Table Of Contents

What Are Financial Ratios?

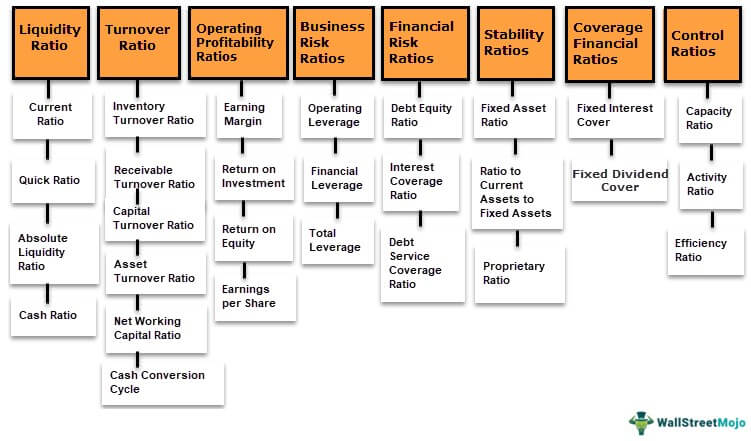

Financial ratios are the indicators of the financial performance of companies. Different financial ratios indicate the company's results, financial risks, and working efficiency, like the liquidity ratio, asset turnover ratio, operating profitability ratios, business risk ratios, financial risk ratios, stability ratios, etc.

They are the best tools used by the company's management and stakeholders to understand its financial health, risk appetite, overall performance, and growth levels. They act as guidance while making financial and investment-related decisions because they provide an insight into the current conditions and future opportunities.

Table of contents

- What Are Financial Ratios?

- Financial ratios are a crucial indicator of a company's overall financial performance and health.

- These ratios offer valuable insights into various aspects of the company's operations, including its financial results, potential risks, and operational efficiency. They cover important areas such as liquidity, asset turnover, operating profitability, business risk, financial risk, and stability.

- An efficiency ratio of 100% or higher is regarded as a positive sign, indicating that the company is effectively utilizing its resources to generate revenue and maximize its operational efficiency.

Financial Ratios Explained

The financial ratios are a perfect quantitative metric that is used to measure the financial condition of the company. It is a process that is used to bring out the current picture of the business as well as make forecasts related to the future possibilities for growth and expansion.

These financial key ratios are extremely useful for management decision making and stakeholders understanding. They are easy to interpret as well as calculate, making them very a very important tool for company evaluation. The management, investors, analysts, etc can use analysis of financial ratios for measuring profitability, efficiency, solvency and financial position.

This makes stakeholders take informed decisions. In this article we will learn about some important and commonly used financial ratios that provide insight into the various aspects of the company’s performance. These ratios are also used in combination with each other so as to get a better understanding of the and a comprehensive view of the company’s financial health. However, along with the ratios, it is equally important to factor in the market performance, economic conditions, company or industry specific factors, etc. Otherwise the information will lead to incomplete analysis.

Financial Ratios Explained in Video

Types

Below are the types and list of financial ratios that are very widely used in every business. Let us identify them:

- Current Ratio

- Quick Ratio

- Absolute Liquidity Ratio

- Cash Ratio

- Inventory Turnover Ratio

- Receivables Turnover Ratio

- Capital Turnover Ratio

- Asset Turnover Ratio

- Net Working Capital Ratio

- Cash Conversion Cycle

- Earnings Margin

- Return on Investment

- Return on Equity

- Earnings Per Share

- Operating Leverage

- Financial leverage

- Total Leverage

- Debt-Equity Ratio

- Interest Coverage Ratio

- Debt Service Coverage Ratio

- Fixed Asset Ratio

- Current Asset to Fixed Asset

- Proprietary Ratio

- Fixed Interest Cover

- Fixed Dividend Cover

- Capacity Ratio

- Activity Ratio

- Efficiency Ratio

Formulas

Given below are some important formula that the company management and stakeholders use for analysis of financial ratios and company evaluation. They are divided as per the type of analysis they perform. Let us study them in details.

Liquidity Ratio Analysis

The first type of financial ratio analysis is the liquidity ratio. It aims to determine a business's ability to meet its financial obligations during the short term and maintain its short-term debt-paying ability. One can calculate the liquidity ratio in multiple ways. They are as follows: –

#1 - Current Ratio

The current ratio is a working capital ratio or banker's ratio. The current ratio expresses the relationship between a current asset to current liabilities.

Formula = Current Assets / Current Liabilities

One can compare a company's current ratio with the past current ratio; this will help to determine if the current ratio is high or low at this period in time.

The ratio of 1 is ideal; if current assets are twice a current liability. No issue will be in repaying liability. However, if the ratio is less than 2, repayment of liability will be difficult and affect the work.

#2 - Acid Test Ratio/ Quick Ratio

Generally, one can use the current ratio to evaluate an enterprise’s short-term solvency or liquidity position. Still, it is often desirable to know a firm's more immediate status or instant debt-paying ability than that indicated by the current ratio for this acid test financial ratio. That is because it relates the most liquid assets to current liabilities.

Acid Test Formula = (Current Assets -Inventory)/(Current Liability)

One can write the quick ratio as: -

Quick Ratio Formula = Quick Assets / Current Liabilities

Or

Quick Ratio Formula = Quick Assets / Quick Liabilities

#3 - Absolute Liquidity Ratio

Absolute liquidity is also among another financial key ratios that helps to calculate actual liquidity. And for that, inventory and receivables are excluded from current assets. In addition, some assets ban to understand better liquidity. Ideally, the ratio should be 1:2.

Absolute Liquidity = Cash + Marketable Securities + Net Receivable and Debtors

#4 - Cash Ratio

The Cash ratio is useful for a company undergoing financial trouble.

Cash Ratio Formula = Cash + Marketable Securities / Current Liability

If the ratio is high, then it reflects the underutilization of resources. If the ratio is low, it can lead to a problem in the repayment of bills.

Turnover Ratio Analysis

The second type of financial ratio analysis is the turnover ratio. The turnover ratio is also known as the activity ratio. This ratio indicates the efficiency with which an enterprise’s resources utilize. Again, the financial ratio can be calculated separately for each asset type.

The following are financial ratios commonly calculated:-

#5 - Inventory Turnover Ratio

This financial ratio measures the relative inventory size and influences the cash available to pay liabilities.

Inventory Turnover Ratio Formula = Cost of Goods Sold / Average Inventory

#6 - Debtors or Receivable Turnover Ratio

The receivable turnover ratio shows how often the receivable turns into cash.

Receivable Turnover Ratio Formula = Net Credit Sales / Average Accounts Receivable

#7 - Capital Turnover Ratio

The capital turnover ratio measures the effectiveness with which a firm uses its financial resources.

Capital Turnover Ratio Formula = Net Sales (Cost of Goods Sold) / Capital Employed

#8 - Asset Turnover Ratio

This financial ratio reveals the number of times the net tangible assets turns over during a year. The higher the ratio better it is.

Asset Turnover Ratio Formula = Turnover / Net Tangible Assets

#9 - Net Working Capital Turnover Ratio

This financial ratio indicates whether or not working capital has been utilized effectively in sales. Net Working Capital signifies the excess of current assets over current liabilities.

Net Working Capital Turnover Ratio Formula = Net Sales / Net Working Capital

#10 - Cash Conversion Cycle

The Cash Conversion Cycle is the total time taken by the firm to convert its cash outflows into cash inflows (returns).

Cash Conversion Cycle Formula = Receivable Days + Inventory Days – Payable Days

Operating Profitability Ratio Analysis

The third type of financial key ratios used in financial ratio analysis is the operating profitability ratio. The profitability ratio helps to measure a company's profitability through this efficiency of business activity. The following are the important profitability ratios:-

#11 - Earning Margin

It is the ratio of net income to turnover expressed in percentage. It refers to the final net profit used.

Earning Margin formula = Net Income / Turnover * 100

#12 - Return on Capital Employed or Return On the Investment

This financial ratio measures profitability concerning the total capital employed in a business enterprise.

Return on Investment formula = Profit Before Interest and Tax / Total Capital Employed

#13 - Return On Equity

Return on equity derives by dividing net income by shareholder’s equity. It provides a return that management realizes from the shareholder's equity.

Return on Equity Formula = Profit After Taxation - Preference Dividends / Ordinary Shareholder's Fund * 100

#14 - Earnings Per Share

EPS derives by dividing the company’s profit by the total number of shares outstanding. It means profit or net earnings.

Earnings Per Share Formula = Earnings After Taxation - Preference Dividends / Number of Ordinary Shares

Before investing, the investor uses all the above ratios to maximize profit and analyze risk. He can easily compare and predict a company’s future growth through ratios. It also simplifies the financial statement.

Business Risk Ratios

The fourth type of financial ratio analysis is the business risk ratio. Here, we measure how sensitive the company's earnings are concerning its fixed costs and the assumed debt on the balance sheet.

#15 - Operating Leverage

Operating leverage is the percentage change in operating profit relative to sales. It measures how sensitive the operating income is to the change in revenues. The greater the use of fixed costs, the more significant the impact of a change in sales on a company's operating income.

Operating Leverage Formula = % Change in EBIT / % Change in Sales

#16 - Financial Leverage

Financial leverage is the percentage change in net profit relative to operating profit, and it measures how sensitive the net income is to the change in operating income. Financial leverage primarily originates from the company's financing decisions (debt usage).

Financial Leverage Formula = % Change in Net Income / % Change in EBIT

#17 - Total Leverage

Total leverage is the percentage change in net profit relative to its sales. The total leverage measures how sensitive the net income is to the change in sales.

Total Leverage Formula = % Change in Net Profit / % Change in Sales

Financial Risk Ratio Analysis

The fifth type of financial ratio is the financial risk ratio. Here, we measure how leveraged the company is and placed concerning its debt repayment capacity.

#18 - Debt Equity Ratio

Debt Equity Formula = Long Term Debts / Shareholder's Fund

It helps to measure the extent of equity to repay debt. One may use it for long-term calculations.

#19 - Interest Coverage Ratio Analysis

This financial ratio signifies the ability of the firm to pay interest on the assumed debt.

Interest Coverage Formula = EBITDA / Interest Expense

- Higher interest coverage ratios imply the greater ability of the firm to pay off its interests.

- If interest coverage is less than 1, then EBITDA is insufficient to pay off interest, implying finding other ways to arrange funds.

#20 - Debt Service Coverage Ratio (DSCR)

The Debt Service Coverage Ratio tells us whether the operating income is sufficient to pay off all obligations related to debt in a year.

Debt Service Coverage Formula = Operating Income / Debt Service

Operating Income is nothing but EBIT

Debt Service is Principal Payments + Interest Payments + Lease Payments

- A DSCR of less than 1.0 implies that the operating cash flows are insufficient for debt servicing, indicating negative cash flows.

Stability Ratios

The sixth type of financial ratio analysis is the stability ratio. It is used with a long-term vision and to check the company’s stability in the long run. One can calculate this type of ratio analysis in multiple ways. They are as follows: –

#21 - Fixed Asset Ratio

This ratio one may use to know whether the company is having good fun or not to meet the long-term business requirement.

Fixed Asset Ratio Formula = Fixed Assets / Capital Employed

The ideal ratio is 0.67. If the ratio is less than 1, one can use it to purchase fixed assets.

#22 - Ratio to Current Assets to Fixed Assets

Ratio to Current Assets to Fixed Assets = Current Assets / Fixed Assets

IIf the ratio increases, profit increases and reflects the business expansion. If the ratio decreases, trading is loose.

#23 - Proprietary Ratio

The proprietary ratio is the ratio of shareholder funds to total tangible assets; it discusses a company’s financial strength. Ideally, the ratio should be 1:3.

Proprietary Ratio Formula = Shareholder Fund / Total Tangible Assets

Coverage Ratios

The seventh type of financial ratio analysis is the coverage ratio. This ratio analysis one may use to calculate dividends needed to pay to investors or interest to the lender. The higher the cover, the better it is. One may estimate it in the below ways: –

#24 - Fixed Interest Cover

It measures business profitability and its ability to repay the loan.

Fixed Interest Cover Formula = Net Profit Before Interest and Tax / Interest Charge

#25 - Fixed Dividend Cover

It helps to measure the dividends needed to pay the investor.

Fixed Dividend Cover Formula = Net Profit Before Interest and Tax / Dividend on Preference Share

Control Ratio Analysis

The eighth type of financial ratio analysis is the control ratio. It controls things by management. For example, this ratio analysis helps management check favorable or unfavorable performance.

#26 - Capacity Ratio

For this type of ratio analysis, one can use the formula below for the same.

Capacity Ratio Formula = Actual Hour Worked / Budgeted Hour * 100

#27 - Activity Ratio

For calculating a measure of activity below, one may use the formula:

Activity Ratio Formula = Standard Hours for Actual Production / Budgeted Standard Hour * 100

#28 - Efficiency Ratio

For calculating productivity, below is the formula:

Efficiency Ratio Formula = Standard Hours for Actual Production / Actual Hour Worked * 100

If it is 100% or more, it is considered favorable. But, if it is less than 100%, it is unfavorable.

Examples

Let us understand the concepts of calculating financial ratios with the help of some suitable examples.

Example #1

For calculation of current ratio, let us assume the following for ABC ltd:

Cash - $30 million

Inventory - $25 million

Short term debts - $10 million

Accounts payable - $14 million

If we try to calculate the current ratio, it will be as follows:

Current ratio = Current Asset/Current Liability = (30+25)/ (10+14) = 55/24 = 2.29

Example#2

In this example, let us see how calculating financial ratios can be used for comparison.

Suppose Black Ltd and White Ltd are two pharmaceutical companies operating in the same region. But the inventory turnover ratio of Black Ltd is 25%, whereas that of White Ltd is 30%. From the above data, we can conclude that White Ltd is able to convert its inventory into sales must faster that Black Ltd because its inventory turnover ratio is higher that Black Ltd.

This also proves that White Ltd’s sale is higher, leading to higher revenue, increasing its chance of profit earning and customer base expansion. It also means that less capital is blocked in the form of inventory, which can be used for some other important purpose.

Importance

These financial ratios in accounting have a lot of importance in the financial market and provide valuable insight for analysts, investor, management, or anyone who has some interest in the overall performance of the company.

- Assessment – The most important use is the assessment or evaluation of performance, which helps investors or stakeholders take important financial and investment decisions.

- Comparison – The metrics can be successfully used to compare similar companies or businesses in the same industry to understand and identify the relative strength and weakness. This also helps in understanding the competitive position. Trend – The raios help in clarifying trends over a number of years to observe whether the company is improving or not. It indicates any improvement, fall or stability in its overall performance.

- Credit analysis – The method also helps in evaluating the credit condition of the business, which means whether they have the capacity to pay off the debts. High credit worthy companies have the facility of getting loans at lower interest rates and favourable credit terms.

- Problem identification – The financial ratios in accounting provide ways and means to identify problems which hinder the progress of the company. It is necessary to identity the problem areas and take steps to control or mitigate them on time so that they don’t accelerate into sometime negative, thus affecting the image and performance of the company.

- Management decision – The management monitors the performance and identify risk and opportunities for the best interest of the business and stakeholders. These ratios help in tracking progress, setting goals and ultimately enhance business efficiency.

Limitations

Let us understand the limitations of the process:

- Lack of proper context – They do not take into account the specific context or industry rules and specifications. One ratio may be good for one company but not suitable for another company even though they are in the same industry.

- Past data – They mostly deal with past data which may not reflect the current market condition of strategy changes.

- Variation in accounting methods – The methods of accounting followed in companies vary leading to inconsistency and differences in financial statements and interpretation of ratios.

- Window Dresssing – The management may use the ratios for making the financial statements and reports look good and profitable in order to attract more investors. This is sometimes difficult to detect and harmful for stakeholders.

- Lack of non-financial consideration – The ratios don’t take into account the non-financial factors like, management skills and quality, technological advancements, etc.

- The inflation effect – The effect of inflation over time on these financial ratios cannot be ruled out. Inflation affects the assets and liabilities over time.

Frequently Asked Questions (FAQs)

1. Why are financial ratios important?

Financial ratios are important because they provide valuable insights into a company's financial performance, profitability, liquidity, and overall health. They help investors, analysts, and stakeholders make informed decisions about investments, assess risk, and evaluate a business's financial stability and efficiency.

2. What financial ratios are important to investors?

Important financial ratios for investors include profitability ratios (such as return on equity and net profit margin), liquidity ratios (like current ratio and quick ratio), and solvency ratios (such as debt-to-equity ratio). These ratios help investors gauge the company's profitability, ability to meet short-term obligations, and long-term financial stability.

3. What are the limitations of financial ratios?

Financial ratios have limitations. They rely on historical financial data and may not capture future trends or market changes. Ratios can vary across industries, making comparing them within the same sector crucial. Additionally, ratios are based on accounting principles and may not reflect a company's true economic value or performance. It's important to consider other qualitative and quantitative factors alongside financial ratios for a comprehensive analysis.