Table Of Contents

What is Growth Rate?

The growth rate formula is used to calculate the annual growth of the company for a particular period and according to which value at the beginning is subtracted from the value at the end and the resultant is then divided by the value at the beginning. This formula is applied to multiple metric such as GDP, turnover, and so on.

A sustainable growth rate formula can be defined as an increase in the value of an asset, individual investment, cash stream, or portfolio, over the period of a year. It is the most basic growth rate that can be calculated. There are a few other advanced types to calculate growth rate, among them average annual growth rate and compound annual growth rate.

Key Takeaways

- The growth rate formula enables quantifying and comparing growth rates over time.

- In addition, it provides a standardized measure to evaluate the relative expansion or contraction of values, making it useful for trend analysis, forecasting, and decision-making.

- The growth rate formula considers both the magnitude and direction of change.

- Moreover, this formula provides a percentage representation of growth, making it easier to interpret and compare across different contexts.

- It's important to note that the growth rate formula calculates the average growth rate over the specified number of periods. It assumes a constant rate of growth throughout the period.

Growth Rate Formula Explained

Growth rate formula is the determining metric for the positive movement of a company in a specific period. It can be defined as a metric that signifies the financial and overall health of an organization.

It is also vital to understand the fact that this metric can be used to gauge the growth of other factors such as wages, turnover, or even on a macro level like Gross Domestic Product (GDP).

The growth rate formula is very much useful in real life. Whether one wants to know how the fund performed over the period or the value of an investment after a given period, say one year. Even statisticians, and scientists use the growth rate in their field for their research. A higher growth rate is always preferred and is a positive sign of the growth of the asset. However, in the long term, the same is difficult to maintain, and the growth rate will revert to the mean.

To simplify your calculations, you can also use a growth rate calculator that instantly computes percentage changes based on beginning and ending values.

Formula

Let us understand the formula to calculate annual growth rate formula before dwelling deeper into the concept as it serves as the basis to understand other in-depth details.

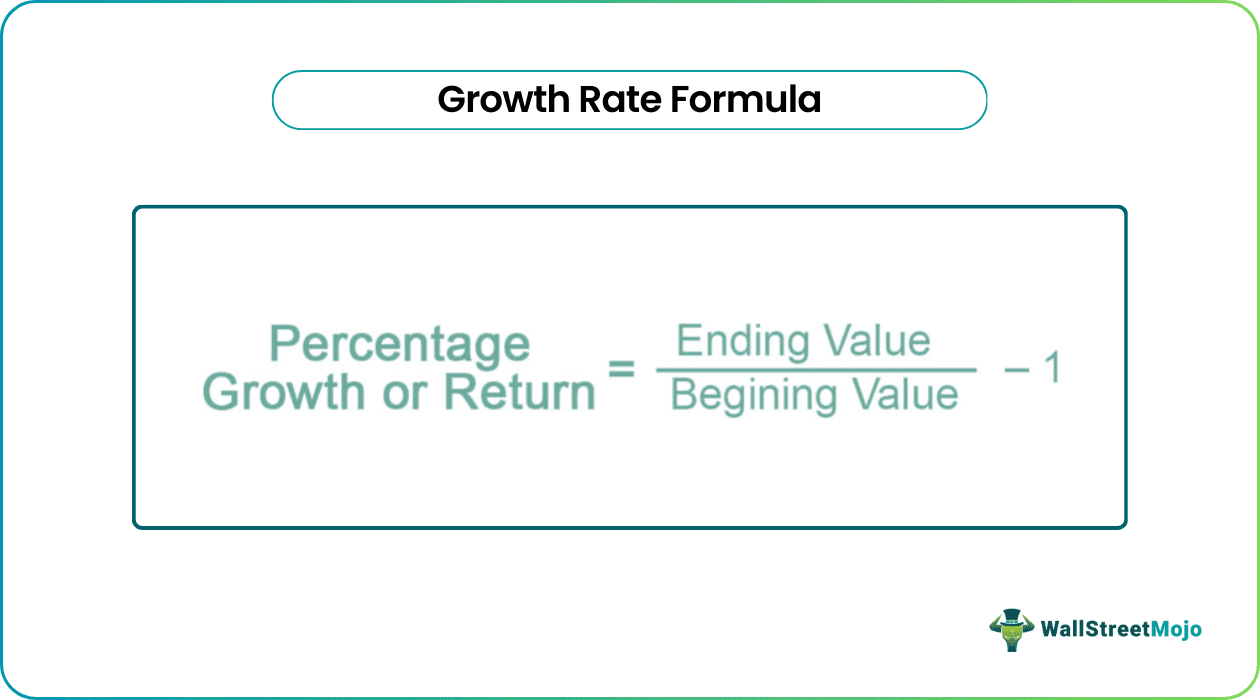

Percentage Growth or Return = Ending Value/Begining Value - 1

How To Calculate?

Let us understand how to calculate a sustainable growth rate formula through the step-by-step calculation given below.

Find out the beginning value of the asset, individual investment, cash stream.

Secondly, find out the ending value of the asset, individual investment, cash stream.

Now divide the value arrived in step 2 by the value arrived in step 1.

Subtract 1 from the outcome arrived in step 3

Multiply the result arrived in step 4 by 100.

The resultant will be the annual growth rate.

Examples

Let us understand the concept of annual growth rate formula with the help of a few examples. These examples will help us understand the intricate details of the concept.

Example #1

John Morrison invested $100,000 in an investment product, and at the end of the year, his investment value went up to $107,900. However, he is yet to withdraw the amount. Does he want to know how much % has his money grown over the years? You are required to calculate the Growth Rate.

Solution:

Use the following data for the calculation of the growth rate.

- Ending value: 107900

- Beginning Value: 100000

So, the calculation of the growth rate can be done as follows –

We are given below the ending value as well as the beginning value. Hence we can use the above formula to calculate the growth rate.

Growth Rate = (107,900 /100,000) – 1

The Growth Rate will be -

Example #2

Kane wants to invest in a fund that has shown a growth rate of at least 20% and wants to allocate funds $300,000 equally. 10 funds have been shortlisted by his broker, and below is the value of funds NAV at the start of the year and the end of the year.

| Fund Name | Start Year | End Year |

|---|---|---|

| Large Cap | 101 | 115 |

| Mid Cap | 52 | 78 |

| Small Cap | 25 | 40 |

| Growth Only | 66 | 82 |

| Dividend Only | 12 | 13 |

| Techno Funds | 75 | 100 |

| Bank Funds | 63 | 75 |

| Money Market Funds | 9 | 8 |

| Debt Fund | 35 | 39 |

| Hybrid Fund | 88 | 101 |

You are required to calculate the growth rate for each fund and allocate funds among the selected ones.

Solution:

We are given below the ending fund value as well as the beginning fund value. Hence we can use the above excel formula to calculate the growth rate.

So, the calculation of growth rate for year large-cap be done as follows:

Growth Rate = ( 115 / 101 ) – 1

The growth rate for year large-cap will be -

Growth Rate For Year Large Cap = 13.86%

Similarly, we can calculate for the rest of the funds, and below is the outcome along with selection.

Finally, we will allocate the amount of 300,000 among the 4 funds that are selected equally.

Hence, Kane will invest 75,000 among the 4 funds, which appear to be riskier.

Example #3

NSE Inc. started a business five years ago and has been catching the eye in the market as one of the multi-baggers due to its impressive growth.

Many investors are considering investing in it for long term purposes. An equity analyst has started coverage over this stock. He first ran through the Gross revenue of the company and wanted to see individual growth years and compare the same with the industry average to confirm that indeed NSE Inc. is really catching eye stock or it's just a fluke.

| Year | Gross Revenue |

|---|---|

| 2014 | 5,50,00,000 |

| 2015 | 6,00,00,000 |

| 2016 | 7,50,00,000 |

| 2017 | 8,50,00,000 |

| 2018 | 11,00,00,000 |

You are required to calculate the growth rate for each year.

Solution:

We are given below the ending gross revenue as well as the beginning gross revenue for each year. Hence we can use the above excel formula to calculate the GR.

So, the calculation of growth rate for the year 2015 can be done as follows:

Growth rate for the year 2015 = (6,00,00,000 / 5,50,00,000 ) – 1

Growth Rate for the Year 2015 will be -

Growth Rate for the Year 2015 = 9.09%

Similarly, we can calculate for the rest of the year, and below is the result.

Relevance and Uses

The growth rate formula is very much useful in real life. Whether one wants to know how the fund performed over the period or their value of an investment after a given period, say one year. Even statisticians, scientists use the growth rate in their field for their research. The higher growth rate is always preferred and is a positive sign of the growth of the asset. However, in the long term, the same is difficult to maintain, and the growth rate will revert to the mean.