Below are some of the differences between Prior Probability and A Priori Probability

Table Of Contents

Get in Touch with our Experts!

“A Priori Probability,” also known as classical probability. It refers to the probability of those events that can only have a finite number of outcomes, and each outcome is equally likely to occur. In this type of probability, the outcomes are not influenced by their primary outcomes. For example, any outcome drawn today will in no way influence the prediction of the probability of future outcomes.

The term "a priori" is Latin for the words "presumptive" or "deductive." As the name suggests, it is more deductive and is not influenced by what has happened in the past. In other words, the underlying principle of a priori probability follows logic rather than history to determine the probability of a future event. Typically, one may calculate a classical probability's outcome by rationally evaluating the pre-existing information or circumstance associated with a situation. As mentioned above, in such a probability estimation, each event is independent, and their previous events impact their occurrence in no way.

One can express the formula by dividing the number of desired outcomes by the total number of outcomes. Mathematically, it represents as below:

A Priori Probability Formula = No. of Desired Outcomes / Total No. of Outcomes

One should note that one can only use the above formula in the case of events wherein all the outcomes are equally likely to occur and are mutually exclusive.

Below are examples to understand the concept in a better manner.

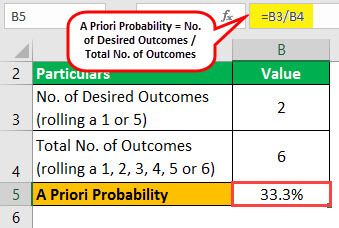

Let us take the example of a fair dice roll to illustrate the concept. A fair dice has six sides with an equal probability of rolling, and all the outcomes are mutually exclusive. So, first, determine the a priori probability of rolling a 1 or 5 in a fair dice roll.

Given,

Solution

Now, one can calculate the probability of rolling a 1 or 5 in a fair dice roll by using the above formula:

Therefore, the probability of rolling a 1 or 5 in a fair dice roll is 33.3%.

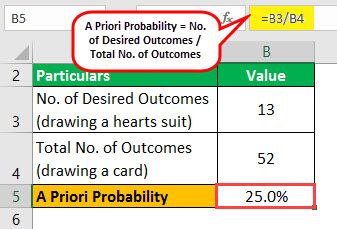

Let us take the example of a standard 52-card deck to illustrate the concept. There are 52 cards equally distributed among four suits (13 ranks in each suit) in a typical 52- card deck. If one draws one card and places it back in the deck, then determine it to draw a card from the heart suit.

Given,

Solution

Now, one can calculate the a priori probability of drawing a card from a hearts suit by using the above formula:

Therefore, the probability of drawing a card from a heart suit from a standard deck is 25.0%.

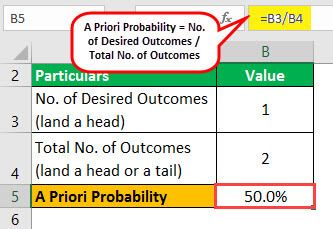

Let us take the example of a coin toss to illustrate the concept. A coin has two sides – a head and a tail. So, first, determine the a priori probability of landing a head in a usual coin toss.

Given,

Solution

Now, one can calculate the probability of landing a head in a coin toss by using the above formula:

Below are some of the differences between Prior Probability and A Priori Probability

| Head | Prior Probability | A Priori Probability |

|---|---|---|

| 1. Definition | It is the probability of an event that is determined prior to collection of new data point. | It is probability wherein the outcomes are not influenced by the previous outcomes. |

| 2. Impact of Information | It changes with the addition of each new information. | It's outcome is indifferent to any information from the past. It is applicable for cases with finite outcomes. |

| 3. Number of outcomes | It is applicable for cases with infinite outcomes. | It is applicable for cases with finite outcomes. |

| 4. Applicability | It is applicable to most real life examples as it is subjective nature. | It is not applicable to many real life cases due to constraint of finite outcomes. |

Some of the major advantages are as follows:

Some of the major drawbacks are as follows:

So, one can see that a priori probability is an essential statistical technique that also extends to other concepts. However, it has its limitations that one needs to take cognizance of while drawing statistical insights.