Table Of Contents

What is the Paasche Price Index?

Paasche Price Index is defined as a methodology to calculate inflation by measuring the price change in a commodity compared to the base year. It was invented by Hermann Paasche, an economist from Germany, to understand the actual inflation in a basket of goods compared to the base year value.

- The index generally uses a base year of 100.

- An index greater than 100 signifies inflation impact, and less than 100 implies deflation.

- Year 0 is the base year, while the calculating year is called the observation year.

- Economists commonly use it to analyze the country's economic growth, considering the inflation in goods and services.

Key Takeaways

- By comparing the price change in a commodity to the base year, the Paasche Price Index is a method for calculating inflation.

- When analyzing the nation's economic growth, economists frequently consider the inflation of commodities and services.

- Paasche Index considers the current level of quantities accessible for the same, and it concentrates more on the consumption patterns in the economy.

- Also, it considers the whole selection of goods and services, including both expensive and less expensive options.

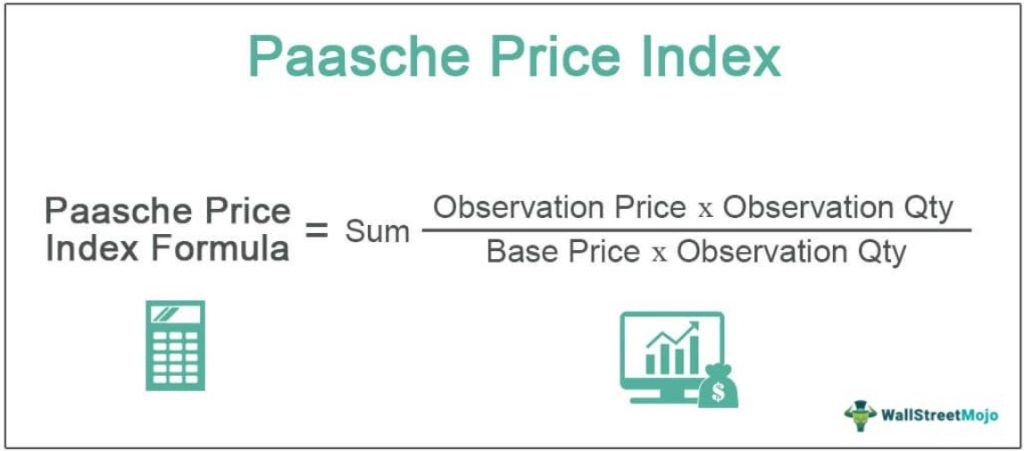

Paasche Price Index Formula

Paasche Price Index Formula = Sum ( observation price * Observation Qty) / (Base Price * Observation qty)

- Here, observation price refers to the price at the current levels for which the index needs to be calculated.

- Here, observation quantity refers to the quantity at the current levels for which the index must be calculated.

- Here, base price refers to the price at year 0, known as the base year for calculating the index.

Example of Paasche Price Index

Let us take the below-mentioned example to understand the computation of the Paasche index for a commodity A, B & C.

| Prices | Quantity | |||||

| Commodity | Year 0 | Year 1 | Year 2 | Year 0 | Year 1 | Year 2 |

| A | $10 | $30 | $60 | 20 | 30 | 40 |

| B | $20 | $40 | $70 | 25 | 35 | 45 |

| C | $30 | $50 | $80 | 20 | 40 | 50 |

Solution:

Below mentioned are the steps to calculate the Paasche index.

Paasche price index at year 0 = 100

The calculation of the Paasche price index for year 1.

Paasche price index at year 1 = {(30*30)+(40*35)+(50*40)} / {(10*30)+(20*35)+(30*40)}

= 195.45%

The calculation of Paasche price index for year 2.

Paasche price index at year 2 = {(60*40)+(70*45)+(80*50)} / {(10*40)+(20*45)+(30*50)}

= 341%

Hence, we can observe the inflation impact on commodities. The prices of commodities A, B & C, observed collectively, have increased by 341% at the end of year 2 and 195% at the end of year 1.

Advantages

The Paasche index is one of the most important tools to observe the inflation in the basket of goods and services by comparing the current levels and quantity available with the base year prices. Below mentioned are some of the major advantages of its ratio :

- It focuses more on the consumption patterns in the economy by considering the current level of quantities available for the same.

- It considers the entire basket of goods and services, including goods at a lower cost and higher cost.

- It reflects the governmental policies on daily goods and services since the common public consumes the same every day, which matters to them the most.

- It gives a trigger or a warning signal to the government about rising prices and an increased cost of living, which may hamper growth for a certain class of people.

- It is a good parameter to frame the future policies that will control inflation.

Disadvantages

Following are the disadvantages of the Paasche index.

- Does not take into account the changing tastes and preferences of the people.

- Ignore the growing economy.

- Data for the current quantities available are difficult to extract from multiple websites.

- A costlier process to execute.

Limitations of Paasche Price Index

Below are the limitations of the Paasche Index.

- It gives more weightage to the current quantity of the goods.

- It ignores economic growth since the goods and services form part of the GDP, and lowering their prices to a certain level can impact the country's GDP.

- Prices tend to rise every year, keeping in mind the consumer patterns and increasing living standards among the people.

- Deciding the base year is a challenge since its value will be 100. So, which year to be selected for the Year 0 itself is debatable.

Points to Note

A significant change in the Paasche price index will signal the government authorities that some action needs to be taken for its sudden increase or sudden fall. On the other hand, very high growth in the index may turn detrimental to the interest of the common people to buy the essential commodities at high prices.

Conclusion

The Paasche Price Index is one of the key ratios to determine the velocity of Inflation in the basket of goods and services. It is calculated every month to understand the trend, whether it is going upward or downward, along with the necessary steps or actions to be taken to maintain the trend.

This index has been widely used in the economic work and the Finance Ministry to be aware of the inflation trends. Therefore, the plans and policies would be drafted keeping in mind the Paasche price index ratio worked out and analyzing its impact on the economy on the common people.