Table Of Contents

#1 - What is Free Cash Flow to Firm or FCFF

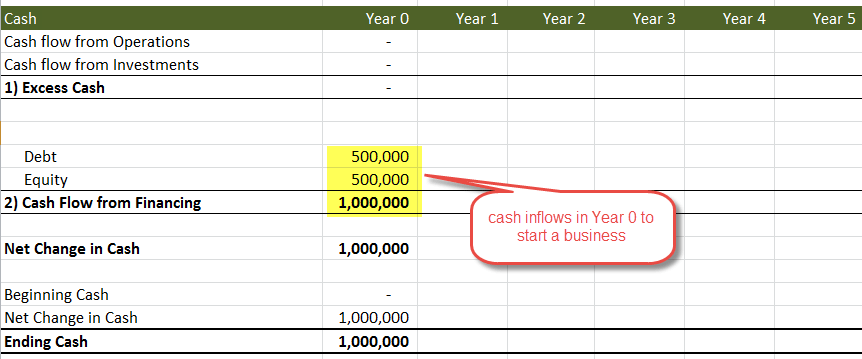

In order to gain an intuitive understand of Free Cash Flow to Firm (FCFF), let us assume that there is a guy named Peter who started his business with some initial equity capital (let us assume $500,000), and we also assume that he takes a bank loan of another $500,000 so that his overall finance capital stands at $1000,000 ($1 million).

- The business will begin earning revenues, and there would be some associated expenses.

- As for all the businesses, Peter's business also requires constant maintenance capital expenditure in assets each year.

- Debt Capital Raised in year 0 is $500,000

- Equity Capital raised in year 0 is $500,000

- There is no cash flow from operations and cash flow from investments as the business is yet to start.

What is Free Cash Flow to Firm? | Explanation on Video

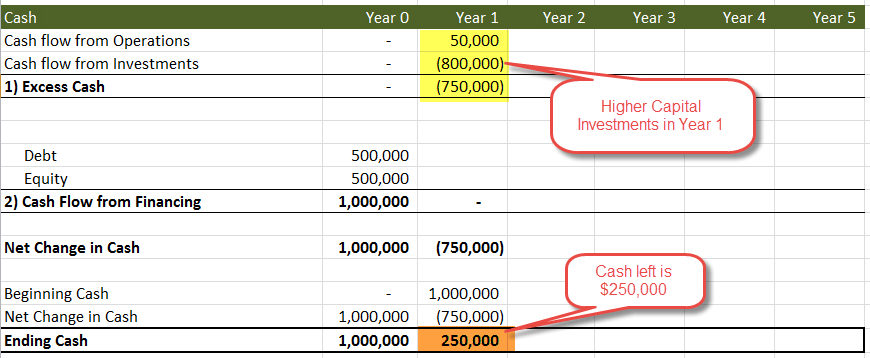

Scene # 1 - Peter's Business with not enough earnings

Year 1

- We assume that the business has just started and generates a modest $50,000 in year 1

- Cash flow from Investments in Assets is higher at $800,000

- Net Cash position at the end of the year is $250,000

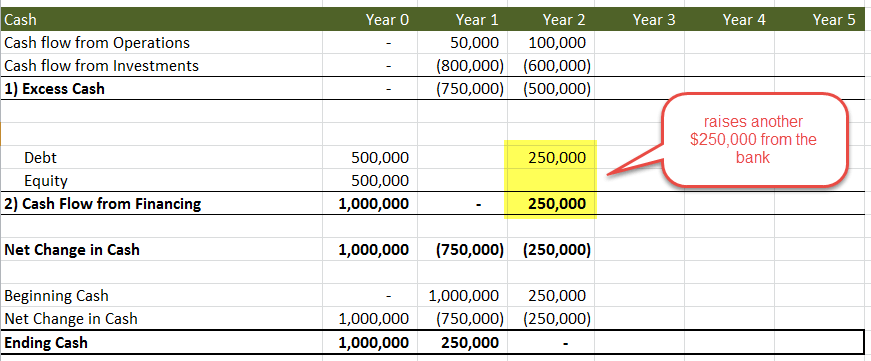

Year 2

- Let us now assume that Peter's business generated only $100,000 in Year 2

- In addition, in order to maintain and run the business, he needs to regularly invest in assets (maintenance Capex) of $600,000

- What do you think will happen in such a situation? Do you think the Cash at the beginning of the year is sufficient?- NO.

- Peter will need to raise another set of capital - this time, let us assume he raises another $250,000 from the bank.

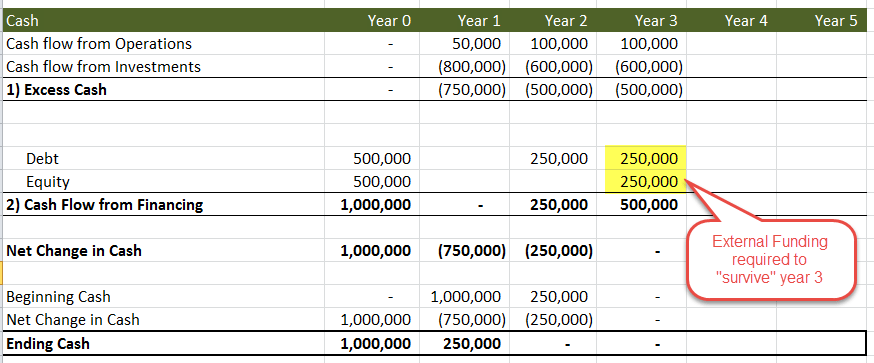

Year 3

- Now let us analyze a stressed situation for Peter :-). Assuming that his business is not doing well as expected and was able to generate only $100,000

- Also, as discussed earlier, maintenance capital expenditure cannot be avoided; Peter must spend another $600,000 to keep the assets running.

- Peter will require another set of external funding to the tune of $500,000 to keep the operations running.

- Debt financing of another $250,000 at a relatively higher rate and Peter invests another $250,000 as equity capital.

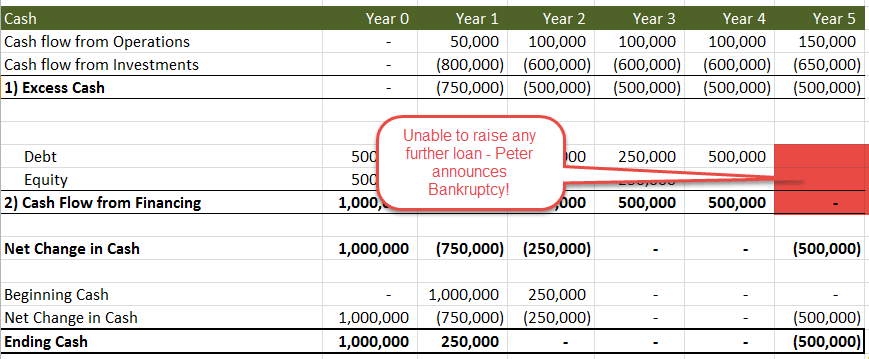

Year 4

- Again in year 4, Peter's business was able to generate only $100,000 as cash flows from operations.

- Maintenance capital expenditure (unavoidable) is at $600,000

- Peter requires another set of funding of $500,000. This time, let us assume that he doesn't have any amount as equity capital. He again approaches the bank for another $500,000. However, this time the bank agrees to give him a loan at a very high rate (given the business is not in good shape and his earnings are uncertain)

Year 5

- Yet again, Peter was only able to generate $100,000 as cash flows from core operations

- Capital expenditure that is unavoidable still stands at $600,000

- This time the Bank declines to give any further loan!

- Peter is unable to carry forward the business for another year and files for bankruptcy!

- After filing for bankruptcy, Peters business assets are liquidated (sold) at $1,500,000

How much the bank receives?

Bank has given a total loan of $1500,000. Since Bank has the first right to recover their loan amount, the amount received on liquidation will be first used to serve the Bank, and Peter will receive the remaining excess amount (if any). In this case, Bank was able to recover their invested amount as the liquidation value of Peter's Asset is at $1,500,000

How much Peter (shareholder) receives?

Peter has invested his own capital (equity) of $750,000. In this case, Peter receives no money as all the liquidated amount goes to the serving of the bank. Please note the return to the shareholder (Peter) is zero.

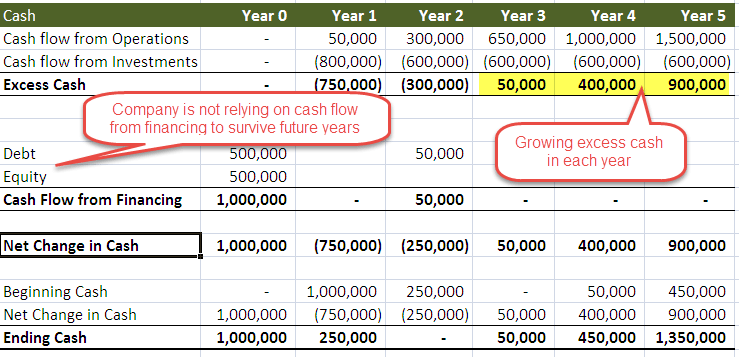

Scene # 2 - Peter's Business Grows and show's recurring earnings

Let us now take another case study where Peter's business is not doing badly and growing each year.

- Peter's business steadily grows from CFO of $50,000 in year 1 to CFO of 1,500,000

- Peter raises only $50,000 in year two due to liquidity requirements.

- After that, he does not need any other set of cash flow from financing to “survive” the future years

- Ending cash for Peter's Company grows to $1350,000 at the end of year 5

- We see that excess cash is positive (CFO + CFI) from year three and is growing every year.

How much the bank receives?

Bank has given a total loan of $550,000. In this case, Peter's business is doing well and generating positive cash flows; he can pay off the bank loan and interest within the mutually agreed time frame.

How much Peter (shareholder) receives?

Peter has invested his capital (equity) of $500,000. Peter has 100% ownership in the firm, and his equity return will now depend on the valuation of this business that generates positive cash flows.

# 2 - Layman's Definition of Free Cash Flow to Firm (FCFF)

To appreciate the layman’s definition of Free Cash Flow to the firm or FCFF, we must make a quick comparison of Case Study 1 and Case Study 2 (discussed above)

| Item | Case Study 1 | Case Study 2 |

| Revenues | Stagnant, not growing | Growing |

| Cash flow from operations | Stagnant | Increasing |

| Excess Cash (CFO + CFI) | Negative | Positive |

| The trend in Excess Cash | Stagnant | Increasing |

| Requires Equity or Debt to business continuity | yes | No |

| Equity Value / Shareholder's Value | Zero or very low | More than Zero |

Lessons from the two case studies

- If excess cash (CFO + CFI) is positive and growing, the company has value

- If Excess Cash (CFO + CFI) is negative for an extended period of time, then the return to the shareholder may be very low or closer to zero

Intuitive Definition of Free Cash Flow to the firm - FCFF

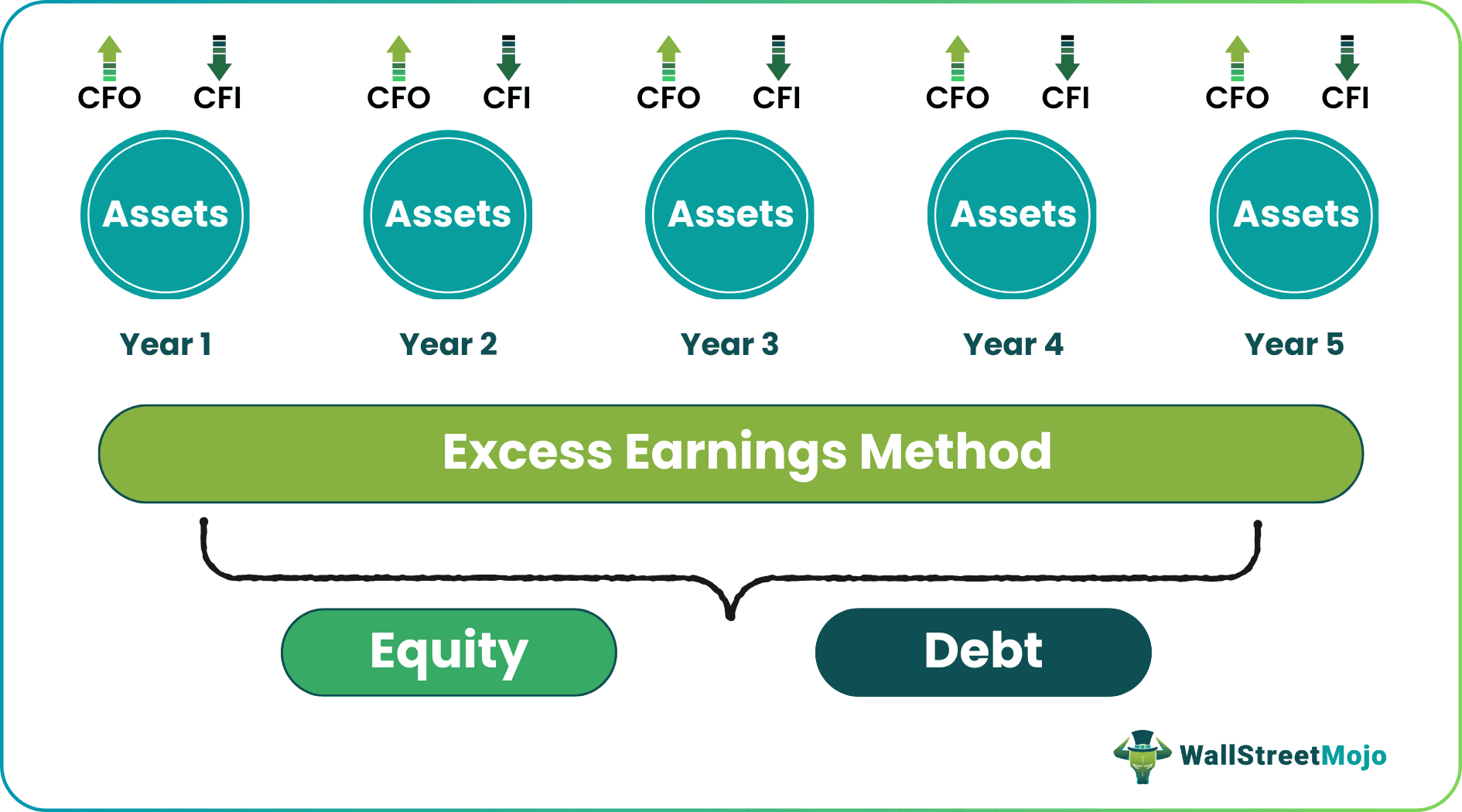

"Excess Cash" is nothing but Free Cash Flow to Firm or FCFF calculation. DCF valuation focuses on the cash flows generated by the Operating Assets of the business and how it maintains those assets (CFI).

FCFF formula = Cashflows from operations (CFO) + Cashflows from Investments (CFI)

A business generates cash by supplying and selling goods or services through its daily operations. Some cash has to go back into the business to renew fixed assets and support working capital. If the business is doing well, it should generate cash over and above these requirements. Any extra cash is free to go to the debt and equity holders. The extra cash is known as Free Cash Flow to firm.

#3 - Free Cash Flow - Analyst's Formula

Free Cash Flow to firm formula can be represented in the following Three way -

1) FCFF Formula starting with EBIT

Free Cash Flow to Firm or FCFF Calculation = EBIT x (1-tax rate) + Non Cash Charges + Changes in Working capital - Capital Expenditure

| Formula | Comments |

| EBIT x (1-tax rate) | Flow to total capital, Removes capitalization effects on earnings |

| Add: Non-Cash Charges | Add back all non-cash charges like Depreciation, Amortization |

| Add: Changes in working capital | It can be outflow or inflow of cash. Watch for large swings year-to-year in forecasted working capital |

| Less: Capital expenditure | Critical to determining CapEx levels required to support sales and margins in the forecast |

2) FCFF formula starting with Net Income

Net Income + Depreciation & amortization + Interest x (1-tax) + changes in Working Capital - Capital Expenditure

3) FCFF Formula starting with EBITDA

EBITDA x (1-tax rate) + (Dep & Amortization) x tax rate + changes in Working Capital - Capital Expenditure

I will leave it to you to reconcile one formula with the other one. Primarily you can use any of the given FCFF formulas. As an Equity analyst, I found it easier to use the formula that started with EBIT. Here is a screenshot of how the calculation looks like within the course.

Image source: Financial Modeling and Valuation

Additional notes on FCFF Formula Items

Net Income

- Net income is taken directly from the Income statement.

- It represents the income available to shareholders after taxes, depreciation, amortization, interest expenses, and the payment to preferred dividends.

Non Cash Charges

- Non-cash charges are items that affect net income but do not involve cash payment. Some of the common non-cash items are listed below.

| Non-cash items | Adjustment to Net Income |

| Depreciation | Addition |

| Amortization | Addition |

| Losses | Addition |

| Gains | Subtraction |

| Restructuring charges (expense) | Addition |

| Reversal of restructuring reserve (income) | Subtraction |

| Amortization of bond discount | Addition |

| Amortization of bond premium | Subtraction |

| Deferred taxes | Addition |

After-tax Interest

- Since interest is tax-deductible, after-tax interest is added to the net income

- Interest cost is cash flow to one of the firm's stakeholders (debt holders), and hence, it forms a part of FCFF.

Capital Expenditure

- Investment in fixed assets is the cash outflow required for the company to maintain and grow its operations.

- A company may acquire assets without expending cash by using stock or debt.

- The analyst should review the footnotes, as these asset acquisitions may not have used cash and cash equivalents in the past, but may affect the forecast of future Free Cash Flow to Firm

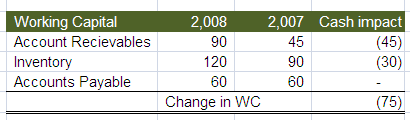

Change in Working Capital

- The working capital changes that affect FCFF are items such as Inventories, Accounts Receivables, and Accounts Payable.

- This definition of working capital excludes cash and cash equivalents and short-term debt (notes payable and the current portion of long term debt payable).

- Do not include non-operating current assets and liabilities, e.g., dividends payable, etc.

# 4 - FCFF Example in Excel

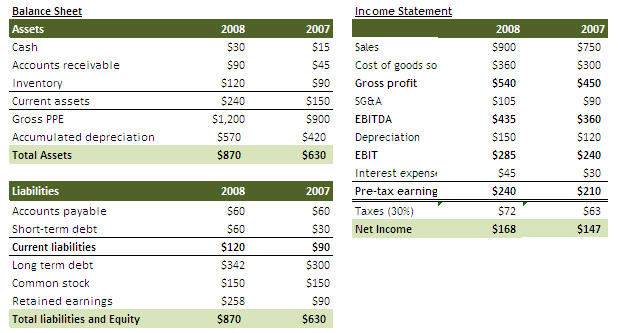

With the above understanding of the formula, let us now look at the firm's working example of calculating Free Cash Flows. Let us assume that you have been provided the Balance Sheet and Income Statement for a company as provided below. You can download the FCFF Excel Example here

Calculate FCFF (Free Cash Flow to Firm) for the year of 2008

Solution

Let us try to solve this problem using the EBIT approach.

FCFF Formula = EBIT x (1-tax) + Dep & Amort + Changes in Working Capital - Capital Expenditure

EBIT = 285, tax rate is 30%

EBIT x (1-tax) = 285 x (1-0.3) = 199.5

Depreciation = 150

Changes in Working Capital

Capital Expenditure = change in Gross Property Plant and Equipment (Gross PPE) = $1200 - $900 = $300

FCFF calculation = 199.5 + 150 - 75 - 300 = -25.5

Calculating Free Cash Flow for a Firm is fairly straightforward. Why don't you calculate FCFF using the other two FCFF formulas – 1) Starting with Net Income, 2) Starting with EBITDA

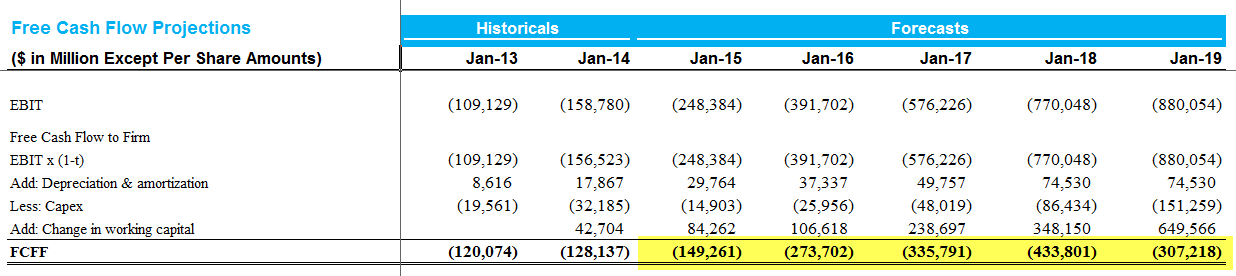

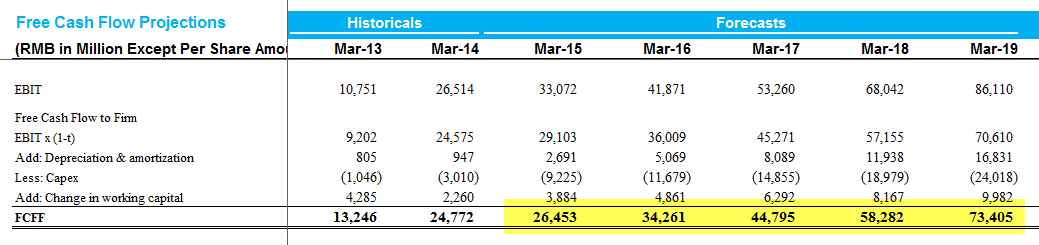

#5 - Alibaba FCFF - Positive and Increasing FCFF

On 6th May 2014, Chinese E-commerce heavyweight Alibaba filed a registration document to go to public in the US in what may be the mother of all Initial Public Offerings in the US history. Alibaba is a fairly unknown entity in the US and other regions, though its massive size is comparable or even bigger than Amazon or eBay. I used a Discounted Cash Flow approach for Alibaba's valuation and found that this amazing company is valued at $191 billion dollars!

For Alibaba DCF, I had made the financial statement analysis, forecast financial statements and then calculate Free Cash Flow to the Firm. You can download Alibaba Financial Model here.

Presented below is the Free Cash Flow to the Firm of Alibaba. The Free Cash flow is divided into a) Historical FCFF and b) Forecast FCFF.

- Historical Free Cash Flow to Firm is arrived at from the Income Statement, Balance Sheet, and Cash Flows of the company from its Annual Reports.

- Forecast Free Cash Flow to Firm calculation is done only after forecasting the Financial Statements (we call this as preparing the financial model in excel). Financial Modeling fundamentals is slightly tricky, and I will not discuss the details and types of Financial Models in this article.

- We note that Alibaba's Free Cash Flow to the firm is increasing year after year

- To find the valuation of Alibaba, we must find the present value of all the future financial years (till perpetuity - Terminal value)

#6 - Box FCFF - Negative and Growing

On 24th March 2014, Online storage company Box filed for an IPO and unveiled its plans to raise US$250 million. The company is in a race to build the largest cloud storage platform, and it competes with the biggies like Google Inc and its rival, Dropbox. If you want to understand further on how Box is valued, please refer to my article on Box IPO Valuation

Below are the projections of Box FCFF for the next 5 years

- Box is a classic case of high growth cloud company which is surviving due to Cash Flow from Finance (refer Case Study # 1)

- The box is growing at a very fast pace and should be able to generate Free Cash Flows in the future.

- Since Box Free Cash Flow to Firm is negative for the next five years, it may not be wise for us to calculate the value of Box using the Discounted Cash Flow approach. In this case, the approach using Relative Valuation is suggested.

- I am rather scared of this IPO and, in fact, wrote an article on Top 10 Scariest Details of Box IPO. Please note that one of the scariest details in Box IPO is the company's Negative Free Cash Flow.

# 7 - Why does Free Cash Flows Matter

- EPS can be tweaked, but Free Cash Flow to Firm can't - Though EPS is widely used to measure the company's performance, however, EPS can be easily tweaked (due to accounting policies gimmicks) by the management and may not necessarily be the best measure for performance. It is best advised to use a measure that is free from accounting gimmicks. Free Cash flow to the firm can be one such measure that cannot be manipulated by Accounting Changes.

- Cannot go bust soon if Free Cash Flow to Firm positive and growing -Companies that produce consistently higher and growing levels of Free Cash Flows are unlikely to go bust any time soon, and investors should take this into account while investing in the firm.

- Good indicator for Investors seeking Capital Appreciation - For growth-oriented investors, companies with high Free Cash Flows to the firm are likely to invest their free cash for the Capex that are necessary to grow their core business. Growing levels of Free Cash Flows are generally an excellent indicator of future earnings gains.

- A good indicator for Investors seeking Regular dividends – For income investors, Free Cash Flows can be a reliable indicator of a company’s ability to maintain its dividend or even increase its payout.

Now that you know Free Cash flow to the firm, What about FCFE - Free Cash flow to Equity? Check out a detailed article on Free Cash Flow to Equity here.

Conclusion

We note that the excess cash generated by the company (CFO+CFI) can be approximated as Free Cash Flow to the Firm. We also note that EPS may not be the best measure to gauge the company’s performance as it is susceptible to accounting gimmicks by the management. A better way to measure the company’s performance by Investment banks and investors is to calculate Free Cash Flow to Firm (FCFF). It looks at the company's ability to survive and grow without external funding sources (equity or debt). Discounting all future Free Cash Flow to the firm provided us with the Enterprise Value of the Firm. Additionally, FCFF is widely used not only by the growth investors (looking for capital gain) but also by income investors (looking for regular dividends). Positive and growing FCFF signifies excellent future earning capabilities; however, negative and stagnant FCFF may be a cause of worry for the business.