot of Colgate's Balance Sheet for years from 2010 - 2013.

Current Ratio is easy to calculate = Current Assets of Colgate divided by Current Liability of Colgate.

For example, in 2011, Current Assets was $4,402 million, and Current Liability was $3,716 million.

Colgate Current Ratio (2011) = 4,402/3,716 = 1.18x

Likewise, we can calculate the current ratio for all other years.

The following observations can be made with regards to Colgate Current Ratios –

- The current ratio increased from 1.00x in 2010 to 1.22x in the year 2012.

- Colgate's current ratio increased due to an increase in cash and cash equivalents and other assets from 2010 to 2012. In addition, we saw that the current liabilities were more or less stagnant at around $3,700 million for these three years.

- The current ratio dipped to 1.08x in 2013 due to an increase in current liabilities caused by the current portion of long-term debt to $895 million.

Colgate's Quick Ratio

Now that we have calculated the Current Ratio, we calculate the Quick Ratio of Colgate. The quick ratio only considers receivables and cash and cash equivalents in the numerator.

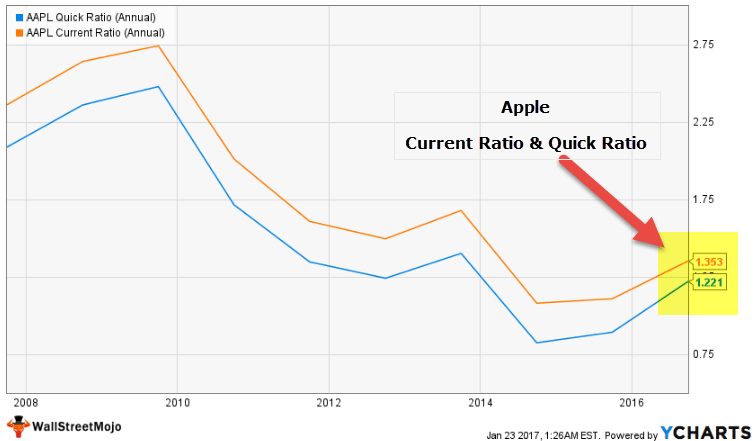

Apple's Current Ratio and Quick Ratio

Now that we know the current ratio calculation and quick ratio let us compare the two for Apple (product company). The below graph depicts Apple's Current Ratio and Quick Ratio for the past ten years.

source: ycharts

We note the following from the above graph -

- The Current Ratio of Apple currently is 1.35x, while its Quick Ratio is 1.22x. These two ratios are very close to each other.

- There is not much difference between these two ratios. We note that historically, they have stayed very close to each other

- The key reason for this is that Apple has most of its current assets as Cash & Cash Equivalents, Marketable Securities, and Receivables.

- Inventory as a percentage of Current Assets is insignificant (less than 2%), as seen from the balance sheet below.

source: Apple SEC filings

Microsoft's Current Ratio and Quick Ratio

Now that we have seen Apple's comparison, it is easy to guess the graph of Microsoft's Current Ratio vs. Quick Ratio.

The below chart plots Microsoft's Quick and Current ratio for the past 10 years.

source: ycharts

We note the following -

- The Current Ratio is currently at 2.35x, while the quick ratio is at 2.21x.

- This is again a narrow range, just like Apple.

- The key reason for this is that Inventory is a minuscule part of the total current assets.

- Current assets primarily consist of Cash and Cash Equivalents, Short Term Investments, and receivables.

source: Microsoft SEC Filings

Software Application Sector - Current Ratio vs. Quick Ratio Examples

Let us now look at sector-specific Current Ratio and Quick Ratio Comparisons. First, we note that Software applications companies have a narrow range of current and Quick Ratios.

Below is a list of top Software Application companies -

source: ycharts

- SAP has a current ratio of 1.24x, while its quick ratio is 1.18x.

- Likewise, Adobe Systems has a current ratio of 2.08 vs. a quick ratio of 1.99x.

- Software companies are not dependent on inventory, and hence, their contribution to current assets is significantly less.

- We note from the table above that (Inventories + Prepaid)/Current Assets is meager.

Steel Sector - Current Ratio vs. Quick Ratio Examples

In contrast to software companies, Steel companies are capital intensive sector and is heavily dependent on Inventories.

Below is a list of top Steel companies -

source: ycharts

- We note that ArcelorMittal Current Ratio is 1.24x, while its Quick Ratio is 0.42

- Likewise, for ThyssenKrupp, the current ratio is at 1.13 vs. Quick ratio of 0.59

- We note that the range (Current ratio – quick ratio) is relatively broad here.

- This is because, for such companies, inventories and prepaid contribute a considerable percentage of Current Assets (as seen from above, the contribution is greater than 30% in these companies)

Tobacco Sector - Current Ratio vs. Quick Ratio Examples

Another example that we see here is of Tobacco Sector. We note that this is a fairly capital intensive sector and depends on a lot on storing raw material, WIP, and finished goods inventories. Therefore, the Tobacco sector also shows a broad difference between the Current Ratio and the Quick Ratio.

Below is the table showing these differences and the contribution of inventory and prepaid expenses to Current Assets.

source: ycharts

Current Ratio vs. Quick Ratio - Limitations

Let's discuss the disadvantages of both of these ratios.

Here are the disadvantages of the current ratio –

- First of all, the only current ratio would not give an investor a clear picture of a company's liquidity position. The investor needs to look at other ratios like quick and cash ratios.

- The current ratio includes inventories and other current assets, which may inflate the figure. Thus, the current ratio doesn't always give the right idea about a company's liquidity.

- If sales depend on seasons for any particular company or industry, the then-current ratio may vary over the year.

- The way inventory is valued will impact the current ratio as it includes inventory in its calculation.

The quick ratio is a better way to look at the company's liquidity. But it still has some demerits. Let's have a look –

- First of all, no investor and creditor should depend on an acid test or quick ratio only to understand the liquidity position. They also need to compare the cash and current ratios. And they also should check out how much the company depends on its inventory.

- The quick ratio includes accounts receivables that may not get liquidated quickly. And as a result, it may not give an accurate picture.

- The quick ratio excludes inventories on all occasions. But in the case of inventory-intensive industries like supermarkets, a quick ratio cannot provide an accurate picture due to the exclusion of inventories from the current assets.

In the final analysis

To be clear about a company's liquidity position, only the current ratio and quick ratio are not enough; the investors and creditors should look at the cash ratio as well. And they need to find out which industry and company they are calculating for; on every occasion, the same ratio wouldn't give an accurate picture. As a whole, they should look at all the liquidity ratios before drawing any conclusions.

Recommended Articles

This article has been a guide to the current ratio vs. quick ratio. Here we discuss the top differences between them along with formulas, interpretations, and examples with calculations. You may also have a look at the following articles-