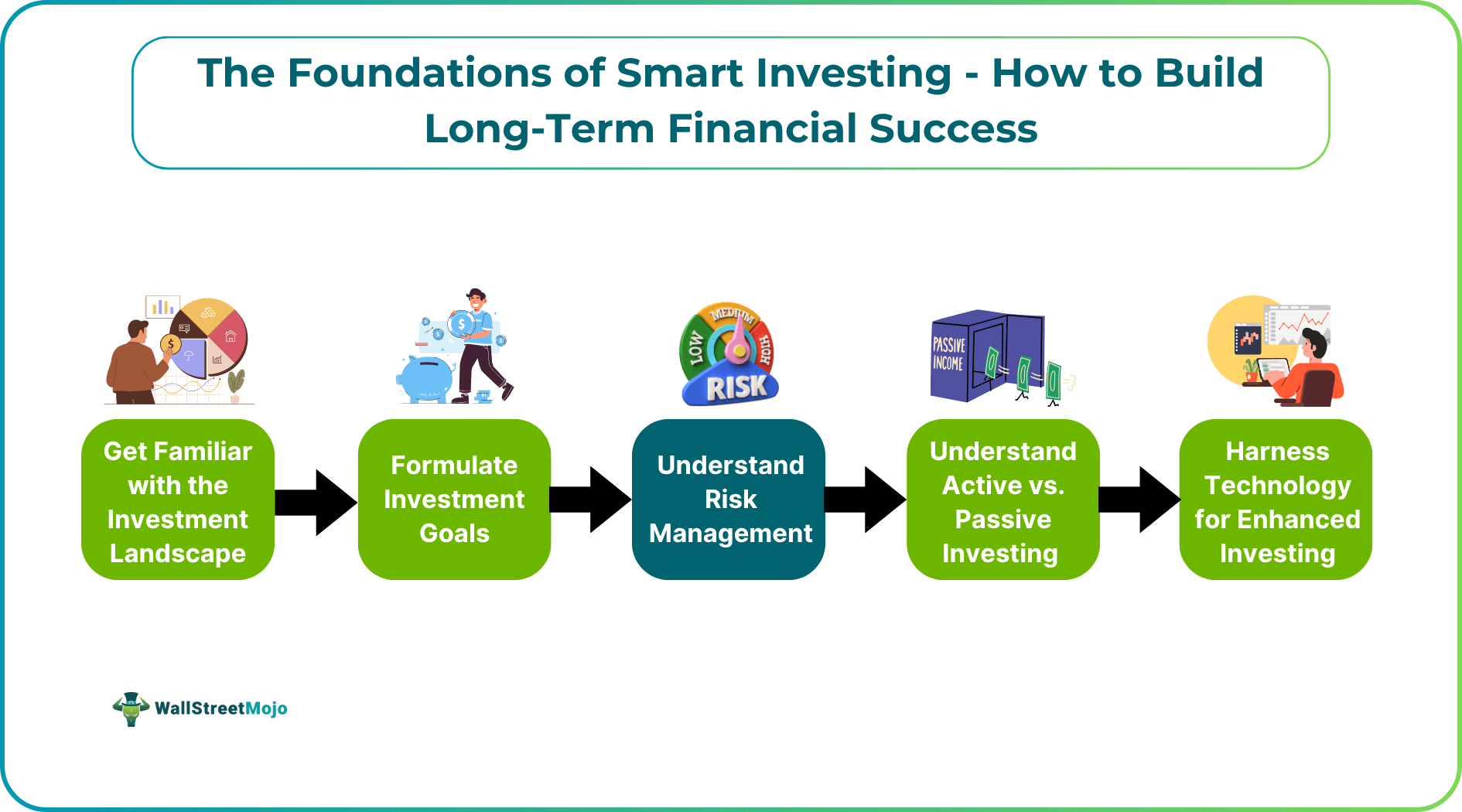

The Foundations of Smart Investing - How to Build Long-Term Financial Success

Table of Contents

Introduction

Achieving financial success in the long term is only possible when individuals make smart trading and investing decisions that enable them to build wealth over time. While financial markets provide people with plenty of opportunities, there are significant associated risks. To keep growing wealth while minimizing or eliminating such risks, it is essential to make informed buy and sell decisions. For individuals, prudent decision-making is only possible when they have a clear idea of the investment landscape. In addition, they must be familiar with risk management practices and understand market psychology.

If you are a person looking to know about these key aspects that define the foundations of smart investing for long-term success, you are in the right place. In this article, we will be providing you with the necessary knowledge that can help you reach your financial goals.

Getting Familiar with the Investment Landscape

Let us look at some key components of the investment landscape that are crucial for mastering investment planning basics.

#1 - Equities (Stocks)

Stocks refer to financial instruments that represent partial ownership in companies. By allocating funds to stocks, one can earn income via capital appreciation or dividends. Individuals can purchase stocks on stock exchanges like the New York Stock Exchange or NYSE. It is important to know that these financial instruments are risky because of price fluctuations. Hence, one should proceed with caution when trading stocks.

#2 - Bonds (Fixed Income)

Earning a stable income over time is key for long-term wealth building, and for that, investing in fixed-income instruments, like bonds, is a popular choice. Bonds denote loans provided by investors to a company or government organization. The bond issuer repays the original face value or principal to the investor along with interest. While government bonds carry low risk, the risk associated with corporate bonds varies.

#3 - Mutual Funds and ETFs

Mutual funds refer to investment vehicles that accumulate funds from different investors and invest those funds in various financial instruments. The choice of financial instruments depends on the investment objective of the fund. Broadly speaking, mutual funds can be of three types depending on the underlying asset class. They are equity funds, hybrid funds, and debt funds. Mutual fund investments can be a crucial component of financial success strategies. This is because they provide investors with exposure to a diversified portfolio that generates returns while mitigating financial risk.

On the other hand, an exchange-traded fund or ETF refers to a collection of securities available for buying and selling on stock exchanges. Individuals may invest in different types of ETFs, like passive ETFs or actively managed ETFs, based on their long-term wealth-building strategy.

#4 - Real Estate

For smart Investing for long-term success, another popular avenue or asset class is real estate. Individuals can purchase properties to generate income via capital appreciation or rent. While investing in real estate can offer benefits like diversification and income generation, it involves substantial debt and upfront capital. Moreover, it might take many years to recover the investment amount or make a profit.

H3: Commodities and Derivatives.

When gaining knowledge of investment planning basics, learning about derivatives and commodities is imperative. Commodities refer to raw materials, mining products, agricultural products or basic resources that serve as an asset class, for example, equity and debt. One can carry out the trading of commodities on commodity exchanges to generate consistent income and remain on track to achieve their financial goals. One may also consider investing in commodities for the long term to generate wealth.

Besides commodities, derivatives are a common choice among other assets for investors engaging in smart investing for long-term success. Derivatives refer to financial instruments traded on stock exchanges. The value of such agreements depends on the underlying asset. Generally, the trading of these financial instruments is suitable for advanced investors. Hence, beginners must consider the derivatives trading tips provided by experienced financial advisors or analysts if they want to allocate funds.

Formulating Investment Goals

Individuals can clearly define their financial goals when they are aware of the different investment horizons, which are as follows:

- Short-Term: Short-term investment horizons refer to a duration of less than 3 years. Investments for this duration are suitable for individuals who are approaching retirement. Alternatively, people requiring a significant amount of capital gains may also have a short-term horizon.

- Medium-Term: A medium-term horizon indicates an investment duration of 3-10 years. Medium-term financial success strategies are generally ideal for people who are looking to build a corpus for their child’s education, a first home, or marriage.

- Long-Term: A Long-term investment horizon is typically for financial goals that one wishes to reach in 10-20 years or more. In other words, having a long-term horizon means holding investments for over 10 years. Generally, people aiming to build a retirement corpus choose this investment horizon.

The Role of Risk Management

One can understand the importance of risk management for traders and investors by going through the following points:

#1 - Diversification

Portfolio diversification involves spreading investments across different financial instruments, geographic regions, industries, and time horizons to reduce risk exposure and generate consistent financial gains. Using this strategy is an essential part of smart investing for long-term success. You can build a diversified portfolio by directly investing in financial instruments like large-cap stocks, small-cap stocks, bonds, etc. Alternatively, you can engage in indirect investing to get diversified exposure via investment vehicles or pooled funds, like mutual funds.

#2 - Asset Allocation

Formulating an effective risk management strategy requires individuals to focus on asset allocation. This means they have to decide what percentage of their portfolio will comprise what asset classes. Note that asset allocation is based on investors’ risk appetite, financial goals, and investment time horizon.

#3 - Regular Rebalancing

Rebalancing refers to the process of making adjustments to a portfolio at regular intervals. It helps in the maintenance of the target returns and desired risk level and assists in avoiding underexposure or overexposure to a particular asset class or sub-class.

#4 - Stop-Loss and Take-Profit Order

Using stop-loss and take-profit orders judiciously is always on the list of the best investing tips. A stop-loss order closes a position in a financial instrument when its price drops below a certain level. Thus, it is a useful tool that allows investors to restrict their losses. On the other hand, a target profit order closes a position when the price reaches a certain level. Thus, this tool enables traders to lock in gains without needing to track the market movements constantly.

Deciphering Market Psychology

Market psychology dives into how biases and emotions impact trading and investing decisions. Indeed, fear, greed, euphoria, and expectations are the factors that constitute the overall sentiment in financial markets. Individuals can predict such sentiments and make buy and sell decisions to achieve their goals by using the following techniques.

- Technical Analysis: This form of analysis involves using tools like oscillators, candlesticks, and trading volume to identify price trends and patterns.

- Fundamental Analysis: This method involves selecting securities to invest in by analyzing some key financial metrics, like debt-to-equity ratio, earnings per share, and price-to-earnings ratio.

Active vs. Passive Investing

Broadly speaking, there are two main approaches that people engaging in smart investing for long-term success typically use. They are as follows:

#1 - Passive Investing

This is an investment strategy that involves aiming to maximize returns while minimizing the costs associated with buying and selling financial instruments. This approach often involves a buy-and-hold approach. In other words, one can often find passive investors holding securities for a long period. Such investors usually do not make moves to profit from short-term price fluctuations. Experts consider this a less risky strategy for building wealth.

This strategy is followed by index funds and certain ETFs; they aim to replicate the performance of an underlying benchmark index.

#2 - Active Investing

Active investing refers to a strategy that involves buying and selling financial instruments frequently in an attempt to make financial gains. Typically, the purpose of active portfolio management is to generate market-beating returns by making the most of short-term price movements. This investing approach requires individuals to conduct thorough investment analysis and in-depth market research.

Harnessing Technology for Enhanced Investing

In today’s investment landscape, smart investing for long-term success involves leveraging the latest technology to make informed decisions. For example, artificial intelligence and machine learning are providing improved market guidance and financial guidance, which, in turn, allow for better stock selection.

Moreover, digital platforms have made an extensive range of investment options easily available to individuals. Anyone can now visit a broker’s online platform and invest in stocks and other financial instruments at their convenience.

With automated trading systems, individuals can even track market movements in real-time easily via different platforms and mobile-based applications. Also, with the development of sophisticated algorithms, people are now able to make decisions faster. Precisely, the technology involving algorithms allows traders and investors to spot potential investment opportunities and make well-informed buy and sell decisions on the basis of key data-backed insights.

As technology continues to evolve, financial markets will keep transforming. Investors who have the ability to embrace innovations will manage to capitalize on the benefits.

Final Thoughts

Whether you are about to start your investment journey or looking for ways to improve your portfolio, the above information will prove to be extremely helpful. Indeed, with detailed knowledge of the various key concepts, like financial instruments, risk management strategies, and investment strategies, you will be equipped to effectively practice smart investing for long-term success.