Table Of Contents

What Is Affine Term-Structure Model?

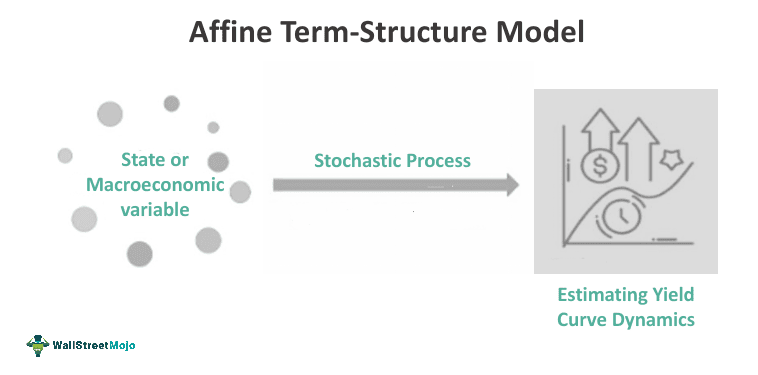

The Affine Term-Structure Model (ATSM) is a framework that facilitates the analysis of the zero coupon bond yield dynamics while eliminating the possibilities of arbitrage. It is based on the assumption that financial markets do not have scope for arbitrage. ATSM represents yields with different maturities as a linear function of certain unobservable macroeconomic factors or state variables influencing the yield curve dynamics.

The Affine Term-Structure Model is a more robust method of modeling the volatility and returns of interest rate derivatives than traditional statistical measures. Its flexibility and tractability make it an essential tool for yield and pricing analysis in fixed-income markets, such as zero-coupon bonds. For instance, ATSM gauges a fixed-income bond's estimated Value at Risk (VaR).

Key Takeaways

- The Affine Term-Structure Model refers to a stochastic interest rate model that facilitates the determination of the yield curve dynamics of interest-yielding assets

- Affine models are a flexible and intuitive financial framework for effectively pricing fixed-income securities and derivatives.

- It is a valuable mechanism for policymakers, portfolio managers, investors, and other market participants handling risk management, asset allocation, asset pricing, financial planning, and decision-making.

- The two common ATMs are the Vasicek Model and Cox-Ingersoll-Ross (CIR) Model.

Affine Term-Structure Model Explained

The Affine Term-Structure Model (ATSM) is a widely used framework in finance to study the behavior of interest rates and the term structure of interest rates. Its use is prevalent in the pricing of fixed-income securities and derivatives. Such models assume that interest rates evolve based on a system of Stochastic Differential Equations (SDEs). These equations capture essential characteristics such as mean reversion (where asset prices return to their normal levels after significant shifts) and volatility, allowing for realistic modeling of interest rate dynamics.

The ATSM differs from other systems/models in terms of its “affine” nature, which implies a linear relationship between the state variables and the conditional expectation of interest rates. This linearity facilitates the derivation of closed-form solutions for pricing various fixed-income instruments, giving it an advantage over other models that require numerical techniques. Moreover, it functions on the following two major components:

- The short rate represents the instantaneous interest rate,

- Term structure, which describes the evolution of the entire yield curve.

Examples

The affine models are widely used statistical techniques in finance and economics to describe the term structure of interest rates. It assumes that the instantaneous spot interest rate follows an affine process, which is a linear combination of state variables. Here are a few examples of ATSM:

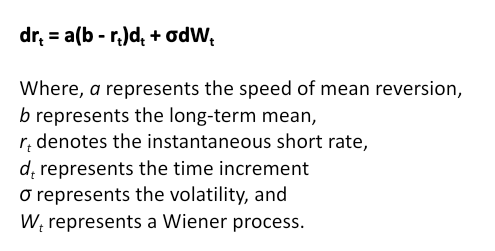

Example #1 - Vasicek Model

The Vasicek Model is a simple and early affine term-structure model. It postulates that the instantaneous spot rate follows a mean-reverting process driven by a single source of risk. The model can be represented by the following Stochastic Differential Equation (SDE):

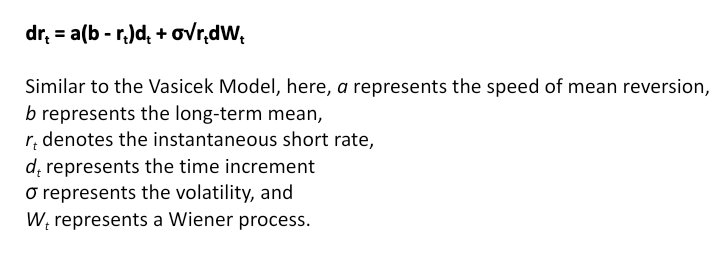

Example #2 - Cox-Ingersoll-Ross (CIR) Model

The CIR Model is an extension of the Vasicek Model that overcomes some limitations. It introduces a non-negative volatility parameter to prevent the spot rate from becoming negative. The following SDE describes the CIR Model:

Applications In Portfolio Management

The affine term-structure model is applied to portfolio management to optimize fixed-income securities and interest-rate derivatives pricing. Some of its common applications are:

- Yield Curve Estimation: The model is employed to analyze the term structure of interest rates by fitting observed market prices of fixed-income securities. Thus, it enables the determination of forward rates and yield curves, essential for portfolio valuation, risk management, and asset allocation decisions.

- Risk Management: Portfolio managers can use the affine term-structure model to calculate interest rates risk measures, such as duration and convexity. These metrics help assess the sensitivity of portfolios to changes in interest rates. Understanding these risk exposures enables managers to adopt suitable hedging strategies and adjust portfolio allocations to manage interest rate risk effectively.

- Asset Allocation: By providing forward rates and yield curves, ATSM facilitates the evaluation of different fixed-income securities and the development of optimal asset allocation strategies. By tracking future interest rate movements, managers can select bonds with favorable risk-return profiles and make informed decisions about their portfolio allocations.

- Asset Pricing: ATSM helps predict interest rate trends and understand yield curve dynamics, which are crucial data points while ensuring the optimal pricing of financial market assets such as interest-yielding bonds.

- Option Pricing: The affine term-structure model is also used for pricing interest rate derivatives, including bond options, interest rate swaps, and swaptions. Portfolio managers can apply these pricing techniques to value and manage derivative positions within their portfolios and assess the potential impact of adding or hedging derivative instruments.

- Financial Planning and Decision Making: This model allows for simulating various interest rate scenarios. Thus, policymakers, portfolio managers, consumers, and other market participants can gauge the current, past, and future economic trends for robust financial planning and decision-making.