Table Of Contents

What Is Profit And Loss Statement Format (P/L)?

The following Profit and Loss Statement Format outlines the most common Income Statement. It is impossible to provide a complete set of examples that address every variation in every situation since there are thousands of such Profit and Loss Statements formats based on geography, accounting policies, etc.

Income Statements and P&L Accounts are used interchangeably. It is also known as the statement of operations, earnings statement, financial results or income, or expense statement.

Profit And Loss Statement Format Explained

The profit and loss statement format is also called the income statement and it is used to show the details of revenue earned and expenses incurred during an accounting period. Based on this information, the profit or loss is calculated during year ending to understand the profitability of the company.

The statement of profit and loss account format is an integral part of the financial statement and reporting, which is not only used by the management but also other stakeholders to take important decisions regarding investments and other plans of growth and expansion. It is a snapshot of the company’s overall performance during the financial year.

Thus, the format summarizes all transactions related to revenue, cost and expenses that the business incurs and acts as a guide to evaluate whether the business is able to generate enough revenue and profit to make it not only sustainable but also competitive and growing in order to ensure good future prospects.

A simple profit and loss statement format is combined along with the balance sheet and the cash flow statement, each of which has a particular format to assess the profitability and financial health of the company. The format can be prepared in the form of either the accrual method or the cash method of accounting that gives an in-depth knowledge of the transactions and can be compared with income statements across different periods to derive useful and meaningful result.

The stage at which Profit & Loss Account is prepared

Contents

This statement of profit and loss account format and an integral part of the financial statement that every public company has to issue. It can be in an annual format or a monthly format, but it is a compulsory process for the purpose of information for stakeholders. In the entire business plan, the format for profit and loss will give an idea about not only the current financial condition but also help in deciding the future or action related to production plan, pricing, inventory levels, budgeting and any other business-related issues.

There is no particular format for P&L Account under GAAP, IFRS, and Indian GAAP. Many customized formats are used. But the P&L Account must include these items:

- Revenue

- Returns

- Net Revenue

- Cost of Goods Sold

- Gross Profit

- Advertising & Promotion

- Depreciation & Amortization

- Rent and Office Expenses

- Salaries

- SG&A Expenses

- EBIT

- Interest Expense

- EAT

- Income Taxes

- Net Earnings

Examples

Let us understand the concept with the help of some suitable examples, which will clearly explain the different types of format, namely the monthly and annual statement. The examples also include the simple profit and loss statement format typically followed by any Indian company to account for the transaction details related to expenses, revenue and cost.

Example#1

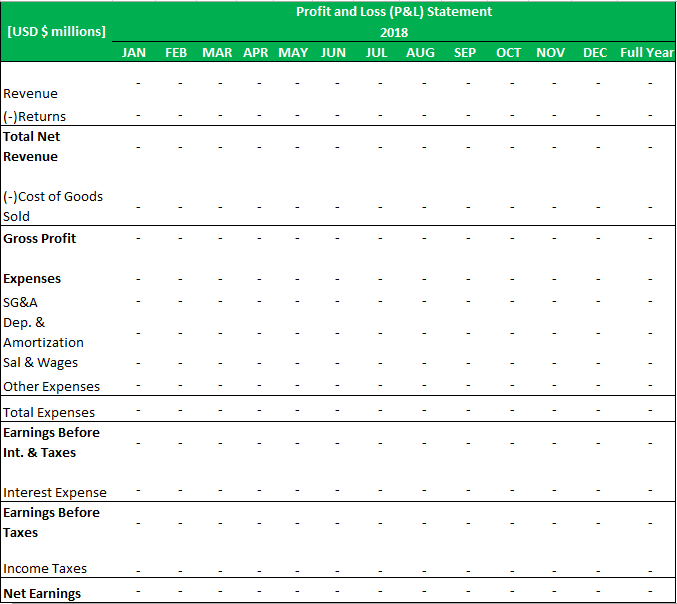

The monthly P&L template is suitable for companies that require regular reporting and detail. All the information is shown in a series of monthly columns.

This format is apt for small, medium, and large companies.

Here, XYZ is a US-based company that follows GAAP.

Example#2

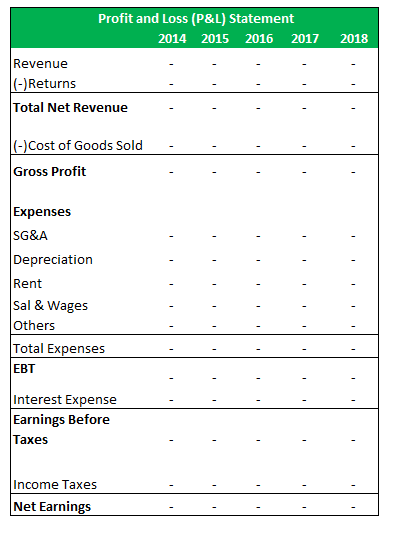

Companies have used this type of profit and loss statement format for many years. This format is suitable for any size company and can easily be customized. It is also useful for analyzing performance YOU.

XYZ is a UK-based company in operation for many years.

Example#3

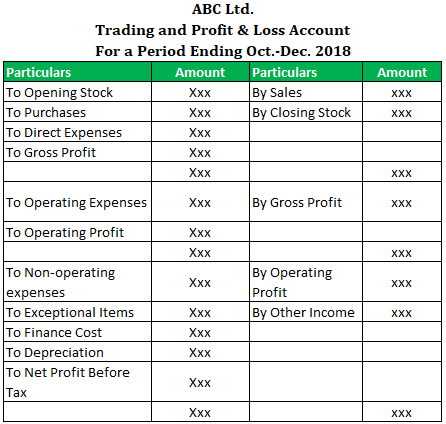

Indian Companies must prepare the Profit & Loss Account as per Schedule III of the Companies Act, 2013.

In India, there are two formats of P&L statements.

- The horizontal format of the P&L Account

- The vertical format of the P&L Account

The “T-shaped structure” for preparing the P&L account is used in a horizontal format. It has two sides – Debit & Credit.

ABC Ltd. is an Indian company. It prepares the P&L Statement as per the schedule of the Companies Act.

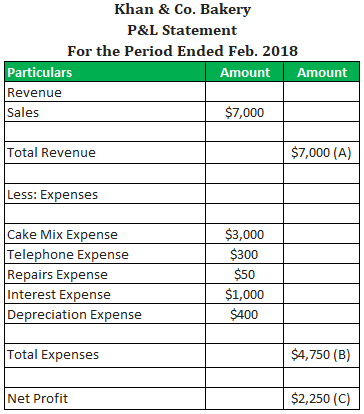

However, in vertical format, there is no use of a T-shaped structure. In this, the figures from trial balance are used.

Khan & Co. The bakery is an Indian company that uses a vertical format for a P&L statement.

From the above examples, we come to know of the different possible formats of the same in details. A simple or comparative profit and loss statement format are suitable for all types of business structures and reveal information that can be used successfully for analysis of profitability, or the return on equity(ROE) through comparison of the net income calculated as per the income statement with the value of shareholder equity given in the balance sheet. The investors and analysts due detailed study on this to ensure investment decisions related to lending or investment in stocks, and evaluate the future of the business.

A profit and Loss Statement is prepared to ascertain the company's net profit or net loss during the accounting accounting period. This is one of the most important objectives of the business. A simple or comparative profit and loss statement format is also important to various other parties. It also summarizes our revenue and expenses, thus analyzing how money has come and how it goes out.

Recommended Articles

his is a guide to what is Profit and Loss Statement Format. We explain its content along with some suitable examples depicting different format. You may learn more about accounting from the following articles –