Table of Contents

What Is Relative Purchasing Power Parity?

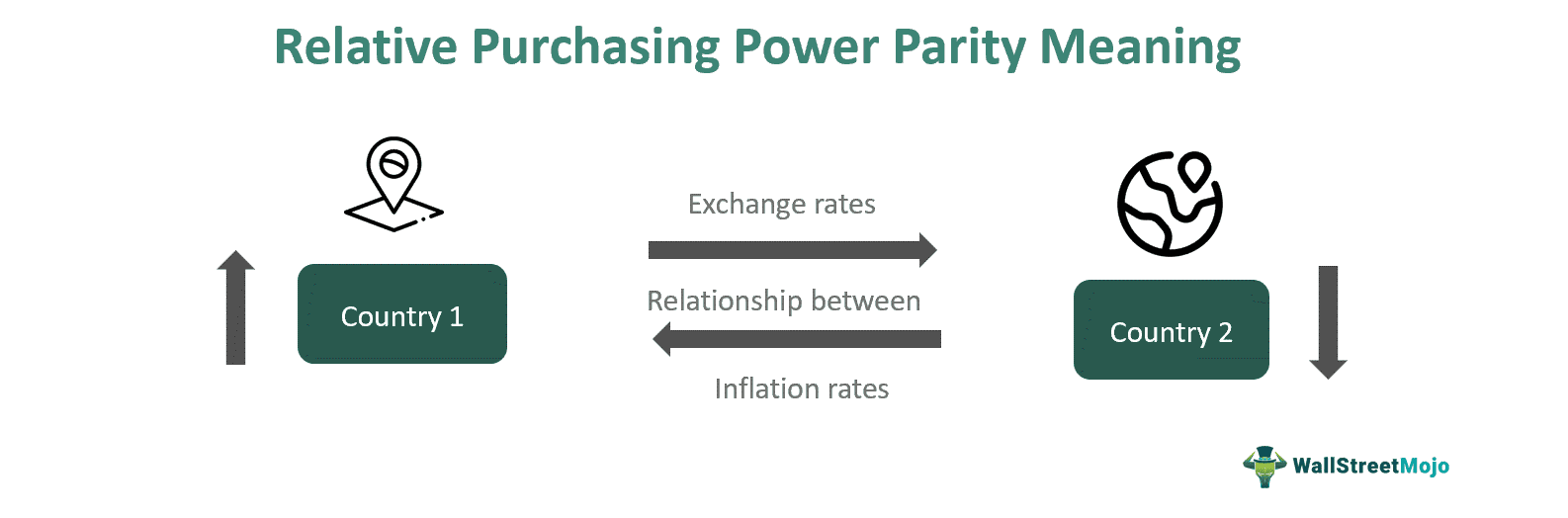

Relative purchasing power parity (RPPP) is a theory that determines the exchange rate between two countries' currencies. According to this, the rate at which the price of goods changes from one country to another is what determines the value of an exchange rate.

According to the RPPP, nations with higher inflation rates will have less valuable currencies than their peers with lower inflation rates. RPPP is an extension of the purchasing power parity (PPP) that considers inflation changes over time. It is based on the idea of purchasing power theory and supports the absolute purchasing power parity (APPP) theory.

Key Takeaways

- Relative purchasing power parity states a correlation between the inflation rates of two nations over a given time frame and the movement in the exchange rates between them during that same time.

- According to RPPP, there is a connection between currency exchange rates and price inflation. It examines the number of goods or services that one unit of money can purchase.

- The theory also suggests that the value of the same commodities in different markets across countries will even out and equalize over time.

Relative Purchasing Power Parity Explained

Relative purchasing power parity theory states a correlation between the inflation rates of two nations over a given time frame and the movement in the exchange rates between them during that same time. According to RPPP, there is a connection between currency exchange rates and price inflation. It examines the number of goods or services that one unit of money can purchase. This can fluctuate over the years as inflation rates change. According to the theory, inflation will decrease a currency's real purchasing power, so inflation must be considered when adjusting the PPP. The theory also suggests that the value of the same commodities in different markets across countries will even out and equalize over time.

Relative PPP suggests that the real exchange rate will be constant when it is at its equilibrium level. i.e., there will be an internal and external balance at equilibrium. Internal and external imbalances may develop when the equilibrium level deviates. However, the real exchange rate will return to equilibrium due to these disparities. For example, if the real exchange rate rises above its equilibrium level, increased domestic competitiveness boosts the trade balance and puts additional pressure on the labor market.

However, the nominal exchange rate will decrease once there is an increase in the trade balance. They happen simultaneously, as higher activity levels usually lead to higher domestic inflation. The actual exchange rate will be pushed back to its equilibrium level due to both of these causes.

Relative PPP Formula

The formula for RPPP is as follows:

Relative PPP Formula, E (St) = S0* t

E (St) = S0* t

Where,

- E (St) = expected future spot rate at time (t)

- S0 = spot rate as expressed in the amount of foreign currency

- P1-P2 = difference between annual inflation rates of two currencies.

Examples

Let us look at some topics to understand the concept better:

Example #1

The price of the USD stood at 4.4% in 2021. Let us, for example, consider that the price of the EUR only increased by 3% in 2021. In such a situation, the EUR users will have to pay extra EUR against the USD to get the same goods they previously purchased. If the EUR price quoted in USD rises by 1.4% (4.4%–3%), the purchasing power will remain unchanged. It means that EUR users can buy the same basket of goods at the same price as in the previous period.

Example #2

Assume that the spot exchange rate between the United States and Europe is 1.5 Euros for every US dollar and that the inflation rate in the United States is predicted to be 3% and 2%, respectively, in the upcoming year.

The expected spot rate in one year is calculated using the formula E (St) = S0* t

Substituting the formula E (St) = S0* t

- =1.5*

- =1.5*

- =1.5*0.99

- =-1.485 (1.5 approximately)

It means that the value is 1.5 Euros per 1 dollar, i.e., the U.S. dollar is expected to depreciate relative to the Euro. In other words, the Euro is expected to appreciate against the U.S. dollar. This means that Euro users will have to spend less than Euro to purchase goods in USD.

Difference Between Absolute And Relative Purchasing Power Parity

| Key Points | Absolute Purchasing Power Parity | Relative Purchasing Power Parity |

|---|---|---|

| 1. Concept | The absolute purchasing power parity (APPP) theory states that a basket of goods should have the same value once two currencies have been exchanged. | The relative purchasing power parity theory suggests that the differences in inflation rates and the prices of goods between two countries are the main factors that influence the exchange rate between the two countries. |

| 2. Essence | Absolute purchasing power parity (APPP) is considered the basic PPP theory. | RPPP is a weaker version of PPP, in other words, an extension of APPP. |

| 3. Implication | APPP suggests that the ratio of one country's price level to the other country's price level determines the equilibrium exchange rate. The equilibrium exchange rate is the number of units of one currency per unit of the other country's currency. | The RPPP theory suggests that the ratio of the equilibrium exchange rate in the current period (t) to the equilibrium exchange rate in the base period (0) is determined by the ratio of one country's price index in period (t) to the other country's price index in period (t), where both indexes are measured to the relative period (0). |

| 4. Elements Included | The theory fails to consider factors affecting the short-term exchange rate, such as tariffs, consumer spending, inflation, and transportation expenses. | According to RPPP, there is a connection between foreign exchange rates and price inflation, and hence these. |