The following points explain the differences between the Net Stable Funding Ratio (NSFR) and the Liquidity Coverage Ratio (LCR):

Table of Contents

What Is Net Stable Funding Ratio (NSFR)?

The Net Stable Funding Ratio (NSFR) is a banking metric used to ensure that banks hold enough stable funding to secure their long-term assets. The primary purpose of this ratio is to ensure the bank has adequate liquidity to meet its funding needs over a one-year period.

The NSFR was introduced as part of Basel III, a comprehensive overhaul of banking regulations. This regulation replaced the Basel II framework and introduced new standards focusing on liquidity requirements. The NSFR helps banks withstand financial stress and provides resistance against financial shocks.

Key Takeaways

- The Net Stable Funding Ratio (NSFR) is a metric introduced by the Basel Committee to assess the funding requirements for banks to meet long-term obligations.

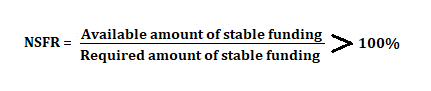

- It represents the proportion of Available Stable Funding (ASF) to Required Stable Funding (RSF). ASF and RSF are assigned factors between 0% and 100% to determine the liquidity of each asset or exposure.

- The minimum NSFR requirement is 100% or higher. A ratio below 100% indicates that the bank needs additional funds to meet the minimum level.

- The NSFR differs from the Liquidity Coverage Ratio (LCR), which focuses on short-term obligations and is calculated over a 30-day period.

Net Stable Funding Ratio Explained

The NSFR measures the relationship between Available Stable Funding (ASF) the Required Stable Funding (RSF). It focuses on the gap between the available stable funding and the standard funding requirements of financial institutions. The ASF includes assets and liabilities with more than one year of maturity, while the RSF covers assets of shorter maturity. The ratio is determined using a one-year timeframe and must be at least 100%, typically on an ongoing basis.

ASF represents the amount of capital and liabilities currently available to the bank. Sources of ASF include customer deposits (CDs), equity, and long-term wholesale funding (such as from the interbank lending market). However, short-term wholesale funding, even from the interbank market, is excluded from ASF.

The Basel III committee defines RSF in the NSFR disclosure standards. The RSF value is calculated by assigning specific RSF factors to different types of assets, ranging from 0% to 100%. An RSF factor of 100% indicates that an asset is illiquid and requires fully stable funding. On the other hand, an RSF factor of 0% reflects a fully liquid asset that can fund itself.

Formula

To determine the Basel Net Stable Funding Ratio (NSFR), banks use a formula that incorporates both Available Stable Funding (ASF) and Required Stable Funding (RSF). As part of regulatory compliance, every bank must maintain a minimum NSFR of 100% or higher. Holding more funding ensures sufficient liquidity to support long-term operations. The NSFR complements the Liquidity Coverage Ratio (LCR), which focuses on maintaining short-term liquidity.

Examples

Let us take a closer look at the concept of NSFR with some examples explaining the ratio better:

Example #1

Suppose James is a branch manager at the Cleveland Bank Group, operating in more than 10 cities. In the past few years, the bank has a good amount of funds in terms of operations and deposits. Following is the bank statement considering assets and liabilities:

- Equity - $100 million (0%)

- Customer Deposits - $500 million (0%)

- Wholesale Funding (1-year maturity) - $200 million (20%)

- Wholesale Funding (5-year maturity) - $100 million (50%)

- Loans (3-year maturity) - $500 million (70%)

ASF = Equity ($100 million) + customer deposits ($500 million)

= $600 million

RSF = ($200 million * 20%) + ($100 million * 50%) + ($500 million * 70%)

= $40 million + $50 million + $350 million

= $440 million

NSFR = ASF/ RSF

= 600/440 * 100

= 1.36 or 136%

This means the bank has adequate funding and exceeds the regulatory minimum requirement of 100%.

Example #2

The Basel Committee on Banking Supervision held a meeting to review liquidity standards and ratios applicable to banks. This review followed significant outflows of deposits observed last year at some regional banks in the United States and Credit Suisse. For large internationally operating banks, the weighted average NSFR dropped to 123%, still above the required minimum but below prior levels.

Impact On Financial Sector

The Basel Committee introduced the NSFR as a liquidity metric for financial institutions, particularly banks. However, its impact extends across the broader financial sector. Let’s explore how:

- Improves Liquidity: One of the key implications of the NSFR is its effect on liquidity. Due to its volatile nature, the NSFR encourages banks to reduce their reliance on short-term funding. As a result, banks seek more stable and reliable funding sources, which can be beneficial in adverse conditions.

- Reduces Lending Activity and Increases Costs: The NSFR also affects lending activity. Banks may become more cautious about acquiring stable funding, as it often comes with higher costs. Consequently, they might reduce lending, especially to riskier borrowers, due to the increased cost of maintaining stable funding.

- Enhances Financial Stability: The NSFR contributes to greater financial stability by promoting liquidity and preparing banks for potential crises. This strengthened liquidity position can increase investor confidence and attract capital to banks.

- Discourages Financially Unsound Practices: The NSFR reduces reliance on volatile funding sources, which helps discourage financially unsound practices. It also prevents the build-up of excessive liquidity in the market, contributing to overall market stability.

Net Stable Funding Ratio vs Liquidity Coverage Ratio

| Basis | Net Stable Funding Ratio | Net Stable Funding Ratio |

|---|---|---|

| 1. Meaning | A liquidity ratio that measures the stability of funding to support long-term assets. | A liquidity ratio that ensures banks have enough liquid assets to cover short-term liabilities. |

| 2. Time Horizon | 12 Months | 30 Days |

| 3. Obligations | Focus on ensuring stable funding for long-term obligations and assets. | Ensures sufficient liquid assets to meet short-term obligations and outflows. |

| 4. Regulatory Requirements | Must be 100% or higher. | The Financial Stability Board (FSB) advises maintaining a liquidity coverage ratio of at least 100% |