Table of Contents

Markets In Financial Instruments Directive (MiFID) Meaning

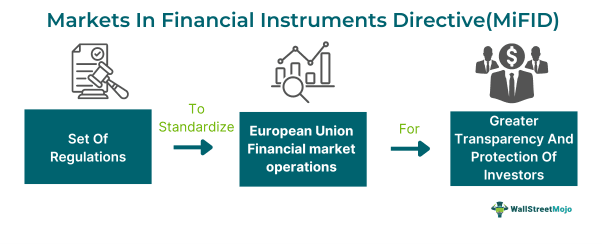

The Markets in Financial Instruments Directive (MiFID) refers to European regulations that govern and standardize the European Union (EU). These regulations aim to enhance their competitiveness, transparency, integrity, and efficiency. Thus, it sets regulations and conducts for the disclosure of various market operations by the financial entities.

MiFID majorly emphasizes the maintenance of utmost transparency in the stocks. However, it failed to consider the other financial products, which turned out to be its notable drawback. However, the purpose of this enforcement was to bring all the EU members under a single regulatory structure to ensure the investors' security by reducing the level of market risk.

Key Takeaways

- The Markets in Financial Instruments Directive (MiFID) refers to the regulations, including provisions, standards, procedures, and rules.

- These measures are designed to ensure transparency and efficiency in all the European Union financial market operations.

- MiFID was established in 2007 to secure the rights and interests of investors by allowing all EU financial market participants to coexist under one regulatory framework.

- Due to its limited implication to the stocks, while neglecting the other financial instruments like directives, the framework was succeeded by MiFID II in January 2018.

MiFID Explained

The Markets in Financial Instruments Directive (MiFID) establishes regulatory standards and procedures for financial firms operating within the European Union. Its goal is to harmonize and enhance transparency, efficiency, and integration in the financial markets across the EU. This framework was enforced in 2007 to confine all the financial markets under a standardized regulatory system. Thus, it was before the financial crisis of 2008 that MiFID came into existence.

However, the initial framework had various loopholes since it was not enforceable upon international or cross-border dealings outside of the EU, where the member state decided the regulatory implications. Hence, foreign firms were at an advantage in terms of eased compliance requirements compared to EU-based firms.

Moreover, this approach specifically covered the stocks, overlooking the financial products that were extensively traded in the financial markets, like ETFs, over-the-counter derivatives, and hedge funds. Therefore, this version of the regulatory framework was subsided by the markets in Financial Instruments Directive II (MiFID II), which was a more inclusive initiative.

The Markets in Financial Instruments Directive 2004 39 ec requires EU member states to standardize regulations for investment services and activities. It was further amended to enforce the markets in financial instruments directive 2014/65/EU. Under this framework, the member states were mandated to form a system of authorizing investment firms to operate across the EU. Also, these firms need to be registered for public accessibility while reporting to the European Securities and Markets Authority (ESMA). It facilitated the non-EU relationship management through their market analysis, thus providing cross-border services to authorized clients. Moreover, this directive seeks to establish a unified European' securities rule book' and standardize the procedures across all EU member states.

Client Classifications

EU markets in financial instruments directive serve three types of clients while providing a different level of safety to them:

#1 - Professional Clients

It comprises the financial organizations that have the power and expertise of decision-making in the investment, finance, and insurance sectors. These firms that need less regulatory protection include:

1. Entities Covered Under The Financial Market Regulations:

- Investment companies

- Insurance and reinsurance firms

- Commodity and derivatives dealers

- Credit institutions

- Pension fund and related management companies

- Local firms are executing investment activities.

- Companies running collective investment schemes and their management

- Other authorized organizations

2. Large-sized undertakings that fulfill at least two of the following requirements:

- A minimum of EUR 2 million of own funds

- At least EUR 20 million of the balance sheet total and

- A minimum of EUR 40 million net turnover

3. Regional and national government bodies, central banks, public bodies responsible for public debt management (except local authorities), and international and supranational organizations

4. Other institutional investors include organizations that securitize assets and financial transactions.

#2 - Eligible Counterparties

These are the most sophisticated capital market participants who process the orders on clients' behalf, such as:

- Credit institutions

- Investment firms

- Insurance companies

- Pension fund and related management companies

- UCITS and related management firms

- National government and its subsidiaries, like public debt management public bodies

- Financial institutions authorized under the regulation of community legislation and member state laws

- Supranational organizations and central banks

- Undertakings excluded from the MiFID laws as stated in Article (l) (k) and (l) thereof and (l) of subsection (2) of section 3

#3 - Retail Clients

The retail parties receive the highest level of regulatory protection; these clients include those:

- Financial entities can neither be considered professional clients nor eligible counterparties.

- Firms can request to be considered professionals if they fulfill the relevant procedures and identification criteria.

Examples

MiFID has diverse implications for regulating the EU financial markets. Some of the relevant examples are discussed below:

Example #1

Suppose XYZ Ltd. is a large corporation based out of Belgium and the EU. Now, its stocks are listed on the London Stock Exchange, where these are openly traded among investors. The company fulfills two of the three requirements for being considered as a professional client. Primarily, it has its own investment of EUR 2.5 million in the company, and its net turnover is EUR 51.7 million. Thus, MiFID offers limited regulatory protection to this firm, considering its knowledge, expertise, and experience in managing systematic risks.

Example #2

The UK's Financial Conduct Authority (FCA) has suggested permitting asset managers to combine fees for investment research with their trading costs. This proposal would reverse a significant aspect of the EU's MiFID II reforms implemented in 2018. These reforms, which UK officials initially supported, required research separation and trading fees to minimize conflicts of interest and enhance independent analysis. However, this separation has led to diminished coverage of small and medium-sized stocks and increased financial pressure on smaller companies.

Following Brexit, there has been a push from UK politicians who plan to abandon these rules to boost research activities and attract more businesses to list in London. The FCA's proposal seeks to offer asset managers more flexibility in paying for research, potentially revitalizing the UK's capital markets and aligning UK regulations with those in the EU and US. Meanwhile, the smaller asset managers have found the upfront costs of research burdensome under the current unbundling rules. However, the proposed changes allow these managers to pass on research costs to end investors more easily. Further, independent brokers, especially those handling small-cap stocks, have struggled to compete with larger investment banks due to MiFID II, causing many to reduce their research teams or merge with other firms.

European Union Regulatory Harmonization

EU markets in financial instruments directive is a part of the European Union regulations since it doesn't work in isolation. Instead, it parallelly functions with other frameworks like the Markets in Financial Instruments Regulation (MiFIR) and the General Data Protection Regulation (GDPR) to fend for the rights of EU citizens and investors while ensuring utmost transparency in financial market operations.

Indeed, being competent on the global front, MiFID has come across various difficulties with cross-border supervision, which can only be overcome through the harmonization of the powers and rules. The new regulations are just a revised, better version of the previous regulations. Therefore, there have been some standardized best practices that every entity functional in the EU market should follow. One such practice is to designate an internal person as an officer who will be solely responsible for ensuring the security of the client's interest.

Also, such harmonized standards need to be acknowledged by the European Standards Organization, such as CENELEC, CEN, or ETSI. Moreover, these standards and procedures must be released in the Official Journal of the European Union (OJEU) to disclose the current harmonized standards and various other European standards in practice.

MiFID Vs. MiFID II Vs. MiFIR

While MiFID II is an improved version of MiFID, MiFIR helps with regulatory integration. Given below are the various distinctions among the three:

| Basis | MiFID | MiFID II | MiFIR |

|---|---|---|---|

| Definition | A regulatory framework that governs transparency and efficiency in the financial market operations across the European Union. | A legislative framework governing financial industry reform covering a wide spectrum of financial products in the European Union. | An additional set of rules that are applicable together with the MiFID and MiFID II directives to ensure regulatory integration for maximum transparency in the EU financial markets. |

| Scope | Primarily covered stocks | Widely included all the financial products like OTC derivatives, ETFs, etc. | Making trading activities public, financial transaction information sharing with supervisors and regulators, and organizing a platform for derivatives trading |

| Aim | Ensuring transparency for investors' protection | Facilitate inclusion with transparency and efficiency in the financial markets | Integrating the regulatory frameworks |

| Introduced In | 2007 | January 03, 2018 | October 10, 2011 |